This dynamic duo hopes to find the next Cadia gold mine

Mining

Mining

The two names behind one of the first resources IPOs for the new decade have a pretty impressive run sheet.

The pair, who have more than two decades of experience, have listed six companies as well as seen four mines built and one currently in construction.

Jonathan Downes and Adrian Byass are now taking their new gold explorer, Kaiser Reef, to the ASX via a $4.5m IPO.

READ: IPO Watch: Moly Mines duo pair up again for new gold IPO

This dynamic duo originally founded Siberia Mining Corp and Hibernia Gold in the early 2000s, the latter evolving into Moly Mines – a molybdenum and iron ore miner.

“With regards to Moly Mines, the molybdenum price ran hard initially, and the stock went from 20c to $7 per share very quickly,” Downes told Stockhead.

“This is an outstanding return for shareholders who sold some shares (35x).

“The molybdenum price did then retrace but we subsequently put an iron ore mine into production and booked an ~$80m profit in its first year of operation and the mine was then sold to MinRes.”

The centrepiece of the original Hibernia IPO was the Dargues Reef gold mine, which is now also in production.

The Dargues Reef ore body, which was originally discovered in the early 1870s by James Dargue, historically produced a minimum of 2,000 tonnes at 14 grams per tonne (g/t) of gold.

At the current +$2,200/oz gold price, anything above 2g/t can be profitable.

The mine is now owned by private Sydney-based Diversified Minerals, which is aiming to produce 50,000 ounces each year in the first six years of full production.

Downes was also founding director of Ironbark Zinc (ASX:IBG) and is currently a non-executive director of Galena Mining (ASX:G1A), Kingwest Resources (ASX:KWR) and Corazon Mining (ASX:CZN).

Meanwhile, Byass is currently a director of Infinity Lithium (ASX:INF), Galena Mining, Kingwest Resources and Fertoz (ASX:FTZ).

Downes’ and Byass’ most recent float was Galena, which first lit up the boards in early September 2017.

Byass is chairman and Downes is a non-executive director, with the company having recently bought in another well-known mining name, Alex Molyneux, to lead Galena through to production.

Molyneux helped bring back what was once one of the world’s largest uranium miners from the brink of bankruptcy, Paladin Energy (ASX:PDN).

He successfully completed a $US700m ($1.02m) recapitalisation of the company and a re-listing on the ASX.

With two decades of experience under his belt, Molyneux has served on a number of public company boards, including Argosy Minerals (ASX:AGY), Tempus Resources (ASX:TMR) and Canada-listed players Ivanhoe Mines Group, Ivanhoe Energy, Metalla Royalty & Streaming and Azarga Metals Corp.

Under Molyneux’s leadership, Galena is now building its Abra base metals mine in Western Australia, which is expected to produce 95,000 tonnes of lead and 805,000oz of silver each year at full production for 16 years.

“The company is now run by possibly the best management I’ve ever come across in Alex Molyneux and his appointments,” Downes said.

But exploration and mining expertise is just one part of the successful equation, according to Downes.

Having a tight share register and skin in the game can also give a mining hopeful an edge over the competition.

“As with all our listings, I should add that Galena was not only benefiting from a tight capital structure, but Adrian and I supported the listing in its first week of trading by buying almost $200,000 worth of stock on market each,” Downes said.

Downes and Byass didn’t get all the shares they subscribed for in the IPO, so they both topped up later on market.

The plan with Kaiser Reef is also to keep its share register tight.

“I believe Kaiser Reef will probably be the tightest for 2020 and would have been for 2019,” Downes noted.

“For every ounce of discovery, if you make it twice as tight as your neighbour it’s going to give twice as much upside to your shareholders.”

Both Downes and Byass plan to sink some cash into the new IPO, but Downes wouldn’t say exactly how much because it’s only just launched.

“We always keep our powder dry to make sure that there’s a good solid aftermarket for the IPO,” Downes explained.

“It’s amazing how many people just invest stag.

“We really believe in our companies and what we are doing. We’ve never had one go backwards and we want to make sure [Kaiser Reef] doesn’t as well.”

