Up, Up, Down, Down: Gold aside, Red October sees metals investors play losing game

China's stimulus bump wore off as metals copper a big whack in October. Pic: Getty Images

- Gold, again, was the big dog in October, as the yellow metal rallied ahead

- But China’s stimulus bump wore off for other commodities as the metals complex went red

- Lithium rout continues as investors eye the bottom of the market

Up, Up, Down, Down is Stockhead’s regular check-up on how metals produced and explored for by ASX miners fared in the past month. All prices correct as at October 31, 2024.

WINNERS

Gold

Price: US$2734.15/oz

% Change: +3.96%

Gold prices surged to a record US$2970/oz late in the quarter on the futures market as analysts lifted bets on a sustained rally to US$3000/oz.

Argonaut, Commbank and last week Goldman Sachs joined other forecasters including Bell Potter and Shaw and Partners who’ve placed US$3000/oz gold on the agenda.

The next triggers will be the US Election and a predicted 25bps US rate cut next week, which could either send prices higher or rein in the bull run. Gold pulled back late last week despite weak non-farm payrolls in the States that upped prospects of future rate cuts.

Miners largely disappointed in September quarter reporting, but high prices meant most pulled in strong earnings. Funding is easier for gold than the rest of the sector, dominating capital raisings across the exploration and producer space, exemplified in Capricorn Metals’ (ASX:CMM) $200m, $6 a share placement last week to expand its Karlawinda gold mine.

UP

- Gold demand soared to a record 1331t for a September quarter, according to the World Gold Council, eclipsing US$100 billion for the first time in any three month period.

- ETF inflows have been recorded over the past six months with investment demand recovering in the West. Exchange traded funds had seen consistent outflows in recent years even as central bank demand hit record levels.

DOWN

- High prices are hurting jewellery demand, with Australia’s 19% fall in the September quarter a case in point.

- Is the US Election result going to be good or bad for gold? Analysts are split, with Saxo’s Ole S. Hanson warning a more restrained result which sees control of both the presidency and Congress split could see some of the pre-election heat come out of the bullion market.

READ

Gold Digger: Who’s better for gold, Trump or Kamala?

Coal (Newcastle 6000 kcal)

Price: US$145.50/t

% Change: +0.27%

Thermal coal continues to be a market in stasis, with little movement in the past few months as a rare period of stability emerges for the typically volatile commodity.

Whitehaven told investors at its recent AGM a 139Mtpa deficit is on the cards down the line, which may foster substantially higher prices if decarbonisation proves a longer and less straight-forward process than previously assumed or hoped.

Met coal prices were strong, lifting on the back of China’s steel industry boosting stimulus measures, taking Australian premium hard coking coal prices back beyond US$200/t after a couple months trending lower.

UP

- The election of the LNP’s David Crisafulli as the Queensland Premier will provide a touch of hope coal miners in the region can repair their relationship with the government, which has been on edge since a sudden royalty hike in 2022. However the regime has now been legislated and there are no indications a reversal of the cash spinner is on the LNP agenda.

- A string of major M&A deals are imminent, with buyers circling EMR’s Kestrel and Anglo’s Queensland met coal portfolio. Whitehaven Coal (ASX:WHC) and Yancoal Australia (ASX:YAL), should it get FIRB approval, are rumoured to be in the respective box seats.

DOWN

- The International Energy Agency said in its World Energy Outlook in October that the world economy can continue to grow without additional coal, gas or oil production from the end of the decade.

- Coal hit a new low in the Australian energy market, albeit briefly, supplying less than 25% of the national grid shortly after midday on Wednesday.

READ

Monsters of Rock: Whitehaven’s proving that coal still has some legs

LOSERS

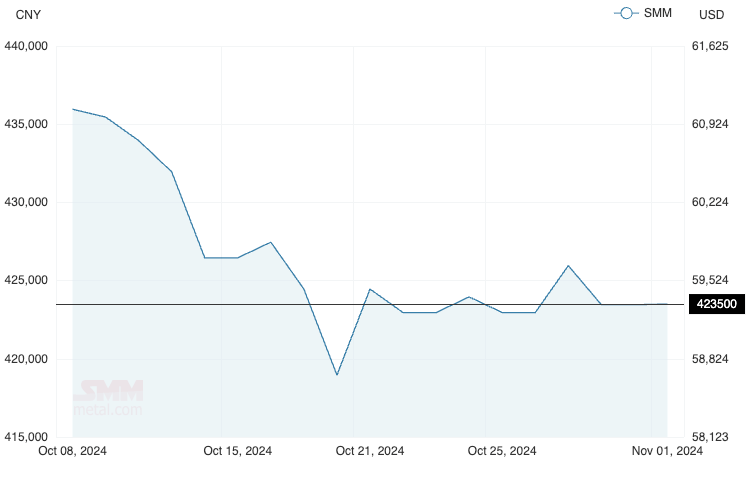

Rare Earths (NdPr Oxide)

Price: US$59.31/kg

% Change: -2.55%

A recovery sparked in part by Chinese stimulus measures in September ground to a halt in October.

