Up, Up, Down, Down: Which commodities won and lost in September?

Pic: Two Meows/Moment via Getty Images

Let’s get the keyphrase stuffing out of the way. Lithium, lithium, lithium.

Investors can’t get enough of the stuff right now, precisely because people who make batteries and electric vehicles, quite literally, can’t get enough of the stuff.

The battery metal continued to climb new highs in September, confounding expectations that Chinese authorities could rein in prices that were starting to concern the CCP.

Supply shortages mean they can do little, just as little it appears can be done right now about coal prices, with energy coal still above US$400/t.

Meanwhile, China’s Covid lockdowns and international rate rises continued to darken the outlook for base metals and gold, which sunk to multi-year lows before a rebound late last month.

WINNERS

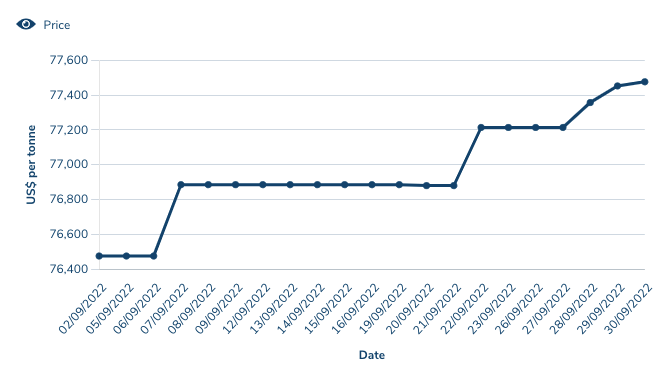

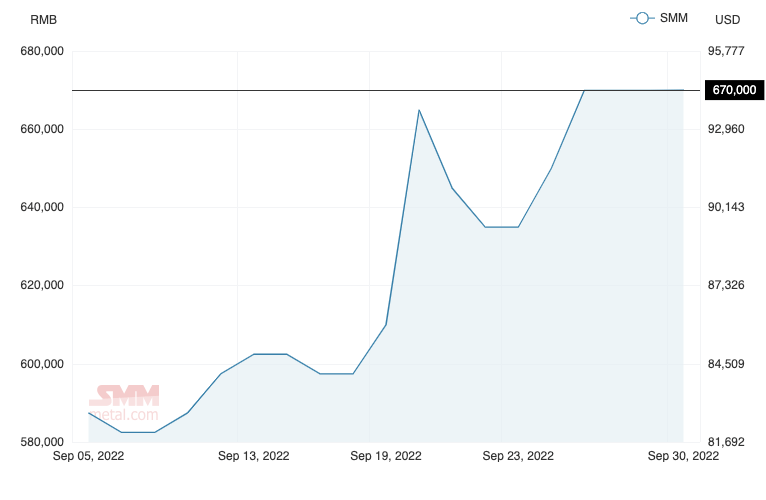

Lithium

Price (Fastmarkets Lithium Hydroxide): US$77,476.19/t

%: +2.43%

Ah dee, ah say do you remember a time when lithium prices weren’t on the march?

It feels like a long time ago (only 2019) that miners were going to the wall left, right and centre.

Now the lithium stocks are the kings of the ASX, with Allkem (ASX:AKE), Pilbara Minerals (ASX:PLS) and Mineral Resources (ASX:MIN) each hitting all time highs last month.

MinRes hit that milestone after news leaked out that it was considering a spinout of its lithium business into a multi-billion dollar New York listed vehicle to capture the multiples being enjoyed by pure play miners in the States.

Pilbara Minerals meanwhile showed how hot the market is for uncontracted lithium raw materials, selling a cargo via its Battery Materials Exchange for US$6988/dmt for a 5.5% product.

That’s US$7708/dmt at a benchmark 6% Li2O basis. Converters would be making less than 5% margin on those feedstock prices, informing the shockingly high prices currently being seen for lithium chemicals.

Lithium hydroxide and carbonate crossed the magical 500,000 RMB per tonne mark in China according to multiple pricing agencies, equivalent to over US$71,000/t.

