Up, Up, Down, Down: 2024 starts as 2023 finished with uranium on top and lithium in the doldrums in January

Pic: Cris Clor/Tetra Images via Getty Images

- Uranium and copper the only winners in a tough January for metals

- Nickel and lithium struggles on forefront of investors minds

- We add graphite to our price list in a 2024 refresh

WINNERS

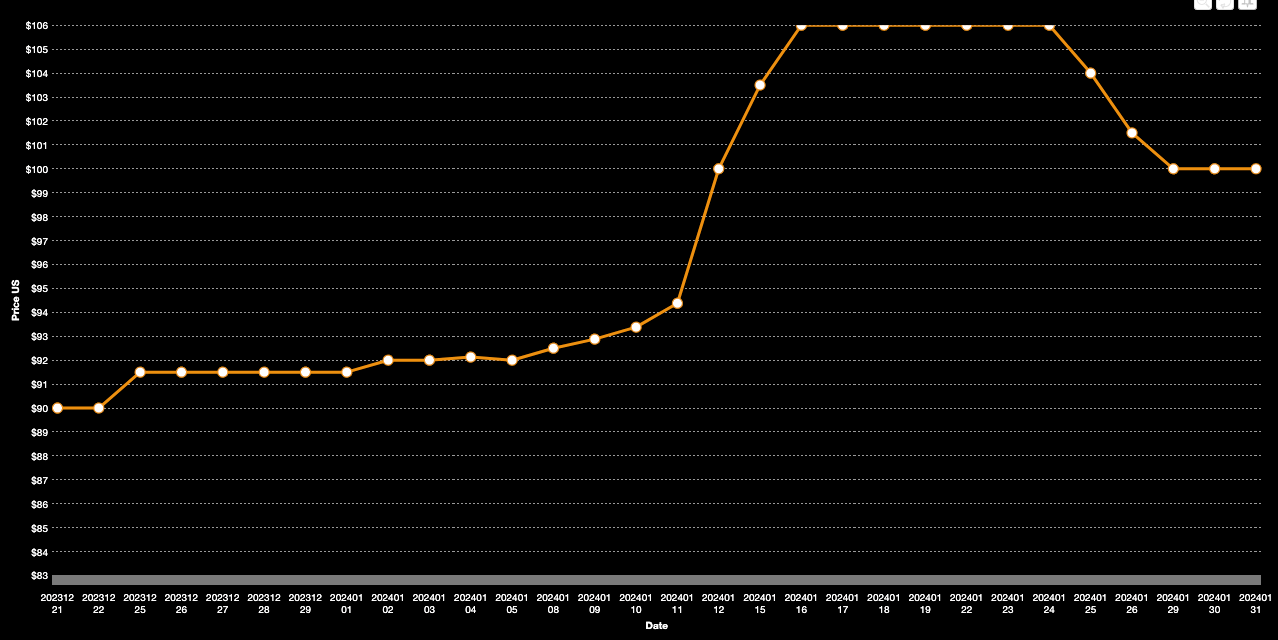

Uranium (Numerco)

Price: US$100/lb

% Change: +9.29%

Uranium prices continued their upward march as spot markets tighter than the last test between Australia and the West Indies spurred the price of yellowcake to as much as US$106/lb.

Other fundamental factors are at play. Kazatomprom, the world’s largest producer of the nuclear fuel, said it could miss 2024 production targets because of sulphuric acid shortages at its mines in Kazakhstan.

The US Government has also thrown its financial weight behind domestic enrichment plans to ween itself off Russian supply, something which spurred a run for Aussie technology developer Silex Systems (ASX:SLX), which has an enrichment JV with Canada’s Cameco.

That would see it fail to hit its target of increasing capacity usage to 90% of its government allowance, around 23,500 metric tonnes.

The rise in prices has seen Aussie producing hopefuls like Boss Energy (ASX:BOE), Paladin Energy (ASX:PDN) and Peninsula Energy (ASX:PEN) find favour with the market. Peninsula raised $60m from investors to support a restart of the Lance ISR mine in Wyoming, having been prevented from opening last year when a tolling deal fell through.

