These stats show ASX lithium companies overtook gold explorers as the go-to small cap investment in 2021

Pic: Getty

Investor enthusiasm for the energy transition thematic has dramatically shifted the balance of the junior exploration sector, with new figures showing ASX-listed lithium explorers deposed gold juniors in raising capital for the first time in 2021.

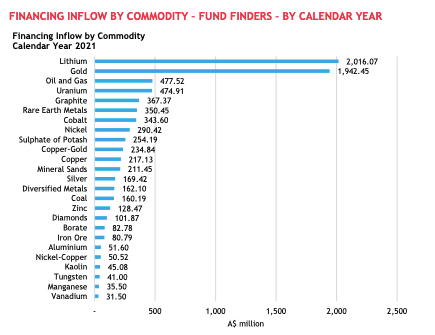

According to BDO’s December quarterly cash update, which tracks investment in and outflows and exploration spending by companies filing Appendix 5B reports, showed lithium companies raised $2.02 billion in 2021, with gold companies raising $1.94b.

That’s a remarkable turnaround on 2020, which aligned with lithium’s astonishing 400% price rise from cyclical lows to all time highs last year.

A year earlier lithium companies received just $150.12 million in financing inflows, behind gold ($1.84b), potash ($528.36m), oil and gas ($309m) and nickel/copper ($209.01m).

Prices for lithium carbonate hit US$40,000t at the end of 2021, around 485% up on the start of last year while spodumene concentrate (the upstream product shipped by Australian hard rock miners) and lithium hydroxide also soaring to record highs.

They’ve continued to climb since with accelerated uptake of electric vehicles that drive demand for lithium batteries showing little sign of slowing down.

Funding for junior resources stocks boomed in the December quarter, with lithium stocks raising $918.08m and gold companies $879.32m, almost half of their full year totals.

The total of $3.75b of financing inflows was a 47% increase on the $2.55b raised in the September quarter, with net financing cash flows up 33% despite a 127% in financing outflows to $858m.

BDO’s global head of natural resources Sherif Andrawes told Stockhead battery metals were receiving rising interest from investors.

“Gold’s been there forever and gold will be a staple of the Australian explorer market going forward for a long time I suspect but I think with lithium, this is a real opportunity at the moment,” he said.

“Going back five or six years, there was a big influx into lithium for a while, that might have been premature, the lithium price then reduced substantially and a few companies went to administration and failed but in the last year, we’ve seen perhaps the timing be right.

“There’s no doubt the demand for lithium is there, it’s just a question of when and how big. And I think now is probably the time and and exploration companies are now seeing this as the right time to (raise money).”

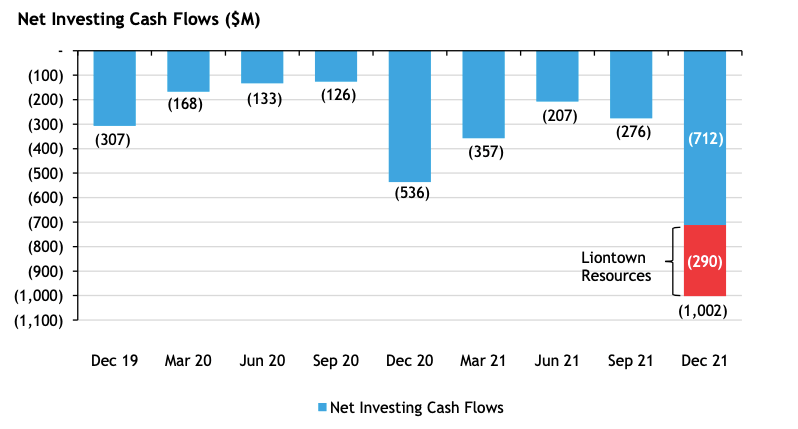

In another sign of the sector’s health new investing outflows rose 263% in the December quarter to top $1b, largely from lithium companies using capital from raisings to invest in equipment and acquisitions.

Lithium companies top raising lists

A record 71 companies raised $10 million or more in December 2021, 22 of them in gold, 12 in lithium, four in nickel, four in the resurgent uranium, and 29 across 19 other commodities.

Lithium companies pulled in four of the top 10 raises, led comfortably by Liontown’s (ASX:LTR) $450m equity raising to fund the development of its Kathleen Valley mine in WA’s northern Goldfields.

Sayona (ASX:SYA), Ioneer (ASX:INR) and AVZ (ASX:AVZ) were the other ASX-listed juniors to raise $75m or more.

Firefinch (ASX:FFX) (gold, but also a sprinkle of lithium), De Grey (ASX:DEG) (gold), New Century (ASX:NCZ) (zinc), West African (ASX:WAF) (gold), Adriatic Metals (ASX:ADT) (silver), and Jervois (ASX:JRV) (cobalt) were the others in the top 10.

Uranium raisings totalled just $58.49m in the December quarter, but it was the biggest moving commodity class in terms of investor sentiment after lithium for 2021, with higher spot prices for the controversial commodity and a rebrand as an ESG-friendly “zero carbon” energy source seeing calendar year inflows jump ninefold from $55.85m to $474.91m.

“I guess a year ago you wouldn’t see uranium on our list,” Andrawes said.

