These stocks have snapped up prime hunting ground in WA’s new critical minerals region

Pic: Getty Images

Traditionally explored for uranium, base metals, and gold, Western Australia’s Gascoyne region is now proving extremely fertile for rare earths and lithium mineralisation, the very metals needed for electrification.

Over the last few years, ASX explorers have ventured back to long-overlooked historic minefields in search of future facing metals like lithium and rare earths in the hopes they might land a ‘company making’ discovery to help feed the green energy transition.

Equipped with a new set of tools, a fresh geological understanding, and backed by government sponsored initiatives, cashed up exploration companies are looking at old data in a new way and finding discoveries.

Such is the case for regions like Western Australia’s vast and remote Gascoyne province, more than 1,000km from Perth city.

While major deposits like Sandfire Resources’ (ASX:SFR) Degrussa copper discovery drew some investor attention to the Gascoyne around 14 years ago, MineLife founder and analyst Gavin Wendt says the region remains largely untapped.

“Typically, the further you move away from Perth and the eastern Goldfields, historical exploration tends to drop off proportionately,” he explains.

“Ironically the main commodity that’s produced in the Gascoyne at the moment is salt.

“The region doesn’t have the same level of significant production or operational history like the Murchison province, for example, but what the Gascoyne does have is prospective geology for elements like rare earths and lithium.

“And that’s what has the market excited.”

Hastings’ leading the pack with rare earth discoveries

The real leading light in the Gascoyne region’s rare earth space is Hastings Technology Metals (ASX:HAS), which is primed to become Australia’s next rare earth producer with its world class Yangibana project.

Interestingly, Yangibana was discovered based on findings from prospectors who carried out rock chip sampling programs in the 1970s and ’80s.

Like many other projects in the area, uranium was one of the first minerals explored for at the time, before various rock chip sampling programs uncovered lead and zinc rich gossans, and eventually rare earths.

While Yangibana was known to host REE mineralisation, Andrew-Forrest backed Hastings chose to take a different approach and carried out a review of previous exploration results once it acquired its original interest back in 2011.

This work identified a significant difference in the rare earths geochemistry between the 12km long, WNW-trending zone between Yangibana North and Kane’s Gossan deposits (subsequently termed the Western Belt) and other deposits at Bald Hill and Fraser’s (subsequently termed the Eastern Belt).

The company managed to take what began with simple rock chip sampled ironstone outcropping and turn it into the 29.93Mt resource it is today.

Neighbouring REE explorers

A proverbial stone’s throw from Hastings (about 25km) is Dreadnought Resources (ASX:DRE) with its Yin discovery at the Mangaroon project, which contains “significantly higher” NdPr as a fraction of the rare earth oxides than most other rare earth element (REE) deposits globally.

Neodymium and praseodymium (NdPr), which are hosted in a rock type called carbonatite, are two REEs used in permanent magnets for electric vehicles and wind turbines – markets that are expected to drive a more than doubling in demand by 2030.

In July last year, shares in the advanced explorer went flying after thick intersections of up to 35m at 2.75% TREO from 94m confirmed the Yin ironstone as a high-grade rare earths discovery.

The company believes the Yin complex is analogous to Hasting’s Yangibana, set to come online next year, and is continuing with infill resource drilling where results have returned the highest NdPr:TREO ratios seen to date from three new discoveries with a combined ~2.5km strike length.

A mere 2km from Hasting’s Yangibana and only 15km from Dreadnought’s fence line is mining minnow Lanthanein Resources (ASX:LNR), formerly Frontier Resources.

Like Yangibana and Yin, the source of rare earths at LNR’s Lyon and Edmund project areas are from Gifford Creek ferrocarbonatities, which have been intruded along the Bald Hill lineament.

New ironstone trends, which may host REE mineralisation, have recently been discovered at Lyons in the most western area of the project with rock samples sent to ALS Laboratories for priority analysis.

Currently a +10,000m RC drilling program testing numerous magnetic ironstone targets, as well as the deep 450m diamond drilling, which is testing margins of large tonnage Carbonatite targets, is underway at the project.

Further east is Miramar Resources (ASX:M2R) who holds a strategic land position comprising several granted exploration licences for a range of commodities including REE carbonatites at Dooley Downs.

While still early days, a magnetic and radiometric survey has identified several large magnetic and/or radiometric anomalies over a strike length of around 35km, highlighting the potential for multiple unmapped intrusions, including carbonatites capable of hosting rare earth element (REE) mineralisation.

Soil sampling is planned for the June quarter.

Lithium shows

Whilst the exploration success by Hastings and more recently, Dreadnought, has helped put the Gascoyne region front of mind in the eyes of investors for rare earths, ASX lithium juniors are showing just how prospective the ground in the Gascoyne is for other critical minerals like lithium.

Delta Lithium (ASX:DLI), formally Red Dirt Metals, acquired its Yinnetharra lithium project just north of Gascoyne Junction last year.

Back then, WA’s Mid-West was anything but a lithium hub, yet according to DLI boss David Flanaghan, the prospectivity was immediately obvious.

“I’m a geologist, and our geos in the field are walking up and finding great big slabs of unmapped pegmatites sticking out of the ground and we’re not the only ones who are doing it,” Flanagan told Stockhead’s senior journalist Josh Chiat.

Latest drilling results at the 505km2 project have returned impressive hits such as 43m at 1.22% Li20 at the Malinda prospect where the company has defined a ‘lithium mile’, comprising two major parallel ore zones M1 and M36 each now drilled out over 1.6km in strike length, remaining open down plunge.