Now at nine straight monthly gains, U3O8 prices saw a slight pullback over the past week back to US$100/lb. But analysts have grown more bullish. Bell Potter thinks prices will hit US$130/lb, with Macquarie eyeing support for US$100/lb.

Shaw and Partners analysts think they could peak at US$150/lb in the coming years, slightly above all time highs. They say the period between 2026-2028 will be critical, when a number of utilities will be uncovered by current contract and inventories.

“We previously assumed that uranium would rally to a peak of about US$85/lb before settling to our long-term U3O8 realised price assumption of US$67/lb (2023 Real) in 2030,” Shaw analysts said.

“With spot at US$106/lb that forecast is now overly conservative (it wasn’t at the time) and we upgrade our price deck to a multiyear peak of US$150/lb before settling back at a long-term sustainable price of US$76/lb in 2030 (2024 real).”

UP

- Shaw and Partners say uranium demand is outstripping supply by 40Mlbpa at the moment, suggesting tightness in the market will persist.

- The US Government announced US$500 million of funding for uranium enrichment to try break Russia’s dominance in the enriched uranium supply chain.

DOWN

- Uranium prices suffered a first down week in months in the final days of January as the bull run paused for breath.

- While there is positivity in abundance, uranium bull runs are notoriously flimsy and sensitive to demand shocks caused by ‘black swan’ events like Fukushima.

Uranium share prices today:

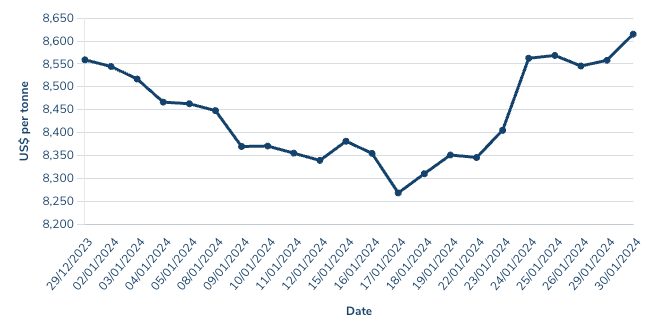

Copper

Price: US$8615/t

% Change: +0.65%

Copper’s tiny gain in January has been all about supply disruptions, with little indication First Quantum will be able to resume mining at the Cobre Panama mine after a contract to continue mining was revoked by the Central American country’s Supreme Court amid major public protests against the mine.

Other operators, notably Anglo American, have revealed output will be short of analyst expectations by around 200,000t.

That’s pretty significant in a market where falling treatment charges from Chinese smelters is indicating a shortage of raw materials.

So far prices have been kept in check because of weakness in China’s property sector and manufacturing industry. But that may not last forever, with stimulus and US rate cuts to be closely watched by copper bulls.

On the equities front Sandfire Resources (ASX:SFR) showed for the first time this quarter it may be able to step into the hole OZ Minerals’ $9.6 billion takeover by BHP (ASX:BHP) left for copper hungry investors last year with a strong December quarter at its MATSA and Motheo operations.

Meanwhile, TSX-listed ~160,000tpa Chilean producer Capstone Copper is looking to snare a secondary listing on the ASX, while Metals Acquisition Corp is said to be chasing around $200m in an IPO pitched to bring its high grade Cobar operation onto the Australian bourse.

UP

- Hundreds of thousands of tonnes has been yanked from the copper market from output cuts in politically testy Latin America, with treatment and refining charges offered by Chinese refiners tumbling as they battle for supply

- Goldman Sachs says copper could hit US$10,000/t within 12 months as supply cuts rock expectations of near term deficits.

DOWN

- China’s weakened economy is keeping a lid on copper sentiment even as supply cuts lead the market into deficit.

- Economic uncertainty fears have seen investors hit their largest net short position on copper contracts in four years, Saxo Bank’s Ole Hansen says.

