This analyst picked Azure early. He thinks version 2.0 could be brewing in Zambia’s copper scene

Does Prospect have a shot of becoming Azure 2.0? Pic: Getty Images

- Zambian copper explorer Prospect Resources is in the crosshairs of major First Quantum Minerals

- $15.2m strategic investment could unlock path for Prospect’s 514,600t Mumbezhi resource to supply FQM’s Sentinel concentrator

- Canaccord Genuity analyst Tim Hoff sees shades of the Azure story in Prospect

In 2023, Canaccord Genuity analyst Tim Hoff was one of the market watchers who staked part of his reputation on the success of Azure Minerals.

Backed by Chilean lithium giant SQM, the Tony Rovira led company went on to find one of the world’s largest lithium bearing pegmatites at its Andover project in a 60-40 JV with legendary WA prospector and mine finder Mark Creasy.

That discovery turned into a $1.7 billion buyout by SQM, in concert with an interloping Gina Rinehart, as both the Chilean and Australian mining behemoths snaggled up half of the junior.

Hoff now sees shades of the Azure story halfway around the world, where $80 million capped Prospect Resources (ASX:PSC) has quietly drilled out one of the largest undeveloped copper deposits held by an ASX-listed company.

At some 514,000t of copper metal, Prospect paid just US$6.5m in cash and shares for its Mumbezhi project in Zambia.

Yesterday, the market’s best kept secret blew out into the open as ~$15bn copper monster First Quantum Minerals emerged with a 15% stake in the Aussie junior, tipping $15.2m into a placement that could eventually net Prospect $18.5m in funds to accelerate drilling.

Existing major shareholder Eagle Eye Holdings has also committed $2.8m to maintain its 15.3% share, with Hoff seeing analogies all over the place.

“I’m going to call this one a ‘big uncle’ stepping in,” he said.

“If you think about it, Creasy was Azure’s big brother and then the big uncle came in which was SQM.

“You saw a resource with size and scale and a jurisdiction that was known. To anyone that was paying close attention to it, it was a foregone conclusion at some point that SQM would make a play at it.

“I think we’re looking at a similar setup again. We’ve got a company with a big brother, which is Eagle Eye, and then you have a big uncle that steps in early, which is First Quantum.”

Conducted at a 36% premium to Prospect’s last traded price, the 15c a share placement sent the junior’s stock 32% higher to 14.5c on Tuesday.

This gets bigger

Hoff, who has a spec buy rating and 40c price target3 on PSC, sees value upside beyond this deal.

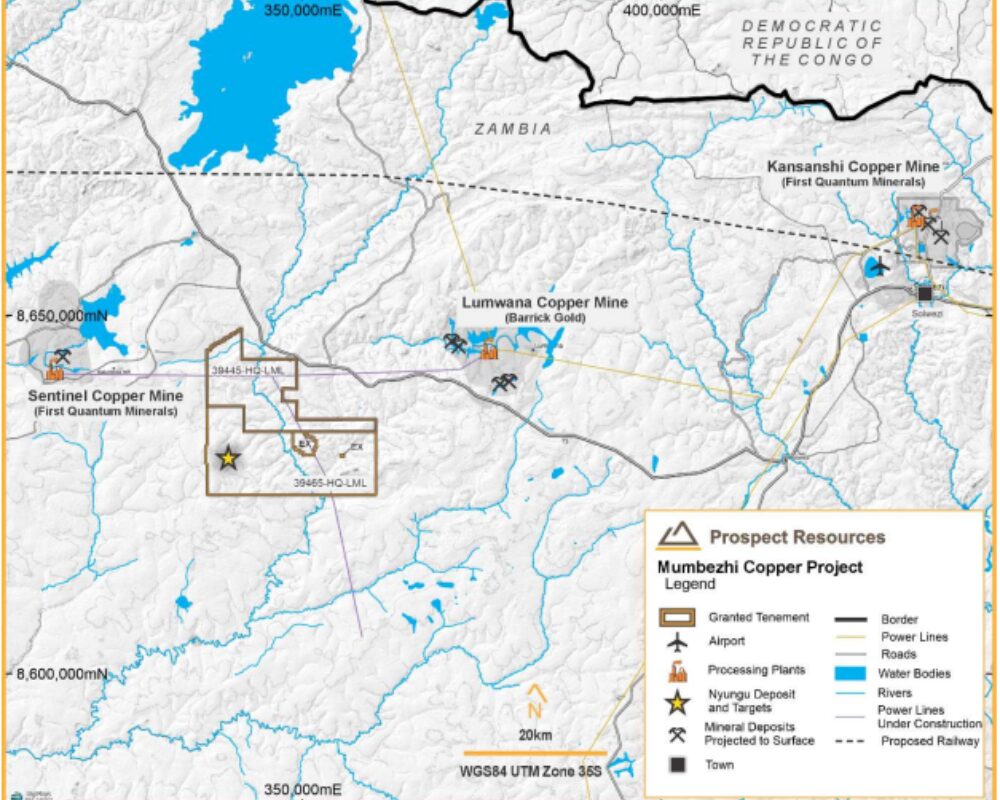

Indeed, he picked it as a likely outcome last month after running the numbers over First Quantum’s Sentinel mine, 25km northwest of Mumbezhi.

