This analyst is confident Big River Gold will have financing in the bag for Brazilian project

Pic: John W Banagan / Stone via Getty Images

Big River Gold is getting closer to securing the cash it needs to fund its 2.4-million-oz Borborema gold project in Brazil.

Big River Gold (ASX:BRV) has indicated it will recommence the process of financing in the current quarter with the release of an updated definitive feasibility study.

And Pitt Street Research analyst Stuart Roberts is very confident the company will have no trouble getting the funding.

“We’re talking a pretty compelling definitive feasibility study with a straightforward flow sheet,” he told Stockhead.

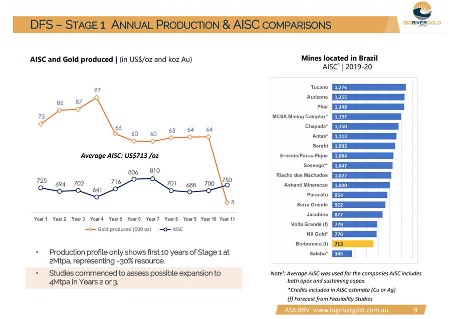

Those “compelling” numbers, announced in 2020, were for an initial 2-million-tonne-per-annum operation include a net present value of $US342m ($464.5m) and internal rate of return of 64.7%, and that’s at a gold price of just $US1550 per oz.

Both NPV and IRR are metrics used to assess the profitability of a project – the higher the number is above 0, the more profitable it will be.

The Borborema mine will also be one of the lowest cost mines in Brazil with a very low all-in sustaining cost of just $US713 an oz.

A recent equity raise in January 2021 saw some major, well-respected industry players enter the register.

Those funds were also applied to advance detailed engineering design and complete an option study to assess the most efficient use of capital and facilitate a seamless transition to an expanded throughput.

The option study suggested some changes in equipment choice and layout such that the fully permitted, construction-ready Borborema project can be expanded to 4 million tonnes per annum seamlessly in the first few years of operation.

The Big River team is currently updating the equipment specifications and costs, incorporating recent mining activity and price changes in Brazil, and advancing discussions for additional wastewater that would underpin a possible production expansion.

Results of the update for the initial 2Mtpa Stage 1 operation over 10 years will be released in August, while the feasibility studies and design work required for an expansion to 4Mtpa will continue.

Pro-mining jurisdiction

According to Roberts, Brazil is a great place for Australian miners to do business.

“It’s got one of the most pro-mining administrations that Brazil has had in a generation or so, and generally a pro-market approach to doing business in a region of Brazil that traditionally has more poverty and higher unemployment than the rest of the country. So Big River will get some localised support to get the project moving.”

While COVID has upset the apple cart for many around the world, Roberts believes this has presented a great opportunity for investors to pick up undervalued stocks like Big River Gold.

“They’ve got everything going in their favour for this project, it’s just been stalled by COVID. That makes it a great buying opportunity,” he said.

When Roberts last released research on Big River in February 2020, he valued the company at between 9.4c and 15c per share. At the time shares were fetching around 2.2c pre-consolidation, giving it a market cap of just under $30m.

Since then, Big River has undertaken a consolidation which has bumped up the share price to around 38.5c and market cap to over $83m currently.

And Roberts believes Big River’s value will only increase further.

“I’d be tempted to increase [the valuation] given what we’ve seen the gold price do since we published that report,” he said.

“That report hit the streets in February [2020], gold peaked in August [2020] at a little over $US2,000 an ounce and it shows every indication of getting back there quite soon.”

Big names on the register

The interest in Big River is strong out of North America, with notable names like Dundee Goodman and Sprott appearing on the company’s register.

In February this year, Canada-based Dundee lifted its stake in Big River to 19.4%.

Dundee Corporation president and CEO Jonathan Goodman said at the time the Borborema project displayed “robust economics” and withstood Dundee’s “rigorous technical due diligence stress testing”.

“Based on our analysis, Big River is significantly undervalued and is resilient to lower commodity prices,” he said.

The potential for a major, long term operation to be developed at Borborema at a time of increasing gold prices has certainly put Big River on the radar of many companies and financiers in the sector.

This article was developed in collaboration with Big River Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.