Triton locks in first graphite supply deal with major Chinese distributor

Pic: John W Banagan / Stone via Getty Images

Special Report: Emerging junior graphite producer Triton Minerals has signed its first binding sales agreement with Chinese processor and distributor Qingdao Tianshengda Graphite.

Laiki City, Shandong Province-based Tianshengda has annual capacity of 30,000 tonnes to 40,000 tonnes of value-add graphite products, including expandable graphite, flake graphite and graphite powder.

The off-take (or sales) agreement covers up to 16,000 tonnes a year of graphite concentrate from Triton’s Ancuabe mine in Mozambique for at least five years.

It also includes a seller option for a further five years, with a minimum quantity of 10,000 tonnes per annum, across a range of graphite product specifications on a cost, insurance and freight (CIF) Chinese port basis.

Investors welcomed the news, pushing shares up 1.3 per cent to 7.8c.

“Securing this binding agreement and becoming part of the supply chain for Tianshengda illustrates the strong demand for premium Ancuabe graphite concentrate, growth of the expandable graphite market in China, and vision of Chinese graphite producers to diversify their supply base in response to domestic shortages and legislative changes,” managing director Peter Canterbury said.

“The off-take agreement also assists Triton to accelerate other development objectives – including engineering, procurement and construction, approvals and project finance – with the confidence of secured offtake and favourable graphite pricing.”

Buyers lined up

Triton has already inked non-binding supply agreements with several Chinese players and is in the process of working to convert them to binding agreements.

Qingdao Haida Graphite, one of the world’s largest producers of graphite, has agreed to take up to 25 per cent of Ancuabe graphite concentrate production.

Triton is aiming to have Ancuabe in operation by July 2019 following a short construction period starting in May this year.

The company recently raised $5.2 million in cash after tying up full ownership of its graphite projects in Mozambique.

Owning 100 per cent of the Mozambique projects will greatly assist Triton in securing mining approvals, offtake and financing for Ancuabe.

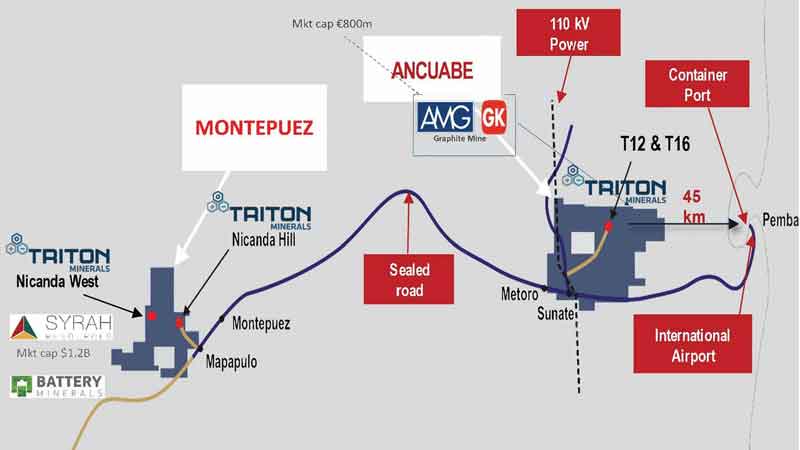

The project is in the same neighbourhood as the already operating Balama and Ancuabe graphite mines owned respectively by Syrah Resources (ASX:SYR) and GK Ancuabe Graphite Mine, a subsidiary of German company AMG Graphit Kropfmuehl GmbH.

Triton’s project is located in the district of Ancuabe, in Mozambique’s Cabo Delgado province, which is known to host large and high-quality graphite deposits.

Around 32 per cent of the graphite in Triton’s deposit is jumbo flake and about 59 per cent is large flake, which attracts higher prices over smaller flake graphite.

“It’s a very big vote of confidence that we’ve got an existing large Chinese producer who wants large flake graphite, acknowledging that there is a severe decreasing in the amount of large flake graphite available in China,” Mr Canterbury told Stockhead.

“I think it’s a reinforcement that the market fundamentals for graphite are very good and it is also another step in the progression of Ancuabe into a producing asset.”

Historically China accounted for about 70 per cent of coarse flake graphite supply.

China’s coarse flake graphite reserves, however, have largely diminished and supply is also under threat by environmental restrictions forcing mine closures.

Graphite a key input for EVs

The growth in the electric vehicle and energy storage markets is driving demand for graphite.

Each lithium ion battery requires 60kg of graphite – more than twice the amount of lithium needed.

The forecast is for a tenfold increase in graphite demand to around 1.4 million tonnes by 2026.

Electric car makers are already striking long-term deals with big battery makers.

Volkswagen is undertaking an aggressive push into the electric car market after securing over $31 billion worth of battery supplies from players like Samsung and LG.

BMW, meanwhile, has locked in three to five-year supply contracts with Samsung for products due to be delivered in 2020.

New market opportunity

Fire safety is rapidly becoming a global issue in commercial and residential construction following fires in London and Melbourne.

New legislation in China, the European Union (EU), Japan and Korea has either required flame retardants in building codes and/or banned brominated and asbestos-based fire retardants.

Australia is also placing restrictions on the use of non-flame retardant materials in aluminium cladding on buildings.

Concerns over the combustibility of building materials used historically may require retrofitting of existing buildings.

Graphite is a cost-effective alternative with the added advantages of higher thermal efficiency and denser composition.

Expandable graphite attracts a significant market premium to batteries and refractories with many uses outside the building industry.

If similar laws are enacted in other countries the potential growth in demand is exponential.

The US Federal Aviation Administration is also looking at using graphite as a flame retardant in aircraft.

Expandable graphite is anticipated to be the second highest graphite market segment.

This special report is brought to you by Triton Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.