This company believes high-grade copper-gold in Colombia is a recipe for success

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Advanced, high-grade copper-gold projects located in attractive jurisdictions and geological settings don’t grow on trees.

But that’s exactly what Andean Mining has brought to the table in the form of its El Dovio copper-gold (with silver and zinc) project in Colombia as it seeks to raise up to $7m through its initial public offering that is due to close on 9 December.

An ASX listing under the code ADM is expected just before Christmas.

El Dovio is a volcanogenic massive sulphide system with high-grade lenses contained within a well-developed and mineralised (albeit to a lesser extent) stockwork system that is up to 68m wide, both of which are exposed at surface.

There is a significant amount of surface sampling and mapping, geophysics, diamond drilling and extensive underground development that have combined to give Andean a very good idea of what is present at the project.

Additionally, the shallow nature of the mineralisation means that it is relatively low cost to quickly drill out a maiden JORC resource while ensuring that any mining operation would be relatively inexpensive.

Speaking to Stockhead, managing director Willian Howe said the company had acquired the project from Newrange Gold Corporation, which had been selling off its Colombian assets to focus on North America..

“The main attraction was the amount of work that had been done before that all pointed to a very high-grade VMS system with copper, gold, silver and zinc,” he commented.

“The grade and advancement were big drivers for us and there’s plenty of upside in relation to a number of other targets that are drill ready.

“We were in the right place at the right time.”

Why Colombia?

Colombia’s growing attraction as a mining destination also played a major part in the company’s decision to acquire El Dovio.

Howe noted that the South American country had a stable, conservative government for the last 25 years and had seen its gross domestic product increase ten-fold during that time from US$1,400 per capita to +US$14,000 per capita.

“Just that alone has generated a tremendous amount of stability because it has taken an enormous number of people out of poverty,” he added.

This is supported by the Fraser Institute, which in 2020 ranked Colombia as its top mining destination in South America, and an incredible fifth in the world on a country-by-country basis.

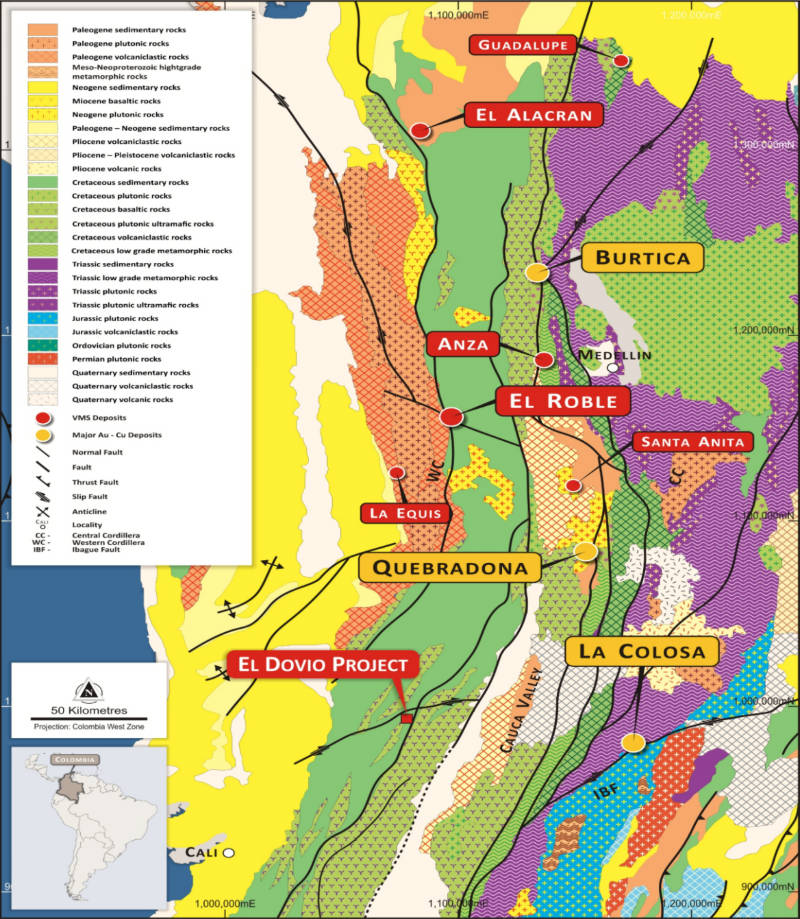

Colombia is also geologically very attractive.

While mining investment has historically gone to Chile and Peru due to their incredible mining endowment, Howe noted that Colombia is equally resource rich.

“It’s one of the greatest metallogenic belts of the world and there is no reason why there shouldn’t be major discoveries in Colombia,” he says.

El Dovio Project

El Dovio is located close to other significant mining projects such as AngloGold Ashanti’s 28 million oz gold equivalent (AuEq) Quebradona project and Zijin Mining’s 12Moz Buritica gold mine.

