Trigg adds more high grade antimony targets with new acquisitions

Trigg Minerals will expand the footprint of its Spartan and Taylors Arm Projects. Pic: Getty Images

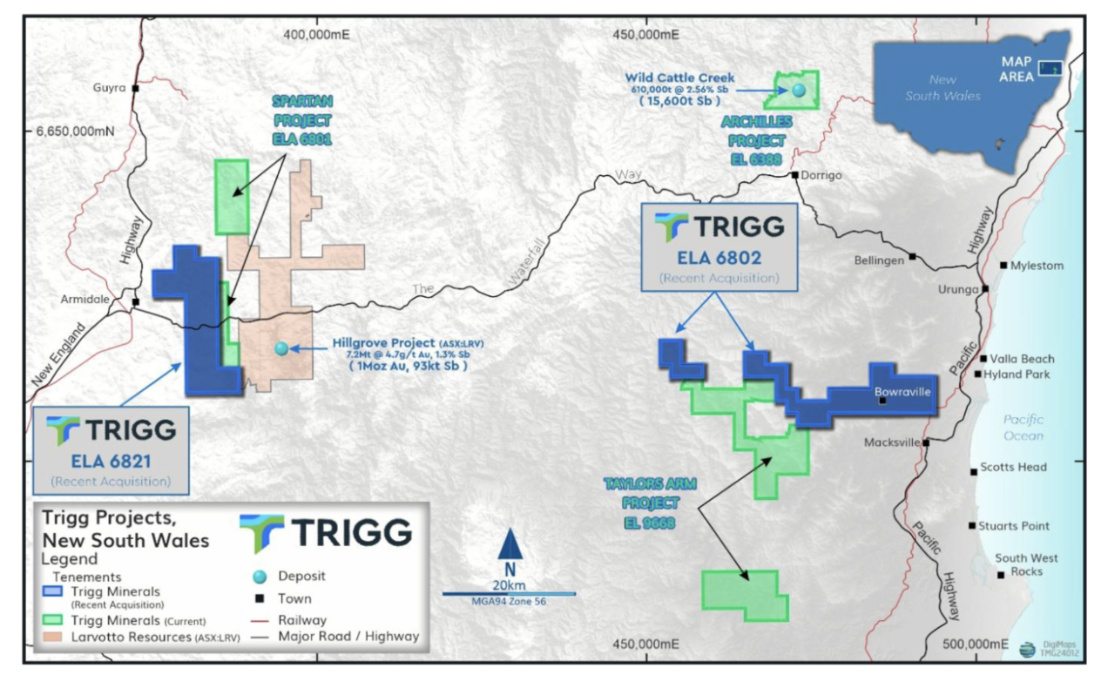

- Trigg expands antimony portfolio entering into binding purchase agreements to acquire 100% of Spartan West and Taylors Arm East Antimony applications

- The projects in New England Orogen in northern NSW are considered highly prospective for antimony, gold and silver

- The combined acquisition cost of both projects is $10,000 cash plus $225,000 worth of shares

Special Report: Trigg Minerals has engineered an expansion program that will see it add a bevy of super high grade antimony targets to its New South Wales portfolio, doubling down on a strategic shift that seen its shares rise close to 250% in six weeks.

The binding purchase agreements to acquire 100% or the Spartan West and Taylors Arm East antimony applications will consolidate Trigg Minerals’ (ASX:TMG) holdings at its Spartan and Taylors Arm projects, where some of Australia’s highest grade antimony discoveries and historic mines have been found.

Spartan West (ELA 6821) is located right next to Larvotte Resources’ (ASX:LRV) Hillgrove mine, the largest mixed antimony-gold resource in Australia, and contains several antimony-gold occurrences in its own right on the same rocks that host the neighbouring mine on the Hillgrove Fault.

Taylors Arm East meanwhile boasts 16 additional workings to the 87 picked up by Trigg at the adjacent Taylors Arm, including the Bull Creek mine where recent rock samples uncovered grades of 57.9% Sb and 16.4% Sb.

Mining has taken place at Bull Creek over the years, sometimes extracting grades of up to 50% Sb.

The project also includes the O’Donnell’s Reef, a brecciated quartz-filled shear zone with stibnite mineralisation grading up to 6.5% Sb, and the Tewinga silver mine.

Worked on and off until 1935, Tewinga has yielded high grade silver – once extracting a bulk sample grading at over 147oz (yes, that’s ounces) to the tonne, with mineralisation traceable over 1200m.

Low cost expansion

Trigg’s agreements with Obscure Minerals (Spartan) and Pinpoint Prospecting (Taylors Arm), picking up separate licences in the New England Orogen of northern New South Wales, represent a low cost expansion of its emerging antimony strategy.

The company will pay $10,000 cash and issue $225,000 worth of shares at a deemed issue price of 5c. The 4.5 million units will be escrowed for six months.

It strengthens the strategic position Trigg holds in the state, which has diversified its portfolio alongside the Drummond gold and copper project in Queensland.

Antimony has become one of the most sought-after commodities on the ASX in recent weeks after China issued export controls on the metal.

It’s used heavily in solar panels and a host of other applications including munitions and infrared technology used in the defence sector, making sourcing supplies outside China and Russia a major focus for the US Government and its diplomatic partners.

Prices are now sitting at record highs.

Executive chair Timothy Morrison said the expansion of the Spartan and Taylors Arm Projects strengthened Trigg’s strategic position in a region known for its high-grade antimony mineralisation.

“These new acquisitions represent a critical step in our long-term strategy to unlock the potential of these assets and to become a key player in the global supply chain for antimony, a critical mineral in the renewable energy and technology sectors,” he said.

“With growing global demand for antimony, particularly as a component in energy storage systems and solar panels, the timing of this expansion is highly opportune.

“TMG will focus on further advancing exploration across the expanded Spartan and Taylors Arm Project, leveraging its proximity to established operations and known high-grade deposits in the region.”

Target ripe for exploration

The western partition of the Taylors Arm application contains three historical workings, including Keayes Creek and Bull Creek, that report high-grade sulphidic-quartz breccia material with grades exceeding 6% Sb and up to 57.9% Sb.

Host rocks for the quartz-stibnite breccia veins are predominantly Permian-aged metasediments of the Nambucca Beds.

These occurrences are structurally controlled by fault, shear and fracture systems and resemble the 71 historical occurrences in EL9668, the main Taylors Arm licence.

The Keayes Creek and Bull Creek workings have undergone minimal exploration, with the last reconnaissance occurring in 2013 and before that in the 1990s.

Bull Creek was an open-cut and underground antimony mine developed along three distinct shear zones with recent rock samples confirming extremely high-grade antimony mineralisation, with assays returning values of 57.9% Sb and 16.4% Sb.

Recent rock samples from the Bull Creek Mine workings have yielded promising gold results, with one sample returning 6g/t gold and a nearby second sample producing an even higher assay of 24g/t gold.

TMG said significant gold and silver mineralisation have been identified across the Taylors Arm Portfolio, with notable assay results including up to 24 g/t gold and 840 g/t silver.

This article was developed in collaboration with Trigg Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.