Up, Up, Down, Down: China rally turns September green for metals, unless you’re in lithium

Pic: Getty Images

- Most metals catch a ride on the Chinese stimulus train

- Gold hits new highs, copper briefly peaks above US$10,000/t and iron ore is back baby

- Lithium oh so lonely as our sole major commodity loser despite equity run

Up, Up, Down, Down is Stockhead’s regular check-up on how metals produced and explored for by ASX miners fared in the past month. All prices correct as at September 30, 2024.

WINNERS

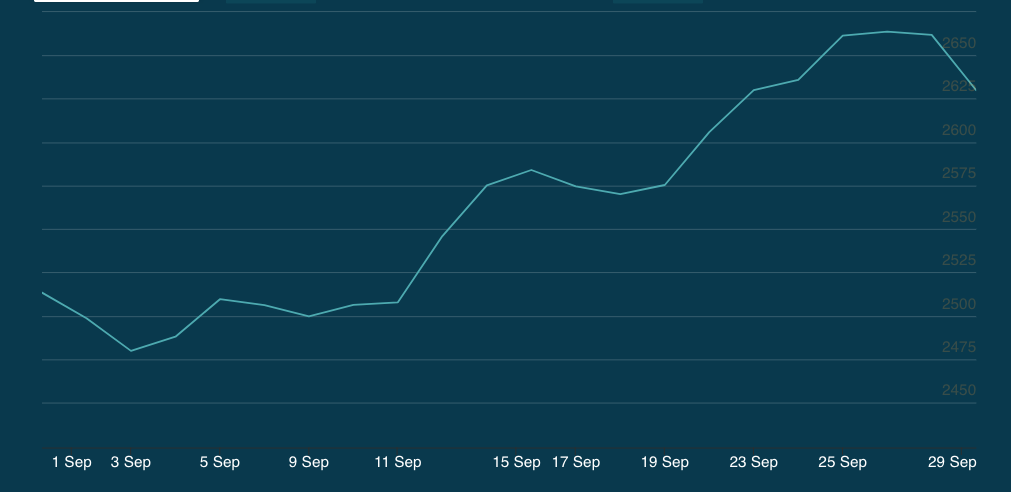

Gold

Price: US$2629.95/oz

% Change: +4.64%

Gold rose to levels never before seen (again), as the US Fed finally pressed the go button on rate cuts. A 50bps trim was effectively priced in by the market, with the initial response tame.

But gold has continued to climb since then with buyers again returning to the market after Jerome Powell’s call to begin monetary easing in the States was met with a surprise bump in the US dollar.

A fair whack of strength in bullion is being added by geopolitical risk, as Israel’s war fronts in the Middle East expanded to include Lebanon and non-State militant group Hezbollah.

UP

- Fitch’s BMI Commodity Insights, previously bearish on gold, turned optimistic tipping a run between US$2500-2800/oz in the coming months. Goldman has also lifted its 2025 forecast from US$2700/oz to US$2900/oz.

- Bell Potter senior research analyst David Coatestold Stockhead in September that US$3000/oz was within reach in 6-9 months as bullion’s run continues.

DOWN

- Chinese gold imports have slowed through the middle of the year, with a main driver of gold demand likely to finish flat for 2024, absent a Q4 rebound in demand.

- Gold may be at record highs, but a history of weak margins and underperformance has investors cautious still on equities. As per the ASX All Ords gold sub-index, Aussie goldies are still shy of their August 7, 2020 peak. That could be good or bad in terms of future direction.

READ

Resources Rising Stars: Institutions target gold juniors as value emerges

Coal (Newcastle 6000 kcal)

Price: US$145.10/t

% Change: +0.94%

Thermal coal has been a steady hand this year, trading rangebound in a market delicately balanced in terms of supply and demand.

On the other hand, met coal has had ups and downs, with premium hard coking coal falling under US$200/t at one point but lifting back to US$239/t at the end of September, with futures rising 7% on the final day of the month on account of China’s mad stimulus push.

That’s lifted hopes of a stronger end to the year for weak Chinese steel markets.

