Toubani confirms Kobada’s low cost, high yield shallow gold oxide credentials

Toubani’s Kobada project is being optimised as a shallow, easy to mine gold deposit. Pic via Getty Images.

- Kobada DFS update confirms project as large, low cost gold oxide development

- Drill program set to commence to convert Inferred material into higher confidence Indicated catergory

Special Report: A DFS update for Toubani Resources’ Kobada gold project in Mali has pegged its development as a bulk mining operation that will bring forward the processing of large tonnage oxide ore.

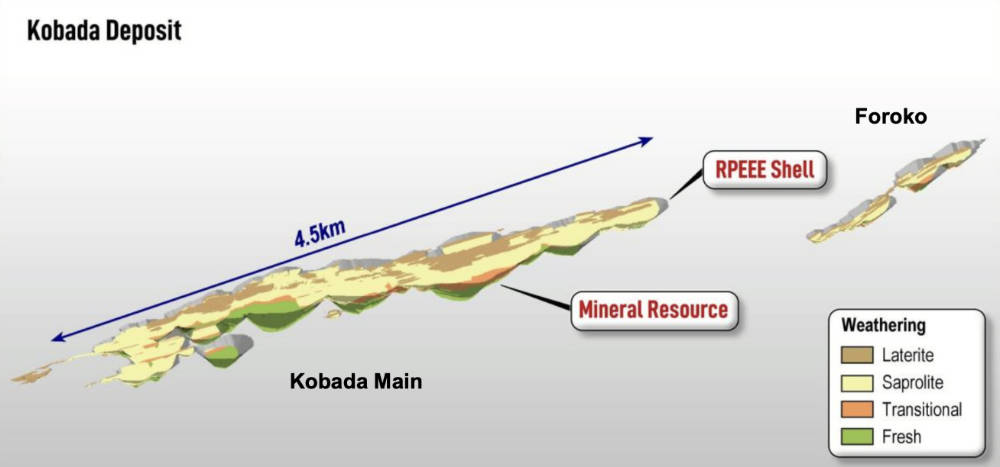

Kobada’s 2.4Moz resource occurs across a shallow 4.5km strike length which lends itself to a predominantly free-digging oxide, open pit development.

Previous studies completed by Toubani Resources (ASX:TRE) in 2021 contemplated a processing plant with a 3Mtpa throughput rate, with mining rates averaging 24Mtpa to enable a higher‐grade feed over the initial 10 years of the project.

The DFS update has made progress in the key areas of mining and processing.

Development optimisation

The update, being completed by Lycopodium Minerals, has confirmed Kobada as a free milling deposit with high recovery rates of ~95% in the oxide material.

A number of viable pit shells have been developed at a range of mining rates which then present ore for processing at different annual rates to be reviewed and decided on.

Additionally, preliminary pit designs have been used to identify key near-surface areas containing a high proportion of material classified in the inferred category, which would be classified as waste in DFS level studies.

Based on the assessments, additional infill drilling in these areas is now being planned, which TRE says should increase the resource confidence and enable more material to be incorporated into future ore reserves and DFS level studies.

A key focus of the planned drill design, the explorer says, is to convert high value, near-surface oxide material into the indicated category to de‐risk the initial mining phases of the project.

Further geotechnical investigations and water balance modelling has been recommended within the next phase of the project and the Environmental and Social Impact Assessment (ESIA) and community development plan will be completed once the final site layout is determined.

The 4.5km strike length of the Kobada deposit. Pic: Supplied (TRE)

TRE chief executive Phil Russo says the company is excited to advance Kobada’s potential as a large, simple, low technical risk and low operating cost oxide project.

“The primary objective of updating the past study at Kobada is to understand the project’s optionality, define the optimal approach forward, and translate that into the upcoming drill program and next phase of engineering work,” he says.

“The optimisation studies have highlighted the benefit to the project of targeting areas within the pit shell for resource definition drilling to convert the Inferred material, currently classified as waste, to Indicated with drilling planned to commence shortly.

“With the completion of these initial studies, a key milestone has been met that validates our strategy that Kobada has the attributes to become a mine and we look forward to continuing this momentum in 2024.”

Next on the agenda

The company says it will kick off a planned a resource definition drill program, with results expected during the March quarter.

The program will focus on key high value inferred areas of the optimised pit shell that can be converted to the higher confidence indicated category and reduce in‐pit waste material and potentially benefitting the overall project.

Engineering and design of the process flowsheet to optimise capital and operating costs for the project will also advance, while non‐process infrastructure such as site access and transport routes will be reviewed.

The DFS update will move to final pit design, mining and processing schedules, capital expenditure estimate and detailed financial modelling over the first half of 2024.

This article was developed in collaboration with Toubani Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.