Top 5 Resources: Too much niobium is not enough as it lights up again on July 4

Pic: Getty Images

- Rincon kicks off drilling in West Arunta at ‘Luni’ size anomaly

- Ark runs on huge 1.5bn exploration target for Sandy Mitchell REE project

- Asakari pegs 323,000oz target for Burracoppin gold project

Here are the biggest small cap resources winners in morning trade, Thursday, July 4.

Rincon Resources (ASX:RCR)

(Up on yesterday’s news)

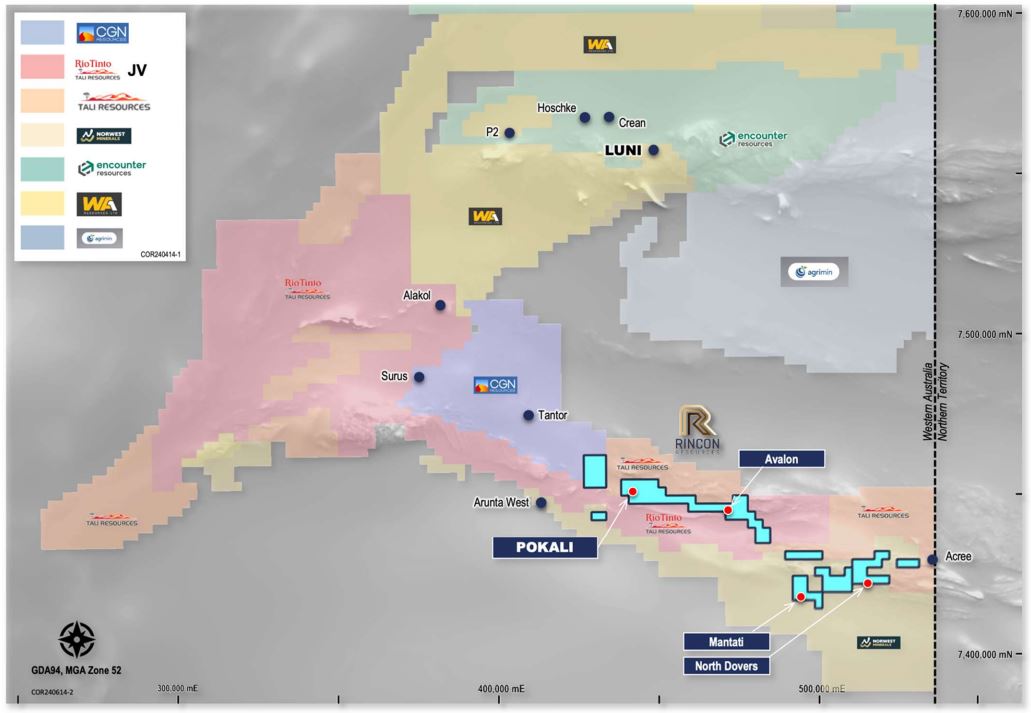

Maiden drilling by RCR is kicking off at the West Arunta project in the, erm, West Arunta region in WA (which is going absolutely gangbusters for REEs and niobium by the way).

The explorer has identified the ‘Avalon’ gravity anomaly at the project, which it says is comparable to WA1 Resources’ extraordinary 200Mt at 1% niobium (Nb2O5) Luni deposit.

WA1’s Luni find catapulted the company from a $9m-capped minnow to a now >$1.3bn mine developer and RCR, among other juniors that have flocked to the region, would be happy to emulate even just a small slice of that success.

Shares in RCR are up 22.7% to 13.5c per share – and notably, WA1’s shares have also jumped 10% after open today.

Ark Mines (ASX:AHK)

(Up on recent news)

Earlier this week ASX junior AHK announced a pivotal exploration target for its unique surface-expressed Sandy Mitchell REE project in QLD of between 1.3-1.5 billion tonnes at 1250-1490ppm monazite equivalent.

Grades and numbers for this type of REE project are a bit different, as the mineralisation can potentially be mined at an average depth of just 11m, AHK says.

‘Surface-expressed’ means there’s no overburden removal and simple extraction techniques can be employed – smoothing the pathway towards development.

Sandy Mitchell’s heavy minerals contain a 24% total rare earths oxide (TREO) basket of high-value MagREEs: neodymium, praseodymium, dysprosium and terbium (NdPr and DyTb), making it one of Australia’s richest MREO deposits.

“The sheer scale of the Sandy Mitchell exploration target, up to 1.5 billion tonnes, delivers a clear statement that this is one of the world’s largest surface-expressed, sand-based placer rare earth deposits,” AHK exec director Ben Emery says.

“With the consistent grades of rare earths and heavy minerals from surface to only ~11 metres deep, we are working with an exceptionally large and very simple deposit with an extremely low environmental impact.”

Shares in the $14m market-capped explorer were up 5c (23.8%) after market open, trading at 26c.

Olympio Metals (ASX:OLY)

(Up on no news)

The last time we heard much a-do with OLY was when it told the market it was kicking off field exploration at its Cadillac lithium project in Quebec’s developing Abitibi region back in May.

Cadillac is near Canada’s only operating lithium mine – Sayona Mining (ASX:SYA) and Piedmont Lithium (ASX:PLL) 119.1Mt at 1.1% Li2O NAL operations.

Fieldwork’s comprised of pegmatite surveying using pXRF and LIBS analysers to locate potential spodumene-bearing pegmatites suitable for drill targeting.

OLY had $2.8m cash in the bank by the end of the March quarter to fund current exploration so we might be hearing from them soon.

That’s because shares rocketed up 31% to 5c in early trade to be the best performing resources junior on the ASX from open today, continuing its price trajectory up from June 24 when it was trading at just 2.2c per share.

Askari Metals (ASX:AS2)

Gold explorer AS2 went into a pause in trading about an hour or so after revealing to the market it’s defined an up to 8.2Mt at 0.91g/t 323,000oz exploration target for its Burracoppin project in WA.

And while that target is separate from the project’s existing mineral resource of 1.32Mt at 1.52g/t gold for 64,000oz, it shows a lot of promise.

Burracoppin’s prospectivity in the region is its proximity to Ramelius Resources (ASX:RMS) 990,000oz Edna May gold mine 15km away.

AS2 MD Gino D’Anna says the company has received a significant uptick in inbound investor and strategic interest for the project.

Could be something to do with record high gold prices? Bullion is on a steamer and sitting pretty around $3500/oz for the past few months.

Shares in AS2 went up 20% before a pause in trading to 4.8c per share.

Editor’s note: Trading has resumed and dipped to just 15% higher at 4.6c per share at time of writing.

Pivotal Metals (ASX:PVT)

(Up on recent news)

Last and a little bit least, we should give a quick shout out to PVT, which a couple of days ago discovered substantially thicker mineralisation at its Horden Lake copper project in Quebec, Canada.

The junior says results show tremendous potential for the project to deliver substantial exploration upside, with a best intercept of a thick 32.1m at 1.2% copper-equivalent.

Shares in the explorer jumped 25% to 2.5c per share today.

At Stockhead we tell it like it is. While Ark Mines is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.