Up, Up, Down, Down: Uranium’s yellow glow and copper rally define June for metals

Uranium was the standout performer for a second straight month in June. Pic: Getty Images

- Uranium leads the winners as Sprott buying return sends spot prices flying

- Coal, copper, rare earths among the quiet achievers

- Gold flat as safe haven demand dissipates, but prices remain near all-time highs

Up, Up, Down, Down provides a wrap of all the main commodities ASX companies are digging, including winners, losers, and key supply-demand news.

WINNERS

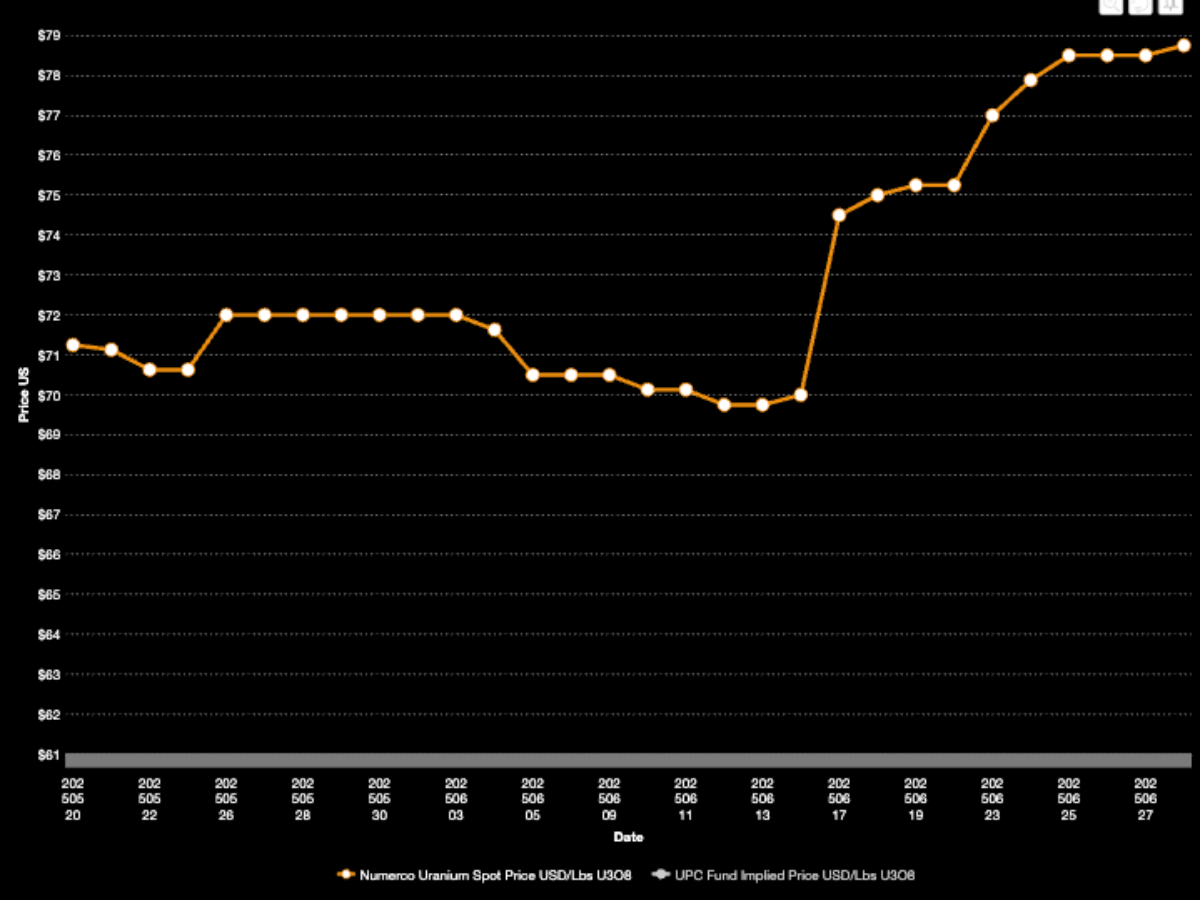

Uranium (Numerco)

Price: US$78.75/lb

% Change: +9.38%

UP

- Sprott’s return to the spot market for uranium has sent prices up 10% since mid-June. For each 200,000lb purchased by the asset manager’s Sprott Physical Uranium Trust, Canaccord Genuity estimates U3O8 prices lift US25-75c.

