Up, Up, Down, Down: Gold and base metals sweep the floor with the opposition to win the commodities market in July

Pic: JaniecBros/E+ via Getty Images

- Gold, nickel and copper post the biggest gains in July across the major ASX commodities

- Rare earths prices arrest a concerning decline with uranium steady

- Lithium hydroxide prices fall almost 15% in July

WINNERS

Gold

Price: US$1970.65/oz

% Change: +3.01%

Gold prices hit a record quarterly high in the last quarter according to the LBMA PM price charts, with gold demand including over the counter investment interest lifting 7% year on year in the June quarter, according to the World Gold Council.

Even with supply rising in the first half to a record 1781t globally, demand kept prices swimming, Jaws-like just beneath the all time record of over US$2000/oz, where a ceiling has proven tough to break through.

Central bank demand fell in the June quarter on a year on year basis to 103t because of sales from Turkey, but at 387t came in at a first half record, while bar and coin demand rose 6% year on year to 277t, gold ETF outflows slowed from 47t in 2022 to 21t this year and jewellery consumption lifted 3% YoY and recorded a total of 951t in the first half.

With rate hikes slowing across the world, that’s a positive launchpad for a commodity already at strong price levels, up 3% in the past month and almost half a per cent on the last day of July.

Gold has had three stabs in the past three years at broaching the US$2075/oz record set in August 2020 only to hit turbulence and fall back.

But as long as your costs are in check and production is largely unhedged there is good money to be made as a gold miner right now.

World Gold Council senior markets analyst Louise Street said there could be further upside in the second half.

“Record central bank demand has dominated the gold market over the last year and, despite a slower pace in Q2, this trend underscores gold’s importance as a safe haven asset amid ongoing geopolitical tensions and challenging economic conditions around the world,” she said.

“Looking ahead to the second half of 2023, an economic contraction could bring additional upside for gold, further reinforcing its safe-haven asset status. In this scenario, gold would be supported by demand from investors and central banks, helping to offset any weakness in jewellery and technology demand triggered by a squeeze on consumer spending.”

On the producer front the outcomes have been mixed. The All Ords gold sub-index is up 16% YTD, but a number of miners including Northern Star Resources (ASX:NST), Regis Resources (ASX:RRL) and Silver Lake Resources (ASX:SLR) were hammered by investors for disappointing FY24 guidance updates.

Gold miners share prices today:

Rare Earths (NdPr Oxide)

Price: US$65.91/kg

% Change: +4.69%

Is the worm turning for rare earths?

The collection of metals prized for their use in magnets, EVs and wind turbines has been under serious pressure this year.

Prices have been sunk by weak demand in major electronics and technology markets like China and Japan, and hamstrung by China’s control of the supply chain.

Production quotas in China lifted 20% in March after a 25% rise last year, something that has seen the market flooded with material at a time consumers are struggling in the world’s second largest economy, with only strong EV and hybrid vehicle sales providing a floor.

With a further bi-annual quota announcement due in the coming months, it has even prompted Lynas Rare Earths (ASX:LYC) to stash material not required for delivery into long term contracts, with an oversupply of both NdPr and lanthanum and cerium hurting market prices.

The largest producer of magnet metals outside China and a major supplier into the Japanese technology and defense sectors, Lynas has seen average selling prices drop over 50% since the fourth quarter of 2022, flopping from over US$79/kg to ~US$38/kg.

But NdPr prices have stabilised in recent days, with Lynas CEO Amanda Lacaze and COO Pol Le Roux remaining confident in the long term outlook for the commodities, eyeing what Lacaze says will be an ‘inevitable uptick’ as stimulus measures lift demand in the ex-EV market in China.

“I think what is important to understand is that (the) Chinese are very confident on the demand increase,” Le Roux said on a call with analysts this week.

“They are all investing in additional capacities and you have to give them this, they are not stupid people and they love money so they won’t spend money for the pleasure of spending it.

“So that means that yes, we are going through a weak demand period at the moment but the long term strategy is really quite enthusiastic on the Chinese side.”

