You might be interested in

Mining

Resources Top 5: Tin prices surge as DRC operation closes and Metals X reaps rewards

Mining

Perpetual’s high-grade tin, niobium, titanium rock chips show potential for multiple commodities at Itinga

Mining

Mining

An obscure conflict in the eastern reaches of the Democratic Republic of the Congo, where a rebellion that has been bubbling for 13 years exploded in recent weeks, could provide the steam needed to power the ASX’s tin explorers.

Tin prices briefly topped US$35,000/t over the past week, returning to levels not seen in close to a year.

The root cause? London-listed Alphamin’s suspension of the Bisie tin mine in besieged North Kivu province, where Alphamin claims to produce around 7% of global tin supplies. The company has called for US diplomatic intervention after announcing its suspension on March 13 as M23 rebels advanced in the direction of the mine.

That’s a big deal in an already undersupplied market, suffering from restrictions in alluvial supply from Indonesia and Myanmar on environmental crackdowns and political instability.

For an example of how single mine issues can effect an entire supply chain, look no further than the Brumadinho dam disaster in January 2019.

The collapse of a tailings dam which killed close to 300 people led to widespread safety closures across Vale’s iron ore business in Brazil.

As high-cost suppliers emerged to fill the gap, the cost curve rose sharply. Since then, iron ore has barely spent more than a week below US$100/t – extremely lucrative levels for low-cost majors like BHP, Fortescue and Rio Tinto.

Tin is an altogether different beast. Primary refined supply fell 2.7% to 371,200t last year, with the International Tin Association reporting a small deficit of 2200t.

But with half of its market coming from solder, essential for electric vehicles, electronics, AI and solar panels, demand is expected to rise substantially in the years ahead, with some analysts projecting a doubling of the market by 2040.

With so much supply insecurity, what does that mean for tin juniors?

Nero Resource Fund portfolio manager Daniel Harangozo, whose fund holds 15% of ASX tin developer Stellar Resources (ASX:SRZ) and a large stake in Tasmanian tin miner Metals X (ASX:MLX), said the concentration of tin supply remains a major risk for the “quiet critical mineral”.

READ: Counter Cycle: Contrarian resources investor Rusty Delroy says “quiet critical mineral” tin speaks the loudest

“These significant supply side pressures continue from unreliable jurisdictions,” Harangozo said.

“Alphamin’s project is material to the market, it’s a good 6% of global tin concentrate last year.

“When you couple that with the supply curtailment out of Myanmar, the regulatory oversight and higher levels of intervention in Indonesia, I think it continues to demonstrate that a concentrated amount of tin concentrate supply out of these challenging jurisdictions is a major risk to the market.”

While the refined tin market deficit was not extensive last year, the deficit on concentrate supply was around 25%, Harangozo said.

“You’ve got some other supportive indicators like a lower US dollar, LME stocks are down 25% this year and big picture global growth in electrification and semiconductors, electronics – these continue to support the demand side of the equation and the associated tin market deficit.”

One region where tin exploration has re-emerged in recent years is Brazil’s Minas Gerais state.

It’s come off the back of the country’s lithium boom, now quieting down after an oversupply of the battery metal sent prices tumbling last year.

Many of the deposits mined for lithium in Brazil were previously tin producers, one of them being AMG Resources’ Mibra mine some 130km southwest of Belo Horizonte, the capital of Minas Gerais.

As lithium’s fortunes have waned, tin’s rise has provided a window of opportunity for explorers planning to excavate Brazil’s rich pegmatites.

