Tim Treadgold: Why it’s time to take a closer look at Emerald Resources

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

UPDATE OCT 30: You read it here first, but only just! A few hours after Stockhead posted its report on Emerald Resources the company unveiled a $30 million fund raising to kick-start construction of its Okvau gold project in Cambodia. The three-stage raising is priced at 3c a share split between professional investors, directors and management and existing shareholders via a security purchase plan. Game on.

Not many investors would back a small gold company purely on the calibre of its management team.

But in ultra-low-profile Emerald Resources (ASX:EMR) you’ll find a stock led by people who once ran much bigger goldminers, including Regis Resources.

Comparing $74 million Emerald with $2.3 billion Regis is very much in the David and Goliath category.

Regis is already a big gold producer. It churns out 360,000 ounces a year from a series of mines in WA at an attractive $901/oz — which led to a record net profit last financial year of $174 million.

Emerald’s major asset is an undeveloped gold project in Cambodia — a South East Asian country with no history of gold mining but an unfortunate history of political and military turmoil.

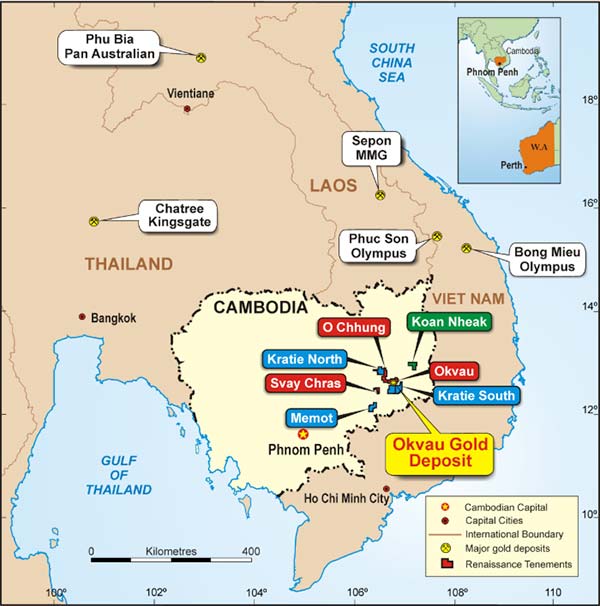

For much of the past two years Emerald — which emerged from the merger of an oil and gas explorer and Renaissance Minerals — has been trying to secure a mining licence for its Okvau project (see map below). That’s not an easy job in a country where the government has limited exposure to mining.

First gold

Three months ago Emerald got its licence, clearing the way for construction to start before Christmas. First gold is expected to be poured in early 2020.

If all goes well Okvau will start with an annual rate of 106,000 ounces of gold from an ore reserve of 14.3 million tonnes of material grading 2 grams a tonne for 907,000oz.

The all-in sustaining cost is forecast to be $US731/oz. That’s good enough to pay back the $US223 million capital cost in under 2.5 years with the project generating an internal rate of return of 48% assuming a gold price of $US1250/oz.

Okvau’s numbers might pale alongside those of Regis. But dig a little deeper and the connection to past success in mining can be found – it’s in the people behind Emerald.

Key managers

The key player is Simon Lee, a man with deep business roots in Australia and Asia who was once well-known in gold-mining as the force behind a series of success stories, including Great Victoria Gold, Samantha Gold and Equigold.

Lee’s involvement as chairman of a small gold company has a whiff of history possibly repeating. He has a track record of generating profits for investors who have followed his career.

The links to earlier gold success gets stronger when looking at Lee’s management team, starting with Morgan Hart, Emerald’s managing director who was chief operating officer of Regis and Equigold, and Mick Evans, an executive director at Emerald who was chief development officer of Regis.

Other Emerald board members have equally impressive mining management credentials.

Ross Stanley was the biggest shareholder in Stanley Mining Services before it was taken over in 1997, and Ross Williams was a founding shareholder in the mine services business, MACA.

First challenge

Their first challenge is to develop the 100%-owned Okvau project in a country with limited understanding of mining, and to then generate the promised profits without attracting government intervention, a possibility in all developing economies.

Relations with the Cambodia Government appear good with a generous tax agreement negotiated (30% corporate tax and a 3% royalty), plus import duty exemptions and no government equity participation.

After that come Emerald’s growth options, which could be substantial because much of Cambodia has never seen any modern mineral exploration.

Early stage work on the company’s 1400 sq km land package has revealed multiple gold occurrences.

Rock chip sampling, which is an early stage technique which doesn’t always show what lies beneath the surface, has returned grades as high as 9.94g/t from the Angkor Koan Nheak prospect which is in a similar geological setting as Okvau and in which Emerald is earning an 80% stake.

The Snoul prospect, in which Emerald is earning a 70% interest, has returned rock chip samples up to 14.45g/t.

Imminent start

For investors with a high-risk tolerance Emerald might appeal because of the imminent start on building its first mine in virgin mining country — and extensive growth opportunities once it makes the leap from project developer to profitable gold producer.

On the stock market Emerald has been a non-performer — tram-lining between 3c and 4c for the past 12 months and last trading around 3.4c:

However, the mechanics of what Emerald is doing are simple.

Okvau has a relatively shallow orebody containing material amenable to conventional processing.

Funding the mine, given Lee’s extensive experience in other gold projects and his strong following, should not be a deal-breaker, while the timing of developing a new goldmine at a time of reasonable gold prices will comfort banks and equity investors.

Apart from all that it will be interesting to see if Lee and the other well-connected mining executives he has recruited can repeat what they have achieved in the past.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.