- The World Bank has ended a long-running ban on providing funding for nuclear energy projects, opening the door to the development of small modular reactors in the developing world. It hasn’t funded a nuclear power project since 1959, with a formal ban in place since 2013.

DOWN

- Term prices have been stagnant at around US$80/lb for most of 2025. That’s not enough to bring new sources of supply online, most of which need US$100/lb to justify capex.

- While it’s a strong policy signal, doubts are emerging over the reality of Trump’s dream to quadruple nuclear energy capacity in the US to 400GW by 2050.

READ

Monsters of Rock: Uranium an unsung hero with June rebound

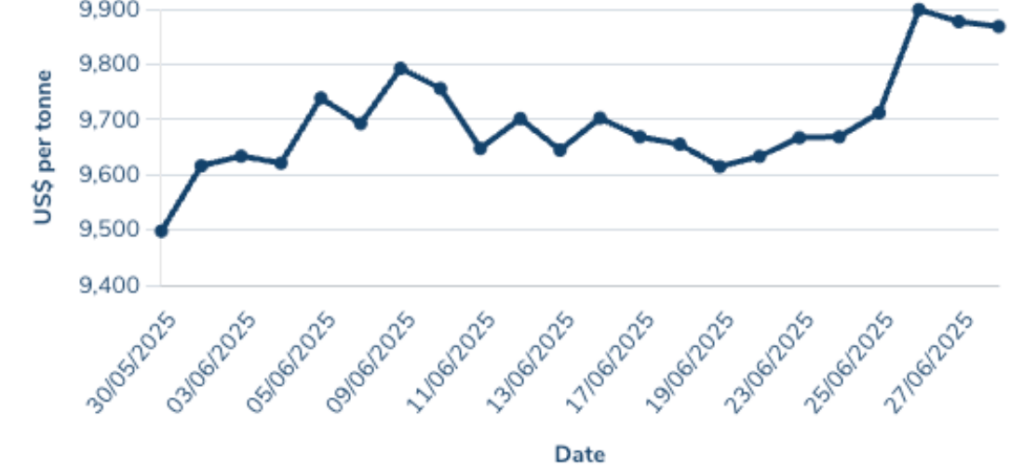

Copper

Price: US$9869/t

% Change: +3.91%

UP

- LME copper stocks have fallen below 100,000t for the first time since August 2023, hitting 91,275t on June 27. More is now held in the US though, prompting Goldman to suggest prices will hit US$10,050/t before retreating to US$10,000/t if Trump levies copper tariffs.

- Antofagasta will supply copper to Chinese smelters at no charge in 2026, as competition for concentrate ramps up. Spot charges are even worse for smelters at ~-$40/t.

DOWN

- First Quantum has begun shipments of copper concentrate to Europe’s Aurubis smelter, according to Bloomberg, from its Cobre Panama mine. The project’s closure in 2023 – cutting ~1.5% of global supply – led to a surge in copper prices as supply tightened.

- Supply from South America is recovering, with copper production up 9.4% YoY to 486,574t from top producer Chile in May.

READ

Copper’s flying under the radar, but long-term thinkers are betting on the red metal

Coal (Newcastle 6000 kcal)

Price: US$109.90/t

% Change: +6.39%

UP

- Coal use in the US power grid has been resurgent this year, with higher gas prices encouraging switching to the cheaper, dirtier fossil fuel. The longer term outlook for the commodity looks brighter if the policy platform of US President Donald Trump holds, after he labelled the fuel “beautiful clean coal”.

- Analysts have been scaling back coking coal forecasts, but lower prices suggest more supply could come out of the market, boosting hopes of a sharp recovery.

DOWN

- A tax credit for met coal producers in the US, after it was assigned by the Trump Administration as a critical mineral, could accelerate steelmaking coal production there and bring additional, subsidised, supply into the market.

- Imports of both coking and thermal coal in China could be cut by as much as 100Mt in 2025, according to China Coal Transportation and Distribution Association vice president Xuegang Li, after hitting a record high of 542.7Mt in 2024.