With the recent discovery of the Jamesons prospect about 20km from Malinda, DLI boss David Flanagan says Yinnetharra “is looking more like a province than a project”.

“It’s very rare to feel like you are the first movers in a province, filled with amazing prospectivity, vastly under explored and delivering results in every respect,” he says.

“Yinnetharra has it all. It feels like we have hit the jackpot. These results further confirm that Malinda is showing all the signs of being the first of a number of major discoveries on our ground.”

Moving further southwest and adjoining Delta’s ground is Minerals 260 (ASX:MI6), backed by Tim Goyder and headed up by former Liontown Resources (ASX:LTR) managing director David Richards.

MI6 acquired the project at the end of March from White Cliff Minerals (ASX:WCN), which consists of six granted exploration licences over 920km2.

Future within Reach and nestled between two notable players

Wedged in its own little sweet spot and smack bang between DLI and MI6 is Reach Resources’ (ASX:RR1) Morrissey Hill lithium project, which has uncovered 22,990ppm or 2.30% Li20 at the Bronzer prospect.

More recently, laboratory assay results following the company’s sampling program at Wabli Creek, also within the Yinnetharra mining precinct, recently delivered 14.3% niobium pentoxide (Nb2O5) 6.7% tantalum (Ta2O5) 3689 parts per million (ppm) total rare earth oxides (TREO) with 70.3% heavy rare earth oxides (HREO).

Niobium is a highly sought-after critical mineral thanks to its superb superconductivity, high melting point, corrosion resistance and wear resistance. It’s widely used in aerospace, superconductors, atomic energy and electronics.

The new findings build upon past high-grade results RR1 produced from Wabli Creek in December last year that showed 6.78% Nb2O5, 3.71% Ta2O5 and 2.57% TREO with 88% HREO.

In an interview with Stockhead, RR1 managing director Jeremy Bower says while the company remains laser focused on its Morrissey lithium project, the outstanding sampling results Wabli Creek are particularly exciting and adds to the company’s understanding of the project.

“We have a team out there at the moment with ATVs, which are four wheel drive motorbikes, doing full grid patterns across our tenements – we want to understand the ground a bit more before we undertake drilling,” he explains.

“When we add the Wabli Creek niobium/HREE prospect together with our Morrissey Hill Lithium project, the Yinnetharra region of the Gascoyne is proving to be an amazing potentially mineral rich area and we are going at it full steam ahead.”

Early stage cost-effective exploration proving a success

2022 relistee Voltaic Strategic Resources (ASX:VSR) is another stock with both rare earth and lithium exposure up its sleeves in the Gascoyne.

In early May, the company bagged on some promising lithium drilling results at the Ti Tree project, which sits around Delta’s Yinnietharra project.

The 15-hole for 900m first-pass program returned continuous pegmatite (rock that can contain lithium) up to 58m thick, from surface across six targets.

Meanwhile, new assays out of the Paddy Well rare earth project, which returned individual metre values up to 1% TREO, and high tenor ‘magnet REE’ percentages up to 30%, has confirmed the presence of a large alumina-rich, kaolinitic REE clay system at the Neo prospect.

VSR says the project has the potential for hosting a “near-surface “open-pittable” REE clay deposit of substantial scale”.

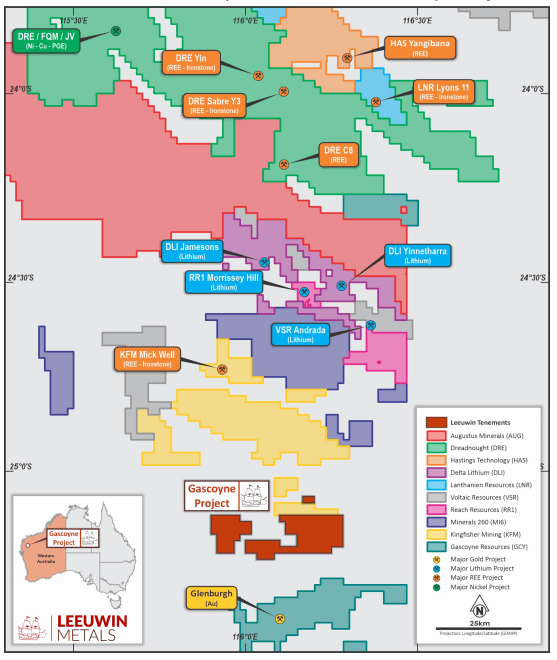

prospective Gascoyne region. Pic: Leeuwin Metals

And there’s Leeuwin Metals (ASX:LM1), who while making progress on its core Canadian projects in Manitoba, Canada is simultaneously seizing the opportunity to explore its own slice of the Gascoyne.

In an interview with Stockhead, LM1 managing director Christopher Piggott says the Gascoyne is “one of the few areas in WA where companies can do early stage, cost-effective exploration and generate interesting results for metals that are important in today’s economy”.

“That is why it is an interesting place to be exploring,” he says.

“Earlier stage exploration methods such as soil sampling, rock chip sampling, and mapping are more effective because it is so under explored.

“These metals are important for the future and we are seeing that play out in consumers buying more electric vehicles as well as from governments who are supportive of these types of projects.”

At Stockhead we tell it like it is. While Hastings Technology Metals, Lanthanein Resources, Miramar Resources, Reach Resources, Voltaic Strategic Resources, and Leeuwin Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.