UP

- Interest in met coal assets is high, with a number of large players in the bidding process for Anglo’s US$4-5bn Queensland coking coal assets. Stanmore Coal (ASX:SMR) , Glencore and Yancoal Australia (ASX:YAL) are said to be in with the best shout, while New Hope Corp (ASX:NHC) has also publicly revealed it bidded for the assets.

- The Federal Government’s forecasters this week said coking coal prices would fall from US$242/t this year to US$205/t by 2026, with exports from Australia expected to rise from 151Mt last financial year to 161Mt in 2024-25 and 179Mt in 2025-26. BUT, 2024-25 exports have been revised down from 172Mt, showing the likelihood of producers to undershoot and keep market supply tight.

DOWN

- Long term thermal coal forecasts monitored by KPMG have been trending downwards, with the median falling from US$100/t to US$90/t in its latest update, though long term hard coking coal estimates from analysts remain robust at US$189.60/t, down from US$197/t. Another update is due soon.

- Canberra’s forecasters see the thermal coal export trade falling in volume over the the next two years by 1.5% and 4.3% respectively, with Australian exports forecast to rise incrementally over the same period. They think prices drop commensurately to US$126/t in 2025 and US$113/t in 2026.

READ

Monsters of Rock: New Hope defies coal weakness with tasty payout

Rare Earths (NdPr Oxide)

Price: US$60.86/kg

% Change: +6.18%

NdPr prices rose significantly in August and kept moving up in September as the outlook for magnet exporters in China improved.

According to the Shanghai Metals Market, downstream demand lifted with US Fed interest rate cuts inspiring more adventurous trade orders from companies outside the Middle Kingdom.

“SMM predicts that with the arrival of the fourth quarter, downstream rare earth orders may see a slight increase,” they said.

Mining quota increases have been kept to a minimum this year, supporting margins for both Chinese and non-Chinese producers of the metals used in EV motors and wind turbines.

Up

- Investors remain supportive of the long-term narrative for rare earths, with Northern Minerals (ASX:NTU) raising $43m and launching a $5m share purchase plan for studies on its Browns Range project in WA, where FID is expected in the first half of 2025. The project is expected to be one of the world’s largest sources of heavy rare earths dysprosium and terbium outside China.

- China’s exports of rare earth magnets hit a record in August 2024, up 26.1% YoY to 5326t. Along with rising prices and improving sentiment around China, Lynas (ASX:LYC) shares recently hit a year high.

DOWN

- The Shanghai Metals Market says there remains friction between customers and miners on price hikes sought by upstream producers.

- Miners say it has become harder to break China’s control of the rare earths supply chain as oversupply has strangled prices, according to a Bloomberg report.

READ

IPO Watch: Canadian rare earths chasing second home in Australia

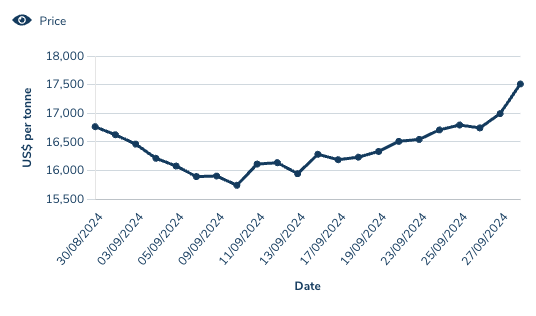

Nickel

Price: US$17,514/t

% Change: +4.46%

It’s hard to move an inch without seeing bad news about the nickel market, which has been effectively hollowed out in Australia since the start of the year due to low prices.

A bump from Chinese stimulus measures, like other commodities, put a bit of lipstick on the pig at the end of the month. But the price direction remains in the thrall of China’s economic performance, growth in the EV market and Indonesian supply, all of which have turned in the wrong direction for prices over the past 12 months.

“In Indonesia, it is expected that different types of nickel product will continue to ramp up production in 2024 and 2025,” the International Nickel Study Group said in its latest update.

“These include nickel pig iron (NPI), mixed hydroxide precipitate (MHP) from high pressure acid leaching (HPAL) plants, nickel matte converted from NPI, full plate nickel cathode and nickel sulphate.

“In China, despite a decrease in NPI production, primary nickel output is also forecast to increase, driven by additional nickel cathode and nickel sulphate production. Elsewhere, mainly due to profitability issues, a number of producing facilities have been mothballed, reduced production or are contemplating the future possibility of one of these options.”

