Resources Top 5: Red Metal makes ‘world first’ rare earths find; Western Gold also makes a REE pivot

Pic via Getty Images

- Red Metal has come across a new type of REE/REO mineralisation in QLD’s northwest

- Western Gold Resources is REE hunting in Europe, bagging three Swedish prospects

- Meanwhile, Native Mineral Resources’ share price is surging after a capital raise

Here are the biggest small cap resources winners in early trade, Monday August 21.

RED METAL (ASX:RDM)

Minerals exploration company Red Metal believes it has found a “world first” new source of rare earths mineralisation at its Sybella project.

Sybella is located about 20km southwest of Mt Isa in northwest Queensland, and Red Metals’s discovery reportedly shows scope for “vast tonnages of weak-acid soluble rare-earth oxide (REO) mineralisation hosted in low-acid consuming granite rock”.

The discovery and the company’s excitement around it follows assay results from proof-of-concept drilling regarding 19 percussion holes (for 2,280m) across the granite, which highlighted the quality of grade and substantial widths of the find.

Importantly, Red Metal is talking near-surface REO mineralisation that “should be recoverable by the application of a weak acid solution”.

Each hole was drilled to 120m, with the assays revealing multiple, long intercepts of total rare earth oxide – neodymium plus praseodymium (NdPr) oxide – plus yttrium oxide (TREO+Y) mineralisation hosted within the granite intrusion.

Many of the intercepts start at surface below a thin veneer of sand, ending in mineralisation at 120m.

The company is excited because it says the Sybella project’s granite-hosted, weak-acid soluble REO deposit style can be “broadly compared with other granite-hosted, weak-acid soluble mineral deposit types such as the giant Rossing and Husab soluble uranium deposits in Namibia and the Morenci soluble copper deposits in the USA”.

Those large tonnage deposit types are able to be bulk mined and extracted efficiently at scale using simple coarse grind and low-acid leach processing.

RDM share price

WESTERN GOLD RESOURCES (ASX:WGR)

Yellow-metal-hunting exploration minnow Western Gold, known for its Gold Duke Project in WA, is also on a rare earths hunt, revealing it’s set to acquire a high-grade REE prospect and two high-grade graphite projects in Sweden.

WGR’s ASX announcement this morning notes it’s entered into a conditional agreement to acquire Euro Future Metals Pty Ltd (EFM), a firm that holds the exploration permit applications for the Holmtjarn REE, Loberget Graphite and Rullbo Graphite Projects.

The Holmtjarn REE project appears to host NYF (niobium, yttrium and REE, fluorine) pegmatites, with the company noting that:

“A rock chip sample of greater than 3.45% (34,448ppm) Total Rare Earth Oxide (TREO) with a ratio of Magnetic Rare Earth Oxide (MREO) to TREO of 25% is recorded in historic sampling of pegmatites.”

Also, numerous mapped pegmatites have not yet been tested for REE potential and will be the focus of an upcoming exploration campaign.

As for the graphite prospects, they’re located in the northern Gävleborg County, which hosts Woxna – the only graphite mine in the European Union. “Nearology” vibes? Quite possibly.

“We believe Sweden’s REE and Graphite potential is still to be unlocked and that these projects can assist making Europe self-sufficient in battery minerals,” said WGR managing director Warren Thorne.

WGR share price

NATIVE MINERAL RESOURCES (ASX:NMR)

NMR is up a whopping 120% at the time of writing. A surge that’s coming off the back of a capital-raising clarification this morning.

The company notes it’s tractor-beamed in $640k by way of a share placement offering to sophisticated and institutional investors (issuing of 21,363,767 fully paid ordinary shares at $0.03.

That’s a discount there, with the current share price sitting around $0.055.

