Tungsten Mining exceed expectations in first copper and tungsten resource for Hatches Creek

The resource contributes to Tungsten Mining’s expanding inventory and underpins its ambition to be a leading player in the critical minerals space. Pic: Getty Images

- A maiden inferred mineral resource estimate has been reported for separate tungsten trioxide and copper domains at Hatches Creek

- Tungsten Mining plans to “rapidly develop” NT project

- A strategy to advance Hatches Creek will first focusing on the collection and processing of historic stockpiles

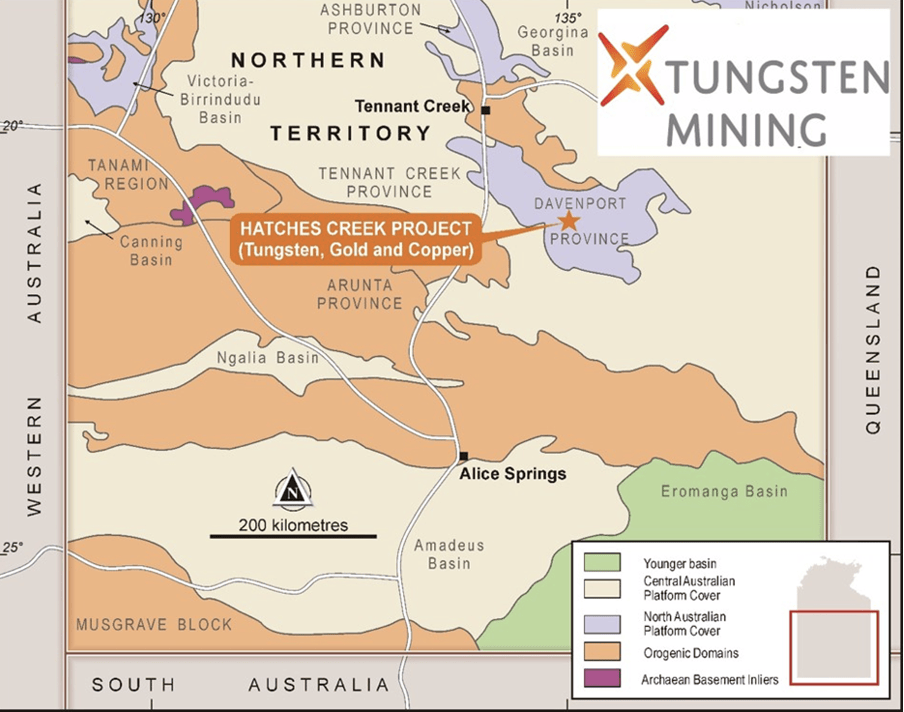

Special Report: In line with rising critical metal prices, Tungsten Mining has uncovered two separate inferred mineral resources for the Hatches Creek project in the NT.

Initial inferred mineral resource estimates for Hatches Creek comprise 12Mt at 0.17% tungsten trioxide and 0.12% copper within tungsten domains, plus a standalone copper domain of 6.1Mt at 0.29% copper.

The explorer, which has been considering early-stage production since lodging its mining management plan and licence application, says the resource strengthens its inventory and supports its ambition to become a critical minerals producer.

Hatches Creek, about 37km northwest of Alice Springs, consists of two granted exploration licences covering 31.4km over the entire historic Hatches Creek tungsten mining centre, a productioon hub between 1915 and 1957.

The project area hosts extensive remnants of past mining – such as waste dumps, shafts, tailings, and a battery site at Pioneer – following historical production of ~2840t of 65% WO3, plus bismuth and copper concentrates.

Tungsten Mining (ASX:TGN) is considering a phased approach to developing Hatches Creek, beginning with processing legacy stockpiled material before advancing to open-pit extraction across the project area.

‘Well beyond target’

TGN chairman Gary Lyons said the maiden JORC resource represents a major step towards the company achieving its objective of rapid evaluation and development of Hatches Creek.

“The results were well beyond target in both scale and grade of tungsten and copper,” he said.

“Drilling has defined 20,900 tonnes of WO3 and 32,100t of copper at a time of strengthening critical metal prices.”

Much like broader markets, copper has experienced extreme swings in 2025, reaching all-time highs in March before returning nearer US$4 per pound shortly after.

So far in 2025, copper prices have climbed around 16%, with analysts expecting further gains fuelled by rising demand from the energy transition, data centres, and infrastructure development.

Tungsten prices have also been creeping higher following China’s export controls on the key military metal.

According to Lyons, the price of ammonium paratungstate (APT) – a vital input for producing tungsten metal – is currently sitting around US$395 per mtu.

The 18% rise since February comes in the wake of China tightening export controls and cutting quotas on key strategic metals, including tungsten.

Highly amenable to processing

Preliminary studies of Hatches Creek material indicate that its well suited for processing via ore sorting, gravity separation and magnetic separation, successfully producing tungsten concentrate grading 50% WO3.

Historical workings at the Hit or Miss prospect have encountered tungsten lodes over 600m of strike, indicating solid potential to increase the resource with further drilling.

Other deposits within the Hatches Creek project include Treasure, Green Diamond, Black Diamond and Bonanza.

This article was developed in collaboration with Tungsten Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.