Up, Up, Down, Down: August saw the revenge of the bulks as iron ore and coal outshone battery metals

Pic: mikkelwilliam/E+ via Getty Images

- Iron ore finds yet another second wind on Beijing stimulus hopes, as does met and thermal coal

- Lithium prices fall flat for a second straight month

- But uranium is creeping, in the winner’s column for the fourth month in a row

Up, Up, Down, Down is our monthly wrap of all the moves in major metals produced by ASX miners.

WINNERS

Iron ore (SGX Futures)

Price: US$114.16/t

% Change: +6.33%

Here we go, iron ore stans.

If you were (somehow) bored of battery metals August was the month the bulks made their return from the doldrums.

Defying some awful real estate data and news out of China — Evergrande bankruptcy anyone? — it all came off the back of hopes China’s stimulus would be there to stoke a rebound in property, infrastructure and steel demand.

It all disagrees with a number of analysts as well, who think rising supply from miners like BHP (ASX:BHP), Rio Tinto (ASX:RIO), Roy Hill, Vale and Fortescue (ASX:FMG) along with promised production curbs in the second half of 2023 will see iron ore prices fall back to US$80/t and eventually US$75/t.

“The structural challenges facing the Chinese economy and constraints to widespread stimulus are likely going to see steel/iron ore demand disappoint,” RBC’s Tyler Broda said in a note last month.

“We detail the impact from seasonality and how production curbs could swing the iron ore market balance by ~120mt in H2, leaving the market well oversupplied.”

Yet prices have continued to rally, hitting US$117/t in Singapore yesterday. Thanks to inflation and the stickiness of high cost supply in the iron ore market, BHP now sees cost support at between US$80-100/t, enough to guarantee strong profits for low cost incumbents in the years to come.

Iron ore miners share prices today:

Coal (Newcastle 6000 kcal)

Price: US$158.50/t

% Change: +12.5%

Thermal coal prices staged a rebound last month as threats to gas supply and the associated switching incentive for coal as energy fuel led to higher prices.

But in line with the run in iron ore it was coking coal that really impressed.

From the start of August premium hard coking coal futures have risen to over US$270/t, as Aussie miners benefit from the reopening of trade with China and the stimulus measures that have sent iron ore prices on the up and up in recent weeks.

That makes them susceptible, of course, if prices happen to fall.

It hasn’t been the same for all grade of coal. Pulverised coal for injection has been troubled by rising supply out of Russia, having surged as high as ~US$670/t last year as the belligerent nation found its coal locked out of Europe.

Coal flows have reconfigured since. It has meant some difficulties for Australian PCI producers like Bowen Coking Coal (ASX:BCB), which has been forced into a strategic review of its portfolio and shift in focus from the Bluff PCI mine to other assets amid a weak pricing market.

Coal miners share prices today:

Rare Earths (NdPr Oxide)

Price: US$69.95/kg

% Change: +6.13%

After a horror start to 2023 which prompted Lynas (ASX:LYC), the largest producer outside China, to stockpile non-committed tonnes in the hope of seeing higher prices down the line, rare earths prices appear to have found a floor.

Having risen for two months straight all eyes are now on the Chinese quota, which was lifted 25% to 210,000t in 2022 and then lifted 20% to 120,000t in the first half.

Reviews typically take place in March and September. China produced only 105,000t in 2017 before a surge in demand from electric vehicles and wind turbines, which use permanent magnets manufactured from rare earth metals.

How to break China’s hold on the market?

Lynas boss Amanda Lacaze says the west needs to pool its resources to develop a mine to magnet supply chain to rival the dominant Chinese market.

After reporting a 43% drop in NPAT to $310.7m for FY23 on lower prices, Lacaze told analysts on an earnings call last week that the company was looking at partnerships after securing funding for light and heavy rare earths separation plants in Texas through the US Department of Defense to go alongside processing operations in Kalgoorlie and Malaysia.

“The success of developing an outside-China industry is important for all of us. Sometimes I think that the desire is to set up outside China operators as if they’re sort of competing with each other when in fact, the main game is China, right? That is our competition,” she said.

