Thomson advancing due diligence on NSW silver projects

Thomson Resources is making headway on due diligence for the Webbs and Conrad silver projects. Pic: Getty Images

Special Report: Thomson Resources is advancing due diligence on the potentially company-making Webbs and Conrad silver projects in New South Wales.

A formal site visit has begun and a team from consultancy Global Ore Discovery is well advanced on the technical due diligence and will then move on to identifying potential extensions to silver deposits at the two projects.

Thomson Resources’ (ASX:TMZ) initial focus has been on the Conrad project and it expects to release initial observations over the next two weeks.

It added that a review of ASX announcements by previous owner Pacific Nickel Mines (ASX:PNM) (formerly known as Malachite Resources) indicates that Conrad has potentially robust economics at current commodity prices.

Both projects have a history of high-grade silver production and Silver Mines has stated existing resources under the older JORC 2004 code that need to be redefined under the industry standard JORC 2012 standards.

Conrad silver project

The Conrad Mine was previously the largest silver producer in the New England region, producing about 3.5 million oz of silver along with lead and tin.

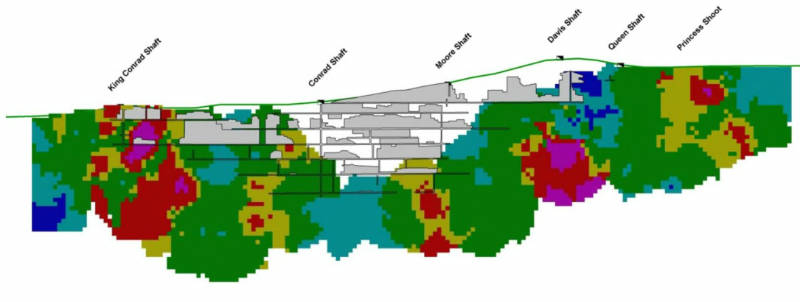

Historical mining targeted the Conrad lode over a strike length of 1.4km. Access was via the Conrad, Moore and Davis shafts, with the deepest development off the Conrad shaft at 267m below surface.

The majority of the old workings are at a shallower depth than this.

Pacific Nickel, which acquired the project in 2002, undertook an extensive exploration program initially aiming to delineate resources within the Conrad lode, King Conrad lode and Greisen Zone that would justify the re-development of a mining and processing operation at Conrad.

In 2010, it stepped out from its main area of focus to the Princess Shoot, where drilling returned a top intersection of 1.6m at 819 grams per tonne (g/t) silver, 0.59 per cent copper, 0.71 per cent tin and 8.35 per cent lead.

This work produced an image of the lode resource that showed that it was open in a number of places at depth.

Thomson added that its own due diligence work to date has not found any evidence to the contrary.

It added that Pacific Nickel was very optimistic about the project and had said then – when silver commanded a price of $30.70 an oz – that its high grade resource could represent a viable project in its own right, while boosting the available tonnage with additional high grade resources from Princess Shoot would only improve the outlook.

The company continues to consider opportunities to expand its silver resources both organically (by exploration) and through acquisition.

This article was developed in collaboration with Thomson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.