Up, Up, Down, Down: Gold shone, lithium dived as 2024 hit metals for six

Gold was 2024's star performer. Pic: Getty Images

This special edition of Up, Up, Down, Down takes you through the key mining commodities and how they fared over the past 12 months.

WINNERS

Gold

2024 Start: US$2078.40/oz

2024 Finish: US$2609.10/oz

High: US$2777.80/oz (October 30)

Low: US$1985.10/oz (February 14)

% Change: +25.53%

In a year the world was holding space for a musical shamelessly leaching off the energy of L. Frank Baum’s classic The Wizard of Oz, Dorothy Gale’s incantation that ‘there’s no place like home’ was replaced by investors chanting ‘there’s no place like gold’.

The market rushed like panicked Mid-Westerners rushing from an unexplained twister from riskier stocks and commodities into the warm embrace of the safe haven metal, which provided the comfort of a stripper in the arms of a disaffected heir to a Russian oligarch.

An Oscar winning performance, no less, from the brilliant bullion, which lifted from already record levels at the end of 2023 to peak at US$2777.80/oz and still eked out a +25% gain despite a nosedive in the days after the election of Donald Trump to the US presidency, which has sparked fears of a stronger US dollar and pause in interest rate hikes.

Experts who watch the market aren’t too concerned, if uneasy that their pro-gold position has become consensus. A number who spoke to Stockhead last year expect the commodity will continue to rise, with the US spending more to service its US$36 trillion debt than on defence and other central banks continuing to purchase gold as a hedge against their own devalued currencies.

The last time gold prices ran so strongly was 2010, in the recovery from the Global Financial Crisis, with silver also along for the ride – up over 23% this year. Only a handful of specialty metals which surged on export controls from China, notably the gold-linked antimony, did better, along with bauxite, the feedstock for alumina and aluminium that suffered major shortages due to export controls out of Guinea, declining grades in Australia and a drop off in domestic production in China.

In Aussie dollar terms gold ran to over $4200/oz. Against last quarter’s average cost of $2150/oz that’s a margin of close to 50%, not something commonly seen in gold. There are of course complexities: Hedges, geological issues and one-off costs can hurt producers or mean they don’t get the full benefit of the spot price. In Calidus Resources’ (ASX:CAI) case, the heavily hedged, underperforming Pilbara gold miner even went under in the midst of a gold boom. West African stocks were hurt by political instability and jurisdictional risk (cf Resolute Mining (ASX:RSG) and its US$160m concession following Mali’s arrest of its CEO Terry Holohan in Bamako).

But overall the picture was good for an Aussie gold market ripe for growth and consolidation – the ASX All Ords gold sub-index lifted ~18% over the past year. That suggests equities still have room to catch up to the commodity price.

UP

- M&A suggests gold miners are bullish on prices going forward, with Northern Star Resources’ (ASX:NST) $5bn scrip offer for De Grey Mining (ASX:DEG) likely one of many deals to go through next year as miners aim to increase output and bolster long-term growth options.

DOWN

- The US Fed chopped its interest rate cut forecast for 2025 from four to two after its last meeting in December. Rate cuts are typically good for non-yielding bullion, while rate hikes are negative since they increase the attractiveness of holding cash and bonds.

Copper

2024 Start: US$8559/t

2024 Finish: US$8768/t

High: US$10,930/t (May 20)

Low: US$8191/t (February 12)

% Change: +2.44%

Copper threatened its long promised break out in 2024 but investors hopeful electrification and decarbonisation will create a new age for the red metal will have to be patient.

Prices hit record highs of almost US$11,000/t in May, even bounding beyond that lofty mark in the US-based Comex futures market, it quickly became apparent the fundamentals didn’t support a price set off by what were temporary shortages of physical metal.

By the end of the year, the International Copper Study Group reported a surplus of 287,000t over the first 10 months of the year, 332,000t if expected changes to Chinese bonded stocks were realised.

That came after the shutdown of the Cobre Panama mine in the Latin American nation in late 2023, taking around 300,000t of primary mined supply out of the market.

Indeed, ICSG stats show refined copper metal output rose 3.7% through October 31, with usage climbing only 2.5%. There was joy for concentrate producers however, who realised close to record low treatment and refining charges from overcapacity in the Chinese smelting market.

