This small ASX stock is jostling with majors for a slice of America’s emerging ‘lithium capital’

The company has a 35% stake in Daytona Lithium in Arkansas’ Smackover Formation. Pic: via Getty Images.

- Arkansas Governor says State could become ‘the lithium capital of America’ – “our state could produce 15% of the entire world’s lithium supply”

- The Smackover Formation is a premium location for oil and gas, but is now becoming a tier 1 lithium address

- Majors including Exxon have swooped on the region

- Rubbing shoulders with these big boys is $6m capped minnow Pantera which secured a slice of the Smackover via its 35% stake in Daytona Lithium

The US state of Arkansas is “moving at breakneck speed to become the lithium capital of America,” Governor Sarah Huckabee Sanders said in a speech late last week to the US Energy Council.

“South Arkansas is home to one of North America’s largest brine processing industries, and new technology allows us to siphon lithium from that brine,” she said.

“I’m not being dramatic when I say this has the potential to transform the region and our entire state.

“Companies are already making massive investments to South Arkansas, and once they fully scale up operations, they estimate that our state could produce 15% of the entire world’s lithium supply.”

Where is this lithium coming from? The Smackover Formation, a geologic trend centred around Arkansas.

A premium location for oil and gas, it is now becoming a tier 1 lithium address chock full of large cap stocks looking for a slice of the pie.