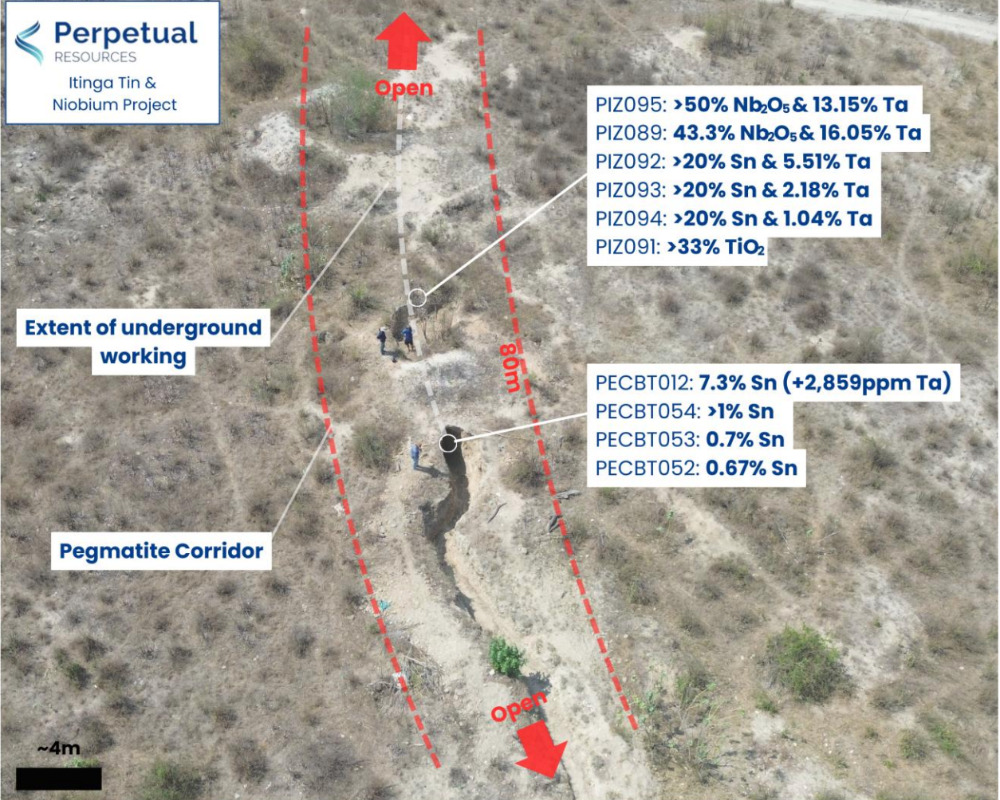

One of them is Perpetual Resources (ASX:PEC), which reported reconnaissance results from its Itinga project in three rock chop samples of over 20% tin in cassiterite, the mineral from which commercial hard rock tin concentrates are extracted.

It’s now expanded an exploration program to include a review of artisanal workings, detailed soil and rock sampling, mapping and trenching to assess for areas with potential to host high-grade tin mineralisation.

Brazil was the sixth largest tin producing country in the world in 2018 at 18,000t, but commanded as much as 22% of the market back in 1989.

“Perpetual is excited about the tin potential of its Itinga project in the Lithium Valley region of Brazil,” Perpetual Resources exec chair Julian Babarczy said.

“We entered Brazil with the intention of harnessing the lithium opportunities but now are concentrating on the tin and niobium potential at Itinga, which is just outside the lithium zone.

“We have altered our exploration priorities and elevated Itinga. This part of Brazil used to be a strong tin-producing area.

“In the next few months we will step-up efforts at Itinga with a targeted exploration plan.

“Tin and the Itinga project are both big sleepers that are showing signs of waking up.”

Babarczy noted there were not many new projects coming online, despite the need for more material and major refiner China’s reliance on imports to feed its smelters.

“Continued strong pricing, which is expected, will see a greater emphasis on tin. There is growing general concern about where future tin supplies will come from,” he said.