Copper miners share prices today:

LOSERS

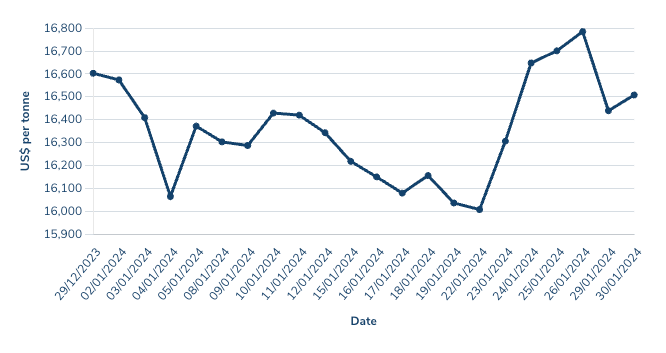

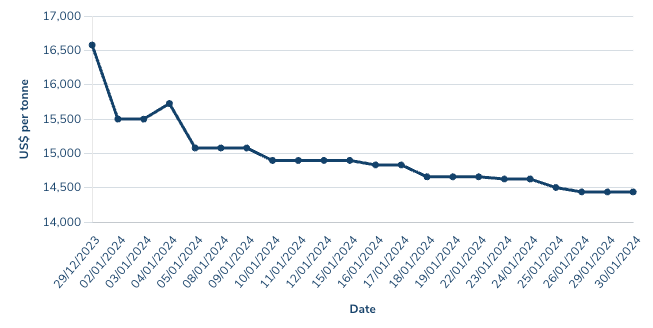

Nickel

Price: US$16,508/t

% Change: -0.57%

That’s it for the winners. And our first loser for the month is a big one.

Nickel prices only fell marginally in January. But mine closures in WA suggest they have little wiggle room, with most producers of nickel sulphide struggling to compete against a rising wave of cheap supply out of Indonesia.

Panoramic Resources (ASX:PAN) began the rout with the closure of the Savannah mine, before First Quantum and POSCO decided to cease mining and instead process stockpiles at the Ravensthorpe nickel laterite mine on WA’s South Coast.

Andrew Forrest’s Wyloo Metals placed its Kambalda mines on care and maintenance, cutting a major source of supply to BHP’s Nickel West division while IGO (ASX:IGO) announced it would place its new Cosmos mine in care and maintenance from May 31.

BHP and Glencore’s nickel assets are now the only mines operating in WA, and they are under the microscope. At the same time Nickel Industries (ASX:NIC), a Chinese and Indonesian backed ASX play which has ridden Indonesia’s nickel boom to become one of the largest producers of nickel metal in the world, has upped its returns to shareholders in the wake of the industry’s structural shift.

If there is positivity to be found it’s that mine closures show prices of around US$16,000/t are eating into the cost curve, and there may not be too much further to fall. That especially comes with some Indonesian HPAL operations, designed to pivot the country’s production from supplying stainless steel to the growth engine of EV batteries, hitting the pause button at current levels.

UP

- Fastmarkets reported Huayue Cobalt was jettisoning its 120,000tpa Huashan nickel-cobalt project thanks to falling prices.

- Aussie miners shutting nickel sulphide operations has taken 40,000t of supply out of the market — around 1.5% of global supply. That’s a drop in the ocean, but news some Indonesian operators were reacting to weak prices by cancelling proposed battery grade nickel projects provides more hope of a major supply response.

DOWN

- Indonesia’s nickel output has surged from 2-3% of global supply in 2015 to 49% last year — lifting 30% between 2021 and 2023 alone — and could rise to as much as 2.2Mt in 2024.

- Benchmark Mineral Intelligence projects it will take until 2028 for a deficit to emerge in the nickel market.

