This tin junior could go inter-Stellar as it moves toward production

You don’t need to go to outer space to find a deal on ASX tin, with Stellar boasting a potential 193% upside, according to East Coast Research. Pic: Getty Images

- East Coast Research lifts Stellar Resources price target 13.3% to 5.9c, just two months after initiating coverage

- New drill results from high-grade Heemskirk project and deal to access mothballed plant catalysts for potential re-rate

- ECR sees 193% upside, with key pre-feasibility study expected in 2026

Special Report: With a materially derisked pathway to production at its high grade Heemskirk project and a rising tin market, East Coast Research has jacked up its price target of ASX tin stock Stellar Resources just two months after initiating on the junior.

East Coast Research analyst Riddhesh Chandwadkar has lifted the firm’s PT on Stellar Resources (ASX:SRZ) 13.3% from 5.2c to 5.9c on the back of high grade drill hits and a deal to procure a mothballed 900,000tpa processing plant on Tasmania’s west coast.

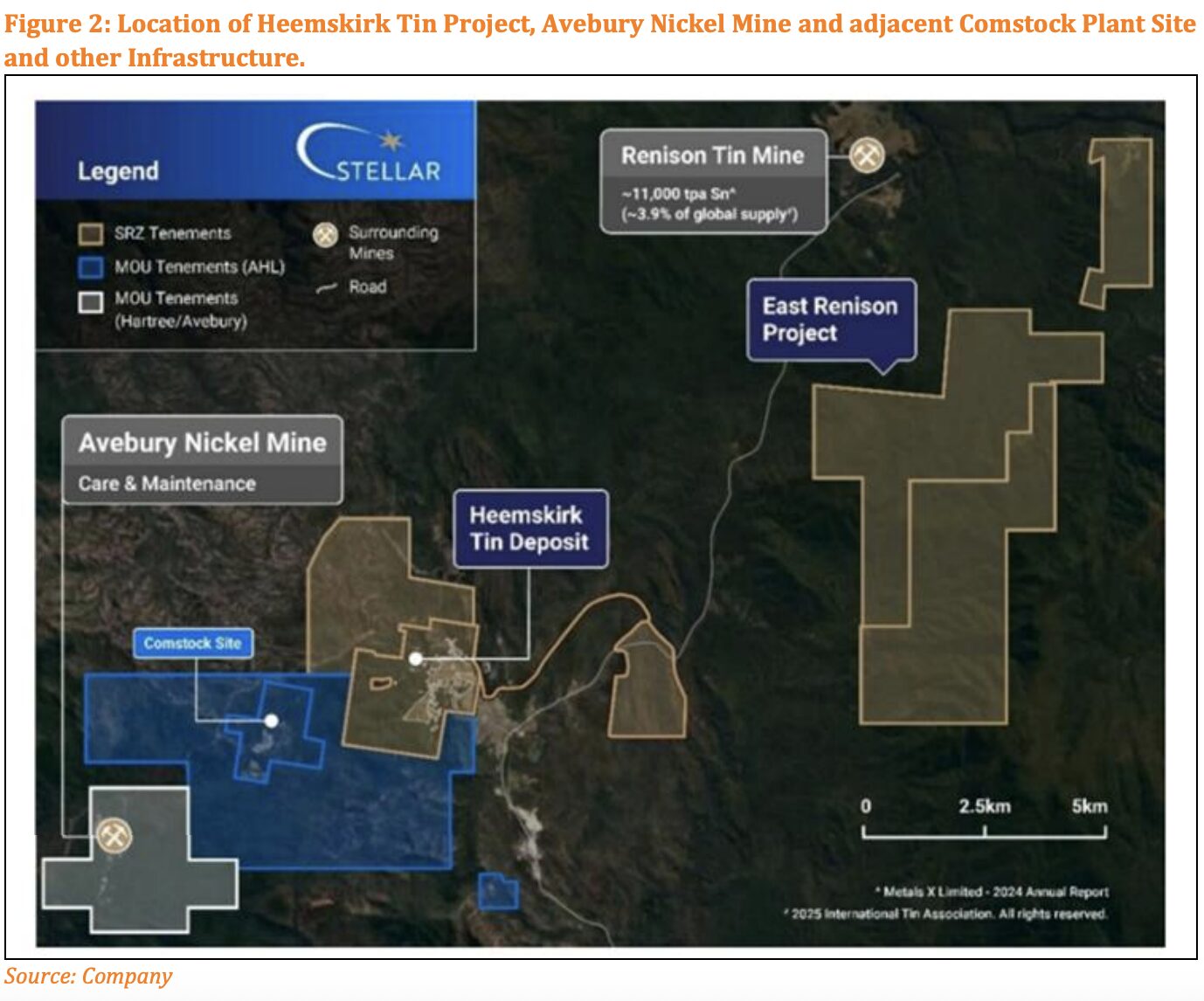

It follows 10,016m of drilling at Heemskirk, which sits just down the road from Metals X’s (ASX:MLX) 11,000tpa Renison Bell tin mine, an operation that supplies close to 4% of global tin metal.

Heemskirk, at a planned run rate of 3000-3500tpa in an updated PFS due next year, would supply a meaningful 1% of the market.

As prices accelerate, even that level of output will unlikely make a dent in demand for the metal, 50% of which is used as solder in electronic circuit boards.

Green demand alone will add 20% of annual supply to the demand picture by 2030, Chandwadkar suggested.

With that in mind, an MoU with Hartree Partners over the conversion of the Avebury nickel plant just 10km from Heemskirk could prove a game changer.

“This re-rating potential is underpinned by SRZ’s delivery of several key milestones, including the completion of over 10,016 metres of drilling at Heemskirk, high-grade depth intersections at Severn that demonstrate clear scope for resource growth and conversion, and the signing of a strategic MOU with Hartree over the Avebury Plant to evaluate access to nearby processing infrastructure,” Chandwadkar said after lifting ECR’s valuation.

“These achievements not only strengthen the outlook for the upcoming updated MRE and PFS in 2025–26, but also significantly de-risk SRZ’s development pathway and enhance its value proposition as a future capital-efficient tin producer in a market defined by rising demand and constrained global supply.”

The upgraded PT places ECR’s valuation of Stellar – the midpoint of a 5c to 6.7c band – close to 200% higher than its current 2c price.