Fastmarkets’ lithium hydroxide CIF price, which takes into account Chinese, Korean and Japanese sales hit US$77,476.19/t on September 30.

The need for spod is so hot that Core Lithium (ASX:CXO), which plans to enter full scale lithium concentrate production at its Finniss mine in the Northern Territory in the first half of 2023, sold a 15,000t DSO cargo at 1.4% Li20 for US$951/t yesterday.

That’s over US$4000/t at benchmark prices; not bad, considering the customer is receiving well over 14,000t of worthless dirt as part of the package.

EVs remain a luxury purchase for the most part, meaning downstream demand is pretty inelastic even with higher prices being passed on to consumers.

Production numbers continue to increase at the world’s leading car brands. Tesla delivered 343,000 cars in the September quarter, producing 365,000.

While that fell short of analyst expectations, it was up almost 100,000 vehicles from the same period in 2021 (254,695).

Lithium stocks prices today:

Rare Earths

Price (NdPr Oxide): US$94.15/kg

%: +8.73%

Lynas Rare Earths (ASX:LYC) started the year like a house on fire but is quietly down around 32% year to date, a signal of how erratic the NdPr market has been in 2022.

Having risen consistently to ~US$175/kg earlier this year the heat had well and truly come out of the rare earths market in China by August, dropping to around US$86/kg.

That remains well above historic levels.

Prices experienced a bounce in line with pre-holiday restocking in China. Whether they continue to recover remains to be seen.

“Large magnetic material companies said their new orders rose slightly this week, while some small magnetic material companies reported that their orders did not improve significantly,” Shanghai Metals Market analysts said.

“At present, many rare earth metal factories have expressed that the spot supply of rare earth oxides is relatively tight. Some rare earth metal factories even suspended their quotations.”

There are other reasons for Lynas’ recent struggles. It has copped a major hit to output at its Malaysian downstream processing plant due to water supply issues.

As with most EV related industries, weak short term demand in China shouldn’t cloud the broader picture, with Wood Mackenzie suggesting demand for rare earths for magnets will increase 70% by 2030.

Alistair Stephens, head of rare earths explorer Lindian Resources (ASX:LIN), told Stockhead’s Reuben Adams last week more around 45,000t of new NdPr would be needed for EVs by 2030.

That’s 10 repeats of Arafura’s (ASX:ARU) upcoming Nolans mine.

“[Lithium demand] is not going to abate; there will be more lithium mines coming online, more capacity, more demand. It is a huge growth market,” Stephens said.

“You will see exactly the same thing in rare earths.”

Rare Earths share prices today:

LOSERS

Coal

Price (Newcastle thermal): US$407.70/t

%: -4.58%

It’s a bit churlish of us to call coal a loser given just how high prices are.

What goes up must come down, as they say, and there’s no guarantee we won’t see coal prices rise once again, with the Northern Hemisphere winter approaching and a La Nina poised to hit Australia’s east coast over summer.

That could see strong demand and supply disruptions emerge yet again in a market that is unlikely to return to any semblance of normality while Russia’s invasion of Ukraine persists.

Coal futures contracts continue to be priced above US$300/t until the start of 2025, signalling expectations the tightness that has driven the market to record levels and underpinned mega profits at Australian coal miners will persist.

As in lithium a number of coal miners climbed to record share prices in September, notably market bellwether Whitehaven (ASX:WHC).

Coking coal remains above US$270/t, still strong despite fetching what is an unusual discount to thermal.

Coal miners share prices today:

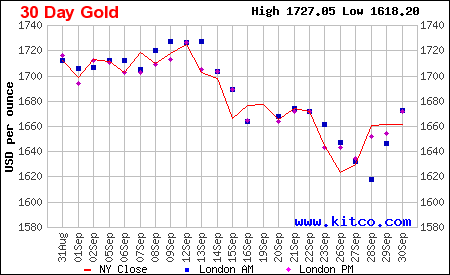

Gold

Price: US$1664.39/oz

%: -3.43%

Gold miners are facing challenges on two fronts.

