Battery metals stocks off the charts as cobalt and lithium prices take off

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

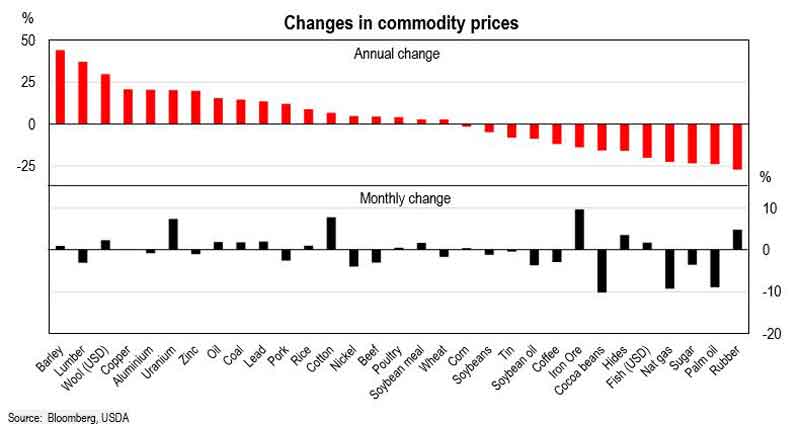

Cobalt prices rocketed 130 per cent last year, making it a top commodities performer among HSBC’s “Commodity Prices Snapshot”.

The report reinforced Stockhead’s findings that cobalt was the clear winner in the resources space in 2017, thanks to electric vehicle makers sucking up supply.

Demand for cobalt is expected to grow because of its use in lithium cobalt oxide electrodes — a common lithium ion battery technology used in electric cars.

“Most forecasts suggest that demand for electric vehicles will either be ‘big’ or ‘very big’, with the two million vehicles currently used set to rise to 50 million (OPEC’s 2016 estimate) or over 500 million vehicles by 2040 (Bloomberg’s 2017 estimates),” HSBC Australia economists Paul Bloxham and Daniel Smith said.

This has also driven demand for lithium, with prices up 35 per cent in 2017.

Benefiting from this rapidly rising cobalt demand were companies like Jervois Mining (ASX:JRV), which was up 1200 per cent for the year, Collerina Cobalt (ASX:CLL), which rocketed over 1080 per cent, and European Cobalt (ASX:EUC), which closed 2017 869 per cent higher than where it was at the start of the year.

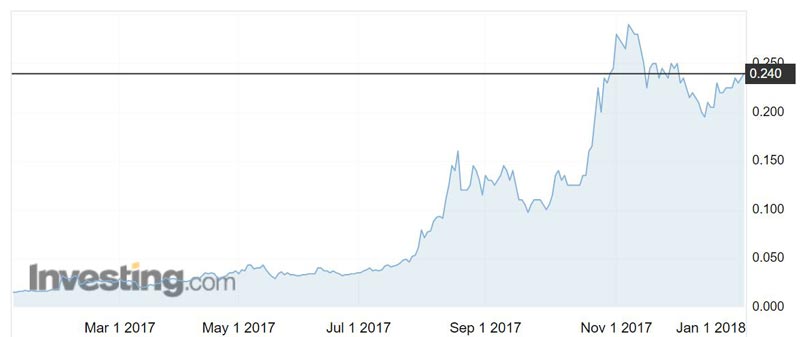

The biggest beneficiary in the lithium space in 2017 was Klaus Eckhof’s AVZ Minerals (ASX:AVZ), which soared 1433 per cent.

The company’s share price has gone from a tiny 1.5c to 24c over the past year, boosting its market value to around $420 million.

Also in the lithium space were Lake Resources (ASX:LKE), which jumped nearly 350 per cent, European Lithium (ASX:EUR) up 345 per cent, and Tawana Resources (ASX:TAW) which gained 318 per cent.

Supply of some battery-related commodities has also been constrained, HSBC noted.

“Although there are significant plans for investment in production of lithium, the ramp-up in supply has not kept pace with expected demand,” Mr Bloxham and Mr Smith said.

“The challenge for cobalt has been its geographical concentration in the Democratic Republic of the Congo and the various Environmental, Social and Governance Risks (ESG) associated with its extraction.”

The DRC hosts around half of the world’s cobalt, but the African nation has been in the spotlight for some time over ethical issues, such as the use of child labour in mines.

In November, the London Metal Exchange launched an investigation into whether cobalt mined by child labour is trading on the exchange.

The DRC is also plagued by violence caused by both rebel and state-backed groups.

Base metals uptick

Most base metal prices rose by double-digit amounts last year — led by copper, followed by aluminium, zinc and lead.

“These metals prices were supported by solid demand growth, but perhaps even more importantly, curtailed supply,” Mr Bloxham and Mr Smith said.

“The pullback in supply partly reflected an increased focus on environmental policies in China, which saw a cut back in onshore production of a number of materials.”

Chinese aluminium production in November was running around 16 per cent below what it was a year earlier.

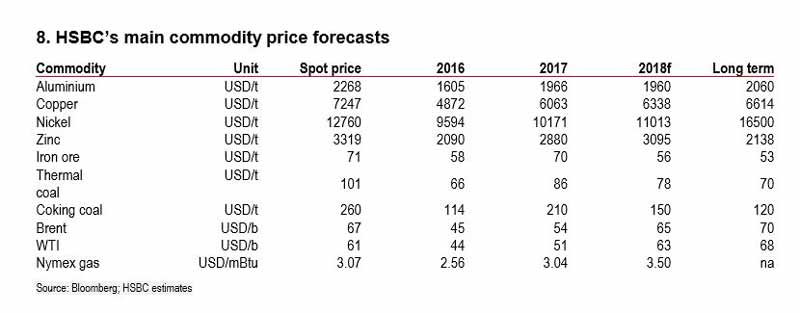

HSBC sees these trends continuing in 2018.

Oil an outperformer

Oil was a key driver of the commodity price index, HSBC noted.

Brent oil started the year off at US$57 ($72.94) a barrel and fell to a low point of US$44 a barrel in June, before rising solidly to close the year out at US$67 a barrel.

The fall in oil prices earlier in the year, largely reflected concerns about oversupply, driven by a ramp-up in US shale production, as well as worries about the resolve of OPEC to stick to its production targets, Mr Bloxham and Mr Smith said.

“As the year progressed, investment in the shale sector lost some momentum, OPEC’s commitment hardened and the lift in global growth supported oil demand.

“As it turned out, a higher oil price was needed to help rebalance the market (much as our oil and gas research team had been expecting).”

The forecast for 2018 is that it will be a year for energy commodities like oil and uranium.

“As you see the global economy continue to emerge like it is currently and economies such as Europe that have been in the doldrums for some time, any recovery is going to be energy hungry,” Tim Weir, executive director of Precision Funds Management told Stockhead recently.

HSBC estimates Brent oil will sit around US$65 per barrel in 2018 before rising to US$70 per barrel over the longer term.

UBS also recently raised its 2018 price forecast for Brent oil to US$60 per barrel from US$55 per barrel previously.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.