‘Unique tech in a massive market’: Parkway is here to disrupt the global mineral processing industry

Pic: Schroptschop / E+ via Getty Images

Special Report: After 10 years of research and development, Parkway Minerals’ (ASX:PWN) revolutionary aMES™ technology is rapidly approaching advanced commercialisation. 2020 is set to be a game changing year for this ~$7m market cap company.

Massive volumes of wastewater including brines (salty water) are produced during mining, particularly in mineral processing plants, including those that produce potash, lithium and other valuable minerals.

In many cases, that’s because current processes are expensive and wasteful. Flotation, for example, requires a lot of fresh water (which isn’t always readily available), power, and chemicals (which are expensive and hard to dispose of sustainably).

And a lot of valuable minerals are still lost to these waste streams, which are complicated and costly to dispose of.

For many mining operations, flotation is an old school technology that works, but is often no longer fit-for-purpose in a more environmentally conscious world. The problem is that it takes a long time to get new technologies to the point where the market is confident in their potential.

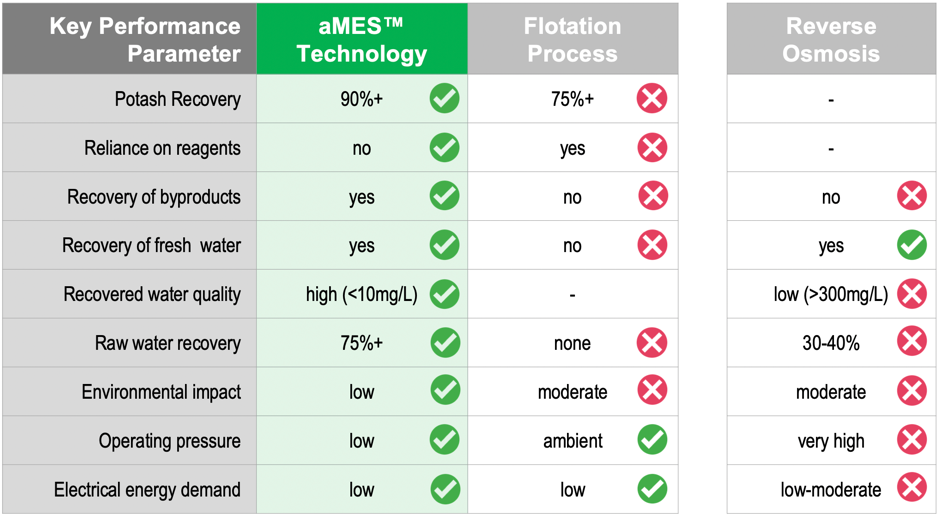

Developed by Activated Water Technologies and its partners over the past 10 years at a cost of almost $10m, aMES™ solves all these existing problems:

And it is now nearing the advanced stages of commercialisation.

Newly appointed Parkway Minerals (ASX:PWN) managing director Bahay Ozcakmak is the founder of Activated Water Technologies and chief exec of Consolidated Potash Corporation (CPC) up until its acquisition by Parkway in September 2019.

As the force behind aMES™ development since inception over the last decade, Ozcakmak will now be the one to drive it towards commercialisation through Parkway.

How does it work?

aMES™ processes those waste brine streams to recover very pure freshwater and a range of high purity, high value minerals, often including potash and lithium.

For miners this means improvements in mineral recovery and product quality; massive project cost savings; more efficient energy and water usage; and improved project footprint and environmental sustainability.

“Just say company ‘X’ has a potash mine and they typically recover 80 per cent of their product through flotation, but 20 per cent of this valuable product goes into a wastewater stream which is pumped into a waste evaporation pond,” Ozcakmak says.

“Through the use our aMES™ technology, they will likely be able to recover an additional 5 to 10, even 15 per cent of additional product from that waste stream, as well as fresh water.”

“These are very large projects, so an extra 5 to 10% of revenue moves the needle, even for a major miner. All of a sudden, what was a cost liability has now become a revenue stream. Not to mention, the miner is now using less freshwater, requires smaller evap ponds, so everybody is a lot happier, particularly the locals.”

Parkway will make money by licensing the tech out to mining companies (through engineering partners), for example, in exchange for a recurring technology licensing fee.

It represents a ‘capital lite’ business model – which is great news for investors, as there is no huge capital hurdle down the road that often stymies smaller companies trying to get projects off the ground. Parkway appears to know exactly where it needs to be to create and capture value.

The road to commercialisation

After a decade-long R&D effort, 2020 is shaping-up to be a big year for Parkway.

A pre-feasibility study (PFS) on the company’s advanced Karinga Lakes potash project in the Northern Territory represents an opportunity to demonstrate the advantages of the aMES™ tech on a larger scale. A scoping study delivered to JV partner (Verdant Minerals) earlier this year, really highlighted the appeal of the aMES™ tech.

The company says the PFS, which includes building a larger scale aMES™ pilot plant, will help with the tech rollout. Parkway is working with a number of strategic equipment (OEM) and engineering (EPC) partners to ensure that the PFS is really a launchpad for not only the Karinga Lakes project, but also more advanced aMES™ opportunities.

But Parkway has already received interest from global miners and advanced-stage project proponents. The company says that it will be in a position to announce these key strategic partners in coming months.

“We aren’t just kicking interesting ideas around in the lab anymore,” Ozcakmak says.

“The tech development work has already been done. We are at the stage where we are partnering with [producers] and scaling up.”

“We are dealing with large established strategic partners, and cashed up, major producers. This means the ‘runway’ from bringing in partners, to working on commercially focused projects, to doing commercial deals, should be relatively short.”

One of these partners is a global top 10 producer of a key globally traded commodity. Parkway is confident it will be able to announce that partnership very soon.

The company is also working on an earlier stage partnership with a predevelopment stage North American potash company.

“More than $100m has been spent on the project which looks really good — but it doesn’t work without water,” Ozcakmak says.

“So, this project basically doesn’t work without us.”

“At the moment we are trying to come to suitable commercial terms, such as paying us some sort of royalty stream.”

That project hosts a 100+ million tonne well defined resource in a tier-1 jurisdiction, so it isn’t going away, and one day it will be developed, Ozcakmak says.

“Having a 2, 5 or 10% per cent royalty on that project is potentially worth millions to Parkway, even before it is developed. North American investors in particular love these sorts of royalties, as they provide enormous leverage, without any capital outlay,” he says.

“That’s the sort of opportunity, without even putting down hard dollars, where we can capture some value. We’re not here to try and whack a burdensome royalty on a project. But the reasons we are having these sorts of discussions is because our technology is providing our partners with the opportunity to create real value.”

The upside is huge for $7.3m market cap Parkway, Ozcakmak says.

“We have a unique technology with very high barriers to entry – if you want to process your waste brine streams and you want to capture some value during the process, then you’ll probably have to deal with us,” he says.

“In addition to mining, we are also working on other large addressable markets with similar brine issues including, desalination and industrial wastewater treatment.”

“Having a unique tech and tackling big markets is the sort of thing small-cap fund managers and cleantech funds are very excited about. We are having some quite encouraging discussions with several of these sorts of institutional investors and are confident they will be attracted to our value-proposition, as we deliver against key milestones.”

We are also buoyed by the recent market recognition and success of other ASX listed water tech companies like SciDev (ASX:SDV) and Phoslock (ASX:PET) which have had a cracking 2019.”

“With severe drought, ever-increasing demands for water and critical awareness about the need for continued improvement in sustainability in the mining industry, we are pumped about what lies ahead for us in 2020.”

This story was developed in collaboration with Parkway Minerals, a Stockhead advertiser at the time of publishing. This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.