The other issue has been continued concern about interest rates. Gold accumulates no interest, so when rates rise the allure of owning the yellow metal tends to lose its appeal and cash suddenly becomes king yet again.

Safe haven demand from geopolitical tensions and the war in Ukraine is doing little to support bullion ATM, with prices hitting a two-year low on September 23.

Not as bad for Aussie gold miners, who enjoy a big boost from the Aussie dollar fall compared to USD. Aussie gold prices have fallen by half of their US counterparts as a result.

Additionally, gold has been able to keep its neck above the US$1600/oz level, with prices rebounding late in September.

Some analysts think the worst may have passed though, with OANDA senior market analyst Edward Moya suggesting the peak of US Fed tightening could be close.

“Things are starting to look better for gold,” he said.

“China’s outlook is improving as support for the housing market is happening and they might be closer to delivering a gradual change to their zero-COVID policy.

“If short-end rates continue to drop, gold’s rebound could make a run towards the $1700 level.”

With equities in the doghouse, gold miners have gone a little quiet of late. But one little story that won’t go away is the consolidation of the Leonora gold field into a major play.

This time it is not Raleigh Finlayson and Genesis Minerals (ASX:GMD) name on the lips, but King of the Hills owner Red 5 (ASX:RED), which revealed last week it had held early discussions about a tie-up with Gwalia gold mine owner and Finlayson target St Barbara (ASX:SBM).

Gold miners share prices today:

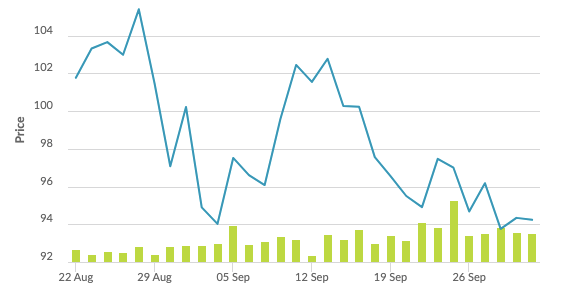

Iron Ore

Price (SGX 62% Fe Futures): US$94.24/t

%: -6.33%

Bears have started to emerge around the iron ore sector, which began the year with a head full of steam but has been weighed down by months of Covid fatigue in China.

Despite efforts from the Communist Party to stimulate its economy the Chinese property market remains weak, with most hopes for iron ore centred on expectations that concerns about China’s economic trajectory will lead to an infrastructure blitz.

UBS thinks iron ore miners are in for a tough time.

Iron ore imports and steel production levels have picked up in the past couple months in China, buyer of 70% of the world’s iron ore and producer of almost 60% of its crude steel.

But the question remains whether this was a genuine reversal in the country’s economic productivity or the standard restocking demand leading up to this week’s national day holiday.

Time will tell. Iron ore miners are still making ripping margins at current prices given their costs are just US$20/t.

And China remains hungry for Aussie iron ore. Within just a couple of weeks the world’s largest steel producer Baowu put its support behind not one but two substantial new iron ore mines.

The first was Mineral Resources’ (ASX:MIN) 35Mtpa Onslow hub, where it will use a network of automated road trains on private haul roads to keep costs to big three levels of around US$20/t.

Baowu has also backed the $2 billion Western Range iron ore mine, the latest to be developed by Rio Tinto (ASX:RIO) at its Paraburdoo hub.

Iron ore share prices today:

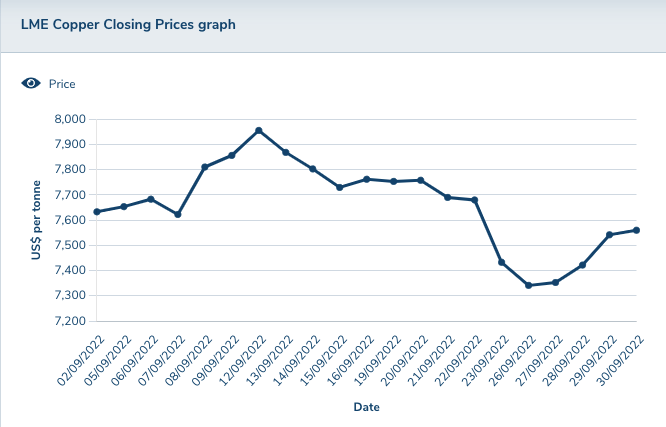

Copper

Price: US$7560/t

%: -3.10%

Copper prices hit a two-month low in late September as the OECD began downgrading global economic growth forecasts in response to the war in Ukraine and rate rises across the world.