“For the rest of us, our success is going to be about building this outside-China industry. Otherwise, we simply produce material that ends up going into China for finishing and further value adding.

“So I think that we do need to work together in this area and we are certainly very focused on engaging with relevant potential partners on further developing downstream activities.”

The issue as of now is incentive pricing, with prices in the US$60/kg range for NdPr not doing enough to incentivise marginal projects. But there is work afoot to expand Australia’s foothold in the rare earths market.

Iluka Resources (ASX:ILU) is aiming to open its more than $1 billion Eneabba Refinery in 2026 to process 4000t of NdPr a year from monazite waste at the Mid-West mineral sands operations and has already committed to a $15 million feasibility study on a metallisation plant to be based in Australia.

Rare Earths share prices today:

Uranium (Numerco)

Price: US$59.75/lb

% Change: +6.22%

Uranium spot prices have lifted every month since April as a potential breakout for the nuclear fuel continues to bubble away and the industry’s major players continue to call for higher prices.

It comes with contracting set to hit decade highs, nuclear supporters garnering more attention for the sector’s potential role in the energy transition and amid a build program that could see more nuclear capacity rolled worldwide than at any point this century.

“We believe it is only a matter of time before utilities return to replacement rate purchasing, signifying a greater potential of future demand for uranium,” famous North American fund manager Sprott said in a note last month.

They say mine restarts like Cameco’s reboot of the 18Mlb McArthur River mine in Canada’s high grade Athabasca Basin will not be enough to satisfy the needs of a growing market.

“Although this represents the largest uranium mine restart, global uranium mine production is still well short of the world’s uranium reactor requirements,” they said.

“This deficit further underscores the need for further restarts and new mines in development.”

Currently retooling the Honeymoon mine in South Australia, Boss Energy (ASX:BOE) MD Duncan Craib gave some insights into why he thought uranium prices, bubbling away at between US$50-60/lb this year, had to lift.

“New production is needed, and that is where Boss is on target to deliver into a rising market,” Craib told delegates at last month’s Diggers and Dealers Mining Forum in Kalgoorlie.

“There is no doubt in my mind that the price is going to overshoot in response to this currently forecast supply deficit.”

Uranium share prices today:

LOSERS

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$34,930/t

% Change: -13.22%

And now to the losers, where lithium’s rough August made it two big drops in a row and could be on track for another losing month in September.

It all comes off the back of some difficult conditions in China where despite rising EV sales, stock levels of lithium chemicals have been climbing according to the Shanghai Metals Market.

“In the week ending August 31, lithium carbonate prices dropped. Some lithium salt producers cut production or undertook maintenance, slightly reducing supply. However, supply still outstripped demand, leading to a surplus and lower price,” analysts at the price agency said.

“The energy storage and NEV sectors saw sluggish growth, resulting in little uptick in battery cell demand. As prices fell, cathode companies cautiously reduced their stock levels, further decreasing demand for lithium salts.

“Sporadic market deals occurred. With stable supply and falling demand, industry inventory rose, pushing down market quotes and transactions.”

Since the end of the month North Asia hydroxide prices have fallen to US$30,000/t, with carbonate at US$29,500/t, according to Fastmarkets, though spodumene concentrate sold by Australian miners has been far tighter, paying US$3250/t to stay around levels seen for much of this year.

At those prices producers are basically printing cash (though most now produce grades far lower than the 6% Li2O benchmark to improve recoveries).

In that context a wave of M & A has seen big miners leap on assets in Australia. Azure Minerals (ASX:AZS) turned down a takeover offer from major shareholder SQM to preserve its control over what looks like the Pilbara’s next major lithium discovery at the Andover project near Roebourne.

This week Albemarle has also returned with a likely to be accepted $6.6 billion offer at $3 a share for Liontown Resources (ASX:LTR). If the sale goes ahead analysts from Canaccord Genuity say it could make other lithium stocks look “undervalued”.