At the same time efforts from the West to break China’s hold on the supply chain for the critical minerals is accelerating.

Earlier this week, Lynas announced it had received more than double the support from the US Department of Defense to co-locate a heavy rare earths separation plant alongside a planned light rare earths facility in the town of Seadrift in Texas.

The Biden Administration will now tip some US$258 million into the project, which will see the construction of the first heavies separation plant outside China.

“Lynas is the only commercial scale source of separated rare earths outside of China and our expertise makes us the ideal partner for the DoD as it addresses supply chain vulnerabilities and strengthens national security,” Lacaze said.

“Seadrift, Texas, is an excellent location for our facility and we thank the local authorities for providing such a warm welcome. We are excited to collaborate with local community leaders to create advanced manufacturing jobs and economic opportunities.”

“This effort is a cornerstone event in securing resilient supply chains by enabling the United States and its allies to gain an organic capability for critical minerals and materials and depart from foreign dependence as directed by President Biden’s Executive

Order 14017,” Deputy Assistant Secretary of Defense for Industrial Base Resilience Halimah Najieb-Locke said.

Rare Earths share prices today:

Nickel

Price: US$22,293/t

% Change: +8.66%

Nickel was the largest major commodity gainer over the past month, a happy respite for nickel bulls after it spent the first half of 2023 as the LME’s worst performer, losing 37% of its value.

The big factor has been oversupply out of Indonesia, where crafty Chinese-backed miners are moving at a rapid pace into supplying class 1 nickel for the electric vehicle industry.

Huayou Cobalt this week revealed US$200m plans to build a 50,000tpa nickel sulphate plant in Indonesia, building on its nickel matte and HPAL production plans.

It had previously been thought that Indonesia’s large nickel pig iron industry would be sequestered to supplying stainless steel producers, leaving Western nickel sulphide producers well-placed to chase premiums from the battery sector.

With that idea turned on its head, LME nickel prices have largely trended down this year.

But suggestions Indonesia could bring in production controls to contain and prevent a nickel supply glut have improved the optimism of traders in recent days.

Three-month LME futures rose US$618/t on Friday alone, with the LME inventory falling 1308t over the month to 37,542t, something like four days of global supplies.

The International Nickel Study Group says primary nickel production will rise this year from 3.06Mt to 3.374Mt while nickel usage will lift only from 2.955Mt to 3.314Mt, implying a market surplus of 239,000t.

As far as producers are concerned Nickel Industries (ASX:NIC) expects lower prices to hit its earnings, but remains set on growing its Indonesian output in the years to come. Its self-owned production capacity could lift to 144,000t, almost double the output of BHP’s (ASX:BHP) Nickel West business, in a few years.

BHP is preparing for a smelter rebuild and plans to lift output from 80,000t to as much as 87,000t at its WA nickel business this financial year, while its supplier Mincor has been taken off the market in a buyout by Andrew Forrest’s Wyloo Metals and IGO (ASX:IGO) announced it will cop a massive impairment of almost $1 billion on the value of the assets it bought from Western Areas in a $1.3 billion takeover last year.

Nickel miners share price today:

Copper

Price: US$8832.00/t

% Change: +6.21%

Chinese stimulus hopes sent copper prices rising to their highest level since April last month after weeks of bad economic data out of mainland China prompted action from its Politburo.

“This came after data showed growth continued to slow. The official manufacturing Purchasing Managers Index rose slightly to 49.3 but remained in contractionary territory. The services PMI eased to 51.5, weaker than expectations,” ANZ economist Madeline Dunk said.

“The spluttering economic recovery has spurred measures from Beijing. The State Council released details of 20 measures to support consumption, including easing restrictions on car purchases and support for people buying their first homes.

“The head of consumer goods at the Ministry of Industry and Information said it is studying measures to promote high-quality development of the audio-visual industry.

“Supply risks were also in focus. Codelco, the world’s largest producer, lowered its annual production guidance as operational issues bite. Overall copper production in Chile fell 0.9% y/y to 457.9kt in June.”