Benchmark prices are typically set at around US$80/t. Concentrate suppliers are expected to see benchmarks closer to the US$20-30/t range, according to Fastmarkets.

Copper remains a focus for major miners as well. Rio Tinto and BHP have big growth plans, the latter failing to secure a mega merger with Anglo American in the hope of snaring its Tier-1 South American copper mines. The world’s largest miner settled for a US$3bn punt on some development assets housed by the Lundin Family in Argentina, while also detailing major expansion plans in South Australia and developments to sustain the scale of its Chilean mines in the 2030s.

Aussie juniors have come on the radar after the entry of Cobar owner MAC Copper (ASX:MAC) to the scene, pointing to a wave of M&A to come in the Australian market. Queensland players like Carnaby Resources (ASX:CNB) and Cannindah Resources (ASX:CAE), which has Chilean beast Codelco doing some due diligence on what would be its first Australian venture, have been touted as targets.

Experts are also looking closely at the explorers in the Lachlan Fold Belt, with companies like Helix Resources (ASX:HLX), Peel Mining (ASX:PEX) and newly-listed Mount Hope Mining (ASX:MHM) all among the companies well within the orbit of MAC, Aeris Resources (ASX:AIS) and Aurelia Metals (ASX:AMI) should they find something of scale.

UP

- The ICSG forecasts the refined copper surplus will drop from 469,000t last year to 194,000t in 2025 as refined production growth (1.6%) is outpaced by consumption growth (2.7%). That is being led by AI market penetration, infrastructure growth to support the energy transition, and rising manufacturing output in India.

DOWN

- Benchmark Mineral Intelligence says the benchmark treatment and refining charge falling to US$21.25/t could see major refiners cut production 4-10% in China next year, relieving pressure on mined supply.

LOSERS

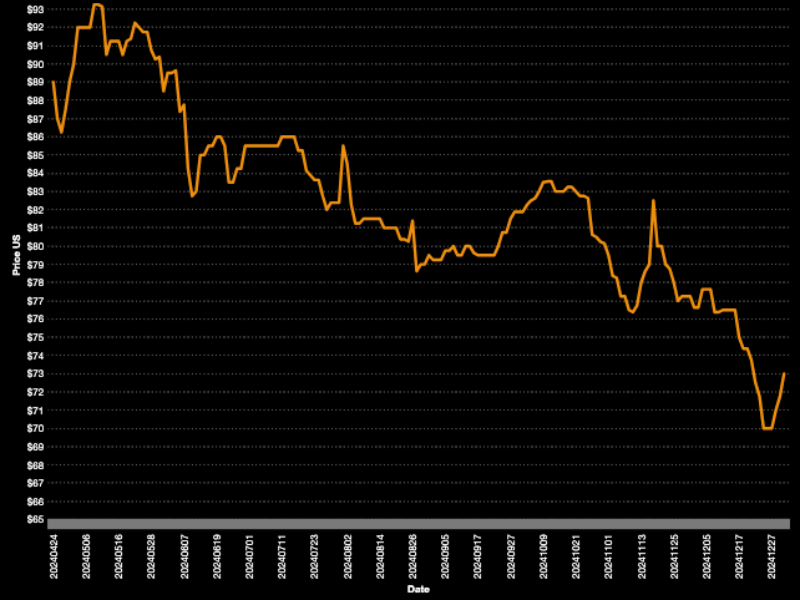

Uranium

2024 Start: US$91.50/lb

2024 Finish: US$71.75/lb

High: US$106/lb (January 19)

Low: US$70/lb (December 25-27)

% Change: -21.58%

There was so much hope for uranium going into 2024 after prices surged close to 90% in 2023. Some experts even claimed we were on our way to seeing US$175/lb, eclipsing historic highs by close to 20%.

Those dreams seemed to be turning to reality as spot prices rose mightily in January to US$106/lb, a 17-year record. But they quickly came back to earth as contracting by utilities, which hit a decade long high of ~160Mlb in 2023, fell by the wayside.

Curiously, the two price points that rule the yellowcake market have been converging. The spot market, relied on by nuclear power plants for years due to low prices, was left short after the arrival of non-market players like Sprott and Yellowcake PLC along with private hedge funds, which bought material in a self-fulfilling prophecy to lift the market from a decade long post-Fukushima slumber.