READ

Resources Top 5: Coal punters breathe sigh of relief with Coronado’s stay of execution

Thermal coal has rebounded from recent lows. Pic: Trading Economics

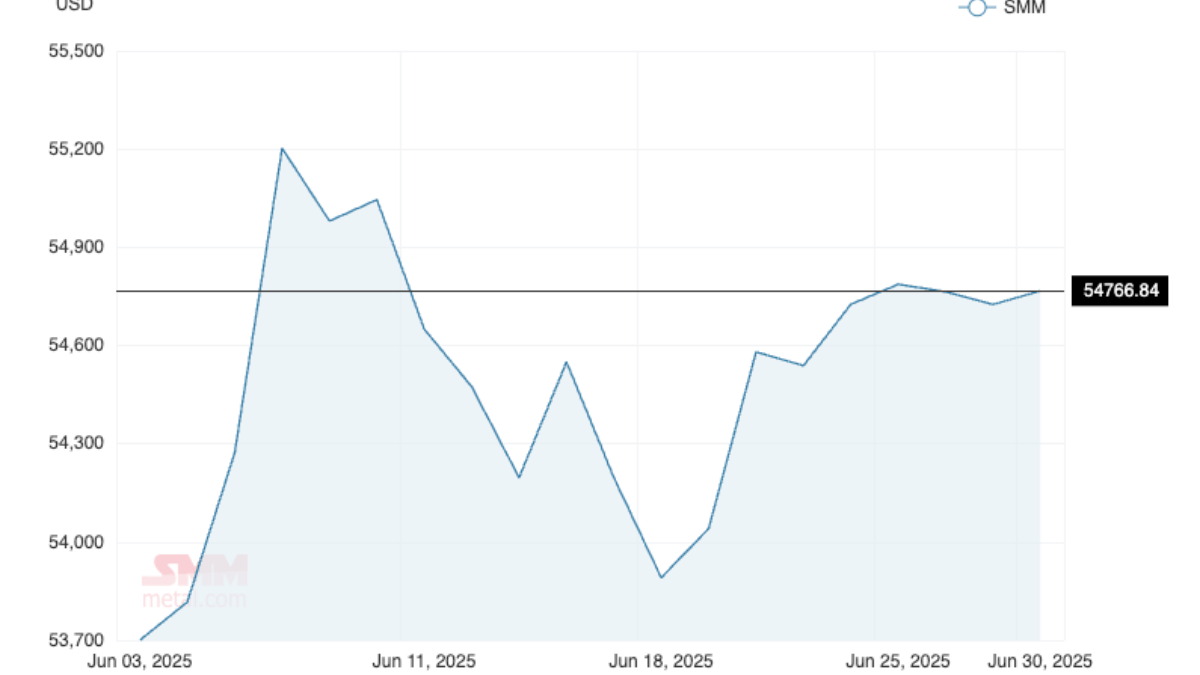

Rare Earths (NdPr Oxide)

Price: US$61.88/kg

% Change: +1.81%

UP

- Rare earths demand could improve with the Chinese Ministry of Commerce starting to issue export controls for companies hoping to supply the West. The limits on the export of seven medium and heavy rare earths were issued in response to Trump Administration tariffs.

- Reporters for Shanghai Metals Market say market participants see more likelihood of price increases for rare earth oxides as demand improves in China.

DOWN

- Lynas boss Amanda Lacaze warned the West remains someway off in its hopes to catch up to China on rare earths supply.

- Magnet shortages due to Chinese export controls have seen some automakers struggle to procure supply of rare earth magnets, key components not just in motors, but also windshield wipers, speakers and aircons. The US announced a deal to have supplies to key customers expedited last week, with China also said to be approving the “bare minimum” of critical licences for European importers.

READ

Could MTM’s Flash Joule processing tech be the shot in the arm America needs for REE independence?

