Up, Up, Down, Down: Metals turn cold in a tough June

Pic via Getty Images

- All the major commodities on the loser’s list as metal heads suffer through a dire June

- Gold the king of the losers as copper, nickel, rare earths and lithium runs wear off

- Bulk metals also in the doghouse, but Anglo coal mine closure could mean higher prices for met coal producers in July

Up, Up, Down, Down is your monthly wrap of the winners and losers in metals markets.

LOSERS

Gold

Price: US$2330.90/oz

% Change: -0.75%

Gold was a winner in June if only because it was the king of the losers, a 0.75% drop hardly terrible in the face of a rising US dollar and growing disenchantment from market bettors hoping for rate cuts to ease mortgage pain.

Bullion, of course, tends to do well when the proverbial is hitting the fan – its immunity to sovereign risk and default leads investors and central banks to lean on the yellow metal in times of crisis, like, oh around now.

It also, typically, performs well when interest rates are low since gold is non-yielding. But gold prices have remained strong, clearing US$2300/oz for most of 2024 despite interest rates that have stubbornly remained near multi-year highs.

UP

- Interest in bankrolling new Tier-1 gold miners is strong, with De Grey Mining (ASX:DEG) closing in on a $1.13 billion debt package for the 530,000ozpa Hemi gold mine in WA’s Pilbara.

- Gold prices are keeping strong in the face of hawkish undertones from federal reserves in the USA and Australia. That’s heavily driven by central banks, with a survey by the World Gold Council this year showing four out of every five central bankers who engage with the WGC expect national reserves to keep adding to their gold holdings in 2024.

DOWN

- High costs mean strong gold prices have come too late for some miners, with Calidus Resources (ASX:CAI) entering administration and KordaMentha drafted in to recapitalise and sell the Warrawoona gold mine in WA.

- The International Monetary Fund has called on the US Fed to hold rates steady for the rest of the year, in commentary that will hurt hopes of cuts in 2024.

Gold miners share prices today:

Copper

Price: US$9599/t

% Change: -4.4%

Copper seemed so close to a long promised breakout as banks and instos such as BlackRock, Goldman Sachs and ANZ ratcheted up their price forecasts to record levels of US$12,000/t, Goldman expecting that number to come within the year.

It could still happen, but the growth of stockpiles in China, the main driver of copper demand, seems to have halted the run in June as waning enthusiasm for the country’s long-buoyant and now morbid property sector has cut most industrial commodities off at the knees.

There’s still plenty of enthusiasm around the red metal’s role in the energy transition and supply challenges continue to stymie hopes of meeting longer term demand forecasts which are only growing. Chile’s Codelco, until recently the world’s largest producer, fell 8.6% behind forecast on its production target for May according to Reuters.

UP

- ANZ upped its copper demand forecast for 2030 from 35.1Mt to 38.5Mt, with the pace of China’s renewable build-out and associated transmission infrastructure behind the change.

- AI data centres could also ramp up copper demand by anywhere from 1.1-2.4Mt in the United States, according to Bloomberg Intelligence. America is the world leader in data centre construction, with the increased copper need expected to end decades of stagnant demand in the once manufacturing dominant economy.

DOWN

- The continued strength of the US dollar could keep copper prices from touching the record highs seen in May any time soon. Copper and other base metals are sensitive to the US dollar since it impacts the buying power of companies trading in weaker currencies.

- International Copper Study Group stats from June 20 show refined copper usage grew 4% in the first four months of 2024, but refined production was up faster at 5.5%. That was backed by a 32% rise in production in the Democratic Republic of the Congo and 7% lift in scrap recycling.

Pic: LME

Coal (Newcastle 6000 kcal)

Price: US$133.20/t

% Change: -7.44%

Thermal coal has weathered a tough run in recent times.

Having surged to unthinkable highs in 2022 following Russia’s invasion of Ukraine, only a lack of new supply linked to ESG concerns and Covid-era labour, weather and supply chain issues that hurt output at existing mines have kept prices propped up.

At the same time higher costs have eaten into the sort of superprofits seen only a year ago.

Met coal has been stronger, with uncertainty over Queensland’s premium hard coking coal supply re-emerging after a fire at Anglo American’s Grosvenor mine which will potentially lead prices higher, at least in the short term.

UP

- A fire at Anglo American’s Grosvenor coal mine will put pressure on high quality coking coal supply.

- The mine is expected to be out of action ‘for months’ and will likely impact the sale of the Anglo steelmaking coal business unit.

DOWN

- Czech energy investor Sev.en Global Investments, the family office of billionaire Pavel Tykač, pulled out of a deal to acquire a 51% stake in Coronado Global Resources.

- Chinese coal terminals are well stocked thanks to heavy rain that has helped the world’s biggest producer and importer of the bulk commodity run on higher loads of hydropower in early 2024.

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$13,480/t

% Change: -4.87%

The steam came out of lithium prices once again in June, with equities trounced as investors ran out of patience waiting for the next lithium revival to come around.