That stirred contracting activity to replace pounds previously accessed from the cheaper spot pool. By November last year term prices, which reflect long term contracts, had outpaced the spot market to hit long-term highs of US$81.50/lb.

What’s in store for 2025?

Sprott, which is understandably bullish on the commodity basket it’s thrown so many eggs in, thinks last year’s pause was merely an entry point for investors.

“Notably, uranium miners predominantly contract in the term market instead of the spot market and are therefore supported by term prices hitting 16-year highs,” Sprott’s Jacob White said.

“These term contracts also contain floors and ceilings, which continue to rise and are reported to be increasing with floor prices in the $70s and ceilings in the $130s (before escalation), indicating a midpoint of a triple-digit uranium price. Similarly, conversion and enrichment prices are at all-time highs, underscoring the strength of uranium’s current market dynamics.”

On the ASX, Boss Energy (ASX:BOE) and Paladin Energy (ASX:PDN) disappointed as investors digested the weaker than expected spot uranium price and ramp up challenges, especially at PDN’s Langer Heinrich mine.

But a handful of pre-development companies were more enthusiastically supported, as investors look to a bright future for nuclear power – which a host of government’s globally including the US want to triple the capacity of by 2050. Deep Yellow (ASX:DYL), Bannerman Energy (ASX:BMN) and NexGen Energy (ASX:NXG) held their shape while Silex Systems (ASX:SLX) rose 17% over the past year as US grant funding and an incoming ban on Russian sourced enriched uranium worked in its favour.

That has potential tailwinds for other uranium stocks like GTI Energy (ASX:GTR), one of a handful of explorers with advanced resources in the United States, where the US government has been motivated to lift supply and sidestep a Russian and Kazakh dominated supply chain. Drilling recently upped resources at its Lo Herma deposit in Wyoming by 50% to 8.7Mlb ahead of a scoping study due in H1 2025.

However, miners started on a high after Kazatomprom revealed it would be unable to produce yellowcake at the Inkai JV with Cameco due to delays in filing approvals to access Block 1 under its subsoil agreements with the Kazakh government.

UP

- AI is energy intensive, and with carbon abatement targets a major focus of tech companies like Microsoft, Google and Amazon, all are looking at accessing nuclear capacity to provide low carbon electricity for data centres, notably Microsoft’s backing via an offtake deal of power from a restarted Three Mile Island plant in Pennsylvania.

DOWN

- Contracting fell from 160Mlb in 2023 to a little over 100Mlb in 2024, with Chinese customers buying heavily from Kazakhstan’s Kazatomprom. But Sprott’s White says the deferment of contracting in the west means they will need to return to the market in heavier numbers in the future.

Iron ore (SGX Futures)

2024 Start: US$140.08/t

2024 Finish: US$100.97/t

High: US$126.01/t (January 3)

Low: US$89.69/t (September 23)

% Change: -27.92%

Another iron ore rally petered out as China’s economy again fell prey to weak property investment demand.

China produced 929Mt through the first 11 months of 2024 and remained on track to hit 1Bt of crude steel production for the fifth straight year, with improved profitability for mills in the back end of 2024 helping alleviate a major dip in the northern summer.

At the same time, domestic consumption was well down, falling 6.2% through the first three quarters of 2024 to 688Mt. Exports picked up much of the slack, lifting +20% to over 80Mt, but complaints about dumping from foreign steel mills and potentially significant tariffs from the incoming Trump government could limit support for its export market this year.

The World Steel Association said globally production was 1.4% down to November 30, with 1.694Bt produced worldwide. India, Turkiye and Brazil were among the few markets growing output, with Indian production up almost 6% to 135Mt. It remains well short of end of decade targets of 300Mt.

Are miners concerned? If they are they haven’t let on. FMG and BHP both expressed their belief that high cost supply at the margins is providing price support at between US$80-100/t, while Rio’s Jakob Stausholm thinks new demand from sources like EVs and renewables is picking up the slack and diversifying the supply chain away from its traditional growth engine in property.

He needs to say that, of course. Rio is tipping ~US$6bn into the construction of its portion of the Simandou iron ore mine in Guinea (Rio’s share will be 27Mtpa) which along with a block owned by another consortium could bring some 120Mt of new supply into the market by 2028.

