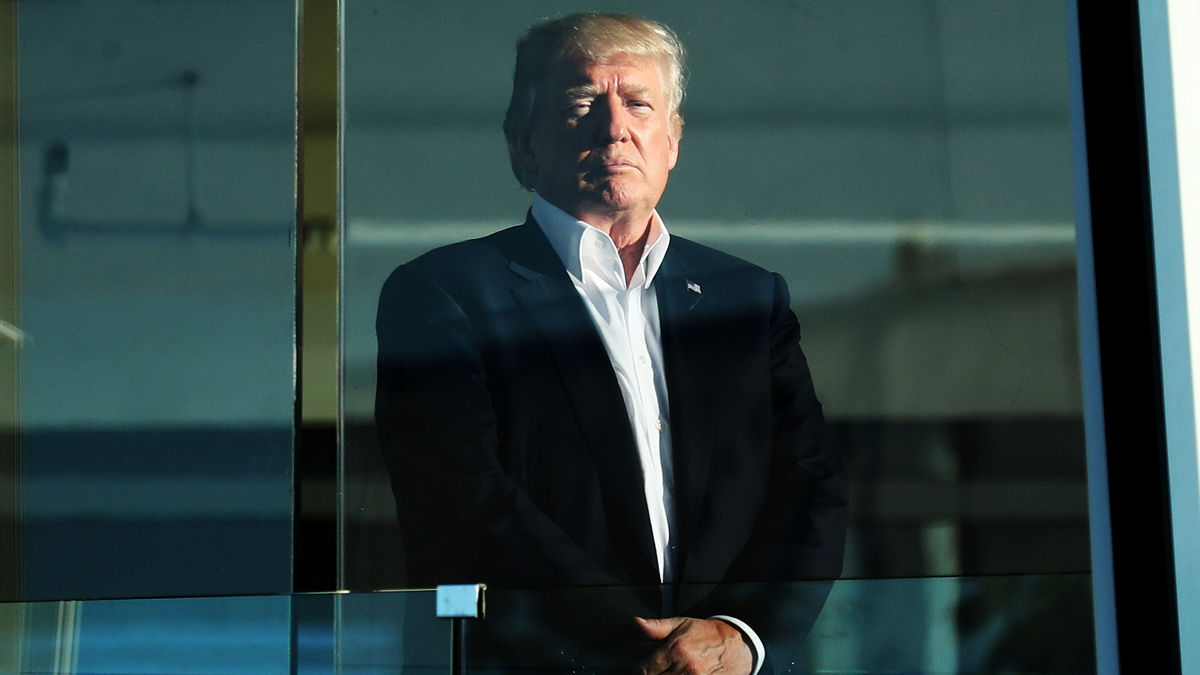

Trade war schmade war? How Trump’s Don Quixote moment may affect commodities

Picture: Getty Images

Unless you’ve been crying under a doona after this week’s share market bloodbath, you’ve probably noticed that the US and China are locked in a trade war. So who wins, and how does the fight affect commodities?

According to China Briefing, we’re almost about to tick over into day 400 of the trade war between China and the US, which has seen tariff and counter tariff, currency devaluation, and rumblings over rare earths.

This week it was given fresh fire with Donald Trump putting tariffs on another $300 billion worth of Chinese goods, and China retaliating by stopping buying US agricultural products.

Markets around the world dove into retreat, and the ASX had its worst day of the year, with $38 billion wiped off the bourse.

The bad news is that the trade war will have a unique impact on Australia, given China is a major importer of Australian commodities, notably iron ore.

So, should the trade war go on, and on, and on, that would be terrible news for commodities, right?

Well, not so much, according to Gavin Wendt.

China will probably win the trade war

Speaking with Stockhead yesterday, Minelife founder Wendt said that in the case of a protracted trade war the effects would be more keenly felt in the US rather than China.

“We’ve seen the impact it’s [the trade war] had on the US share market in recent days. If all of a sudden the cheap consumer goods that go into places like Walmart start drying up or the cost of those goods start going up — that’s going to have a huge impact on the US economy,” he said.

