This small cap gold play will definitely be on the radar with the gold price bull run

Pic: Tyler Stableford / Stone via Getty Images

Special Report: With the gold price still holding strong, there are only a select few junior explorers that will be looking attractive to the larger players that are cashed up and looking to build their gold inventories.

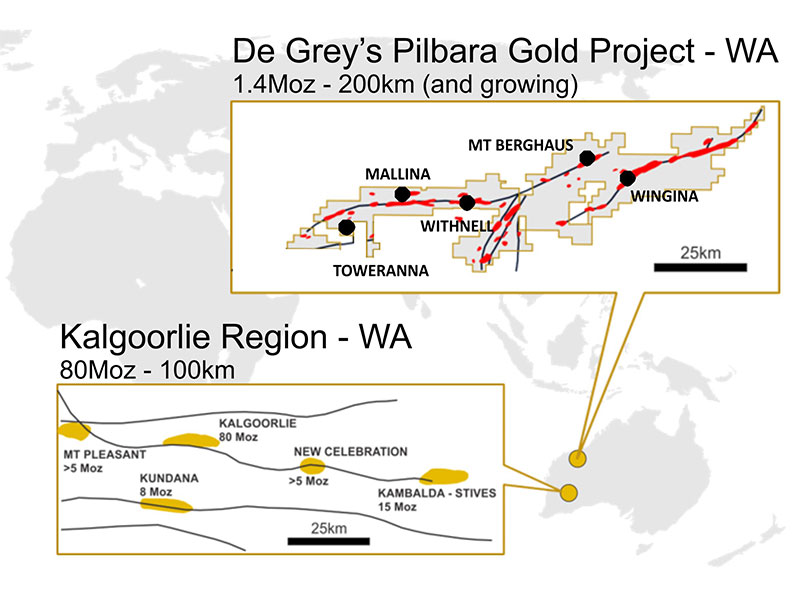

One of the small cap companies that is looking particularly attractive is De Grey Mining (ASX: DEG), which already has a hefty 1.4Moz resource base in Western Australia’s Pilbara and is expecting to deliver another resource upgrade in July 2019.

De Grey is well advanced down the path of building its Pilbara gold project into a multi-million-ounce mine, having previously stated that the primary exploration focus is on resource growth with a goal of exceeding 2Moz by the end of calendar 2019 and moving to 3Moz plus from there.

“Domestic Aussie gold producers are going to be making even more money, and they’re going to have even bigger war chests,” Gavin Wendt, senior resources analyst and founding director of MineLife, told Stockhead recently when the Aussie dollar gold price cracked $2000/oz.

“It’s going to put those companies that are in the mid-cap space in an even stronger position to look at doing corporate deals, and we’ll probably see the rate of corporate deals increase once again, I would imagine, because these companies are going to be even more cashed up.”

“Egan Street, Bardoc, Capricorn and Bellevue — companies that aren’t in production yet — are four companies that I think would definitely be on the radar screens,” Wendt said.

“And then you look at something like De Grey, you’ve certainly got candidates there that have a lot of gold in inventory.”

>> Learn more about De Grey Mining

Toweranna – Is it just the tip of the iceberg

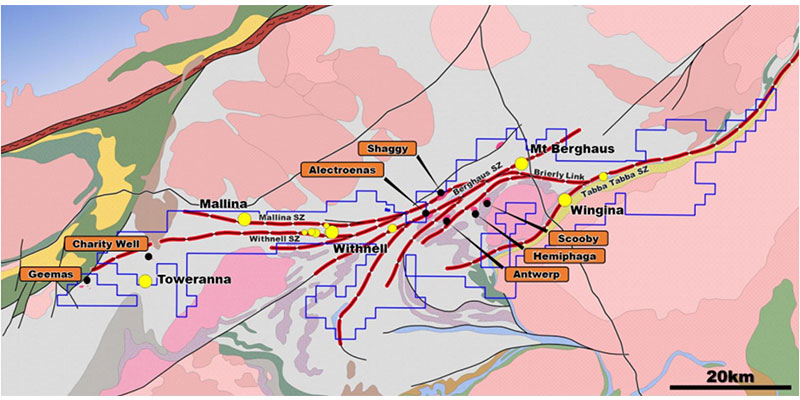

De Grey is clearly focusing on establishing further gold resources from the extensive shear zone and intrusion related gold bedrock targets across its project.