It’s a little cloudier for the juniors. Cyclone Metals (ASX:CLE) posted strong gains late in the year after a surprise farm-in deal with Brazilian giant Vale. Back home, Grange Resources (ASX:GRR) raised concerns over the long-running Savage River mine in Tasmania after delaying an underground development critical to its future due to current iron ore prices.

It was annus horibilis for Mineral Resources (ASX:MIN) and its boss Chris Ellison as well. The company closed the Koolyanobbing mine with high costs and low reserves bringing a terminal end to the project in WA’s Yilgarn. But more pointedly it saw founding boss Chris Ellison announce plans to step down due to a string of corporate governance failings including undisclosed related party deals.

The miner’s lithium operations and spending were a big part of its corporate stresses, though the company is hopeful it has stronger and more reliable earnings ahead after opening the $3bn, 35Mtpa Onslow Iron site in mid-2024.

UP

- Iron ore survived another sell off that took prices to under US$90/t in early September, showing any stimulus measures in China will likely support the commodity’s price.

DOWN

- Supply is expected to begin rising, with Vale recovering volumes post the Brumadinho dam disaster, Simandou nearing completion and incremental tonnage increases in the Pilbara.

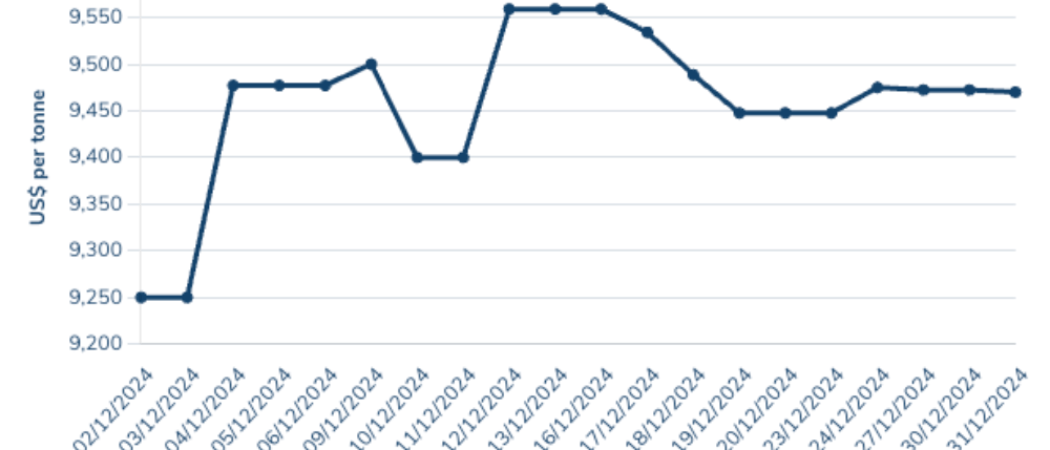

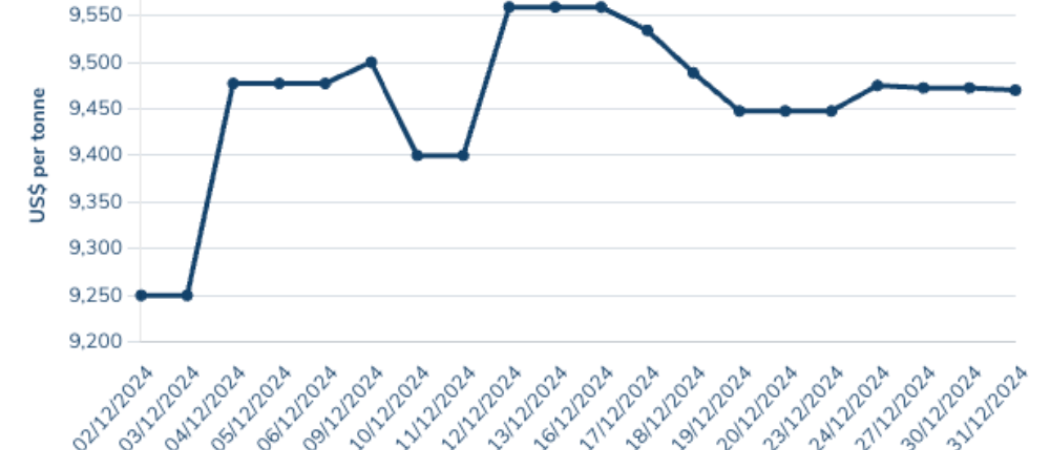

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

2024 Start: US$15,500/t

2024 Finish: US$9470/t

High:US$15,740/t (January 4)

Low: US$8600/t (November 11)

% Change: -38.90%

Lithium suffered so badly in 2023 it was hard to see it getting much worse heading into 2024. It did, with oversupply resulting from the rapid growth of new mines in Africa and lepidolite in China helping battery makers keep a lid on prices.