Tin soldier

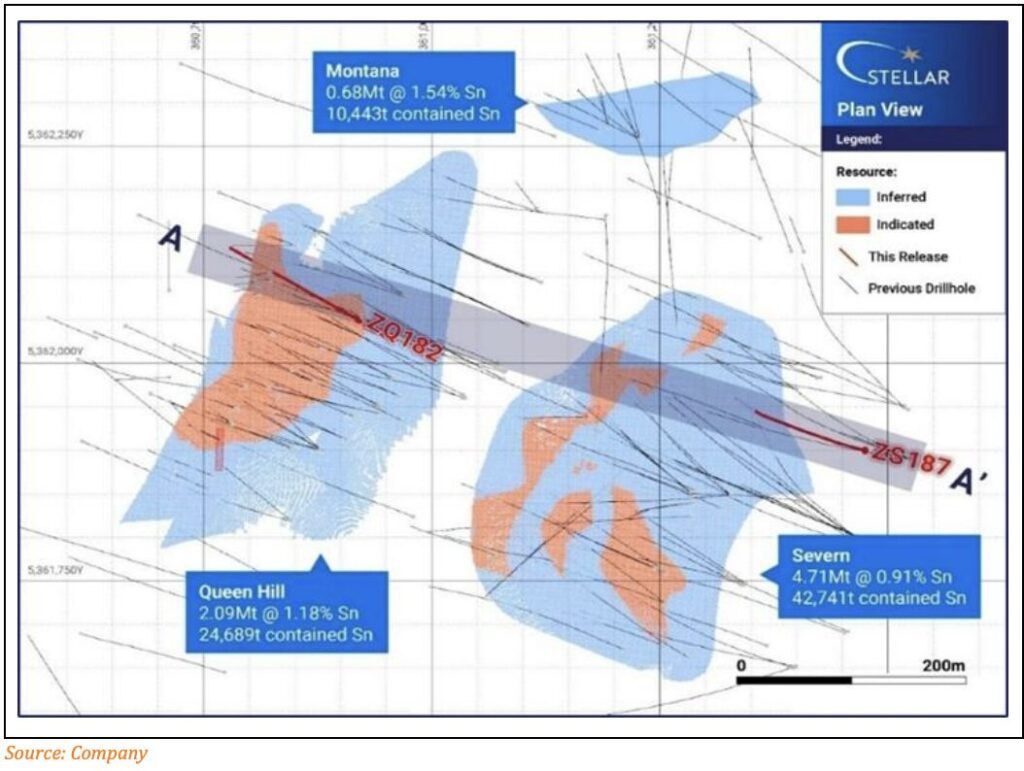

Heemskirk is regarded as the highest grade undeveloped tin project in Australia and third highest in the world with a resource of 7.48Mt at 1.04% Sn for 77,800t of contained tin.

A study in 2024 estimated the mine could produce 22,828t of tin in concentrate over a 12 year mine life at a capex of just $71m, with a base case pre-tax NPV of $122m and IRR of 33% at a tin price of US$28,000/t.

Since then, supply restrictions have sent tin surging to US$35,000/t, close to historic highs. And new mines are not getting any easier to find, with major producers in Indonesia, Myanmar and the DRC all seeing their fair share of disruptions.

A resource update at Heemskirk is due in the second half of 2025 after the +10,000m drill drive, which outlined opportunities to increase confidence and expand the known resource. Twenty-four of 29 drill holes have been completed to date.