The metal, known as Dr Copper, is commonly viewed as a barometer of the health of the world economy.

In that context, we were looking a little ill last month, with copper inventories on the LME building 25% between September 15 and later in the month.

Supply from Chile and Peru, the world’s two largest producers, has tended to disappoint this year.

Longer term investment banks and ratings agencies expect to see copper prices rise strongly.

Fitch thinks they’ll hit US$8400/t in 2023 and US$11,500/t by 2031, with deficits expected to outpace supply even with 7.3Mt of new capacity to come online over the next nine years.

Goldman Sachs, meanwhile, said last month that prices in excess of US$9000/t would be needed to incentivise new supply and prices of US$13,000/t or more would be essential for miners to develop enough copper assets to satisfy net zero targets, which will need lots of additional copper for electrical infrastructure, EVs and renewables.

Rex Minerals (ASX:RXM) boss Richard Laufman, whose Hillside project in South Australia made Goldman Sachs’ list of the top 50 undeveloped copper projects, said the world is far behind the pace of production growth needed to fuel the energy transition.

“Just to reverse the decline in new mine startup, we have to spend over US$400 billion before 2030. That’s US$400 billion globally before 2030 and we’re already nearly at 2023,” Laufmann told Stockhead last month.

“If you don’t front load that expenditure. You’re not going to get there, it’s too late, she cried.

“If we press the go button today it still takes time and ours is a straightforward project to develop. If you look at some of the projects in the world, they are not straightforward.

“They will take eight years to develop even when you press the start button, assuming they’re financed and permitted. So it’s a really interesting predicament that the world is in.”

Copper miners share prices today:

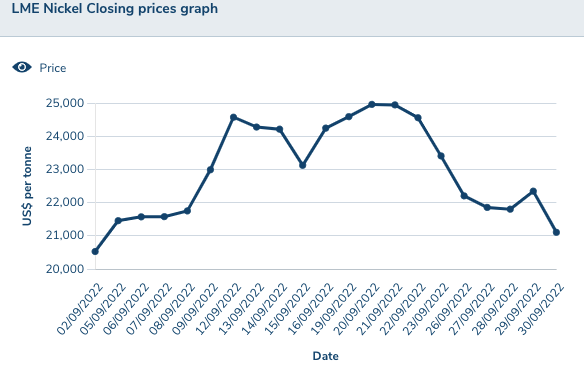

Nickel

Price: US$21,107/t

%: -1.42%

The LME’s three month contract for nickel briefly rose to a touch under US$25,000/t as hopes of a recovery in Chinese demand permeated a host of commodity markets.

But the joy was short-lived, with more lockdowns and the deterioration of the global fiscal environment sending prices down to a 1.42% loss.

Higher than expected production out of Indonesia, the world’s dominant nickel market, has also helped to alleviate concerns about supply shortages for the stainless steel and battery ingredient.

Indonesian supply increased 41% over the first seven months of the year compared to 2022.

The positive news for Australian miners is that the main form of production rising is nickel pig iron, with a record 583,000t shipped to ports in China in 2022. This can’t be used for batteries, freeing up refined metal for the growing EV market.

At the same time, Western nickel stocks are down 49% this year Reuters says, with issues around Russian nickel supply and self-sanctioning from buyers likely to support Class 1 nickel demand from other sources like Australia and Canada.

Still the long-term outlook for nickel is bullish, with miners investing heavily in new sources of supply to feed the EV revolution. Vale is bringing 333,000t of battery grade nickel supply online over the next three years in Indonesia, for example.

