Triton tops up coffers as it nears construction at Mozambique graphite project

Pic: Schroptschop / E+ via Getty Images

Special Report: Emerging junior graphite producer Triton Minerals is raising $5.2 million in cash after tying up full ownership of its graphite projects in Mozambique.

The company (ASX:TON) has already received firm commitments for a placement to institutional and professional investors to raise $1 million and is also undertaking a fully underwritten entitlement issue to raise a further $4.2 million.

The company’s key focus is its Ancuabe project, which it is aiming to have in operation by July 2019 following a short construction period starting in May this year.

“Having considered the possibility for a larger share placement, Triton determined it was in the best interests of the company to provide existing shareholders the opportunity to participate in the capital raising, particularly given the anticipated project milestones and a final investment decision for Ancuabe anticipated in Q2 2018,” managing director Peter Canterbury said.

“It also provides some working capital to commercialise Nicanda Hill, our graphite-vanadium project, still one of the largest deposits of graphite and vanadium in the world.”

The cash raised will be used to top up the coffers following the acquisition of the remaining 20 per cent of Grafex Limitada and fund early works at the Ancuabe project while Triton finalises the engineering, procurement and construction (EPC) contract.

Owning 100 per cent of the Mozambique projects will greatly assist Triton in securing mining approvals, offtake and financing for Ancuabe.

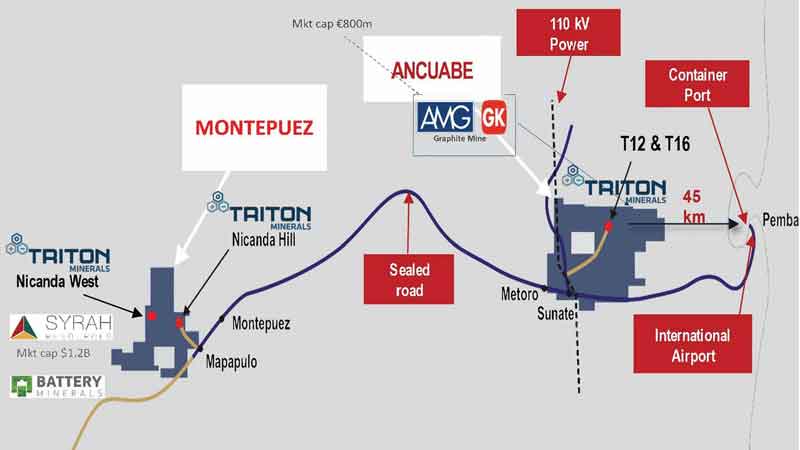

The project is in the same neighbourhood as the already operating Balama and Ancuabe graphite mines owned respectively by Syrah Resources (ASX:SYR) and GK Ancuabe Graphite Mine, a subsidiary of German company AMG Graphit Kropfmuehl GmbH.

Triton’s project is located in the district of Ancuabe, in Mozambique’s Cabo Delgado province, which is known to host large and high-quality graphite deposits.

Around 32 per cent of the graphite in Triton’s deposit is jumbo flake and about 59 per cent is large flake, which attracts higher prices over smaller flake graphite.

“Ancuabe has operating costs of about $600 per tonne, but because of the large flake size it can fetch a price of around $1400 per tonne,” Mr Canterbury told Stockhead.

“So we can generate margins of about $800 per tonne.”

The project, which will produce 60,000 tonnes of graphite concentrate each year, has a pre-tax net present value of $US298 million ($376.9 million), pre-tax internal rate of return of 36.8 per cent and payback of less than four years.

Graphite a key input for EVs

The growth in the electric vehicle and energy storage markets is driving demand for graphite.

Each lithium ion battery requires 60kg of graphite – more than twice the amount of lithium needed.

The forecast is for a tenfold increase in graphite demand to around 1.4 million tonnes by 2026.

Electric car makers are already striking long-term deals with big battery makers.

Volkswagen revealed this week its aggressive push into the electric car market after securing over $31 billion worth of battery supplies from players like Samsung and LG.

BMW, meanwhile, has locked in three to five-year supply contracts with Samsung for products due to be delivered in 2020.

New market opportunity

Fire safety is rapidly becoming a global issue in commercial and residential construction following fires in London and Melbourne.

New legislation in China, the European Union (EU), Japan and Korea has either required flame retardants in building codes and/or banned brominated and asbestos-based fire retardants.

Australia is also placing restrictions on the use of non-flame retardant materials in aluminium cladding on buildings.

Concerns over the combustibility of building materials used historically may require retrofitting of existing buildings.

Graphite is a cost-effective alternative with the added advantages of higher thermal efficiency and denser composition.

Expandable graphite attracts a significant market premium to batteries and refractories with many uses outside the building industry.

If similar laws are enacted in other countries the potential growth in demand is exponential.

The US Federal Aviation Administration is also looking at using graphite as a flame retardant in aircraft.

Expandable graphite is anticipated to be the second highest graphite market segment.

Buyers lined up

Triton has already inked non-binding supply agreements with several Chinese players and is in the process of working to convert them to binding agreements.

Qingdao Haida Graphite, one of the world’s largest producers of graphite, has agreed to take up to 25 per cent of Ancuabe graphite concentrate production and Qingdao Tianshengda Graphite has negotiated up to 15,000 tonnes per annum for a minimum of five years.

Triton is also in the final tender process for EPC contracts with Chinese heavyweights Sinosteel and China Metallurgical Group (MCC).

Mr Canterbury says Sinosteel and MCC can help Triton secure debt funding through their banking connections at a much lower interest rate than other financiers outside of China.

Value proposition

You just have to look at Triton’s neighbours to see the potential value of the company, which currently has a market cap of about $70 million.

Triton’s third project, Nicanda Hill, is right next door to Syrah, which has a market cap of $1 billion.

“We have one of the world’s largest graphite and vanadium deposits at Nicanda Hill,” Mr Canterbury said.

The project’s resource of 160 million tonnes of contained graphite and 4 million tonnes of contained vanadium makes it larger than Syrah’s Balama mine.

Part of the capital raising proceeds will be used for accelerating the review of the vanadium development potential of the Nicanda Hill project.

“Given the strong increase in vanadium prices and equity market valuations of vanadium projects, Triton has engaged CSA Global to undertake a review of the vanadium resource and exploration data,” Mr Canterbury said.

Triton is currently looking for a joint venture partner for Nicanda Hill, a move that could significantly reduce its equity requirements for the development of the Ancuabe mine.

This special report is brought to you by Triton Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.