While demand is yet to soar, the early momentum is expected to emerge this year and next, with the International Copper Study Group aiming to see 1.4% growth in copper use in 2023 and 2.8% in 2024.

S&P Global thinks copper demand could double on 2020 levels to 50Mt by 2050, though in the short term new supply is expected to place the market into a surplus of around 111,000t in 2023 and 188,000t in 2024 according to analysts aggregated by Reuters.

Copper miners share prices today:

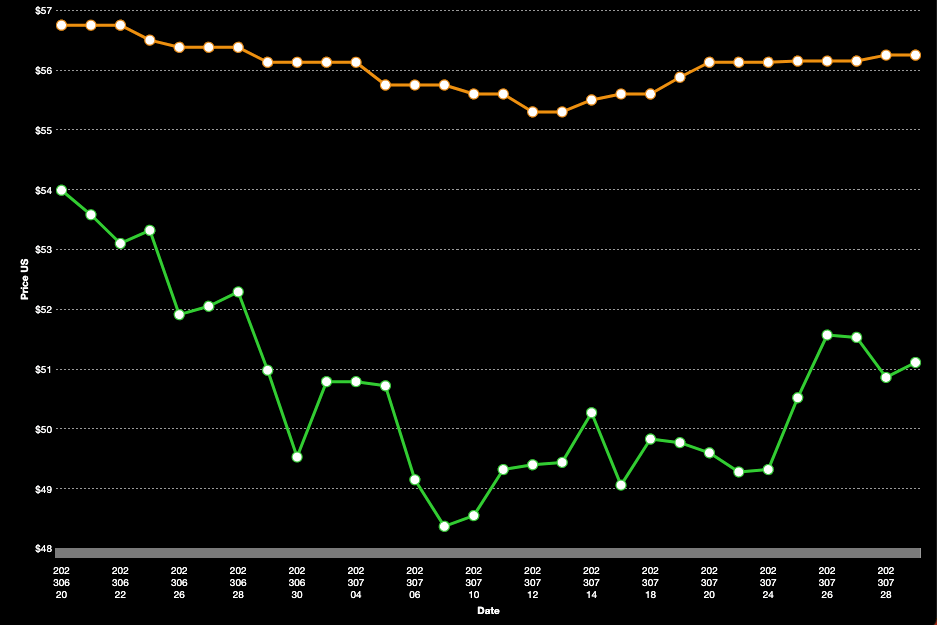

Uranium (Numerco)

Price: US$56.25/lb

% Change: +0.2%

“This is the biggest moment for nuclear energy since the dawn of the atomic age. Everywhere we look, we see demand surging.”

Those are the words of Nuclear Energy Institute president and CEO Maria Korsnick, talking at the 2023 Nuclear Energy Assembly in Washington DC back in May.

So far this year spot prices have proven resilient, with around 14.4Mlb of spot U3O8 sold in the June quarter, up from 12.6Mlb in March 2023.

That was even with Sprott remaining on the sidelines, with a very healthy 116Mlb contracted on term pricing in the first half of the year, driven by Ukraine and Bulgaria.

Andre Liebenberg, the boss of uranium fund Yellowcake PLC, said the market was looking increasingly positive, echoing the bullish voices of Aussie developers and explorers like Deep Yellow’s (ASX:DYL) John Borshoff and Elevate Uranium’s (ASX:EL8) Murray Hill.

“We remain confident in the medium-term outlook for the price of uranium, based on the continued supply and demand fundamentals that we expect to drive further upward pricing pressure on the commodity in the second half of 2023,” Liebenberg said after increasing the NAV of its physical uranium holdings by 6.4% in the June quarter.

“Though we have seen some supply increases over the past six months, the supply-demand balance remains tight. Demand continues to increase, driven by considerable growth in both India and China, but also due to a more supportive sentiment across the world as nuclear continues to gain acceptance as a vital source of clean energy and a major factor in meeting net zero targets.

“Another key theme we expect to see in the second half is continued uranium contracting, as utilities look to acquire fuel supply due to years of below-replacement-level contracting.