Lithium stocks prices today:

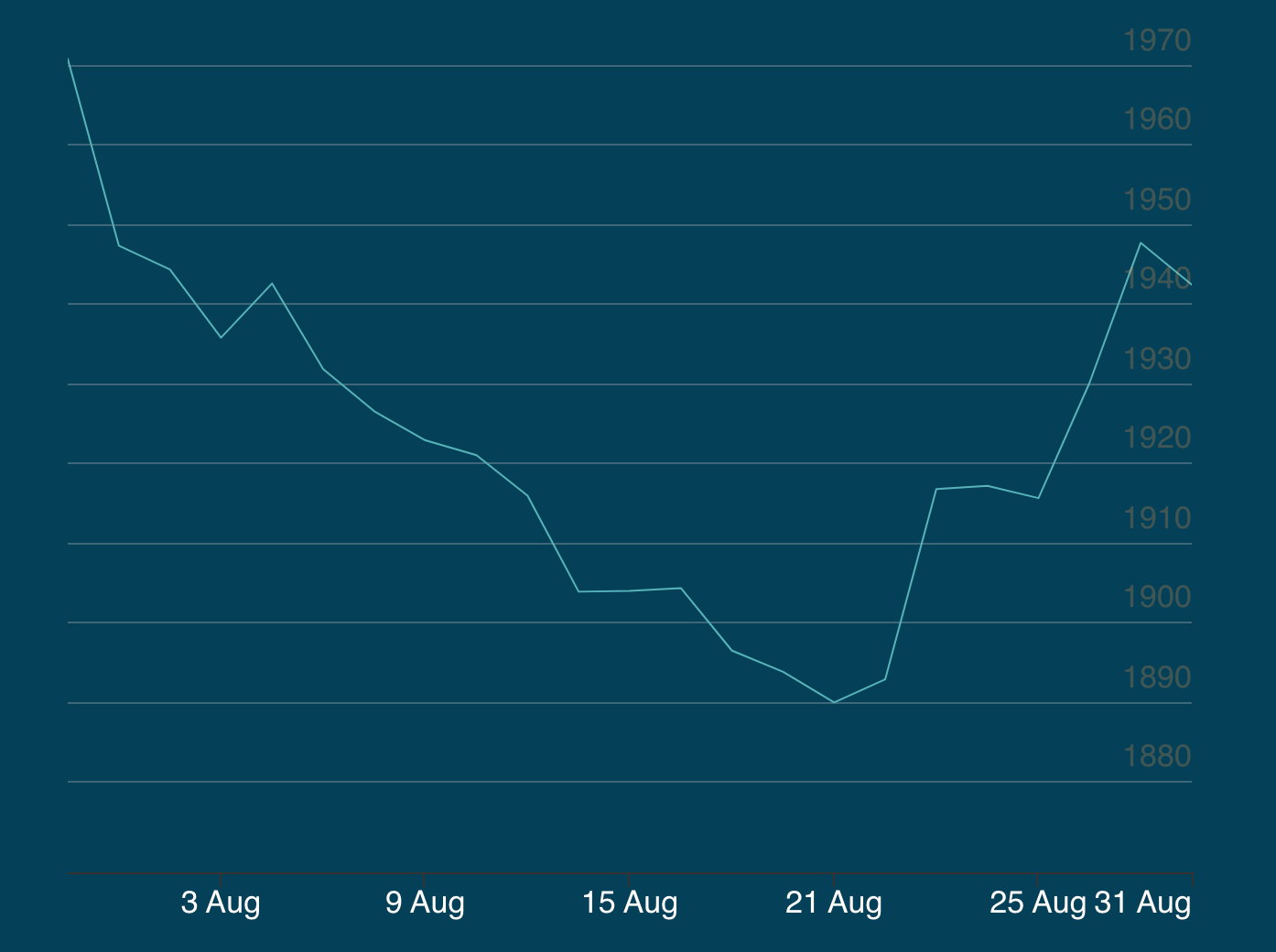

Gold

Price: US$1942.50/oz

% Change: -1.43%

Gold lives and dies by a handful of factors — the US dollar, bond yields, US fund rates and geopolitical stability.