That didn’t stop producers keeping a lid on production, with major Australian miner Lynas (ASX:LYC) reporting it managed output in the September quarter due to weak prices.

LYC’s sales revenue from its Malaysian refinery fell from $136.6m in the June quarter to $120.5m in September.

“The market price of NdPr recovered slightly at the end of the quarter. Possible contributing factors include a reduction in imported material into China and the economic challenges faced by many producers at the low price levels,” the $7.3bn firm reported.

“The recovery was more modest for Dy and Tb, as speculators carried substantial inventory from prior periods and as technology improvements were made by magnet makers to allow a decrease in the Dy-Tb requirements.

“Lynas maintained a stable Average Selling Price throughout the quarter and continued to serve key strategic customers.”

Up

- A border closure between troubled Myanmar and China could cut off rare earth imports to China, putting pressure on the market if it continues for a sustained period. The Chinese Government shut the crossing through which it both imports rare earth oxides and sends mine workers south due to conflicts between Myanmar’s junta and local ethnic Kachin rebels.

- China Northern Rare Earth increased its listing prices for early November, albeit marginally.

DOWN

- Shanghai Metals Market says Chinese processors have been able to rely on material from Laos in response to the border closure with Myanmar, with the border closure likely to impact if it persists for two months or more.

- The SMM expects prices to remain stable with downstream customers unwilling to lift prices for finished rare earth products.

READ

Barry FitzGerald: Garimpeiro narrows in on Brazil as the rare earths tide turns

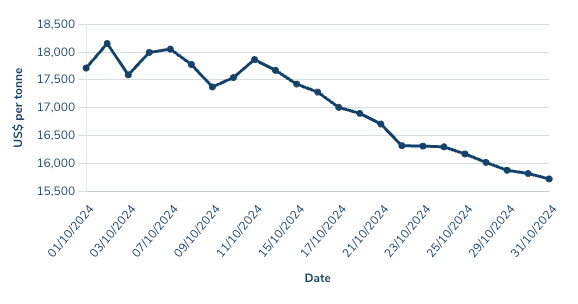

Nickel

Price: US$15,718/t

% Change: -10.25%

Flecks of optimism last month fell to the wayside as new nickel ore supply approvals from Indonesia’s mining authority led to concerns of yet higher supply from the southeast Asian nation.

With BHP winding down its Nickel West operations, surviving Aussie producer IGO (ASX:IGO) disappointed with output from its Nova mine in the September quarter.

Nova is one of only two mines to remain operational in WA once BHP shuts down, alongside Glencore’s Murrin Murrin laterite.

UP

- While nickel output is expected to grow around 15% this year in Indonesia, ore supply shortages have led processors including Tsingshan to look elsewhere for mined supply to maintain production.

- Now with OPEC like control over the nickel industry, Indonesia’s has flagged tighter government oversight of supply to match demand and avoid further price falls.

DOWN

- BHP has begun the redeployment of workers from its Nickel West business ahead of a total shift to care and maintenance this year.

- Sumitomo is the latest non Indonesian miner to review output from its nickel assets after a pipeline failure hit production in October at the Ambatovy mine in Madagascar.

READ

Resources Top 5: Cobar Basin delivers surprise gold find, and nickel’s looking premium in Finland

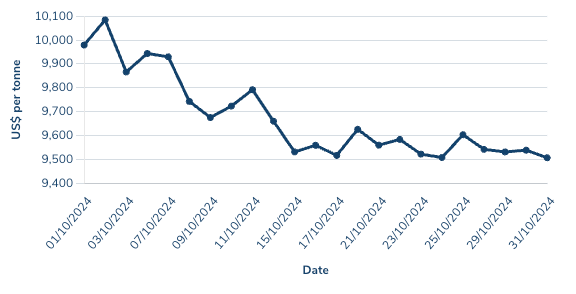

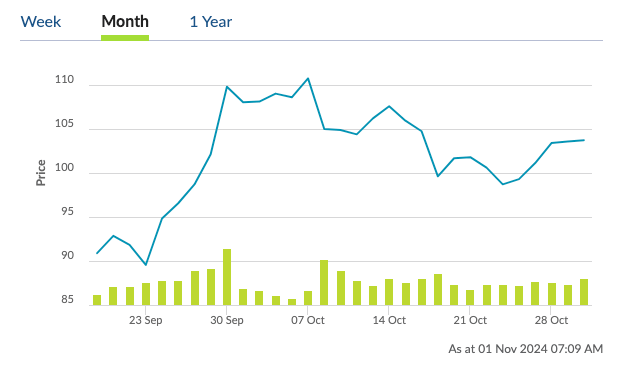

Copper

Price: US$9506/t

% Change: -3.29%

Copper prices moderated in October after a solid September, but the long-term support for the commodity gets no less bright.