“The threat of restrictions on Russian-sourced nuclear fuel deliveries to the West may also have a material impact on the uranium price. We continue to believe the investment case remains very compelling.”

Uranium share prices today:

LOSERS

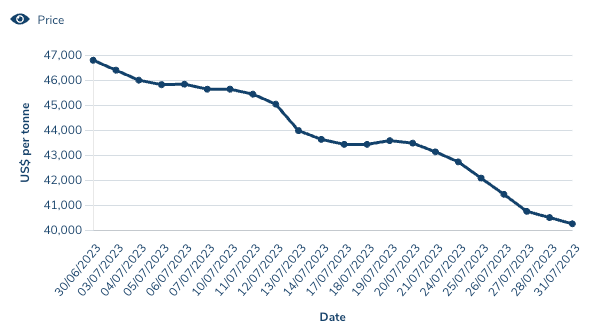

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$40,250/t

% Change: -14.18%

If markets like nickel and copper have been dire places to invest this year, lithium has been the opposite.

Despite prices more than halving through the first four months of the year the froth from a wave of M&A activity washing over the industry has kept investor interest and share prices high.

Aggressive US major Albemarle’s latest strategic move, investing C$109 million to take a cornerstone ~5% stake in TSX and ASX listed Patriot Battery Metals (ASX:PMT) is just the latest in a string of investments from the majors.

July was a tougher month for lithium chemicals producers in Asia, seeing prices fall almost 15% after they stabilised across May and June.

But while prices have ameliorated, at over US$3500/t for spodumene, margins for hard rock lithium miners in Australia remain around the 90% mark. Let that sink in.

The cavalcade of takeover action across the industry suggests its biggest players remain bullish about the long term demand outlook of the EV fuelling commodity, and the capacity for prices to remain at profitable levels in the years to come.

Where there would be a note of caution is around established market players moving downstream into lithium hydroxide processing.

IGO (ASX:IGO) revealed a massive regression in the ramp up of its JV processing plant with Greenbushes partner Tianqi in the June quarter, with the companies only expecting to hit half of its 24,000tpa nameplate rate by the end of 2023.

Mineral Resources (ASX:MIN) boss Chris Ellison meanwhile dumped plans to invest around $1 billion in two hydroxide plants owned by Albemarle in China, preferring instead to study the production of a midstream lithium sulphate at home in Australia.

In the price front, Canaccord Genuity’s Reg Spencer told Stockhead the brokerage firm expects lithium prices to remain relatively rangebound across the second half of the year.

Lithium stocks prices today:

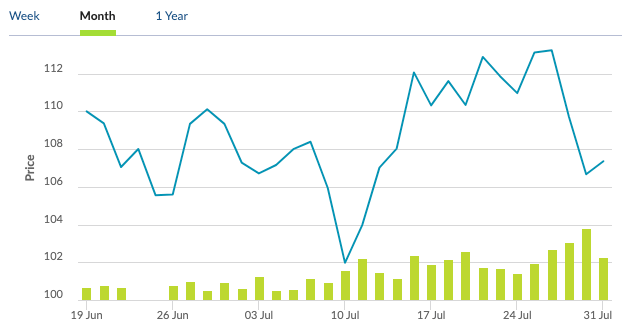

Iron ore (SGX Futures)

Price: US$107.36/t

% Change: -1.57%

Iron ore prices continue to remain wobbly, wading at the deep end of the pool as the tug of war between China’s weak economic data and stimulus measures leave confusing signals about prices.

Where they go from here on in is uncertain, with China’s stimulus measures unlikely to result in the property booms which sent iron ore prices rallying in times gone by.

Citi sees a surplus emerging in the second half of 2023 as steel production controls come in to keep output in China below 2022 levels.

“We think the market will move into a surplus with increasing steel production controls kicking off, reducing offtake; meanwhile, we expect iron ore supply to remain relatively stable in the second half of 2023,” Citi analysts said in a note.

These moves may have already begun at the local government level in China, where the steel city of Tangshan saw output cuts last month.