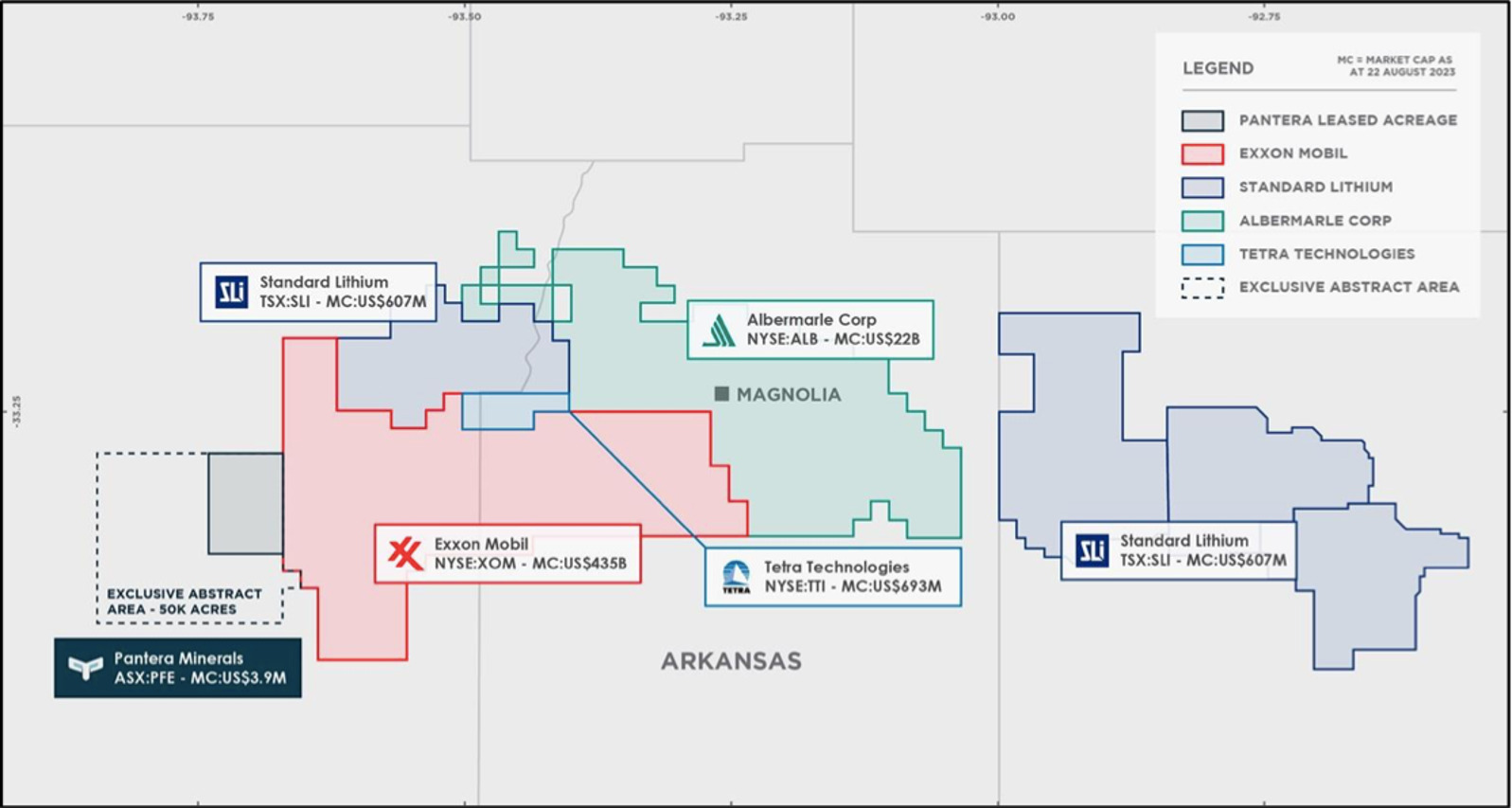

$US470bn capped O&G major Exxon (NYSE:XOM) signalled its intention to move into lithium brines with the recent acquisition of Galvanic Energy’s 4Mt Smackover brine acreage for ~US$100 million.

It has plans to build a 75,000-100,000Mt LCE production plant, which would equate to ~15% of the world’s current lithium refinement capability.

It subsequently inked a deal with neighbouring $US830m capped chemical producer Tetra Technologies (NYSE:TTI) to develop 6,138 acres of salty brine deposits.

Tetra had previously agreed to lease more than 27,000 acres in Arkansas to US$670m capped Standard Lithium (TSX:SLI), which has now signed a JV with a Koch Industries subsidiary to expand on its industrial-scale lithium extraction demonstration plant and 3.1Mt Lanxess project.

Meanwhile, US$20bn capped Albemarle (NYSE:ALB) is building a facility in Arkansas to test its direct lithium extraction (DLE) technology, which it hopes will filter lithium from existing bromine operations.

Rubbing shoulders with these big boys is $6m capped minnow Pantera Minerals (ASX:PFE), which secured a slice of the Smackover via its 35% stake in Daytona Lithium and its flagship Superbird project.

Superbird directly abuts Exxon’s Smackover lithium project, Standard’s Lanxess and South West Arkansas projects, and Albemarle’s lithium-bromine brine project.

Despite the incredibly competitive leasing environment, Daytona has managed to increase its land position to 8,416 acres in under four weeks, with a further 7,000 acres under negotiation.

Ideal for direction lithium extraction

The comments from Governor Huckabee Sanders come as the focus on commercialising several DLE projects across North America has intensified.

Instead of relying on traditional hard rock mining, many US lithium players are turning to the production of this essential raw material from brine sources found in subterranean salt brine formations, using oil and gas extraction methods.

Direct extraction technology is nothing new – it’s been used in water treatment for decades – but its use to extract lithium from brines is just now coming into its own.

DLE tech promises to produce cheaper, higher quality, and more environmentally friendly lithium than incumbent processes and could be used literally anywhere there’s an oil & gas wells – and there’s a lot of those in America.

No wonder that big names in O&G like ExxonMobil are getting in on the action, with independent testing by Galvanic last year already confirming the Smackover oilfield brine is compatible with DLE technology.

Even Goldman Sachs is waxing lyrical about the potential of DLE, saying the tech has the potential to significantly increase the supply of lithium from brine projects (much like shale did for oil), nearly doubling lithium production on higher recoveries and improving project returns, “though with the added bonus of offering ESG/sustainability benefits, while also widening rather than steepening the lithium cost curve.”

Pantera and Daytona are confident of the Superbird project’s DLE potential, with discussions with DLE technology providers planned to kick off in the near-term.

8,416 acres and growing

Since Pantera secured the 35% stake in August, Daytona has acquired a further 3,091 acres of ground, taking the Superbird project up to 8,416 acres – with negotiations underway to acquire a further 7,000 acres of land.

Daytona’s leasing strategy is supported by a 50,000 acres exclusive 6-month agreement for the provision of land abstract services, an essential process in identifying owners of the lithium brine rights, which can be severed from surface rights in the US.

This provides a key advantage in that Daytona will be able to acquire the required accurate mineral ownership information from the project area quicker than its competitors.

Along with expanding their landholding in the new lithium hot spot, Pantera and Daytona are working to ascertain the possibility of generating a lithium exploration target from the advanced geological and petrophysical data that is available from historical oil and gas exploration and production conducted on Superbird.

Scoping is also underway for initial well location to test brine flow rates and lithium grade on leased acreage position.

This article was developed in collaboration with Pantera Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.