Tin on a tear: Citi tips tin to hit US$40,000/t – laying the perfect platform for Stellar’s Heemskirk development

Citi’s forecast positions tin among the next wave of metals to benefit from global growth and decarbonisation demand. Pic: Getty Images

- Citi backs tin for a breakout, forecasting US$40,000/t by 2026

- The outlook means good things for Stellar Resources, owners of Australia’s highest-grade undeveloped tin asset

- The company is moving through feasibility stages and is now aiming to lift its tin resource at Heemskirk

- SRZ also secured a fresh $9m to fuel its next growth phase, with the raise well-backed by new institutional and sophisticated investors

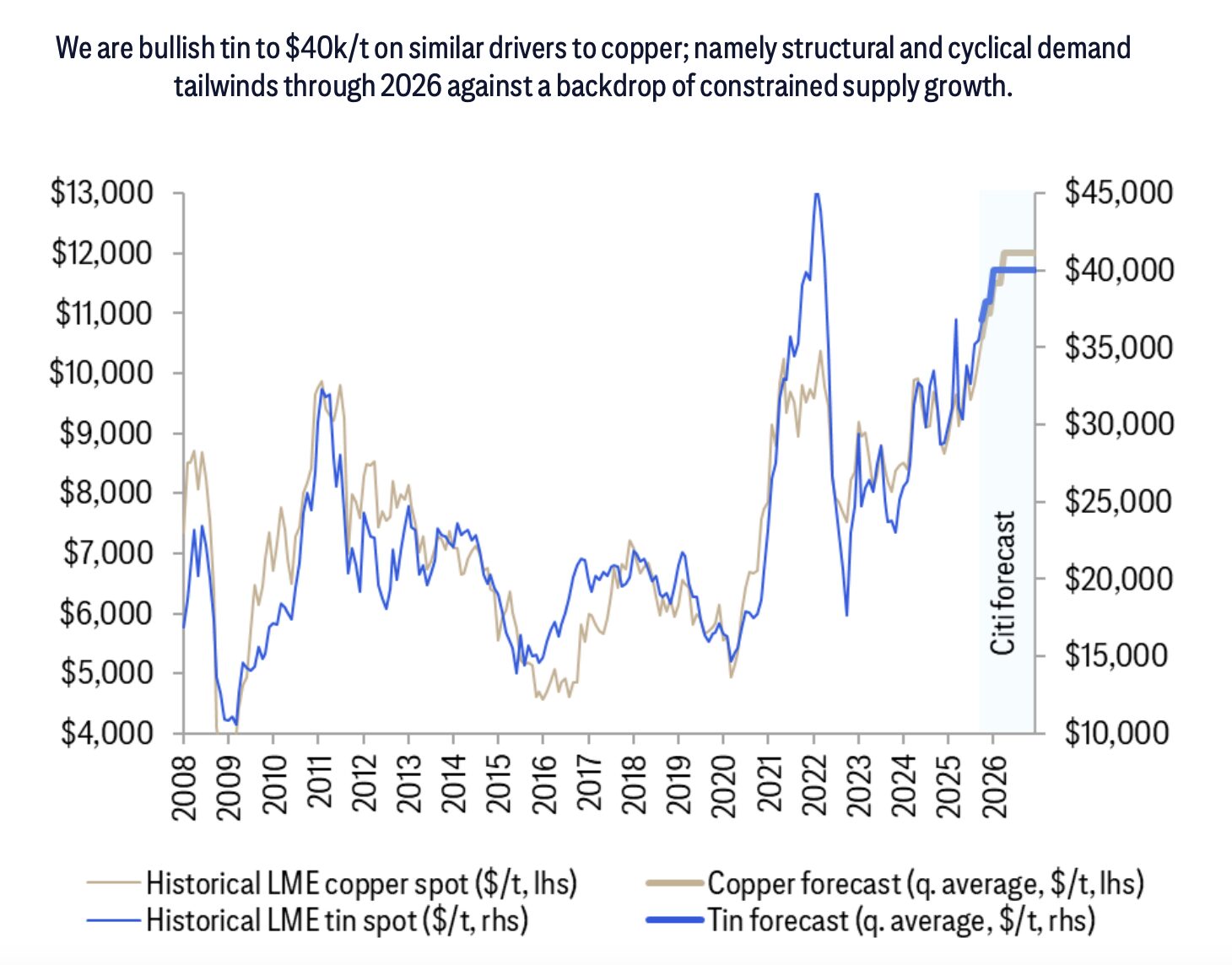

Special report: Global investment bank Citi has forecast tin prices will climb to US$40,000t per tonne through 2026, citing a combination of cyclical demand recovery and structural supply constraints.