Nickel miners share price today:

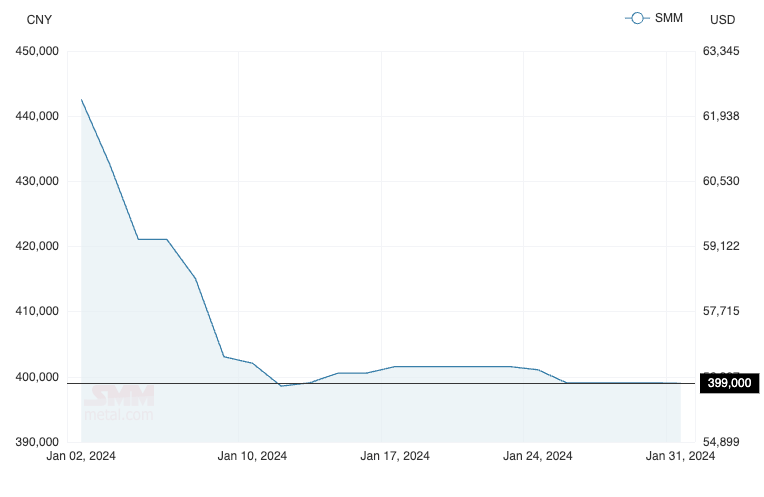

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$13,250/t

% Change: -20.08%

A similar story in nickel, where spodumene concentrate is now paying US$850/t against US$8000/t early in 2023.

Chemical prices in China have fallen precipitously over the past year, with a number of mines now loss making or cutting back on production.

Core Lithium (ASX:CXO) decided to cease mining at its Finniss operation near Darwin, while IGO and its JV partners at the Greenbushes joint venture in WA’s South West will restrict production this year.

Liontown Resources (ASX:LTR) will have to scale back plans to immediately expand its Kathleen Valley mine, on schedule to open in mid-2024, after lower lithium price forecasts prompted a syndicate of bankers to pull out of a proposed $760m debt finance package.

At the same time, Pilbara Minerals (ASX:PLS) and Mineral Resources (ASX:MIN) have kept up their plans to maintain and grow their capacity in the sector, targeting economies of scale that will lower unit costs and prepare them for the next upturn.

At some point in summer it gets so hot you can’t take off anymore of your clothes. Whether we’ve reached that point in lithium and who exactly gets burnt at this stage of the cycle remains to be seen.

Looking ahead lithium M&A and enthusiasm over the longer term outlook for the EV metal remains strong, with new float Kali Metals (ASX:KM1) surging on debut (amid some curious trading from MinRes, boss Chris Ellison and his connects) and Hancock Prospecting and SQM appearing likely to close a $1.7 billion takeover of Azure Minerals (ASX:AZS).

UP

- Lithium traders in China have begun to tentatively bet on a recovery, with carbonate prices reported by Shanghai Metals Market up since hitting a trough on January 10.

- Aussie miners Pilbara Minerals and Mineral Resources are trimming unit costs with expansions and say they continue to be profitable at current prices, with MinRes’ Chris Ellison saying its mines would make money at US$600/t SC6 spod prices.

DOWN

- Hopes for a sharp uptick in lithium prices early this year are likely to be dashed by the timing of Chinese New Year, when little purchasing or factory activity takes place.

- Australian lithium hydroxide plants continue to show severe ramp-up issues, with low prices likely to tighten China’s grip on the chemical conversion end of the EV supply chain.

Lithium stocks prices today:

