This is how $3m market cap minnow Ramelius became an $850m gold miner

Pic: Tyler Stableford / Stone via Getty Images

From the many hundreds of listed small cap explorers, barely a handful will become long-term success stories.

But pick the right one as an investor and gains can be monumental.

Like mid-tier gold miner Northern Star (ASX:NST), which has grown from a $5m market cap wannabe to $9 billion mid-tier gold miner. That’s a gain of almost 40,800 per cent.

Or Gold Road Resources (ASX:GOR), which successfully evolved from struggling minnow to $1.18 billion miner.

READ: How this small cap explorer became a +$1.2 billion success story

Then there’s Ramelius Resources (ASX:RMS), an $850m market cap, +200,000oz per annum gold miner with mid-tier ambitions.

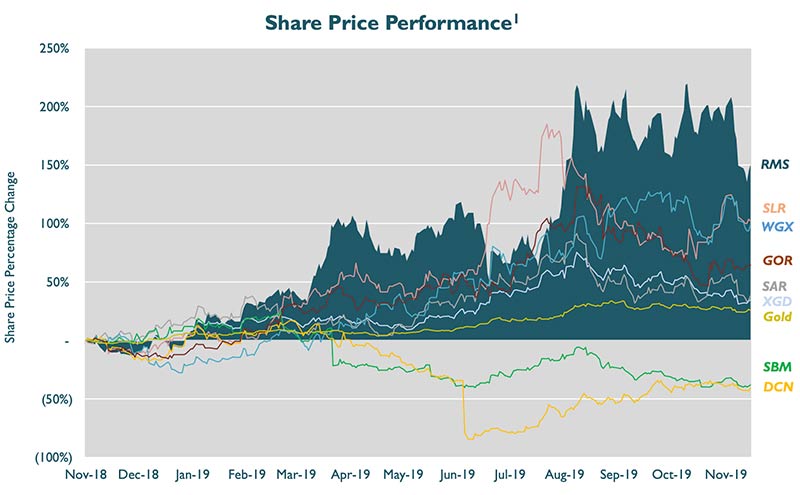

Between November 2018 and November 2019 Ramelius’ market cap grew by more than 151 per cent, clearly outperforming its peer group:

But back in 2003, Ramelius was just another newly listed nickel-gold explorer with a $3m market cap. How did this company succeed where so many have failed?

It all starts with Wattle Dam

Wattle Dam was a 13,500oz ‘starter pit’ which mysteriously evolved into a +275,000oz company maker.

Ramelius began mining this tiny, very high-grade deposit near Kambalda in 2006, three years after listing. The small cap expected to mine the deposit for five months, process the gold at a third party mill, and make a tidy $10m in revenue.

But early mining exceeded expectations, and later that year Ramelius had made enough money to buy its own mill called Burbanks for $2.8m. An excellent move.

In 2008, Ramelius discovered a high-grade zone beneath the Wattle Dam open pit with intersections including 16m at 482 grams per tonne (g/t) gold, 123m from surface. Plans were made to take the mine underground in 2009.

By this point the open pit had already exceeded expectations, producing 34,500oz compared to the original mine plan of 13,500oz.

When it finally closed in 2013, the mine had produced +275,000oz at an average grade of ~12.5g/t.

But why was the Wattle Dam deposit such a mystery? Ramelius chief exec Mark Zeptner says it was a spotty, nuggety orebody that was really hard to read.

“Our resource modeller — who is still here — could never really build an accurate model because it was so variable,” he told Stockhead.

“You could drill 10 holes; eight would be dusters, the other two absolutely spectacular.

“So he said that if we mined the geology – mine the sheared part of the orebody instead of trying to follow the high-grade hits – then we would get the gold.

“After that, it was like ‘this orebody continues. Let’s start the underground and see how it goes’.”

Ramelius basically built an underground portal and decline based on very little information. A geological leap of faith.

“The market was really struggling with it,” Zeptner says.

“We would release some spectacular grades, or had a quarter where we produced 25,000oz and made $20m.

“But then people would ask ‘how long will this mine go for?’ and the company would say – ‘we’re just going to drill the next level. We aren’t sure’.”

But Wattle Dam and Burbanks went on to cornerstone the company’s success, allowing the small but cashed-up miner to then make some savvy, growth-focused acquisitions.

“It was great company starter,” Zeptner says.

“In 2009-2010, when the company was looking to build this company beyond that single asset, they already had $100m in the bank.

“That’s from a ~$3m IPO just seven years earlier.”

In July 2010, Ramelius’ strong financial position enabled it to buy the mothballed Mt Magnet gold project for about $40m.

Mining started in late 2011 and commissioning of the mill started in 2012.

Zeptner joined Ramelius as chief operating officer in March 2012 and became managing director in 2014.

This was a particularly tough period for the company, driven by a weak gold price, as well as some initial mining and mill refurbishment issues at Mt Magnet. The company’s market cap plummeted back to $23m in late 2014.

“Our cash fell to about $15m in the middle of 2014, so it got pretty close,” Zeptner says.

“But we didn’t have any debt. That probably saved our bacon.”

Joining the 300,000oz club

Things came good in 2015, and in 2017, Ramelius bought the Edna May gold mine from Evolution Mining (ASX:EVN) for about $90m.

This strengthened existing operations at Mt Magnet and Vivien and catapulted Ramelius into the +200,000oz per annum production club.

In 2019, Ramelius shelled out another $64m for explorer Explaurum and its Tampia gold development, and $13m for the Marda Marda asset — both in close proximity to Edna May.

“[Over the last few years] we’ve tried to be a little more aggressive, which manifested itself in the Explaurum takeover where in the end we had to go hostile,” Zeptner says.

“We’ve also put a debt facility in place for $35m. It’s not a huge amount, but without being super aggressive we’ve ratcheted up our willingness to use debt at the right time.”

But this growth story isn’t over. Now the goal is to reach the magic 300,000oz-per-annum mark, Zeptner says.

“That’s a path we haven’t completed yet. We are at ~215,000oz this year, looking to go to 250,00oz next year,” he says.

“If we, as a 300,000oz per annum producer with a five-year life, even get a fraction of the valuations those bigger guys have — Northern Star, Saracen, Regis, St Barbara and Evolution — then you are looking at a significant increase in market cap.”

Small caps in 2020 ‘don’t have it any easier’

So – is it easier or harder for small caps to make a go of it in 2020, like Ramelius did back in 2006?

Zeptner gets the feeling that getting that “start” is probably not as easy as the gold price currently suggests.

“There’s been a couple of ‘hiccups’ in the industry involving single asset companies, which means banks and investors are probably a little wary,” he says.

“A good asset will always find money at any gold price, but I think if you have a ‘run of the mill’ asset it’s going to be hard for you.

“Right now, Ramelius can get money, debt and equity for the right asset and the right deal.

“But on the smaller end of the scale – that goodwill in the gold industry probably hasn’t flowed down yet.”

NOW LISTEN: Ramelius — Prepping for a gold price shift

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.