This is why Terry Streeter joined the board of explorer Corazon Mining

Pic: Tyler Stableford / Stone via Getty Images

Special Report: WA mining stalwart Terry Streeter has already helped develop two junior nickel explorers into mid-tier success stories. Could Corazon Mining be his third?

Streeter built his name on the success of nickel-focused companies Jubilee Mines and Western Areas.

Jubilee Mines, worth about $20m when it discovered the Cosmos nickel deposit in WA, was eventually sold for over $3bn.

Similarly, Western Areas (ASX:WSA), which floated with a market cap of $5m in 2000, is now an established WA nickel producer with a market cap of ~$680m.

Streeter is currently on the board of junior explorers Moho Resources (ASX:MOH) , Corazon Mining (ASX:CZR), EMU NL (ASX:EMU), and unlisted companies Fox Resources and Riverbank.

Why these companies? It’s all about the “management team, the project and the commodity”, he tells Stockhead.

“If you are in the right company, with the right management, going in the right direction – you will make something happen.”

Corazon Mining: an overlooked gem

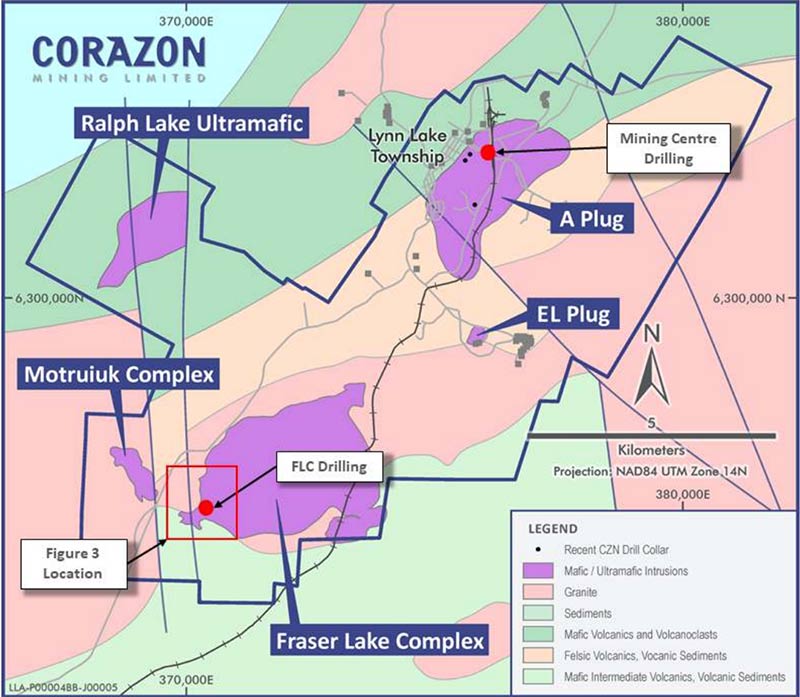

Last year, Streeter was appointed chairman at Corazon, a junior explorer which managed to consolidate the entire historic Lynn Lake nickel-copper-cobalt mining centre in Canada.

It is the first time this project has been under the control of one company since the mine — which produced about 206,200 tonnes of nickel and 107,600t copper over 24 years — closed in 1976.

Corazon believes there’s a lot more metal to be found here.

Streeter knows this project well from his time at Western Areas, which formerly held a portion of Lynn Lake.

“Western Areas did some exploration and got some decent results — nearly 2 per cent nickel in a couple of drill holes,” Streeter says.

“But we couldn’t get our hands on the entire thing; a Canadian company controlled most of the ground.

“Corazon is a different story. It has consolidated the entire area because it believes — as Western Areas believed — that Lynn Lake has a lot of potential.”

This project is analogous to Western Area’s high-grade Forrestania nickel camp in WA, Streeter says.

In 2002, then junior explorer Western Areas bought into Forrestania, a previously mined project which came with a 55,000t nickel resource across three deposits.

There was tremendous exploration potential for nickel deposits outside the known resources, Western Areas said at the time.

They were right.

The company soon discovered extensive high-grade nickel mineralisation below the mothballed Flying Fox underground operation, which was subsequently redeveloped by Western Areas in 2006.

The Flying Fox and neighbouring Spotted Quoll mines are now regarded as two of the world’s highest-grade nickel producers.

“Like Forrestania, Lynn Lake has been mined before — but the potential for more success is right there,” Streeter says.

“At these projects, once you are in a system where the nickel sulphides are prevalent, there’s usually more to be found.

“It just a matter of using modern exploration techniques to uncover them.”

FLC: A compelling new target

Current drilling at Lynn Lake by Corazon is focused on the Fraser Lake Complex (FLC), 5km south of the historic Lynn Lake mining centre.

This compelling new target is twice as large as ‘A Plug’, one of the two historic mining areas at Lynn Lake.

A new geophysical target at FLC — covering an area of at least 350m by 200m, about 450m below surface — has been identified by a number of different geophysical methods.

It is ‘pregnant’ with nickel-copper sulphides, the company says.

Corazon is currently drilling a hole into the large anomaly as we speak.

“We are exploring some very exciting targets — targets that could demonstrate the project’s potential as a profitable nickel sulphide operation,” Streeter says.

A Nickel Boom is coming

This virus has crippled not only the health system, but also the financial systems, of most countries, Streeter says. And yet the outlook for nickel is very positive.

A coordinated infrastructure spending boom to restart the global economy could have a very tangible impact on demand for commodities like nickel, copper, iron ore, and battery metals.

“You will find that after this there will be a massive boom. Massive,” Streeter says.

“A huge amount of government money will be pumped into infrastructure spending.”

We live in some interesting times, Streeter says, but people should look to the future rather than focusing on the negative commentary that comes from the media.

“There’s a massive opportunity out there in the resources sector, a massive opportunity for people to get involved,” he says.

“I have never seen the market so low, with companies that have truly wonderful assets trading at just cents.

“I’ve never seen anything like it.”

This story was developed in collaboration with Corazon Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.