This veteran geo has found his Xanadu and is setting it on the path to greatness

Pic: John W Banagan / Stone via Getty Images

Special Report: Xanadu Mines chairman and veteran geologist Colin Moorhead believes the company is back on track and well placed to prove the tier-one credentials of its Kharmagtai copper-gold project in Mongolia following a corporate reset and newly clarified strategy.

Moorhead joined the board of Xanadu (ASX, TSX: XAM) in November last year after returning to Australia from Indonesia where he played a key role in developing the giant Tujuh Bukit copper-gold deposit in executive and non-executive roles with PT Merdeka Copper Gold, now a US$3 billion company.

Prior to that, he was with Australia’s biggest goldminer, Newcrest Mining, for 28 years, including eight of those as executive general manager minerals, a role that gave him responsibility for global exploration, resource development, resources and reserves governance and mine geology across the group.

What piqued his interest in Xanadu were the similarities he recognised between Kharmagtai and some of the world’s largest copper-gold deposits.

“I came back to Melbourne after three years in Jakarta and took up a number of board roles,” he says. “Xanadu appealed to me because Kharmagtai’ s clearly a large porphyry intrusive complex like Rio Tinto’s Oyu Tolgoi or Newcrest’s Cadia.”

But when he joined he says Xanadu’s strategy was unclear and some key stakeholders had different ideas about what the company should be and how Kharmagtai might be developed.

Oxide gold option scrapped

One option being examined closely was starting with a small oxide gold project before moving onto to mining the larger gold-rich copper porphyry, in much the same way as Tujuh Bukit is being developed.

But Moorhead had his doubts about whether this approach was appropriate for Kharmagtai and commissioned CEO Andrew Stewart to conduct a desktop study on a heap leach operation benchmarked against Steppe Gold’s ATO mine, the smallest comparable heap leach project in Mongolia.

The study found that Kharmagtai’ s gold resources were too small, strip ratios would be too high and leach recoveries would be too low for such an operation viable.

“Those findings enabled me to convince all stakeholders that we needed to focus on the discovery and definition of world class copper deposits,” Moorhead says.

“The strategy is now very clear. We’re here to grow the global resource at Kharmagtai.

“I’d like to get it to more than one billion tonnes at 0.5% copper equivalent.

“My belief is that if a higher-grade starter pit or block cave of say a minimum 100Mt or more at >0.8% copper equivalent is included in that volume, it will differentiate the asset from the rest of the field.”

The current global resource at Kharmagtai stands at 600Mt at 0.49% copper equivalent for 2.9Mt copper equivalent in contained metal.

In August, Xanadu completed a $12 million share placement that saw the introduction of several new domestic and international institutions, while existing shareholders Asia Capital and Advisors Pte Ltd and SSI Asset Management AG participated to the point of ensuring their interests weren’t diluted.

Moorhead says all these parties are supportive of the newly defined strategy and the freshly raised capital will allow the company to complete 18-20km of drilling over the next 12 months.

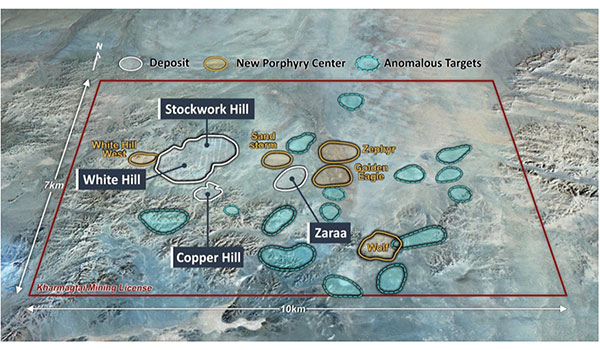

There are currently two rigs in operation at Kharmagtai systematically stepping out from known higher grade zones testing Xanadu’s structural model and two rigs engaged in discovery drilling testing porphyry targets under shallow cover, identified through geophysics and geochemistry.

Although Moorhead has no doubt the company could assemble an A-grade team to develop Kharmagtai, noting the recent recruitment of another former Newcrest executive Spencer Cole as CFO as an example, he says that is not necessarily what will happen.

His main goal is to position the company for a liquidity event; to ensure the project is on the radar of the majors as a growth option that they might seriously consider acquiring.

Mongolia a great place to be

Moorhead doesn’t profess to be an expert on Mongolia, but he did manage to sneak up there with Stewart in January and came back enthused about the country as an operating environment.

Compared to the jungles of Indonesia or the highlands of Papua New Guinea, the flat, sparsely populated South Gobi Desert presents significantly fewer challenges in exploring and developing mining projects and doesn’t lack for infrastructure.

The only real drag, Moorhead concedes, is the perception of an unclear fiscal regime based on Rio Tinto’s experience with Oyu Tolgoi.

Rio is headed for arbitration over a tax dispute with the Mongolian government, which owns 34% of Oyu Tolgoi, while the government has also flagged a desire to review aspects of the seminal legal agreement that underpins Rio’s work in Mongolia.

But Oyu Tolgoi is the single biggest mining project in Mongolia and Moorhead believes it will be possible to avoid the issues Rio Tinto has faced as a lower profile operator.

A strong endorsement of the country came from legendary mining investor Eric Sprott in July when he made a C$15 million strategic investment in Steppe Gold.

While drilling out a tier-one asset at Kharmagtai is Xanadu’s primary focus in Mongolia, the company also has a joint venture with Japan’s JOGMEC at Red Mountain that Moorhead describes as “another cracking porphyry province, less like Cadia, more like Northparkes”, the CMOC-owned copper-gold operation in New South Wales.

Under the farm-in agreement, JOGMEC is sole funding exploration of up to US$7.2 million over four years at Red Mountain to earn a 51% interest in the project.

Xanadu manages the exploration program at Red Mountain and anticipates completing about 2km of drilling on the project this year.

The company’s rejuvenation under the guidance of Moorhead appears well timed, given the price of copper has rallied from March lows to be back above US$3/lb and many observers are forecasting it to continue to outperform on the back of strong Chinese demand and dwindling inventories.

This story was developed in collaboration with Xanadu Mines, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.