“The Yunnan Provincial Development and Reform Commission affirmed its yearly cap of steel production at 2022 levels and asked local mills to submit individual output targets,” Westpac economists said yesterday in a note.

Iron ore miners meanwhile have posted strong production figures for the first half of the year. FMG (ASX:FMG) and BHP hit financial year records in FY23 of 192Mt and 285Mt respectively, while Rio says it is on track to hit the upper half of its 320-335Mt guidance for calendar 2023.

Fortescue and BHP could see output rise further in 2024, posting guidance ranges with upper limits of 197Mt and 294Mt respectively.

Iron ore miners share prices today:

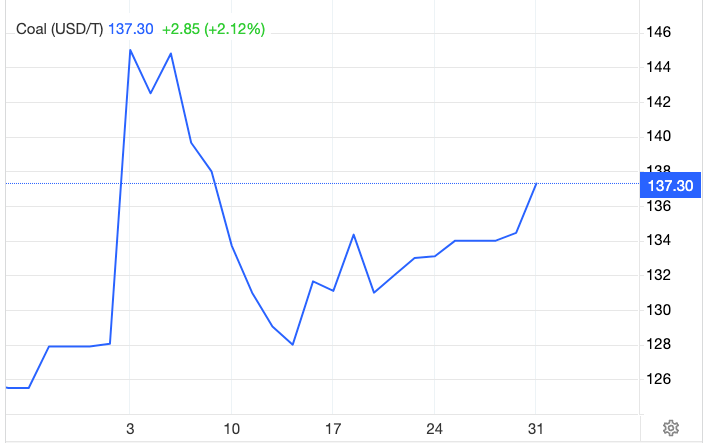

Coal (Newcastle 6000 kcal)

Price: US$140.90/t

% Change: -5.88%

After a stunning fall across the first six months of 2023, coal prices have returned to something resembling normality.

Having surged to well over US$400/t in 2022, the energy fuel has been as mild as, until recently, the northern hemisphere weather that resulted in subdued demand for the commodity.

All the focus in the coal market is now turning to the auction for BHP’s Daunia and Blackwater coal mines in Queensland, set to fetch into the billions with major Aussie coal companies like Whitehaven (ASX:WHC), Coronado (ASX:CRN) and Yancoal (ASX:YAL) among those believed to be in line for the assets.

According to The Australian, bids are due by August 9, with prices of between US$3-5bn quoted for the mines.

Meanwhile, coal miners are facing questions on how they go about financing growth outside the impressive bank balances they built up in last year’s boom.

Whitehaven has $2.65 billion in its bank account, but received the cold shoulder from its lenders recently, failing to renew a $1b finance facility in a development that suggests banks are taking stronger action to remove emissions exposure from the lending portfolios.

“We went through that process. It’s a range of banks. I’d say to you that it is increasingly difficult being a thermal coal producer to attract external funding,” CFO Kevin Ball said on a call with analysts last month.

“It’s fairly challenging when you go to a bank and say I’ve got $2.6 billion on a balance sheet and they look at you and say ‘sir, why do you need that? First of all.’ That certainly played into the conversation,” he added later.

“A number of banks took opportunities to say ‘well you’ve got plenty of cash, come back when you’ve got something else you want to do, but at the moment we’ll take our opportunity to decarbonise’.

“On that front, the contingent side of the world, we were really well supported, a diversified group there, and I’d say to you anybody who is in thermal coal is going to face difficulty getting funding from traditional sources.”

BHP’s mines on the block are met coal mines, product that is currently attracting much higher prices than thermal coal and more likely to be acceptable for mainstream financiers.

Coal miners share prices today:

OTHER METALS

Prices correct as of June 30, 2023.

Silver

Price: US$24.36/oz

%: +8.41%

Tin

Price: US$28,637/t

%: +6.90%

Zinc

Price: US$2565/t

%: +7.41%

Cobalt

Price: US$33,420/t

%: +0.00%

Aluminium

Price: US$2282.50/t

%: +6.09%

Lead

Price: US$2149/t

%: +2.36%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.