At the same time, incumbents with lower cost bases continue to add to their growth plans, eyeing a stronger market share to prepare for future deficits as EV demand rises globally, albeit not at the pace seen in 2022 and 2023.

Among the most curious stories was the re-emergence of Rio Tinto (ASX:RIO) and its Jadar project in Serbia. Canned in early 2022, the Serbian Government now appears keen to broker a deal to develop Europe’s largest lithium project in the face of community opposition that threatened to overshadow a national election two years ago.

Spodumene concentrate prices, which lifted from recent lows of US$850/t in January to ~US$1200/t a couple months back in response to auction sales by miners, were trading back down at US$1005/t on June 28.

UP

- Pilbara Minerals (ASX:PLS) demonstrated its confidence in the long term outlook for the lithium and EV markets, posting a study on a $1.2bn expansion that could double the capacity of its Pilgangoora mine to 1.9Mtpa from 2028.

- IGO (ASX:IGO) boss Ivan Vella says mainstream media and the general public are underestimating the strength of China’s EV industry.

DOWN

- Analysts are forecasting more tough times ahead for marginal lithium producers, with WoodMac expecting to see US$1000/t spodumene to 2028.

- Fitch research unit BMI thinks lithium prices are entering a period of stability, not characterised by the wild bull and bear runs seen in recent years.

Nickel

Price: US$17,291/t

% Change: -12.27%

Nickel pricing is back in pickle territory, flopping by 13% in June to revert to a touch over US$17,000/t.

The bump provided by mine closures in WA and civil unrest in New Caledonia appears to have subsided with broader pessimism across the base metals space dominating sentiment.

There is a sense even some Indonesian projects will struggle at these rates. Case in point, BASF and Eramet’s decision to dump a nickel-cobalt HPAL refinery in Indonesia’s Weda Bay industrial park.

UP

- Nickel production in Indonesia, which has led to oversupply across the global market, is seeing increased scrutiny, with international pressure returning over a mass fatality at a plant in Sulawesi around Christmas last year.

- Macquarie continues to see an improvement of sorts in nickel prices, predicting US$19,500/t next year and US$21,000-23,000/t from 2026-2028, despite pulling back its 2025 forecast by 5%.

DOWN

- Bloomberg believes a rise in cheaper LFP EV battery cars, which don’t contain nickel in their cathode, will see nickel and manganese demand far lower than expected in the years ahead.

- Indonesia is waving off concerns about the overexploitation of its nickel laterite reserves, with government figures saying swathes of land yet to be explored could be tapped to extend the life of its assets.

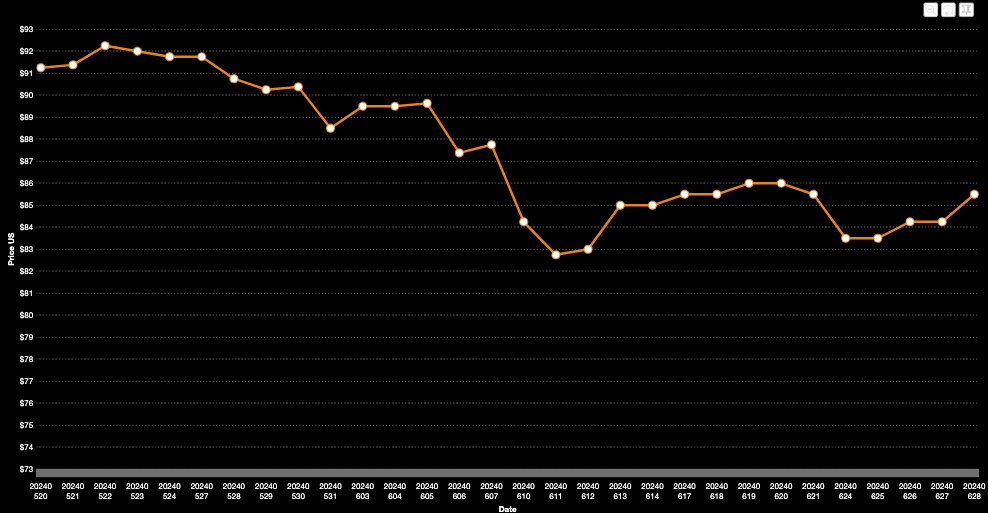

Uranium (Numerco)

Price: US$85.50/lb

% Change: -3.39%

Uranium’s upwards flight has hit turbulence in recent weeks with spot prices moderating after exuberance pushed them to 16-year highs of US$107/lb in January.

Where prices have been improving is, arguably, where it counts, with term prices hitting US$77/lb in May.

According to Sprott, while a ‘healthy’ pullback in the spot price has been seen, contracts between miners and utilities are being drawn with higher ceilings and floors.

The month ended with a bang as Paladin Energy (ASX:PDN) announced an (immediately unpopular) deal to acquire TSX-listed Fission Uranium, in a C$1.14 billion merger that would add a development asset in Canada’s high-grade Athabasca Basin to its recently restarted low-grade Langer Heinrich mine in Namibia.