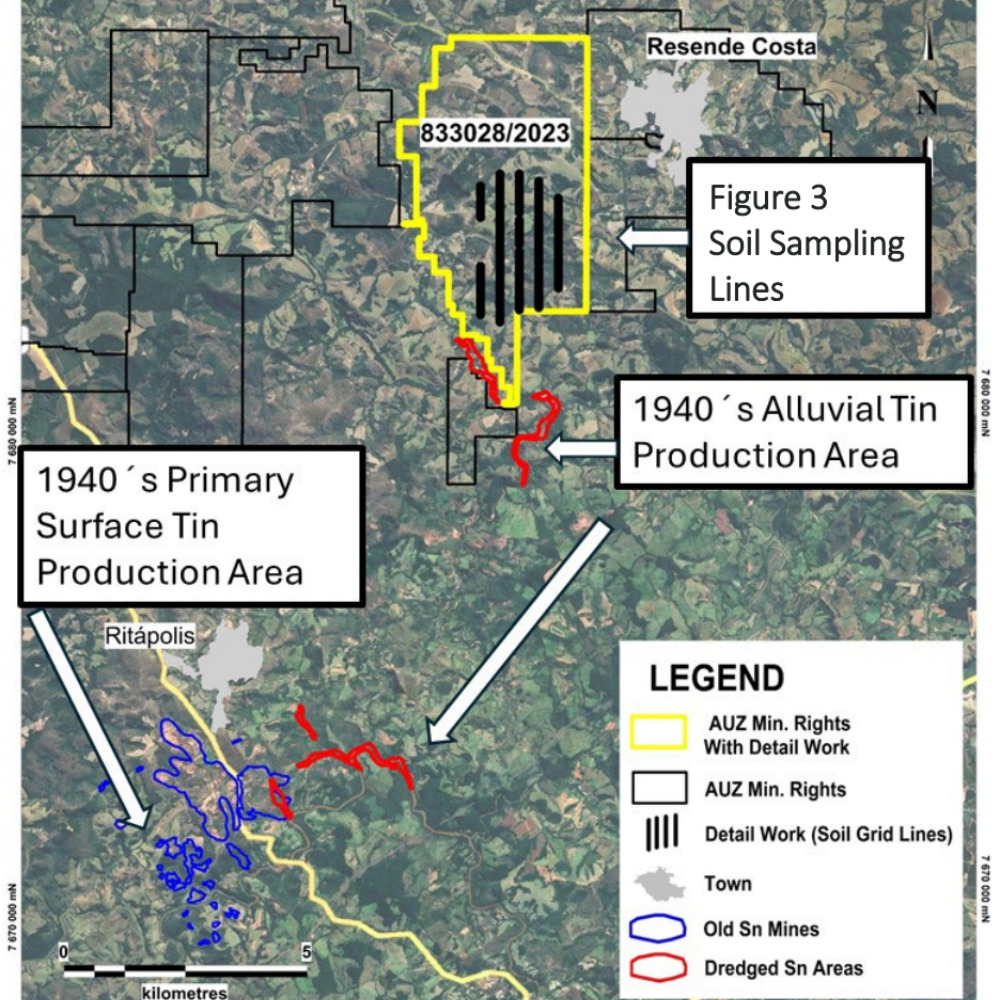

Australian Mines (ASX:AUZ) is another ASX junior taking a closer look at its own tin prospects in Brazil, alongside rare earths prospects in the South American mining powerhouse and its Flemington scandium project in New South Wales.

AUZ’s tin exploration potential centres on the Resende project, located just to the north of an area mined for alluvial tin in the 1940s.

Also acquired with the intention of looking for lithium, trace elements for lithium closer to surface include, as is common in pegmatite orebodies, tin and tantalum.

AUZ’s tin does not outcrop, meaning diamond drilling will be key to determine the concentration and metallurgical properties of any potential tin mineralisation.

“We’ve got the right host rock, we’ve got a good soil anomaly and we don’t have a fresh outcrop to take a sample,” Australian Mines MD Andrew Nesbitt said.

“So we’re going to drill it. From the records and from the literature of the area, if you do find tin it will be cassiterite.”

Nesbitt said AUZ is currently identifying a drill contractor with the aim to test Resende in the next four to six weeks.

In the meantime, the tin market is likely to remain clouded by events in the DRC.

“(Alphamin’s) also the lowest cost producer in the world,” Nesbitt noted.

“So obviously you should have some supply restrictions, which translates to better pricing for tin, which gets people excited about tin again to go back and start looking more seriously at their resources.”

Nero’s favourite small-cap tin exposure is its holding in Stellar, which Harangozo says holds Australia’s highest grade and the world’s third highest grade undeveloped deposit, at Heemskirk in Tasmania.

But he said rising prices and supply uncertainty could bring support from the market for early stage explorers as well.

“The tin market and tin price, backwards looking, has meant that we haven’t had an exploration or capital cycle incentivised in tin for a long time,” he said.

“So that’s what makes us particularly constructive on assets that are already well advanced, like Stellar.

“That same price signal, I think, would incentivise new exploration but that comes with a lag.

“Ultimately, that’s going to be perhaps your next cycle of potential projects rather than this cycle.”

Most junior tin explorers are yet to move on the DRC news but established producer Metals X (ASX:MLX), which owns half of the historic Renison Bell tin mine in Tasmania, has gained over 21% in the past month.

At Stockhead, we tell it like is is. While Perpetual Resources and Australian Mines are Stockhead advertisers, they did not sponsor this article.