‘Trending higher than previously assumed’: The metal most likely to boom in the second half of 2023

Pic: dzika_mrowka, iStock / Getty Images Plus

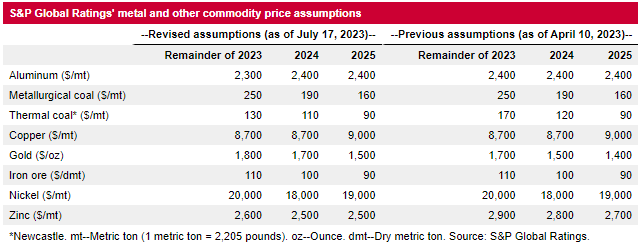

- S&P Global makes modest changes to metal and commodity price assumptions for remainder of 2023

- The ratings agency is lowering price assumptions for aluminium, thermal coal, and zinc, and raised them for gold; base metals are unchanged

- Spot price for gold has been trending higher “than we previously assumed”: S&P

S&P Global has made modest changes to its metal and commodity price assumptions for the remainder of 2023, with gold emerging the biggest winner.

While steep interest rates hikes in the face of persistent inflation perpetuate risks to economies and the demand for commodities, for now S&P continue to anticipate “broadly supportive” market conditions for most rated metals and mining companies.

“Metal prices [have] receded from their historic highs between late 2021 and mid-2022, but for the most part, this has not affected metals and mining companies’ credit profiles,” Simon Redmond, an analyst at S&P Global Ratings says.

“Companies have generally reduced the amount of debt they carry as it has become more expensive and market conditions have worsened.”

In its latest Metal Price Assumption S&P are lowering price assumptions for aluminium, thermal coal, and zinc, and raising them for gold.

It continues to anticipate “supportive fundamentals” for base metals.

The golden child

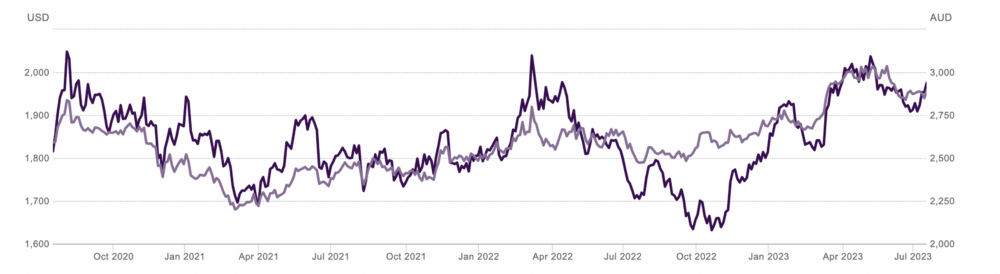

At more than US$1,900 per ounce over the past few weeks, the spot price for gold has been trending higher “than we previously assumed”, Redmond says.

“Our higher gold price assumption through 2025 reflects, in part, the persistence of higher costs around the world, along with ongoing geopolitical and financial market risks,” he says.

“As a result, we assume that the average price per ounce of gold will be US$1,800 for the remainder of 2023, up from US$1,700 previously.”

Even that revised US$1800/oz prediction sounds like a lowball, with the gold price trading comfortably in the 1900’s for the first half of 2023 (range: ~US$1820 to ~US$2040/oz).

S&P has a recent history of underestimating gold’s resilience.

In 2021, S&P predicted prices would average $US1,600/oz in 2022 and just $US1,400/oz in 2023.

In August last year, S&P’s price prediction for 2023 was increased US$1600/oz.

Still way off.

Sources: FastMarkets, ICE Benchmark Administration, Thomson Reuters, World Gold Council

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.