Also late in June, Silex Systems (ASX:SLX) enjoyed a bump from news the US Government planned to purchase US$2.7 billion of locally enriched uranium. The Aussie stock has a uranium enrichment JV with Cameco.

UP

- Nuclear power is back on the agenda in Australia, with the Federal Opposition aiming to turn it into an election issue. For all the talk of using domestic resources to our advantage, it’ll take 15-odd years, and maybe more, for that to mean anything. It’s all semantics though. Uranium equities are counting on the adage that any publicity is good publicity.

- The M&A activity led by Paladin will have shovel ready juniors hopeful of premium bids from larger resource hungry players hoping to bolster their market share ahead of the sustained uptick in uranium prices they hope is coming.

DOWN

- France’s Orano had a licence to mine an undeveloped uranium deposit in Niger revoked in a sense of the sovereign risk in some uranium mining jurisdictions.

- Term contracting has lagged in 2024 after a decade high 160.8Mlb was sold under contract in 2024. Just 28.1Mlb had been contracted this year to the end of May.

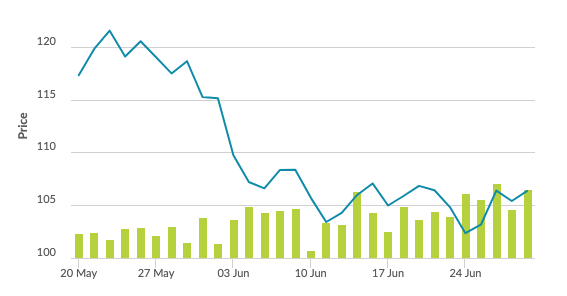

Iron ore (SGX Futures)

Price: US$106.35/t

% Change: -7.62%

Iron ore continues to be flotsam and jetsam in 2024, rising on hopes the Chinese Communist Party will pump economic steroids into its ailing property sector.

Thus far the slack has been picked up by other sources of demand like infrastructure, car manufacturing and exports, but rising stockpiles this year have been a cause for concern.

MinRes boss Chris Ellison decided to shut the higher cost Yilgarn iron ore operation in WA last month, but at the same time it opened the larger scale Onslow Iron project.

The 35Mtpa site’s opening is a sign of confidence from the Pilbara producers that they can make strong profits by keeping costs low.

UP

- While property data has been bad, China’s private Caixin manufacturing index has been brighter, showing eight months of growth. The NBS report for large State-owned corporations wasn’t as bright.

- Traders are hopeful additional stimulus could arrive this month after China reduced the down payment required to purchase property in a bid to improve conditions in the downtrodden industry.

DOWN

- Mineral Resources (ASX:MIN) announced the closure of the Yilgarn iron ore operations in WA, a sign marginal operations are beginning to feel the pinch without boom-level pricing.

- China’s steel PMI fell 2 points to 47.8 in June, despite a recovery in mill margins

Rare Earths (NdPr Oxide)

Price: US$49.81/kg

% Change: -2.52%

Rare earths prices continue to pose a problem for new entrants trying to stake a claim in the Chinese dominated industry, sliding for two straight months.

It comes at the same time as governments outside China are trying to stimulate miners into action.

The latest was a US$150m loan announced for Arafura Rare Earths (ASX:ARU) from Korea’s export bank to help bankroll the Nolans Rare Earth mine in the Northern Territory.

Arafura is seeking US$775 million in debt funding and already had conditional support for large debt facilities with the Commonwealth Government and Export Development Canada. It is expected to become a supplier of magnet materials for EV parts in cars produced by Korea’s Hyundai and Kia.

In the broader market, the Shanghai Metals Market says low prices have participants nervous to act, with most traders waiting to see which direction major producer China Northern Rare Earths goes with its listing prices in July.

Up

- Lindian Resources rose almost 50% yesterday after announcing a study on its Kangankunde deposit in Malawi that suggested it could produce at a cost level that is a fraction of the bargain basement price we’re currently experiencing for rare earths.

- Lynas (ASX:LYC) announced plans to produce heavy rare earths dysprosium and terbium at its plant in Malaysia from next year, breaking into a market almost entirely controlled by China.

DOWN

- Iluka Resources was crowned by Morningstar Australia as the cheapest ASX miner in its coverage compared to its fair valuation. But doubts still hover over its Eneabba Refinery, with news yet to come through on whether the Australian Government will extend finance further for the blown-out project.

OTHER METALS

Prices correct as of June 30, 2024.

Silver: US$29.37/oz (-6.08%)

Tin: US$32,739/t (-0.92%)

Zinc: US$2937.50/t (-1.08%)

Cobalt $US27,150/t (0.00%)

Aluminium: $2524.50/t (-4.83%)

Lead: US$2224/t (-2.16%)

Graphite (Fastmarkets flake) US$465/t (-1.27%)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.