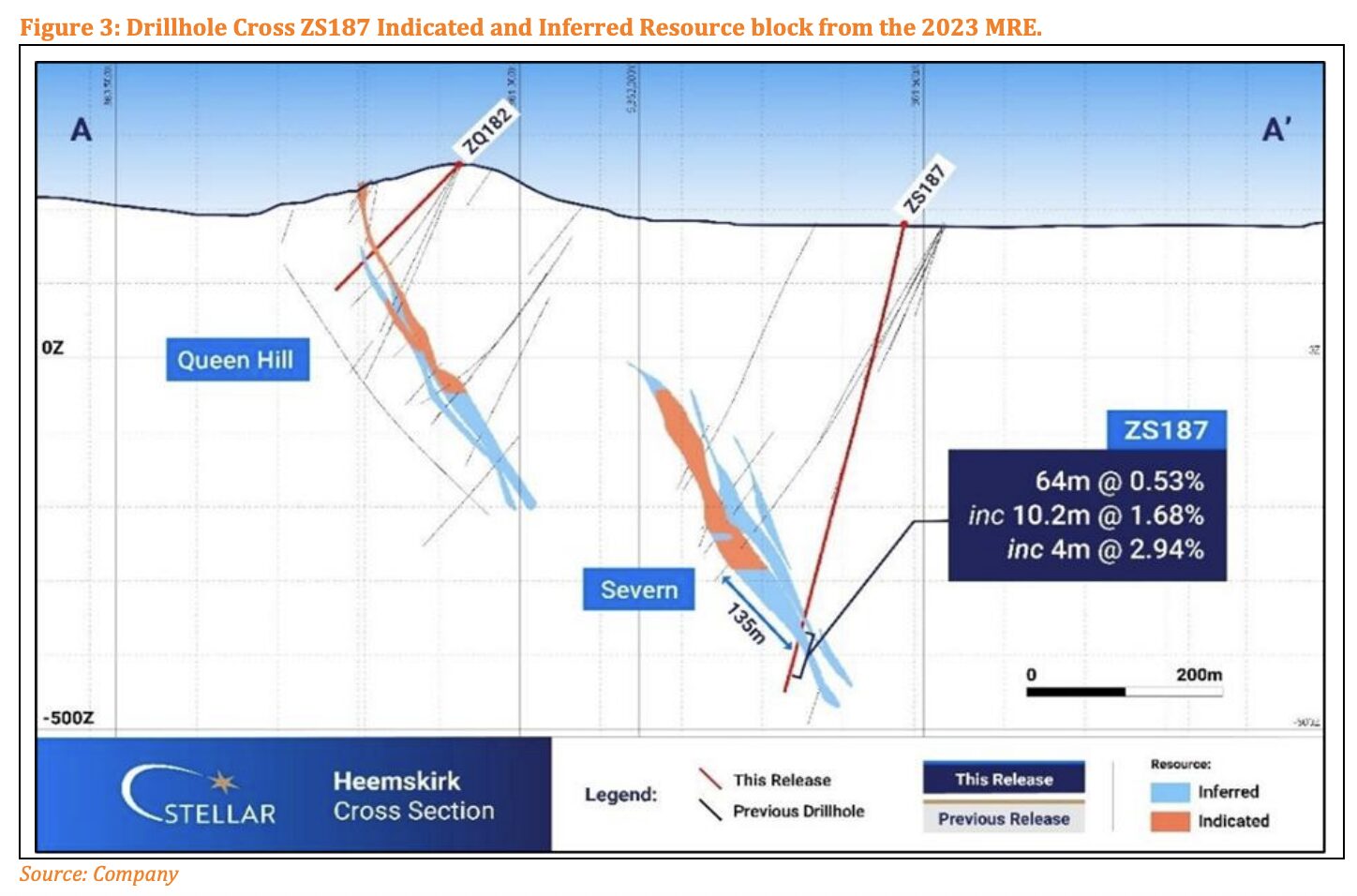

A strike of 64.4m at 0.53% Sn from 560m, with a standout interval of 1.68% Sn, in drill hole ZS187 at the Severn deposit demonstrated the site’s rich continuity at depth and potential for resource conversion, Chandwadkar said.

“The results highlight the dual focus of the program, de-risking the PFS while also building the case for resource expansion ahead of the updated MRE in 2H 2025,” he said.

PFS on the way

With the recent drilling success, the pre-feasibility study was now looking likely for delivery in H1 2026, Chandwadkar said.

“The PFS remains well underway and, given the recent drilling success, is now more likely to be delivered in 1H 2026,” he said.

“This extended timeframe reflects the opportunity to capture additional Resource growth and incorporate new data from the ongoing PFS drilling program.

“Recent results continue to underscore the upside potential at Heemskirk. For example, drillhole ZS187 was completed at Severn to test deeper extensions in an under-explored zone.

“Encouragingly, this hole is advancing towards the style of deeper tin mineralisation intersected in ZS140, located around 200m outside the current MRE, highlighting the scope for future Resource additions.”

There’s additional upside with the higher tin price, with Stellar also looking outwards to successfully apply for an exploration licence immediately next to the world class Renison Bell mine, as well as receiving a State Government grant for exploration at the Carbine Hill target there, which boasts strong rock chip, surface sampling and EM results.

ECR has already run some numbers on key measures of profitability for Heemskirk at the higher tin price to inform its valuation, delivering a post- tax NPV8 of $209m and IRR of 42.5% at a base case tin price of US$34,500/t, rising to $286.6m and 52.7% at a US$36,500/t bull case.

“These figures represent a meaningful step-up from the outcomes published in our initiation report and reaffirm the strong leverage of the Heemskirk Tin Project to rising tin prices,” Chandwadkar said.

“Importantly, they also highlight the valuation gap in SRZ shares, with the Company’s current market capitalisation trading at a substantial discount to intrinsic value.”

Stellar, which counts WA’s Nero Resource Fund as a major 18.1% shareholder, is well funded with an assumed cash balance of over $6 million including the recent exercise of $2.4m in options.

That included $2.26m from Nero, demonstrating the value of a supportive institutional shareholder.

“This balance could be further enhanced by an additional ~$500k from the exercise of in-the-money options due in October,” Chandwadkar said.

This article was developed in collaboration with Stellar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.