In its latest research, Citi has assigned a 60% probability to its base case scenario of tin averaging US$40,000t in 2026, highlighting the base metal’s leverage to similar upside drivers as copper and aluminium from an expected rebound in cyclical growth and energy transition demand.

It models a bull case (20% probability) of US$50,000/t, supported by constrained supply and solid demand, and a bear case (20% probability) of US$30,000/t, should new supply weigh on prices amid subdued global conditions.

The investment bank has pointed to ongoing vulnerability in global tin supply, particularly from policy led disruptions in Indonesia and Myanmar, while demand from solar applications and datacentres continues to strengthen.

Even with Myanmar and Indonesia tightening the taps this year, Citi reckons tin stocks show the market’s holding its ground and not tipping into a major shortfall just yet.

Tin has emerged as the strongest performer among base metals year-to-date, with gains exceeding 25% outpacing copper and aluminium.

This outperformance reflects the metal’s unique exposure to both energy transition demand – particularly from solar panel manufacturing and datacentre cooling applications – and more traditional electronics sector consumption.

Against this backdrop, fund positioning has turned decidedly bullish, with net long positions elevated at 9 out of 10 on Citi’s scale, reflecting investor conviction that structural and cyclical tailwinds will outweigh near-term supply adjustments.

Citi’s analysis positions tin alongside copper and aluminium as beneficiaries of the anticipated 2026 global cyclical growth rebound, whilst acknowledging near-term headwinds from slower economic activity.

The bank expects a gradual recovery in Myanmar mine output to facilitate stronger Chinese refined production over the next year, but maintains that Indonesian production will remain under pressure, creating the supply constraints that underpin its bullish price forecast.

Highest-grade undeveloped tin resource in Aus

With resource and feasibility work progressing at its Heemskirk project, Stellar Resources (ASX:SRZ) stands out as a player well placed to benefit from what Citi expects will be a supportive tin market through 2026.

The forecast arrives as Stellar looks to upgrade its current 7.48Mt resource at 1.04% tin, which ranks as the highest-grade undeveloped tin resource in Australia and third highest globally.

The company’s coffers just got a $9 million boost via a placement at 2.2 cents apiece, drawing strong support from both new and existing institutional and sophisticated investors.

“We are very pleased with the strong support received for this placement from both existing shareholders and new investors, enabling the board to increase the amount raised from what was originally sought,” managing director Simon Taylor said.

“The funds raised, together with recent option conversions, significantly strengthen our balance sheet and positions Stellar to advance the Heemskirk Tin Project towards development, as we aim to become a global top 10 tin producer.

“The strong investor interest reflects growing recognition of Heemskirk’s potential as a high-quality, conflict-free tin project approaching development in a Tier-1 jurisdiction at a time of robust tin prices and tightening global supply.”

Growth is on the agenda

Heemskirk’s Severn and Queen Hill deposits have been the focus of an extended 29-hole drilling campaign totalling approximately 12,000m, designed to convert inferred resources to the indicated category whilst testing for extensions.

The recent wedge hole at Severn, which intersected 25m at 0.38% tin from 539m depth, including a high-grade core of 4m @ 1.26% Sn from 546m, represents the first of multiple wedge holes planned to efficiently execute the resource conversion strategy.

To date, 26 holes and wedges totalling 11,215m have been completed with two rigs operating and additional assays pending, supporting the company’s timeline for a resource update in the second half of 2025.

Heemskirk also offers exposure to a Tier-1 mining jurisdiction with established infrastructure, transparent regulatory frameworks and proximity to Asian processing hubs. It is located just down the road from Renison, Tasmania’s most prominent mine responsible for around 4% of global tin production.

Stellar’s targeted production of 3000-3500tpa of payable tin, representing 1% of global supply, would provide an additional source of the critical metal from a geopolitically stable region at a time when supply security is increasingly valued by end-users and investors.

Upcoming catalysts

A PFS, currently underway, is due in the first half of 2026.

SRZ has raised nearly $12 million in recent months, a clear sign of strong investor demand for tin exposure in conflict-free, tier-1 mining jurisdictions.

This article was developed in collaboration with Stellar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.