August is typically a good time for bullion, the World Gold Council noted in a report last month, but it saw reasons to be cautious that the lower bond yields and Asian restocking that normally helped the precious metal wouldn’t eventuate.

“This time round we don’t expect these factors to be as supportive as in the past, with yields pressured higher, equities trending up and conditions for a demand pick-up poor in India and China,” the WGC said at the time.

“However, this does not diminish our view that over the next few months, economic concerns will continue to mount and asset volatility will rise with them – factors that should help underpin investor interest in gold.”

It certainly played out that way. Prices took a massive dive in the middle of the month before recovering to a slight loss by the end of August.

They have since failed to break the US$1950/oz barrier with the direction of the US Fed’s rate hikes uncertain.

But some miners and analysts remain confidence a bull market is not too far off, with Evolution Mining’s (ASX:EVN) Jake Klein using his talk at Diggers and Dealers last month to lay out why he thought extraordinary debt levels across the world and a weakening China set a strong platform for the metal in years to come.

Resources investors Goehring and Rozencwajg meanwhile told their followers in August that the lesson of the rate rises of the 1970s was that when they ended gold could have an explosive exit.

Gold miners share prices today:

Nickel

Price: US$20,289/t

% Change: -8.99%

After a strong July, nickel prices fell off in August, though China’s re-emerging stimulus impulse has since steadied the ship.

Among the big issues has been a big lift in production in Indonesia this year, which will steer the nickel market to a projected 239,000t surplus this year.

It’s important to note that there are now two markets emerging for nickel. Class 1 nickel to be fed into electric vehicle batteries and high quality stainless steel and class 2 nickel, largely fed by Indonesian nickel pig iron, for standard stainless steel applications.

However, as Indonesia pivots more to HPAL and nickel matte operations to feed the battery market, some industry observers say it could crack down on a massive expansion in supply.

“In terms of oversupply, I think what we’re seeing here is exactly what we saw in NPI,” Nickel Industries (ASX:NIC) MD Justin Werner told analysts after releasing the company’s half year results last month. It will be a race, and those who aren’t at the front of the race will struggle to catch up if at all even be in the race,” he said on a call with analysts and investors.

“I was at a conference yesterday and the Indonesian Government is basically at the point of probably banning any further RKEF lines for the production of NPI. We are one of the largest producers of MPI outside of Tsingshan and we have an 80% interest across 12 RKEF lines.

“We’ve been able to build that up very quickly and very rapidly. As I said, our newer lines ANI and ONI are still making very, very strong margins, still around US$3,000 a tonne.

“A lot of people are making announcements about HPAL and what actually gets built and funded, I think will be significantly less than what’s been announced and that will be for a number of different reasons.”

Nickel miners share price today:

Copper

Price: US$8422.50/t

% Change: -4.64%

Copper prices have also staged a recovery in early September, but fears China’s economy could lag have kept a lid on the commodity in August.

It comes despite bullish projections about the long term outlook for the metal, which could see demand double by 2050 to feed new applications in battery EVs, renewables and the expansion of poles and wires needed to support that.

Improving output at Chile in July also helped beef up the supply side of the equation.

Despite a 2.6% output fall to 124,700t at the world’s largest copper producer, the struggling State-owned operator Codelco, Cochilco said its national production lifted 1.7% to 430,900t in July.

That included a 1.23% rise to 82,400t at BHP’s Escondida and 5.71% jump to 50,000t at Anglo American and Glencore’s Collahuasi.

Copper miners share prices today:

OTHER METALS

Prices correct as of August 31, 2023.

Silver

Price: US$24.54/oz

%: +0.74%

Tin

Price: US$25,396/t

%: -11.32%

Zinc

Price: US$2430.50/t

%: -5.24%

Cobalt

Price: US$33,420/t

%: +0.00%

Aluminium

Price: US$2208/t

%: -3.26%

Lead

Price: US$2218/t

%: +3.21%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.