At the same time OZ Minerals (ASX:OZL) has approved the construction of the $1.7 billion West Musgrave nickel and copper more than 20 years after it was first discovered by Western Mining Corporation.

In its first few years the mine will produce around 35,000t of nickel sulphide and 41,000t of copper a year, making it one of the largest nickel projects ever developed in Australia.

Nickel miners share price today:

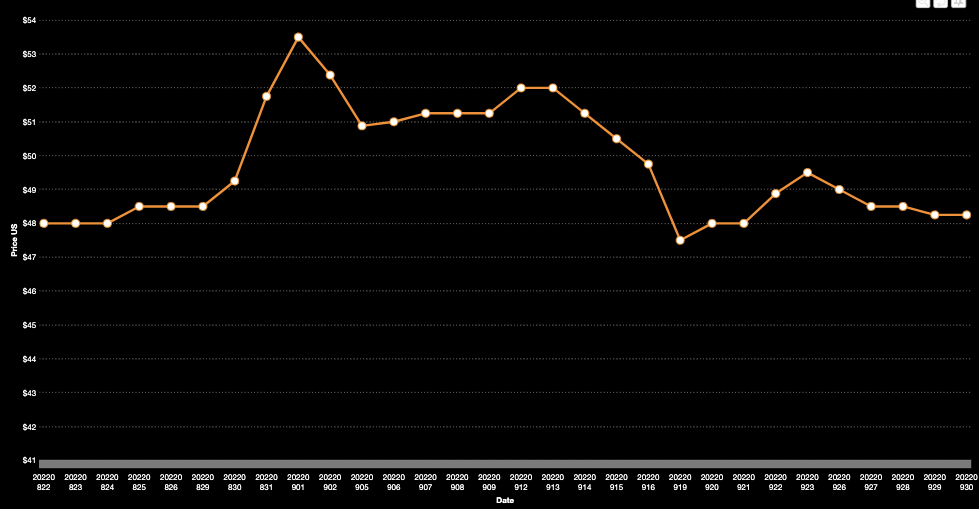

Uranium

Price (Numerco): US$48.25/t

%: -6.76%

Uranium was one of the big movers in August as concerns about energy security saw Japan announce the restart of its reactor fleet and positive talk about the outlook for the nuclear energy sector dominated the headlines.

Investment banks are getting bullish – Macquarie and BMO have both upgraded their uranium spot price forecasts over the past month – but price action in the real world remained subdued compared to the wild volatility seen in uranium markets last year when the Sprott Physical Uranium Trust emerged, sucking up supply from the lightly traded spot market and putting a rocket up prices.

BMO analysts say uranium is set for a renaissance amid concerns over energy independence and Russia’s stranglehold on European energy supplies.

“Uranium prices have underperformed peers, for good fundamental reasons, over the past decade and indeed the past 18 months,” they said in a note.

“However, this leaves uranium as the only major commodity we cover trading below its long run equilibrium price, and thus relative to peers has more upside on a five-year view.”

Excitement around uranium prices has contributed to a growing stoush between Rio Tinto (ASX:RIO) and its subsidiary Energy Resources of Australia (ASX:ERA).

Rio owns more than 86% of ERA and wants the company to complete a multi-billion dollar rehabilitation job at the shuttered Ranger Mine, respecting traditional owners’ wishes for the land to be returned to the same environmental standard as the nearby Kakadu National Park.

But there have been growing ructions from minority shareholders, led by 7.9% owner Packer and Co. — the investment fund of Perth corporate identity Willy Packer — who think the Jabiluka mine held by ERA should be developed.

That is against the wishes of the Mirarr People, who say the land should never be mined.

Uranium share prices today:

Other Metals

Silver

Price: US$19.03/oz

%: +5.60%

Tin

Price: US$20,634/t

%: -9.47%

Zinc

Price: US$2968/t

%: -14.21%

Cobalt

Price: $US51,995/t

%:0.00%

Aluminium

Price: $2162/t

%: -8.35%

Lead

Price: $1908/t

%: -2.15%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.