6% Li2O spodumene concentrate, the benchmark price for hard rock mines in WA, fell as low as US$760/t at their nadir, having tumbled from over US$8000/t in late 2022.

How is the second lithium winter of the past half-decade effecting miners?

From one of the ASX’s most profitable industries just a year and a half back, lithium producers have cut back on dividends and shut mines to control supply.

Greenbushes, the world’s biggest and lowest cost hard rock lithium producer, cut back on FY24 output with Chinese part-owner Tianqi choosing not to take up its full allocation of material, Pilbara Minerals (ASX:PLS) announced the mothballing of the smaller of two plants at its Pilgangoora mine, embattled Mineral Resources (ASX:MIN) halted expansion plans and shut the recently acquired Bald Hill mine late in the year, while Core Lithium (ASX:CXO) shuttered its Finniss mine in the NT.

The WA government eventually announced a $150m support package. Whether that will be enough to save new producers like Liontown Resources (ASX:LTR) (owner of the Kathleen Valley mine, one of two to open in WA last year)

If there is a silver lining it’s that prices have not fallen anywhere near as far as they did in the last lithium winter, and offtakers remain keen on Aussie product. Additionally, big players are spending up on assets in preparation for a new rally as EV demand rises.

Rio Tinto will acquire Arcadium Lithium (ASX:LTM) in a $10bn deal, while PLS has put Latin Resources (ASX:LRS) on its radar with a $560m scrip bid, Gina Rinehart and SQM paid $1.7bn for Pilbara explorer Azure Minerals and Volkswagen punted C$69m on a 10% stake in Patriot Battery Metals (ASX:PMT).

UP

- What goes up must come down and vice versa. Patriot Battery Metals boss Ken Brinsden, a man who’s been there, done that in this market, told Stockhead last month the recovery would likely surprise analysts with its timing.

DOWN

- Some bearish forecasters see the market remaining in surplus for years. Bank of America Merrill Lynch forecasts US$750/t SC6 prices in 2025 and US$800/t in 2026 with surpluses until 2027. Wood Mackenzie sees a 436,000t LCE surplus in 2026, 26% of projected demand, or close to 200 days of inventory.

Coal (Newcastle 6000 kcal)

2024 Start: US$136.95/t

2024 Finish: US$125.25/t

High:US$153/t (October 7)

Low: US$115/t (February 21)

% Change: -8.54%

The war in Ukraine is still going but the extraordinary fuel it poured on the coal market has run dry. Prices for thermal coal were largely rangebound in 2024 after a mild European winter a year earlier brought balance back to the market.

Coking coal has performed better, even though its 2024 yearly loss was more stark. Futures ran close to US$300/t early in the year before falling as China’s steel industry hit the skids.

They’ve since recovered to a touch over US$200/t – a decent premium over thermal.

With that in mind the big miners have increasingly looked to diversify into the more robust met coal market. Peabody Energy won the hotly contested auction for Anglo American’s Queensland mines – forking out up to US$3.8bn if a string of contingent events occur.

Glencore emerged as the world’s top met coal producer after its takeover of Teck’s Elk Valley Resources business in Canada, and decided against the demerger of its coal assets into a separate entity.

And South32 (ASX:S32) sold out of its Illawarra coal mines to a JV of local trader M Resources and GEAR, the entity through which Indonesia’s Widjaja family owns its majority take in Stanmore Coal (ASX:SMR).

UP

- Coal consumption continues to surprise despite the “energy transition”, with the IEA projecting demand would hit a record 8.7Bt in 2024. It will continue to rise incrementally to 8.9Bt by 2027.

DOWN

- Weak prices for Chinese domestic and Russian coal have placed a cap on seaborne prices.