Sentinel produces in excess of 200,000tpa and, combined with the Kansanshi mine and smelter around 100km northeast of Mumbezhi, generated 402,000t of copper in concentrate for FQM last year.

Kansanshi itself is undergoing an expansion to ~400,000t of smelting capacity per annum.

Sentinel remains a top-20 global copper mine. But there are storm clouds on the horizon.

“Its grade goes from 0.5% to 0.3% in 2029,” Hoff noted. “And by 2034, it’s got no more ore.

“So First Quantum have an absolute imperative to fully utilise this asset that’s sitting there with 62Mtpa of processing capacity.

“It’s a really interesting dynamic for Prospect … it’s pretty clear why First Quantum steps into the picture.”

By supplying either 10Mtpa or 20Mtpa to the Sentinel concentrator, Canaccord estimates Mumbezhi could add an incremental US$439-607m ($696-963m) in value to the Sentinel operations.

“So what do you pay for that is a big question for First Quantum,” Hoff said.

The upside at Mumbezhi runs beyond the initial resource estimate of 107.2Mt at 0.5% copper for 514,600t, most of it contained in the Nyunga Central deposit (37.5Mt indicated and 49.2Mt inferred).

Another 20.5Mt of ore has been found (inferred) at the Kabikupa deposit, though much of the newly raised cash – at least US$2.5m – will go towards drilling outside Nyungu Central, including regional targets at Nyungu North, Nyungu South and West Mwombezhi.

Inclusive of the posted mineral resource estimate, Prospect boasts an exploration target of 420Mt-1.05Bt at 0.4-0.6% Cu, the sort of scale that could be game changing for PSC and, indeed, FQM.

“That’s the sort of scale that we see the big guys stepping in for, and I think there’s a fairly high degree of confidence that the work that Prospect’s done can unlock the exploration target,” Hoff said.

With the cash from the FQM strategic investment in the bank, Hoff says it’s now “game on” to deliver on that potential.

Competitive tension

FQM may have its foot in the door, but the excitement around the emerging Zambian copper scene means it’s not the only company that could make a play at PSC if that exploration upside crystallises.

Zambia’s government has set its sights on lifting its copper output around 4x by 2031 to 3Mtpa, and the growth of Barrick’s nearby Lumwana mine, which sits between Mumbezhi and Kansanshi, will be key to that dream.

Hoff says Barrick was always a less likely investor than First Quantum because, unlike Sentinel, Lumwana does not have the same time pressure.

Its resource is larger and longer dated, even if stripping ratios are expected to increase as it mines deeper, meaning it could face cost escalation.

But FQM’s 15% stake, while substantial, is not yet at the ~20% level that would constitute a true blocking stake. Eagle Eye’s 15.3% holding also makes it a true kingmaker.

“You’ve got the big brother in there with Eagle Eye keeping it honest. They’re not about to let an asset go for too far below intrinsic value,” Hoff said.

PSC’s management team, led by MD and CEO Sam Hosack, has already tasted success once before in nearby Zimbabwe, selling its 87% interest in the Arcadia lithium mine to Zhejiang Huayou Cobalt for ~US$378m.

Elsewhere in Zambia, Hoff thinks there are other ASX juniors who could tap the jurisdiction’s vast copper potential.

One he’s watching at a much earlier stage is Patriot Lithium (ASX:PAT), which is now hunting for copper in Zambia as well.

“When you have a look at that, it’s very, very early stage, of course. But it’s got a next door neighbour that’s building a copper mine in Sinomine,” Hoff told Stockhead.

“I spent some time with Sinomine in Zimbabwe, they’re African investors and operators. And so I see some similarities in the setup.

“PAT doesn’t yet have the backing of a big brother. But, certainly it’s at an interesting point and location given the news flow we’re seeing out of Zambia today.”

Shares in $7m capped tiddler Patriot rose ~6% on Tuesday.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

At Stockhead, we tell it like it is. While Prospect Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.