BHP could make another play at Anglo American after walking back comments from chair Ken MacKenzie at its AGM that the company had moved on from the takeover process (important wording given the stringent nature of UK takeover rules).

Big copper producers continue to disappoint on output. Ivanhoe Mines cut its 2024 guidance last week from 440,000-490,000t to 425,000-450,000t, while Codelco’s production in Chile fell 5% over the first nine months of the year.

At 338,000t, its September quarter output was, at the very least, 2% up on the same period in 2023.

Fastmarkets, which notes the fourth quarter is historically stronger for copper, thinks prices could average US$10,265/t, a record high.

However, that would require a major bull run in November and December after a weaker October.

UP

- UBS thinks copper deficits could run to 200,000t in 2025, sending prices to an average of US$10,500/t next year and US$11,000/t in 2026.

- Old copper mines are increasingly being looked at by investors as opportunities to restart production quickly without making a dent in long term supply shortages. Most were shut at times of considerably lower prices with Cygnus Metals’ merger with Dore an example.

DOWN

- Copper’s role as an industrial metal means it is closely tied to China. If stimulus measures disappoint, so could the copper price.

- LME copper stocks drew down over the month of October, sitting at around 271,000t on the 31st from ~300,000t on September 30. But they’re much higher than earlier this year, indicating the physical market was tighter in April and May when prices hit all time highs.

READ

A new mining chapter in Nunavut excites ASX copper explorers

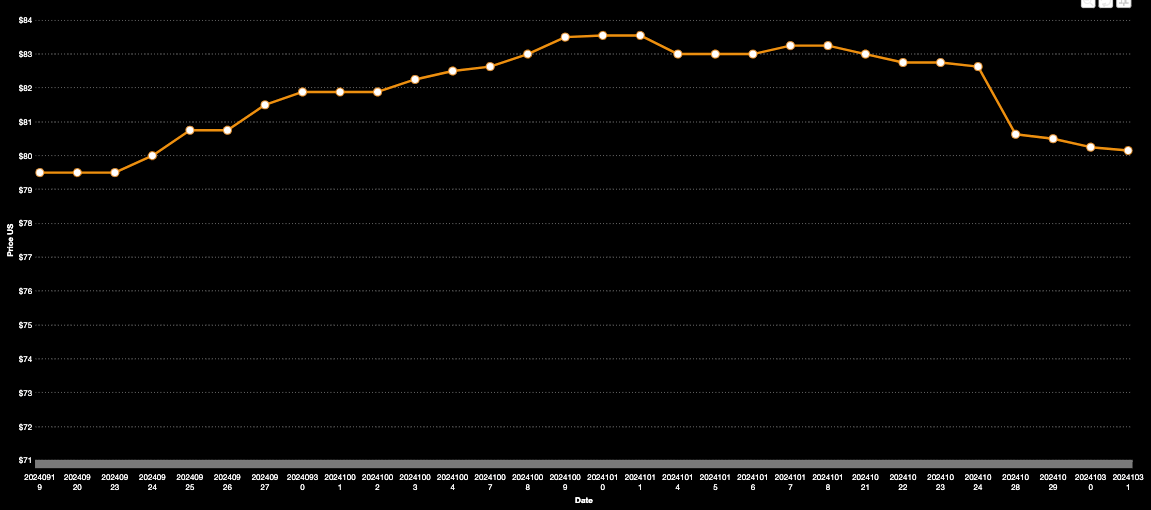

Uranium (Numerco)

Price: US$80.15/lb

% Change: -2.11%

Uranium buzz was generated not by the sector itself but by the big tech players, who are looking to nuclear energy to power their future energy needs.

The power required to run energy hungry data centres is emerging as a serious concern for Magnificent Seven tech firms, with Amazon, Google and Microsoft all keen to offtake nuclear power for their operations.

At the same time, spot prices have been tepid, but are sitting roughly in line with long term contract prices, which augurs well for new producers.