Rare Earths (NdPr Oxide)

2024 Start: US$62.50/kg

2024 Finish: US$54.40/kg

High: US$63/kg (September 10)

Low: US$49/kg (June 13)

% Change: -12.96%

The rare earths industry is “swimming in red ink”, CEO of magnet producer Neo Performance Materials Constantine Karayannopoulos told Fastmarkets in a recent interview.

When will that ink dry out and be replace with a soothing black tone?

At best only Australia’s Lynas (ASX:LYC) and China’s Northern Rare Earths, with the benefits of scale and built infrastructure, are operating on positive margins.

Even they are struggling, with Lynas pausing uncontracted sales and moderating volumes of lower quality rare earths to improve a balance sheet weighed down with capex for planned future expansions.

While EV and wind turbine demand is growing, two key end users of magnet metals like neodymium, praseodymium, dysprosium and terbium, the Chinese property sector has been a major drag on rare earths demand.

The commodities are key components of, among other things, air conditioning units.

There are some green shoots. The seizure of rare earth mines in Myanmar’s north by an ethnic militia has cut some supplies, especially of heavies, to Chinese refiners.

But it appears increasingly likely that support and subsidies from western governments – the extension of a loan from the federal government to Iluka Resources (ASX:ILU) to maintain progress on its Eneabba refinery in WA is a case in point – will be needed to grow the industry outside China.

That’s seen friction emerge at the board and shareholder level of ASX-listed companies with significant deposits like Northern Minerals (ASX:NTU) and Lindian Resources (ASX:LIN).

At the same time, there are hopes Brazilian clay-hosted rare earths explorers can move into development during the next upswing with operations that have the grade and geological advantages to populate the bottom end of the cost curve such as Meteoric Resources (ASX:MEI), Brazilian Rare Earths (ASX:BRE), Viridis Mining and Minerals (ASX:VMM), Equinox Resources (ASX:EQN) and Brazilian Critical Minerals (ASX:BCM).

UP

- Iluka MD Tom O’Leary says the company is hopeful of a western offtake market developing with better pricing, having accused China of suppressing rare earth prices with its market dominance to keep out external players.

DOWN

- It may be a wait to see prices turnaround as demand pulls back ahead of the quiet Lunar New Year season in China, Shanghai Metals Market reported.

Nickel

2024 Start: US$16,603/t

2024 Finish: US$15,328/t

High:US$21,650/t (May 20)

Low: US$15,180/t (December 20)

% Change: -7.68%

BHP’s decision to shut its 80,000tpa Nickel West business until at least 2027 was the topper on the crap sandwich that was nickel in 2024.

It was hardly an orphan. Panoramic Resources, owner of the Savannah nickel mine in the Kimberley, went into administration before First Quantum and POSCO closed their Ravensthorpe mine. IGO paused construction of the Odysseus project, the cause of a staggering $1bn+ write down in 2023, while its Forrestania operations reached the end of their life.

Andrew Forrest’s Wyloo Metals shut the Kambalda nickel field, a mainstay of Australian industry since 1966.

By December 31, just two nickel mines were still operating in WA – IGO’s Nova and Glencore’s Murrin Murrin. The issues that have piled up on nickel – rising supply (largely from Chinese-sponsored miners and refiners in Indonesia) and shifting EV battery chemistries – have also crunched cobalt. Shareholders in cobalt producer Jervois Mining (ASX:JRV), including AustralianSuper, will be left with nada in a recap sponsored by its top creditor.

There could be some support from the Indonesia government, which now has an OPEC like control over the market and has been rumoured to be planning production limits in 2025.

UP

- The closure of a string of nickel mines in WA and New Caledonia, along with restrictions placed on some miners in overstocked Indonesia, could see supply gaps emerge that weren’t previously written in by forecasters.

DOWN

- The International Nickel Study Group still sees a big surplus of 135,000t in 2025, down from a predicted 170,000t in 2024.

OTHER METALS

Prices correct as of December 31, 2024.

Silver

Price: US$29.46/oz

%: +23.83%

Tin

Price: US$29,083/t

%: +14.43%

Zinc

Price: US$2978.50/t

%: +12.06%

Cobalt

Price: $US24,300/t

%:-16.6%

Aluminium

Price: $2384/t

%: +7.02%

Lead

Price: $1952/t

%: -5.63%

Graphite

Price: US$454/t

%: -17.9%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.