Uranium M&A heats up around GTI Energy

US uranium mergers are happening all around GTI Energy’s projects. Pic: Getty Images

- Final phase of GTI’s Lo Herma 2024 drilling campaign to start later this month

- Resource update on track to be released by end of the year

- UEC snaps up Rio’s Wyoming uranium assets for US$175m and ISO Energy buys out Anfield Energy for $US126.8m

Special Report: The final phase of GTI Energy’s 2024 exploration campaign will commence in late October, in line with plans to update its Lo Herma U3O8 resource by the end of this year.

The final phase of GTI Energy (ASX:GTR) 2024 drilling will be focused on construction of three hydrogeologic and water monitoring wells in advance of an update to the current 5.7Mlb U3O8 inferred resource (at 630ppm average grade) and the exploration target of an additional 5 – 10Mlbs U3O8 (grade range 570 – 670ppm).

The plan is for the updated resource plus hydrogeology and met testing data will all bundle into a planned scoping study to illustrate Lo Herma’s economic potential.

Moves and shakes in US Uranium districts

It comes as Wyoming emerges as one of the hottest districts for uranium miners globally, evidenced by a massive M&A push by established players.

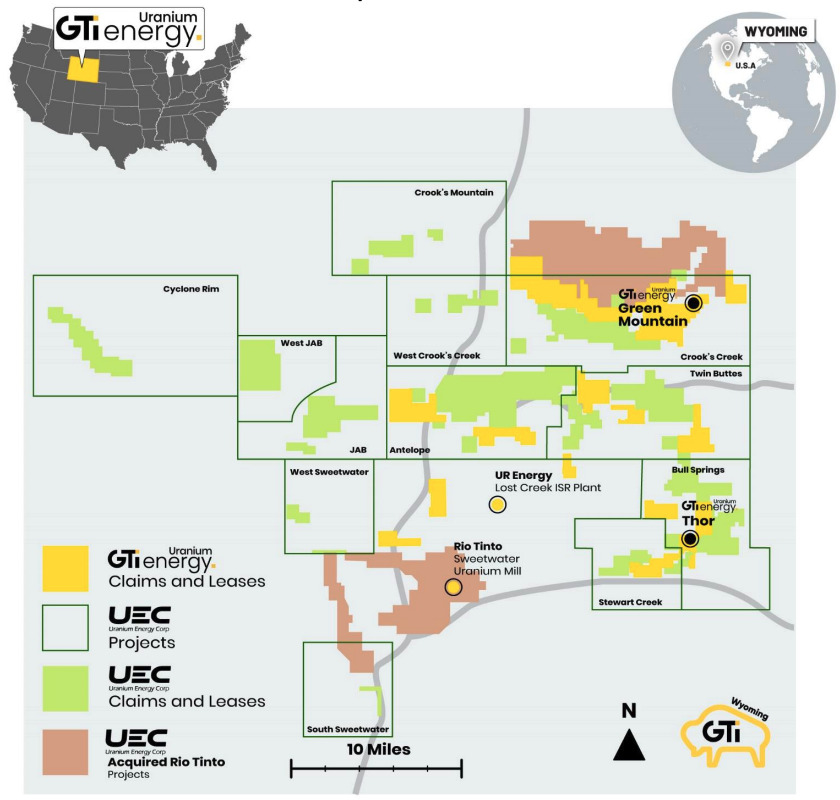

NYSE-listed Uranium Energy Corp recently acquired all of Rio Tinto’s (ASX:RIO) Wyoming yellowcake assets for US$175m, including the Sweetwater uranium plant and a portfolio of projects in the Great Divide Basin and at Green Mountain.

UEC is the USA’s largest uranium company and this latest purchase builds upon on its transformative purchase of Uranium One Americas in 2021, which significantly expanded its holdings in the Great Divide Basin.

UEC points to meaningful development synergies between their previous purchase and the Rio portfolio acquisition.

The move will bolster UEC’s in ground uranium inventory by circa 175Mlb of historical resources – about half of which UEC considers to hold potential to be amenable to in-situ recovery (ISR) mining.

At GTR’s nearby Green Mountain project, all drilling permits are in place to test the validity of the historical Kerr McGee drill hole maps, as well as the interpreted ~19kms of mineralised regions it delineated through an airborne geophysical survey completed in late 2023.

GTR CEO Bruce Lane says that UEC acquired the assets from Rio so it can build its third ‘hub-and-spoke’ ISR production centre based around the Sweetwater mill site.

“We remain convinced that uranium resources in the Great Divide Basin and Green Mountain district have real potential to be developed in a similar fashion to those in Texas and the nearby Powder River Basin production district,” GTR CEO Bruce Lane says.

Lane points to Ur-Energy’s producing Lost Creek ISR plant and Shirley Basin ISR satellite mine development that “demonstrate the viability of ‘hub-and-spoke’ production strategies within the district”.

ISO Energy snaps up Anfield

M&A activity in the US uranium market is heating up further still, with ISO Energy jumping on Anfield Energy and its Shootaring Canyon Mill project next door to GTR’s Henry Mountains Utah properties for US$126m.

The move is expected to expand ISO Energy’s near-term U3O8 production capacity, as the purchase includes a conventional uranium mill – giving ISO Energy access to two out of only three permitted mills of its type in the US.

American government investment to support domestic production and enrichment has escalated this year in the wake of laws to restrict the sale of Russian enriched nuclear fuel in the States.

This article was developed in collaboration with GTI Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.