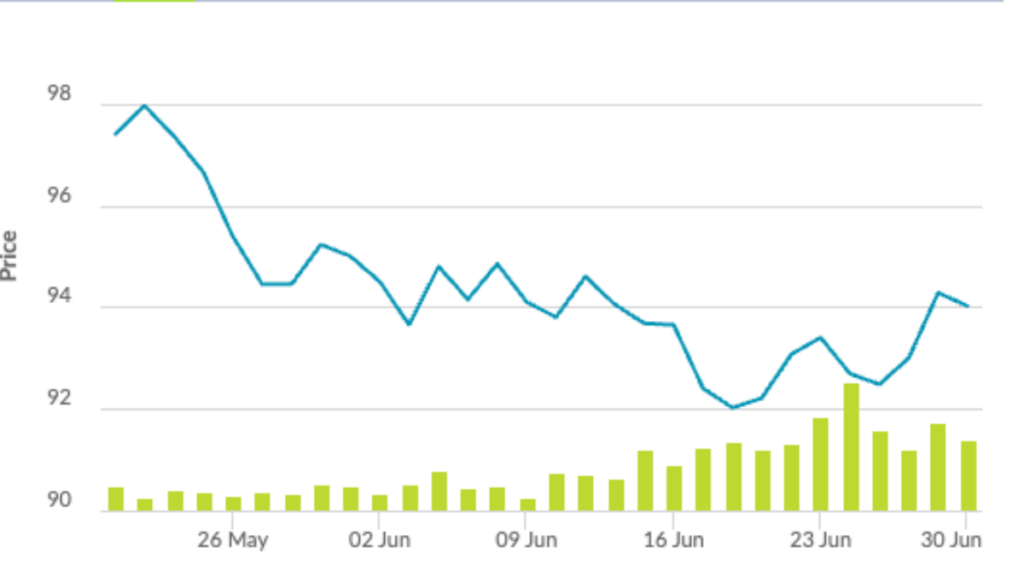

Iron ore (SGX Futures)

Price: US$94.02/t

% Change: +0.42%

UP

- According to Commbank’s Vivek Dhar, it would take a drop of 6-7% in Chinese steel production to support an iron ore price below US$90/t. It hasn’t fallen more than 3% since at least 1990.

- Majors continue to invest in new developments, with Rio Tinto opening its Western Range mine in June before approving the Hope Downs 2 development with Hancock Prospecting and gaining environmental approval for the West Angelas mine. All up its replacement mines in the Pilbara will cost US$13bn to develop.

DOWN

- Canberra’s lead forecaster, the Office of the Chief Economist has revised down its forecast for Aussie iron ore earnings by $1bn for 2024-25 to $115.7bn, $8.3bn in 2025-26 to $104.8bn and $6.5bn in 2026-27 to $96.5bn.

- That is being led by lower price forecasts, tipped to fall to US$83/t in 2025, US$76/t in 2026 and US$74/t in 2027, levels not seen since 2019.

READ

Rio stays the course on lithium as it looks to rejuvenate iron ore business

LOSERS

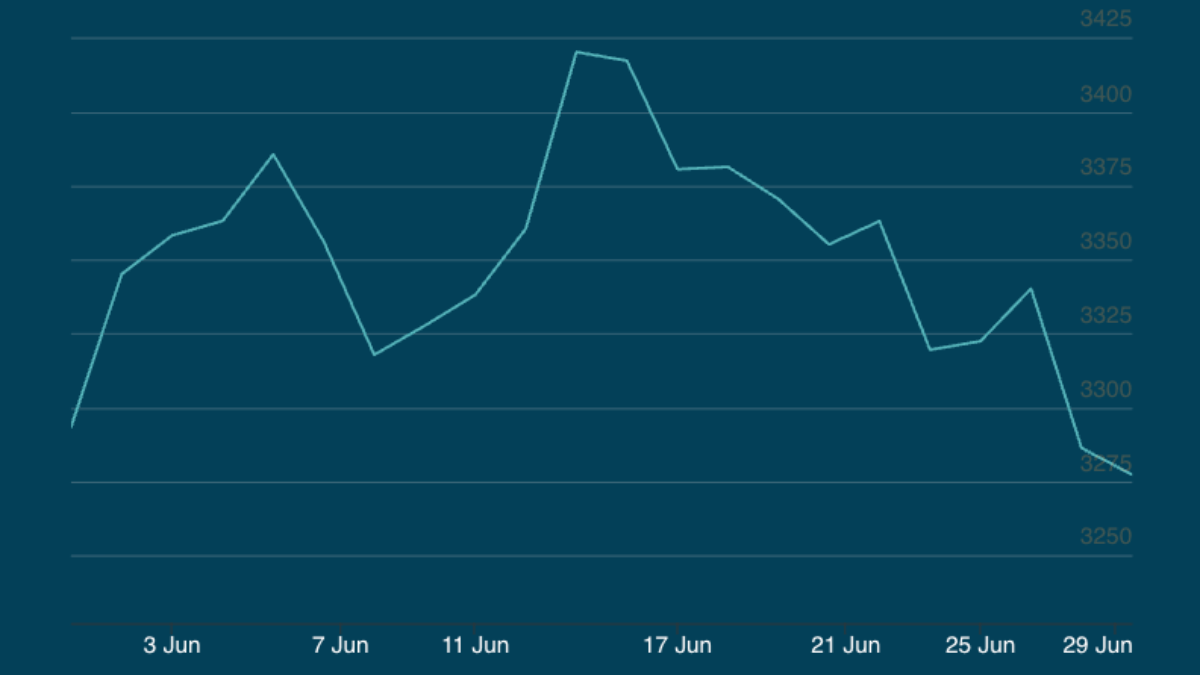

Gold

Price: US$3277.50/oz

% Change: 0.00%

UP

- The World Gold Council’s latest survey of central banks show a record 95% of the world’s sovereign bankers expect governments to hoover up more gold in 2025.