UP

- Panoramic Resources could have a new lease on life – at the expense of short-changed creditors – with large shareholder Zeta Resources (ASX:ZER) making a bid to salvage the owner of the Savannah nickel mine from liquidation via a deed of company arrangement supported by administrators FTI.

- There’s still the potential to make money in nickel, as long as the asset is right. Stavely Minerals (ASX:SVY) boss Chris Cairns told investors at the Resources Rising Stars Conference on the Gold Coast last month that magmatic nickel discoveries, like Norilsk and Nova, remained highly profitable at current prices and sat below Indonesian nickel pig iron on the global cost curve. SVY is looking for a deposit of that nature in WA’s Kimberley region.

DOWN

- A senior mining official in the Indonesian Government warned the profitability crisis in China’s steel sector could hamper demand for nickel further.

- The International Nickel Study Group last month forecast surpluses to continue in 2025 of 170,000t and in 2026 of 135,000t after a 167,000t surplus last year, equivalent to 4.8% and 3.7% of the market.

READ

Chief economist sets scene for nickel, gold, copper and lithium

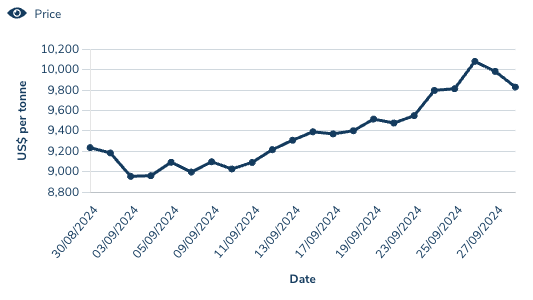

Copper

Price: US$9829/t

% Change: +6.43%

Copper prices surged in the final week of the month, powered past the magical US$10,000/t mark thanks to China’s stimulus announcement.

That promises to open up finance for housing and infrastructure projects in the Middle Kingdom, supercharging industrial metals like copper.

At the same time, discovery rates have slowed. According to analysis by S&P Global, just 14 deposits of 500,000t copper or more have been discovered in the past decade, just 3.5% of the total.

4.2Mt alone have been added by significant deposits discovered since 2019, with exploration spending still 34% below its 2012 peak last year despite the recognised need for new copper discoveries to fuel the energy transition and growth of data centres.

By 2050, BHP (ASX:BHP) predicts copper demand will rise 70% to 50Mt, with the energy transition accounting for 23% of demand and digital applications making up 6%. Traditional uses of copper (replacement demand, urbanisation) will account still for 71%, down from 92% today.

UP

- Cochilco, Chile’s national copper monitor, thinks treatment and refining charges will fall to new lows in 2025, good news for copper concentrate suppliers with smelters potentially to be 1.9Mt short on material next year.

- Demand growth has slowed from 3.1% annually over the past 75 years to just 1.9% in the 15 years to 2021. BHP’s analysts say that trend is reversing, with the CAGR to 2035 to rise to 2.6%. Doesn’t sound like much but that means 1MT of new copper supply – equivalent to the world no. 1 Escondida mine – is needed each year. That’s double the supply growth rate of the past 15 years.

DOWN

- Goldman Sachs walked back ambitious calls that copper would hit US$15,000/t by year’s end in September, citing weaker than expected demand from China.

- Copper warehouse stocks on the LME drew down slightly over September, but are now 80% higher than they were at the same time in 2023.

- Thrifting and efficiencies could see copper intensity of EVs reduce by 38kg by 2030, according to Benchmark Mineral Intelligence. However, copper demand from EVs will still rise 177% to 2030 (2.5Mt).