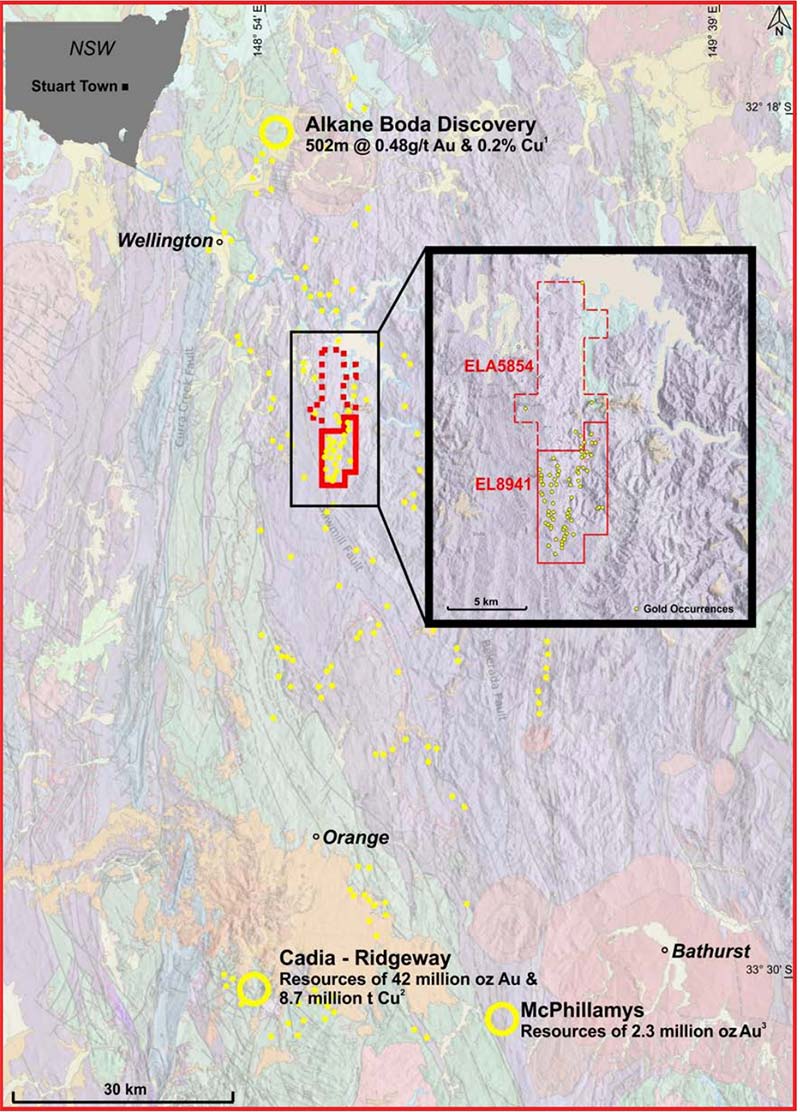

Sure, one of the world’s biggest gold miners Newcrest Mining (ASX:NCM) has been operating one of Australia’s largest gold mines since the late 90s in New South Wales’ Lachlan Fold Belt, but it has taken much smaller Alkane Resources (ASX:ALK) to really propel the region into the spotlight.

In FY19, Cadia produced nearly 913,000oz of gold and 91,000 tonnes of copper at an insanely low all-in sustaining cost of just $132/oz.

“Against a gold price of $2,200 Aussie an ounce it’s making a couple of billion dollars free cash flow,” Downes said. “I actually can’t think of anything that’s got a higher margin.”

And then, in September last year, Alkane discovered something potentially very big at its Northern Molong porphyry project.

The company hit 502m at 0.48g/t gold and 0.2 per cent copper, 211m from surface, at its Boda prospect.

And it just so happened that unlisted Chase Metals had a very nice patch of ground between Newcrest’s Cadia mining operation and Alkane’s recent significant porphyry gold-copper drill intercept.

Enter Downes and Byass with newly formed Kaiser Reef.

“That’s an asset we’ve had an interest in for a very long time and the market has just never been really ready or interested in the Lachlan Fold Belt for quite some time,” Downes told Stockhead.

“It really took Alkane to make that stellar discovery and I think mix that at the same time with the success of the Cadia gold mine.”

Now Downes and Byass are hoping to be the ones to find the next Cadia.

And interestingly, Kaiser Reef’s new ground has “probably the densest amount of gold workings of anywhere in New South Wales”, while Cadia sits in number two spot, according to Downes.

“I think it’s such a blindingly obvious target to test and it’s over such a big area with such a large soil anomaly associated with it that CRA generated, and no one’s ever tested it for a big intrusive gold play, which I just find is staggering,” he said.

Kaiser Reef has already pinpointed some “really big targets” at its Stuart Town gold project that were generated in the late 90s.

It also has a collection of soil and preliminary work that was undertaken by CRA previously.

This gives Kaiser Reef a good starting point to prepare for first drilling.

“We’ve been working with other geophysical contractors to hone those targets and we’ve started access agreements to do the drilling,” Downes said.

“What we hope to do is be drilling some of these very big targets very soon after listing.”

Kaiser Reef is hoping to light up the ASX boards on February 27.