“But now as the uranium price, has come back so the interest has come back into uranium.

“I guess where it sits in the whole net zero debate is up for debate itself but I think that’s something that we wouldn’t have seen a while ago so that’s quite quite healthy in my view.”

December top 10 fundraisers share prices today:

Exploration hits eight year high

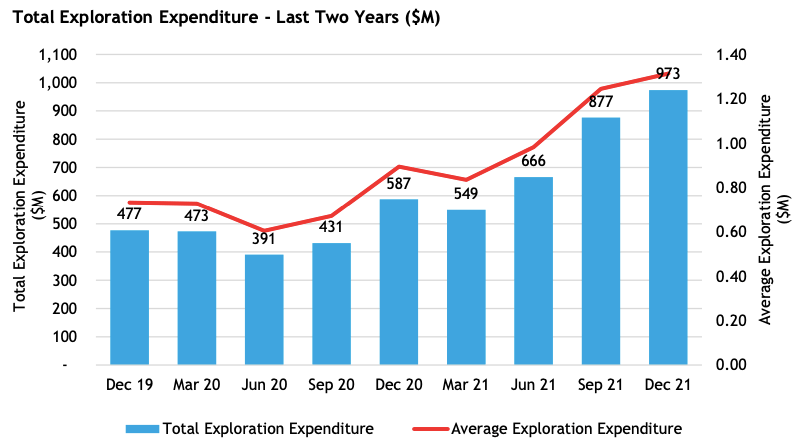

Those funds are helping explorers pump more into the ground than any time in the past eight years.

The $973 million spent on exploration across the 5B cohort in December 2021 was not only 11% higher than the September quarter ($877m) but also surpassed the $921m spent in the March 2014 quarter, previously the most since BDO began its survey in June 2013.

That’s despite there being ~860 companies reporting in 2014 compared to 740 in December last year.

The surging trend across 2021 partly reflects rising costs for drilling services amid competition for relatively sparse equipment and trained drillers and offsiders.

Administration expenses are also going up along with the cycle, but not at the same rate as exploration spending.

At $283m administration spending was 45% higher than the two year average of $195m, with average spending up from $360,000 to $380,000. Exploration expenditure was around 60% above the two year average.

“There is a rein on that spending which is which is also good to see,” Andrawes said.

No slowing down just yet

The big question on any investor’s mind will be how close are we to the peak?

By any normal measures the junior exploration sector is as healthy as it’s been since the last mining boom.

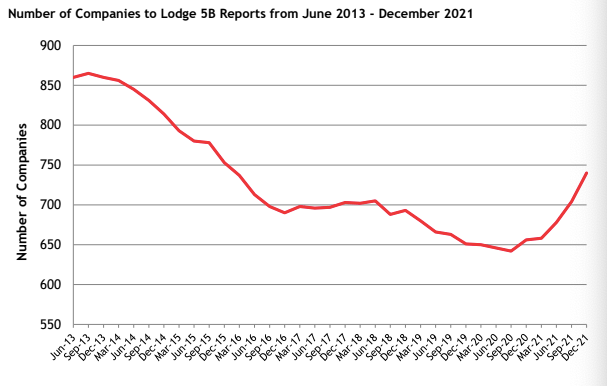

The number of companies lodging 5B reports fell over 20% between September 2013 and September 2020 from more than 850 to under 650.

But a surge in IPOs saw 740 lodge reports for the December quarter, 36 more than the 704 that reported in the September quarter last year.

Historically the December quarter has been quiet, making the 40 new IPOs in the three months to December 31 a sign of buoyancy in the small cap market.

The cash balances of most of these companies are healthy as well. Just 12% had less than $1 million cash on hand at the end of 2021, compared to 43% in March 2020.

More than half have over $4m in reserves, with 82% funded for at least the next two quarters and 93% of those that aren’t looking to raise new capital, showing there’s plenty of risky cash flying around.

Is this a sign we’re flying too close to the sun? Andrawes doesn’t think the market’s Icarus moment is coming yet.

“There’s always a top to the cycle,” he said.

“In preparing this report, looking through the numbers that was something we thought quite carefully about – are we calling the peak of the cycle yet? I don’t think we are yet.

“I think that’s a bit premature. I think that there’s still life in this cycle, there’s still a way to go.

“Now whether there’s a plateau or whether there’s a continued increase, I’m not sure. But I suspect that for the next report, we’ll see these numbers and trends continuing, the number of IPOs continuing still.”

A number of issues are floating in the background, including inflation, access to labour and supply chains, the impact of Russia’s war with Ukraine and possible decline in Chinese commodity demand.

But Andrawes said gold, the mainstay of the junior resources market, tends to do well in times of uncertainty and that the energy transition and net zero policies would drive demand for lithium, nickel, cobalt and other battery metals.

“I think, if anything, as you would know, in times of uncertainty gold does quite nicely on one side,” he said.

“On the other side, I think that the move for the energy transition and net zero, isn’t going to be necessarily impacted too much by these geopolitical issues.

“And so the demand for lithium, nickel, cobalt, etc, won’t be impacted too much.

“And the size of the companies we’re talking about here, the amounts they’re raising and needing is smaller. So I don’t think they’ll be necessarily impact too much by this.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.