READ

Australian copper enters new era where scale is king

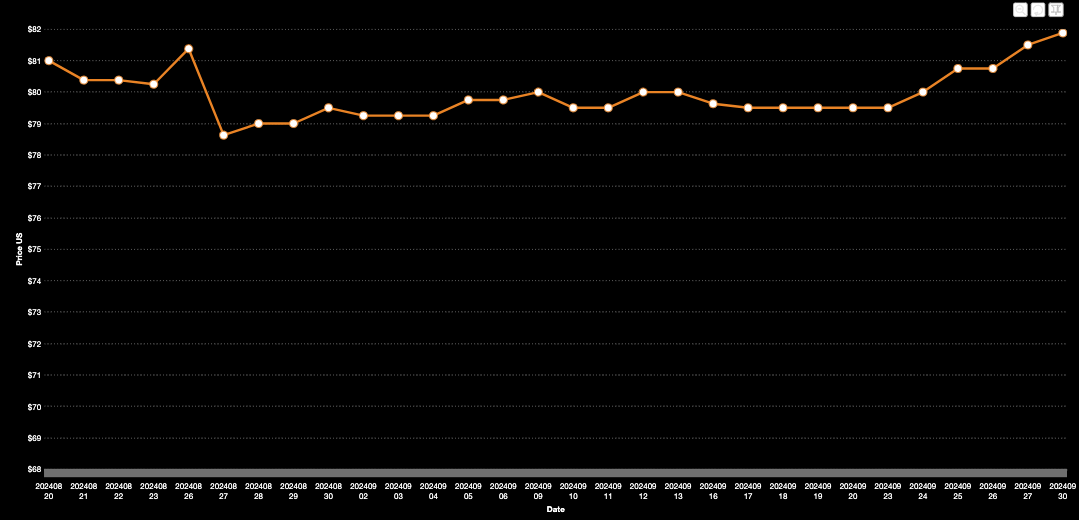

Uranium (Numerco)

Price: US$81.88/lb

% Change: +2.99%

Uranium prices failed to catch all the gains on offer for the sector, but equities sure did.

They were provided a big bump from two angles. First Microsoft announced it would support the reopening of a unit at the Three Mile Island nuclear facility in Pennsylvania, giving hope to uranium miners that data centres would become an incremental source of demand for their product.

Following that 14 major banks signed a pledge at New York’s Climate Week to support the tripling of nuclear energy capacity by 2050. That all means little for today’s supply-demand matrix, but sentiment lifted, with the Global X uranium ETF now on a 3.3% YTD gain and 10.5% 1 month lift.

UP

- Institutional investors remain bullish on the uranium narrative, with yellowcake stocks the second strongest fundraisers behind gold companies in the June quarter of 2024 according to BDO.

- Guy Keller of fund manager Tribeca says the uranium spot price has held up well despite macroeconomic pressures that have tanked oil and steel prices. Weak production guidance for next year from Kazakh giant Kazatomprom has added to the fundamental support for the nuclear fuel.

DOWN

- Slim hopes for the development of the Jabiluka uranium deposit look to have faded after the Takeovers Panel declined to halt an $880 million capital raise that could enable Rio Tinto to compulsorily procure the stakes of minorities. The shareholders who lobbed the complaint, Zentree Investments and Packer and Co., were pushing for the company to lobby traditional owners to support the proposed mine or sell it to a miner that would.

- Uranium M&A is continuing to develop, though some investors are sceptical. Paladin Energy (ASX:PDN) is trying to acquire TSX-listed Fission Uranium and gained the support of shareholders in a very tight vote, procuring 67.9% of the votes cast at the meeting (barely above the 66.66% threshold set in Canada). A subsidiary of China’s General Nuclear Power Corp, which holds 11.26% of Fission’s shares opposed the deal at the final hearing in British Columbia on September 26.

READ

Why Tribeca’s Guy Keller plans to lead, not follow, on the next uranium move

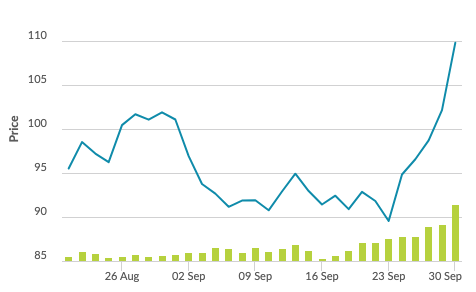

Iron ore (SGX Futures)

Price: US$109.81/t

% Change: +8.83%

Iron ore was looking pretty damn depressing, falling to levels not seen in at least a couple years as Singapore futures tumbled on pitiful Chinese steel activity to US$89.45/t.

But China couldn’t leave its property sector to languish much longer, as the People’s Bank launched a ‘bold’ if not ‘bazooka’ stimulus package last week.