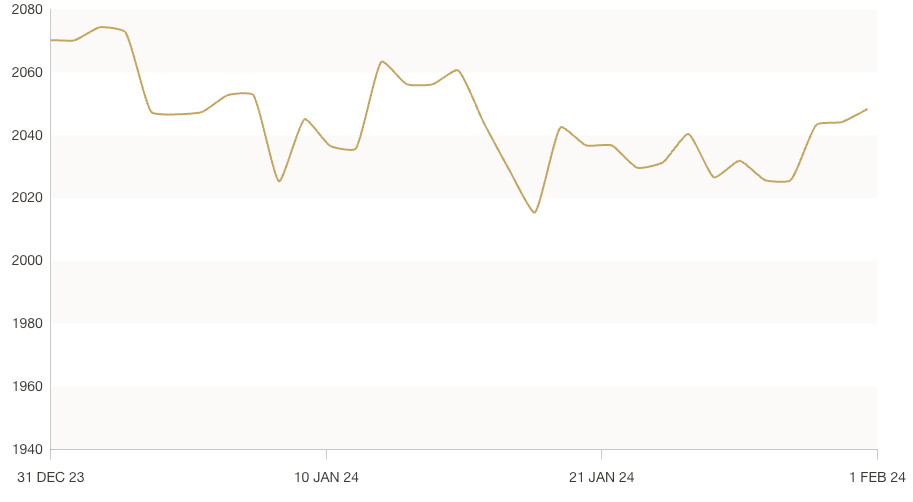

Gold

Price: US$2048.33/oz

% Change: -1.45%

The World Gold Council’s 2023 demand trends report painted a bullish picture on interest in gold, with demand up 3% to record highs with the over-the-counter market included.

Where the sector is facing struggles is costs, impacted by the age of operations and rising inflation.

Gold mines are generally smaller than commodities like iron ore and miners take additional processing steps that go beyond the DSO and concentrate steps in most bulk and base metal mines, which means margins are generally tighter.

While some of the big miners struggled in reporting season, notably Evolution Mining (ASX:EVN), a number have given confidence in the gold industry’s ability to return to profitability as Covid-era cost inflation moderates, notably Australia’s top locally listed gold name Northern Star (ASX:NST).

On the Fed front, miners would have been disappointed to see US Fed Chair Jerome Powell douse hopes of a quick return to rate cuts with the US economy still someway short of its 2% inflation target. Cuts are expected to be a tailwind for gold if they emerge later this year.

UP

- Israel’s campaign in Gaza continues while Houthi rebels continue to disrupt shipping through the Suez Canal, heightening the safe haven appeal of gold.

- The World Gold Council’s Shaokai Fan says the outlook for gold demand is positive after it rose 3% to a record level of almost 4900t in 2023 once over-the-counter demand is factored in.

DOWN

- The US Fed has doused expectations of a quick shift to monetary easing after US inflation hit 3.4% YoY in December. It will not begin cutting interest rates until the governors of the world’s largest central bank see inflation sustainably within its 2% target range.

- High costs are eating into profit margins for gold miners despite strong prices, with Metals Focus assessing the September quarter last year as the most expensive ever operationally for the global gold sector.

Gold miners share prices today:

Iron ore (SGX Futures)

Price: US$135.27/t

% Change: -3.43%

Iron ore prices have remained resilient against the prospect of a weak Chinese economy, with hopes of stimulus and strong steel output in mid-January keeping prices at high levels.

Supply increases remain incremental. Vale on Wednesday reported a 4.3% lift in output from its Brazilian mines YoY to 321Mt, its highest production rate since the Brumadinho dam disaster in 2019.

But its 2024 guidance is just 310-320Mt, with other majors BHP, Rio Tinto and Fortescue seeing only marginal production increases in the coming year. High grade miners caught the attention of the market, with Mt Gibson Iron (ASX:MGX), Grange Resources (ASX:GRR) and Champion Iron (ASX:CIA) all delivering stellar December quarter results.

Corporate interest has returned also at the smaller end of the iron ore industry, with Mark Creasy’s CZR Resources (ASX:CZR) and Paulsens East iron ore mine owner Strike Resources (ASX:SRK) announcing deals to a linked group of Chinese-Australian buyers valued at around $120m to sell two Pilbara iron ore deposits with a combined production potential of 5Mtpa.

UP

- Higher iron ore prices are giving stranded or marginal operations a lifeline, with a host of juniors in WA, Africa and Tasmania dusting off plans to restart or invest in idled mines and undeveloped iron ore deposits.

- Iron ore supply is typically affected by wet weather at this time of year in Australia and Brazil, with BHP’s Newman operations smashed by over 130mm of rain around Australia Day

DOWN

- ANZ said in a note yesterday that China’s productivity data showed a fourth month of declines in December, with the official PMI at 49.2 (anything under 50 is a contraction), while its top 100 real estate companies saw home sales fall almost 35% in 2023.