“The big issue there will be with consumer confidence, and potentially inflation because the prices will go up.”

He said thanks to Beijing’s tight control over the domestic economy of China, that it would be able to find domestic growth levers and adapt to new economic situations far better than the US could.

“China, to a significant degree, is insulated from what’s going on,” he said.

“I’m not saying it’s immune…but China, because of its managed economy and because its growth is still relatively robust…the consequences for China are much less than for the United States.”

He said evidence of China’s relatively robust domestic market can be seen on the demand side for key commodities such as iron ore and copper, which have held up despite 400 days of a trade war.

The outlook for iron ore, copper

He said that in the case of an ongoing tit-for-tat trade dispute, that he expected the demand side for iron ore to hold up.

“What we see is that iron ore dynamics are really driven by supply and demand dynamics rather than speculators, and China’s appetite hasn’t really diminished,” Wendt said.

Luckily for Australia exporters, the last six to 12 months of trade has been characterised by a lack of supply — notably from Vale in Brazil.

Unluckily for Australian exporters, that Brazilian supply is expected to come back on stream over the next six to 12 months. Not that it will affect the demand side too much.

There could be weakness in pricing as Vale production comes back on stream, but so far the iron ore price has been “extremely resilient”.

“We’ve had fluctuations in the price of iron ore, it does rise and fall, but they haven’t fallen back to the long-term trend line that the market was expecting — something around the $50/t mark or lower,” Wendt said.

“The broad spectrum of commodity demand, as far as China’s concerned, is very much driven by its internal growth engine and that hasn’t been affected by the trade war.

“China has been able to find other customers for its products, and we’ve seen what it’s been doing on the currency front.”

Copper too has been hit by a lack of supply, but without finding the price support iron ore has enjoyed.

“The thing about copper is that its price is really affected by speculation, despite the low volumes at LME warehouses,” Wendt said.

Indeed, the low demand has China worried about fresh supply, with new mines not coming on stream quickly enough to meet robust demand.

This might be where the trade war can have a real impact.

Scared money

If there’s one things lenders don’t like, it’s geopolitical turmoil and that’s making lenders keep their powder dry according to Wendt.

“The world of project financing seems to be getting more difficult rather than easier,” he said.

“There are more issues in terms of sovereign risk, debt providers not wanting to take risks. The issue we’re talking about now in terms of the trade war just chases money away.”

He said the financing issue was even hitting commodities like nickel, which has enjoyed pricing support this year,

“Everybody realises from the bigger picture perspective that demand for these commodities is going to go through the roof, but there’s not that much supply out in the market at the moment,” Wendt said.

“The big question is how the new mines will be funded. None of that is being reflected in the pricing of these commodities.”

So while commodities like copper haven’t been supported (yet) — one commodity which has had all the support in the world is gold — will the good times continue to roll?

Is gold’s golden run about to end?

Gold has continued to profit from geopolitical uncertainty around the trade war and things like Brexit, and has been a safe-haven for lots of investors.

This uncertainty has driven the gold price to all-time highs, hitting $AU2180 at the time of writing.

Given gold was sitting at about $AU1750 at the start of the year, there’s got to be scope for a correction, right?

“I can’t see a correction happening. The big thing that may change momentum there would be some resolution to the trade war and we seem to be further away from that now than when it started,” Wendt said.

He said a confluence of bad news about the US economy including low interest rates, questions over the debt level and the weaker US dollar meant investors were seeking value in gold.

“So all of these factors are at play to provide a perfect storm and I can’t see any of the factors that are driving gold being resolved or easing off any time soon,” Wendt said.

“So where there are economic growth concerns that aren’t going to be resolved any time soon, it’s a positive for gold.”

Given Donald Trump is playing to his political base with his attacks on China, don’t expect the geopolitical storms to ease off any time soon, especially since there’s an election next year.

“Trump’s playing to his domestic base, which seems to involve starting a fight with everyone and hoping his base gets him re-elected — and hang the economic consequences of it all,” Wendt said.

“It’s pretty scary stuff.”

Well, except for commodity traders it seems.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.