On the final day of the month iron ore futures lifted over 10% on both the Singapore and Dalian exchanges, with the front month contract in the former surging to US$113/t.

UP

- Stimulus, stimulus, stimulus. The Chinese package cutting mortgage lending rates, reducing downpayments for first and second home buyers from 25% to 15% and issuing new facilities for banks creating billions in liquidity. Will it be enough to cure what ails Xi Jinping’s Communist subjects?

- MySteel reported strengthening, if still weak, steel sector fundamentals across September, with port stockpiles of iron ore falling from three year highs to a touch over 150Mt and blast furnace capacity utilisation improving.

DOWN

- Goldman Sachs maintained previous calls that iron ore would fall to US$85/t even after China’s stimulus news, saying long steel demand was 20% lower year this year than in an already 9% down 2023.

- China’s official PMI for the steel industry recovered in September, rising from 40.4 to 49.0, with production up from a pitiful 34.9 to 54.8 MoM. But anything below 50 remains contractionary and the Caixin index, the non-State measure covering smaller export-oriented firms, fell sharply in September.

READ

Barry FitzGerald: Garimpeiro mines for hidden gems … iron ore?

LOSERS

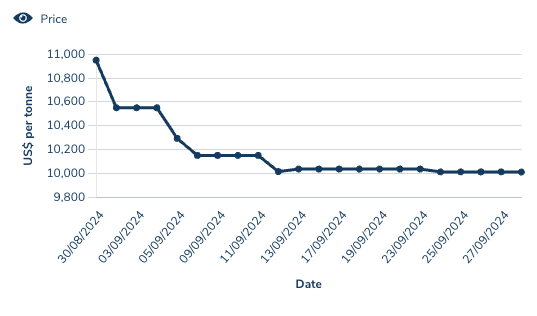

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$10,010/t

% Change: -5.12%

Asian lithium chemical prices continued to find new lows, especially in terms of lithium hydroxide, despite mine closures and expansion pauses tightening up the raw materials supply side of the market. There was a glimmer of hope as carbonate prices rose, lifting to around US$10,900/t in China in late September.

Battery grade carbonate is more commonly used in cheaper lithium-iron-phosphate battery EVs, which are gaining in popularity in China, whereas hydroxide is more common in luxury end, longer-range EVs which use batteries with high cobalt and nickel concentration.

European EV registrations went backwards in August, fuelling negative sentiment, though cheaper models are likely to arrive in the next year as OEMs build out factory capacity.

UP

- Lithium producers have been buoyed by the reported closure of CATL’s Jianxiawo mine in Yichun, a city on the Jianxi Province of China. The low grade lepidolite operation produces around 8% of China’s domestic supply and 2% of global lithium carbonate equivalent tonnes, with its suspension suggesting even integrated producers are struggling with current prices.

- Lithium producers in the West could be among the beneficiaries of price support proposed for critical minerals by the Biden Administration. Benchmark estimates the program could cost the US$7.5 billion for to deliver to 2030 for lithium miners alone, in a bid to compete with China’s subsidised supply chain.

DOWN

- Lithium prices continue to struggle, even as miners pause production and pull back expansion plans. Chinese prices have barely shifted on the news of CATL’s Jianxiawo suspension even as equities have surged.

- How much of the recent run in lithium share prices was driven by short covering remains to be seen. Battery metals stocks have copped the most bearish bets of any section of the market in the past couple years, with three of the top 10 short-held stocks on the ASX in lithium. Pilbara Minerals (ASX:PLS) is still the most shorted stock on the bourse, though its level fell from a record 22.5% on August 8 to 19.7% on September 23. MinRes was fifth at a record 12.48% held short and Liontown Resources (ASX:LTR) was ninth at 10.38%.

READ

Benchmark Gigafactories APAC: UBS calls lithium bottom, sends share prices surging

OTHER METALS

Prices correct as of September 30, 2024.

Silver: US$31.08/oz (+5.46%)

Tin: US$33,458/t (+3.44%)

Zinc: US$3091/t (+8.77%)

Cobalt $US24,300/t (0.00%)

Aluminium: $2612/t (+6.74%)

Lead: US$2096/t (+2.09%)

Graphite (Fastmarkets flake) US$460/t (-4.96%)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.