The VMS potential of the region can also be seen with other nearby projects such as the producing El Roble mine, which has mined ore plus reserves totalling 3.89Mt grading 2.77% copper and 2.44 grams per tonne (g/t) gold, and El Alacran (4.8Mt at 1.4% copper and 0.83g/t gold).

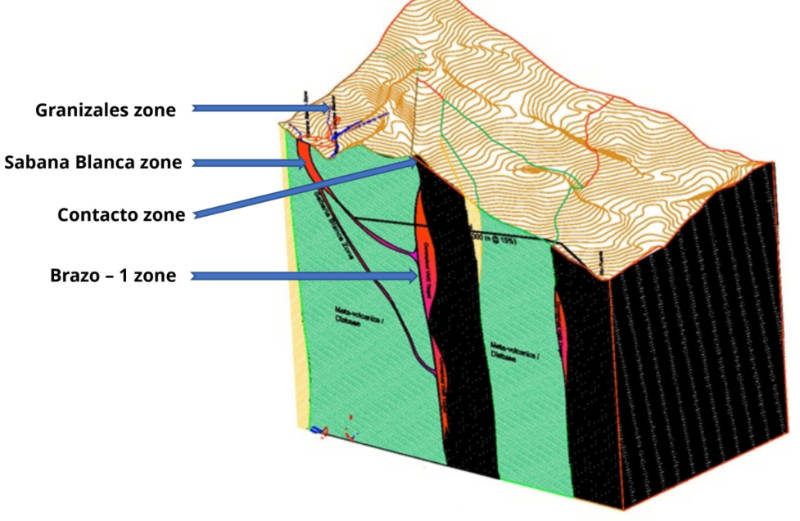

At El Dovio, trenching, drilling and underground development on the Sabana Blanca stringer zone has identified high-grade polymetallic mineralisation within a stockwork system up to 68m wide in outcrop and about 1km long.

Other drill ready targets include the Granizales and Sopetrana stringer zones located 400m to the south and in the footwall of the Sabana Blanca stringer zone respectively that were identified at surface.

This mineralisation style offers two possible development opportunities for Andean.

The first is focused on the bigger, lower grade stockwork system that will return larger tonnages and a longer mine life in exchange for much higher development capital costs.

However, Andean favours the second option, which will focus on mining the high-grade lenses such as at the El Roble mineand have correspondingly low development capital costs.

“You’re not looking for big tonnages, our view of a very good outcome for a starter operation is about 1,000t per day for at least 10 years, which would make it the same size tonnage wise as the El Roble operation,” Howe explained.

“We are talking about grades of somewhere between 4-6g/t gold and 2.5% to 3.5% copper, which account for about 95% of the value of the metal, plus zinc and silver.”

Metallurgical test work carried out by the company has also proved that 93.6% of the gold and 86% of the silver reports to the copper concentrate rather than the zinc concentrate.

“You don’t want gold in the zinc concentrate as it will force you to treat the zinc concentrate on site to extract the gold, as buyers do not pay for any gold in zinc concentrate, adding another layer of complexity and capital and operating costs,” he added.

These positive results along with achieving the same 95% overall recoveries that Newrange had historically achieved for all the metals into separate copper and zinc concentrates combine into a positive outcome for Andean.

“We have answered that question and did all the grind tests for both crushing and milling for a future plant development, all that work has been done.”

Management team

Andean also benefits from what Howe describes as a well complemented board.

Howe himself has over 40 years’ experience in the mining industry with a focus on mine operations and has lived in South America for 14 years, four years of which were in Colombia.

Independent director Paul Ingram is a geologist with extensive experience in managing exploration programs around the world.

“The other two directors – chairman Dr Phillip Wing and non-executive director James Green – on the board bring long-standing legal and financial skills to the table and they have been associated with the mining industry for a long time,” he added.

Additionally, the acquisition of the Newrange subsidiary company that held the El Dovio project also came with a team of people on the ground in Colombia.

“So we have a team that covers administration, legal and technical that we inherited in Colombia, giving us the ability to operate successfully in Colombia.”

IPO and upcoming activity

Andean’s IPO is currently underway and is seeking to raise a minimum of $6m and a maximum of $7m through the issue of shares priced at 20c each.

The company is looking to spend between $4m and $4.9m on exploration, subject to the full amount raised by its IPO.

Most of this will be spent on a 15,000m drill program that will focus on defining a JORC resource at the Sabana Blanca zone and should allow Andean to take it to a scoping study and eventually a feasibility study.

Holes will also be drilled at Granizales, Sopetrana and Brazo 1 with Howe noting that the latter represents a contact between the volcanics and the sediments that is likely to host the main VMS system.

“We have also designed a very large exploration program to cover the rest of the tenements. So we will do a lot of surface work, trenching, sampling, geophysics, geochemistry and geological mapping,” Howe added.

“There are a number of other areas that will receive some of that drilling, but a big part of the drilling will go into Sabana Blanca to define a JORC resource.”

Andean Mining Investor Presentation

To learn more, please click on this link to join the webinar on Friday, 26 November and Monday, 29 November at 11:30am.

This article was developed in collaboration with Andean Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.