- As gold rises so to are metals linked to the historic store of wealth. Bargain hunters have lifted silver to ~US$36/oz and platinum to an 11-year high of US$1400/oz as jewellers and investors look for alternatives to premium priced bullion.

DOWN

- The role of geopolitical risk in inflating the price of gold was on full display, as the metal swung wildly around developments in the Israel-Iran War. What happens if conflicts in Ukraine and Gaza can be brought to a halt?

- Citi became the first major bank to cut its 2025 price target for gold from US$3500/oz to US$3300/oz, pointing to potential declines to US$2500-2700/oz in the second half of 2026. Strong US economic growth expectations and sliding safe haven demand are both in play.

READ

Gold Digger: Central banks want EVEN MORE GOLD as boom goes on

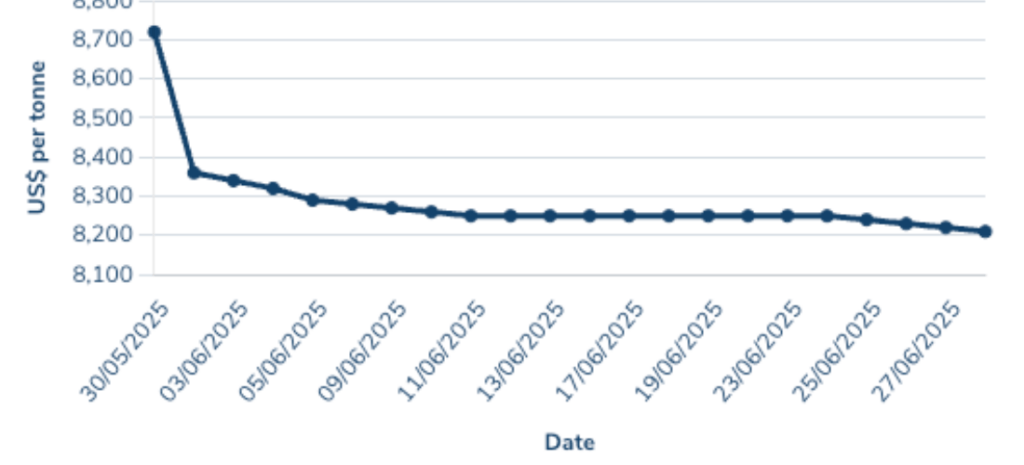

Lithium (Fastmarkets Carbonate CIF China, Japan and Korea)

Price: US$8100/t

% Change: -0.61%

UP

- The market may be trawling along the bottom still, but analysts are starting to bet on a brighter future. Argonaut thinks 6% Li2O spodumene prices could hit US$1500/t next year, well above current levels in the low US$600s.

- Institutional investors and insiders are betting on a price recovery, with a survey showing lithium remains the most exciting commodity market outside gold for strategic investors.

DOWN

- China could grab the largest share of the market in mining lithium raw materials next year, giving the world’s top refiner more control over the supply chain.

- Benchmark Mineral Intelligence’s latest lithium forecast shows chemicals remain in a 72,000t surplus despite spodumene shortages, with the downstream market keeping a lid on prices for hard rock miners.

READ

Lithium customers are still jostling for offtake, suggesting long term outlook is strong

OTHER METALS

Prices correct as of June 30, 2025. Due to low news flow nickel has been taken out of the main commodity list.

Nickel

Price: US$15,215/t

%: -0.14%

Silver

Price: US$35.98/oz

%: +8.77%

Tin

Price: US$33,716/t

%: +10.89%

Zinc

Price: US$2851.5/t

%: +8.84%

Cobalt

Price: $US33,335/t

%: -1.08%

Aluminium

Price: $2597.50/t

%: +6.28%

Lead

Price: $2045/t

%: +4.44%

Graphite

Price: US$415/t

%: –1.19%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.