The company continues to report thick, high grade gold hits, more recently at its Toweranna deposit, which looks to be just the tip of the iceberg.

The Toweranna deposit is the first intrusion-hosted gold deposit recognised in the Pilbara Craton and confirmation of its high-grade, free milling characteristics and high gold recoveries has given it greater significance.

The resource at Toweranna stands at just over 2Mt at 2.2 grams per tonne (g/t) for 143,900 contained oz, with the recent drilling result to be incorporated into the resource update scheduled for later this month.

Further Exploration Potential – Seven “Toweranna Look-alike” targets identified”

Earlier this week, De Grey stated that it had very recently identified seven new targets on its ground that are geologically similar to Toweranna, but “significantly larger” – ranging in size from 0.5km to 2km.

This was after undertaking a comprehensive exploration review which has provided a leap in the geological, structural and geochemical understanding of the regional targets both within and outside of the known resource areas.

De Grey said it had identified the targets from “encouraging” historic results that showed widths of up to 16m and grades of up to 14.28g/t.

Drilling at Toweranna previously revealed a new style of mineralisation similar to several major gold mines around the world.

One of those big mines is Gold Fields’ 8Moz Wallaby deposit in the WA goldfields, which produces over 250,000 ounces each year.

Another is Dacian Gold’s (ASX:DCN) nearby 1.6Moz Jupiter deposit, both in Western Australia.

This style of mineralisation also underpins the Lamaque and Sigma gold deposits in Quebec, Canada, which have each produced over 4.5 million ounces.

The recent drilling success at Toweranna, where stacked lodes occur within an intrusive host and the mineralisation shows high gold recoveries and free milling characteristics, has provided a sharp focus and impetus to discover similar style mineralisation elsewhere in project area.

Until recently this style of mineralisation was poorly understood and not previously noted anywhere else in the Pilbara region.

This is an important recognition as this style of mineralisation in other Archaean goldfields of the world, including Kalgoorlie, has been associated with large scale multi-million ounce deposits.

New Potential Resource Extension targets

De Grey has also uncovered “numerous new potential resource extension targets” at its Withnell, Mallina and Mt Berghaus prospects.

The Withnell Trend currently hosts defined resources of 9.05Mt at 1.8g/t for 517,300 contained gold oz.

At Mt Berghaus and Mallina the new targets were identified immediately along strike from known gold lodes and elsewhere within the trends, which are 6km and 5km in length respectively.

Could this be the start of renewed interest in Pilbara gold – Novo Lag Gravels Agreement?

Earlier this week, De Grey also revealed it had struck a binding deal with Canadian Pilbara gold pioneer Novo Resources (TSX-V:NVO) that will give De Grey yet another avenue for the potential discovery of more gold resources.

Novo is paying at least $1m to explore De Grey’s Pilbara project for gold-bearing lag gravel “surface” deposits, but all up the deal could be worth four times that and possibly more.

“The agreement adds value to De Grey shareholders through an active exploration program on the lag gravel potential managed by specialist explorer Novo,” De Grey technical director Andy Beckwith told investors.

“De Grey will maintain its committed focus on growing and developing our bedrock gold resources.”

Novo has the right to explore De Grey’s project for gold-bearing lag gravel deposits for an initial three-year period by paying $1m.

The Canadian company also has the option of extending its exploration rights for an additional two years by stumping up a further $1m.

After that, the company can continue to extend its exploration rights in two-year increments for a further $1m per extension.

If a mining lease is granted over a proposed lag gravel mining area on De Grey’s tenements, the pair will form a joint venture and Novo will own an 80 per cent stake for a one-off payment of $2m.

Importantly though, the deal excludes the Indee Gold mining tenements being acquired by De Grey; existing resources including a 300m buffer around each deposit – and any future mining lease related to the existing resource areas; in situ “hardrock” conglomerate gold targets; and an existing third party gravel right.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

This story was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.