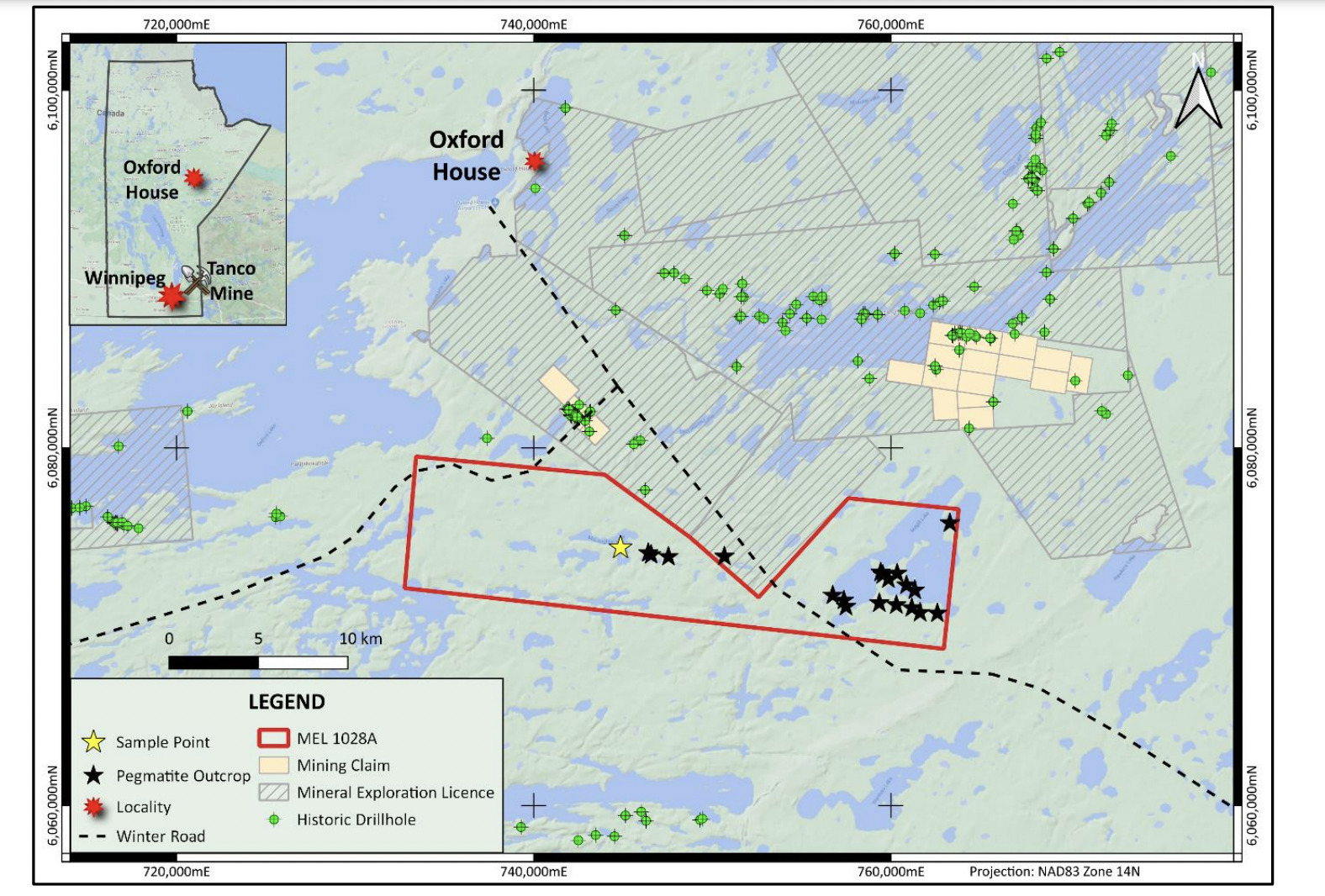

Jostling for position with several others, the company is on a lithium hunt in Canada, and the funds raised here will be used for the acquisition of the Mclaughlin Lake Lithium site in the province of Manitoba, along with various operational expenses.

NMR is set to gain 51% of the highly prospective lithium project from New Age Metals Inc for $200,000 in NMR shares, $75,000 CAD in cash and $500,000 CAD funding of exploration over 18 months.

“NMR has secured a strategic early position in an under-explored, yet hugely prospective, greenfield lithium province with known pegmatite outcrops and high-grade lithium results,” said Native Mineral Resources’ MD Blake Cannavo recently.

NMR share price

FIRETAIL RESOURCES (ASX:FTL)

(Up on no news)

Copper-hunting miner Firetail Resources continues its recent good form.

There’s nothing too specific to say about it so far today, but something’s brewing, as the company placed a trading halt on $FTL this morning.

Why? That’s the question, and the answer is not completely clear but relates to a pending announcement from the company regarding exploration results. And investors are clearly anticipating those to be positive results.

Firetail recently signed a binding term sheet to purchase up to an 80% stake in the Peruvian copper projects of Valor Resources, which actually sealed the drilling permission from the Peruvian Ministry of Energy and Mines.

Valor sold that amount of its interest in the project to FTL in order to instead focus on its Canadian uranium portfolio.

Firetail will be taking on the maiden program of 5,000m of diamond drilling at Pichu, and that’s planned to initially test four key targets – Cobremani, Cumbre Coya, Maricate and Fundicion.

The Picha #Copper Project, under option to $FTL.AX, recently received approval from the Peruvian Ministry of Energy for 'Permission to Drill'.

This is a key milestone, allowing for up to 120 holes to be drilled within the approved Effective Area.https://t.co/NC34BWQoiQ#ASX pic.twitter.com/XXK7teDWE5

— Firetail Resources (@FiretailRes) August 17, 2023

FTL share price

AGUIA RESOURCES (ASX:AGR)

(Up on no news)

We have nothing new to report here on the phosphate and copper-sulphate hunter.

Back in May, AGR noted it was close to production at its small, but potentially very profitable, Três Estradas phosphate (TEPP) and Andrade copper projects in southern Brazil.

As reported by Stockhead’s Reuben Adams at the time, “construction at Três Estradas has been stymied by civil action after a Federal Public Prosecutor slapped the company with an emergency injunction in 2021 to put a stay on environmental licensing for the TEPP, granted 2019.”

At that time, AGR was pushing the line around positive settlement negotiations after also receiving a “first favourable decision in court”. Scouting around for an update on this, there appears to be no fresh news.

In a recent investor presentation, AGR noted:

“At full capacity, Tres Estradas can supply 10% of the State of Rio Grande do Sul (RS) needs for phosphate. All other supply is imported to Brazil.

“Aguia is also now undertaking agricultural testing in multiple international settings in an effort to pave the way for additional demand in higher-margin retail and small-scale agricultural settings where certified organic products are paid a premium.”

Per Reuben’s May 1 article:

“The TEPP is expected to produce 306,000tpa over 18 years following a three-year ramp up. It will cost just $8m to build.

“A March 2021 early-stage project study at Andrade showed an impressive 67.1 per cent internal rate of return (IRR) on a 1mtpa copper sulphate (salt) operation over 14 years.

“Average earnings before tax would be almost $20m a year – and it would cost just $10m to build the thing.”

AGR share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.