- Rising supply from the Pilbara, Brazil and Africa could leave iron ore market oversupplied if Chinese steel production reverts from a surprise uptick seen last year.

Iron ore miners share prices today:

Rare Earths (NdPr Oxide)

Price: US$56.17/kg

% Change: -10.12%

There was little joy for the rare earths market in January, with the introduction of an unprecedented third quota by the Chinese Government in mid-December leading producers in mainland China to cut prices.

That flowed through to Shanghai’s Neodymium-praseodymium pricing, which remains at levels unlikely to incentivise the massive rush in production needed to satisfy late decade forecasts for demand for the magnet metals from renewables and electric vehicles.

Lynas saw its worst prices since the pandemic, pulling in US$28.7/kg of rare earth oxide, due to both lower benchmark prices and shutdowns at its Malaysian processing plant that saw more lower value rare earth metals in its sales mix.

“It really is all about the subdued environment in China,” Lynas MD Amanda Lacaze said after seeing revenue almost halve year on year in December.

“Generally speaking across out various markets we continue to see automotive is pretty strong, in our Japanese customers demand remains resilient.

“But really inside China, particularly when it comes to those areas which are associated with the real estate market, we are seeing very soft demand which is translating to conservatism in terms of inventory holdings and sales in the rare earths market.”

UP

- Heavy rare earths like dysprosium are holding up better than other magnet metals like NdPr, with Lynas announcing higher concentrations of heavies in drill intercepts outside its current resource at the Mt Weld mine in WA.

- China continues to show strong demand for rare earth imports, with rare earth oxide imports up over 200% in 2023 and imports 3.4x its export levels, according to the Shanghai Metals Market.

DOWN

- A shock third quota announced in China for rare earths supply saw miners in the Middle Kingdom reduce prices on NdPr and other light rare earth products.

- Low consumer demand for goods like air-conditioners in a weakened Chinese economy is hurting rare earths pricing.

-

-

Rare Earths share prices today:

Coal (Newcastle 6000 kcal)

Price: US$118.10/t

% Change: -13.76%

It’s a tale of two coals right now, with thermal coal reverting back to levels resembling the higher side of longer term prices in the aftermath of the mild 2022-23 northern winter. But the outlook for met coal remains bullish, with demand from Chinese and Indian steel mills keeping prices above US$330/t.

Despite the massive fall in energy coal prices, the head of one of the few restart operations with an eye on the market told us she was confident in the long term outlook for the commodity, in spite of existential pressures from ESG.

““When we speak to particularly the Japanese buyers, they don’t have other alternatives. The alternative that they have for electricity supply is not something they want to grow, which is the nuclear power plants,” Australian Pacific Coal (ASX:AQC) interim CEO Ayten Saridas told Stockhead.

“So in terms of the demand, we believe that it’s going to be sustained in the long run, at least for another 20-30 years.

“The fundamentals for the supply side, though, is that the supply is going to come off with restrictions on being able to raise capital for it, ESG concerns around it.

“But also projects not being sanctioned. Especially in Australia, it’s very difficult to get a greenfield project sanctioned.”

UP

- Miners continue to point at a slow pace of approvals and lack of support for new thermal and met coal operations as support for prices for multiple decades.

- Defying calls for its use to be phased out, coal consumption remained around record levels in 2023 of 8.5Bt according to the IEA, led by China and India.

DOWN

- While met coal production in Queensland will be constrained by bad weather, Newcastle coal exports rose 6% in 2023 to 144.5Mt, easing supply shortages that contributed to a mammoth price run in 2022.

- High production levels in India and China and strong gas stores in Europe have sent energy coal export prices to near three year lows.

Coal miners share prices today:

OTHER METALS

Prices correct as of January 31, 2023.

Silver: US$23.09/oz (-2.94%)

Tin: US$26,233/t (+3.22%)

Zinc: US$2527.50/t (-4.90%)

Cobalt $US29,135/t (0.00%)

Aluminium: $2280/t (-4.36%)

Lead: US$2158.50/t (+4.35%)

Graphite (Fastmarkets flake) US$524/t (-5.24%)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.