UP

- Amazon and Google joined Microsoft in signalling plans to invest in nuclear power supply, with Amazon announcing plans to invest US$500m on small modular reactors including a deal with the utility provider for data centre hub Virginia.

- The plateau in uranium prices could be an opportunity for investors who believe in the narrative to top up.

DOWN

- Paladin disappointed with its first quarter returning to full production at Langer Heinrich in Namibia, setting up a battle to meet 2025 guidance.

- Peter Dutton faces a battle with the States to sanction nuclear power if the LNP wins the next Federal Election. New Queensland LNP Premier David Crisafulli looms as a roadblock for the Coalition’s flagship energy policy.

READ

Kristie Batten: Uranium believers get rare ‘second chance’

Iron ore (SGX Futures)

Price: US$103.89/t

% Change: -5.39%

The furious rise brought about by Chinese stimulus in September subsided as follow up measure to the People’s Bank’s People’s Pump underwhelmed.

On the fundamental side it was a brighter month for steel producers as Chinese mills reopened from maintenance and production lifted.

Iron ore miners were less stellar. Rio Tinto, notably, has gone back to the drawing board to sort out ore quality issues as delays to bring new mines on board are seeing it rely on more low grade shipments to keep customers happy.

The high grade Rhodes Ridge deposit is expected to solve those woes, but not til the end of the decade.

There’s still plenty of cash to be made in iron ore though. Case in point, the $5.6 billion after tax profit delivered by Gina Rinehart’s Hancock Prospecting for the year to June 30, 2024.

That came largely from the 70% owned Roy Hill mine, which shipped 64Mt in FY24 from the Pilbara and banked $3.2bn in NPAT, as well as $1.5bn from a 50% stake in Rio Tinto’s Hope Downs JV.

UP

- Despite concerns about the Chinese real estate market, BHP sees a bright future for steel and by proxy iron ore, with green tech like solar, EVs and wind picking up the slack from the weakening property market.

- Chinese steel production rose 4.5% on a per day basis in October, according to MySteel, as higher prices and the end of maintenance campaigns saw them return to profitability.

DOWN

- Steel demand continues to lag in developed markets, with the European Steel Association or Eurofer indicating consumption would fall 1.8% for 2024 in a fourth downgrade this year last week.

- While it’s factories have been propped up by exports, the World Steel Association says Chinese domestic steel consumption will fall this year for the fourth time in a row, tumbling to less than half of the global total.

READ

Bulk Buys: BHP says green tech replacing property in bullish take on China steel market

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$9050/t

% Change: -9.59%

Lithium continues to disappoint, with hydroxide prices falling again in October.

It comes despite a strong run for lithium stocks in September off the back of the reported closure of a major Chinese lepidolite mine, giving hope the industry was so far into the cost curve a rebound was inevitable.

Spodumene prices are now in the order of US$750/t, a point at which few miners are making money. Those that are, like the Greenbushes and Pilgangoora mines, are using operating cash flows to fund capex, with returns for shareholders drying up.

But the industry’s despair also brings hope. As miners lose money, it stands to reason mines will be closed or at least production curtailed. The last lithium winter saw prices for spodumene concentrate fall below US$400/t before underinvestment and an electric vehicle boom saw them climb to over US$8000/t at their peak.

Anything can happen in this nascent market.

UP

- Supply continues to be taken out of the market, with Pilbara Minerals the latest to cut back with the closure of its Ngungaju plant at the Pilgangoora mine.

- Rio Tinto’s deal to acquire Arcadium suggests majors see a bottom in the lithium market, pinpointing now as the perfect time for counter-cyclical M&A.

DOWN

- While higher cost material is coming out of the market, expansion projects are continuing, with Jarden suggesting spodumene prices will be range bound between US$750/t to US$1200/t with mines like Pilgangoora, Greenbushes, Mt Holland, Kathleen Valley, Goulamina and brine ops like Arcadium’s continuing to add capacity.

- A subisidiary of Chengxin Lithium received approval to mine the Murong project in China’s Sichuan Province, reported by SMM and Asian Metal as Asia’s largest and highest grade spodumene resource.

READ

READ: Kristie Batten: Rio goes all in on Argentine lithium

OTHER METALS

Prices correct as of October 31, 2024.

Silver: US$33.59/oz (+8.08%)

Tin: US$31,213/t (-6.71%)

Zinc: US$3029/t (-2.00%)

Cobalt $US24,300/t (0.00%)

Aluminium: $2617.50/t (+0.21%)

Lead: US$2019.50/t (-3.65%)

Graphite (Fastmarkets flake): US$460/t (0.00%)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.