These ASX goldies have shovel-ready projects in WA

These juniors have their eye on near-term production to unlock the commercial value of their gold projects. Pic: Getty Images.

- Moving from developer to producer is a major milestone

- As gold hovers around US$4000/oz it’s the perfect time to become a miner

- These ASX goldies are at or approaching shovel-ready status

For junior exploration companies, the leap into production is a defining moment.

It signifies the transition from discovery of a high potential deposit to the unlocking of its commercial value through extraction and sales.

Timing production during a period of elevated gold prices, like the boom we’re in now, can also bring a multitude of opportunities. New miners are able to build stronger balance sheets and higher valuations with single assets and see more interest from larger mining companies willing to pay premiums to grow.

ASX-listed companies nearing gold production often draw strong investor interest, with developers starting to run faster and harder than the established producers.

Today we’re taking a look at WA goldies who are lining up shovel-ready projects.

Ballard Mining (ASX:BM1)

First cab off the rank is Ballard Mining, which spun out of Delta Lithium a few months ago as a ready made gold developer having already cleared the regulatory hurdles to enable mining and processing to begin at its Mt Ida project in the Goldfields.

The company recently released a conceptual exploration target of 11.8-14.6Mt grading 2.6-3.9g/t gold for Mt Ida, which sits separate to the existing 1.1Moz resource.

Importantly, some 930,000oz sits in a single deposit at Baldock, a proposed open pit grading an impressive 4.1g/t Au.

With approvals now in place for a 2 million tonne per year processing plant and tailings storage facility, and approvals for open pit and underground mining, Mt Ida is officially shovel ready.

It’s well and truly on the watchlist of big gold players. Ballard just raised $20.6m via a placement at 55c per share led by Mt Ida neighbour Aurenne Group Holdings, making it BM1’s largest shareholder with 9.6% of its register.

It’s worth noting that Aurenne has successfully developed multiple open pits which supply ore to its 100% owned CIL plant, located only 8kms from Ballard’s project. That means there are multiple different development and value creation pathways open for Ballard.

Depth extension drilling is in the works at the 930,000oz Baldock deposit and the Timoni deposit where drilling will delve past historical workings from the 1960s.

BM1’s shares have lifted some 77% since its first trading day on July 14.

Western Gold Resources (ASX:WGR)

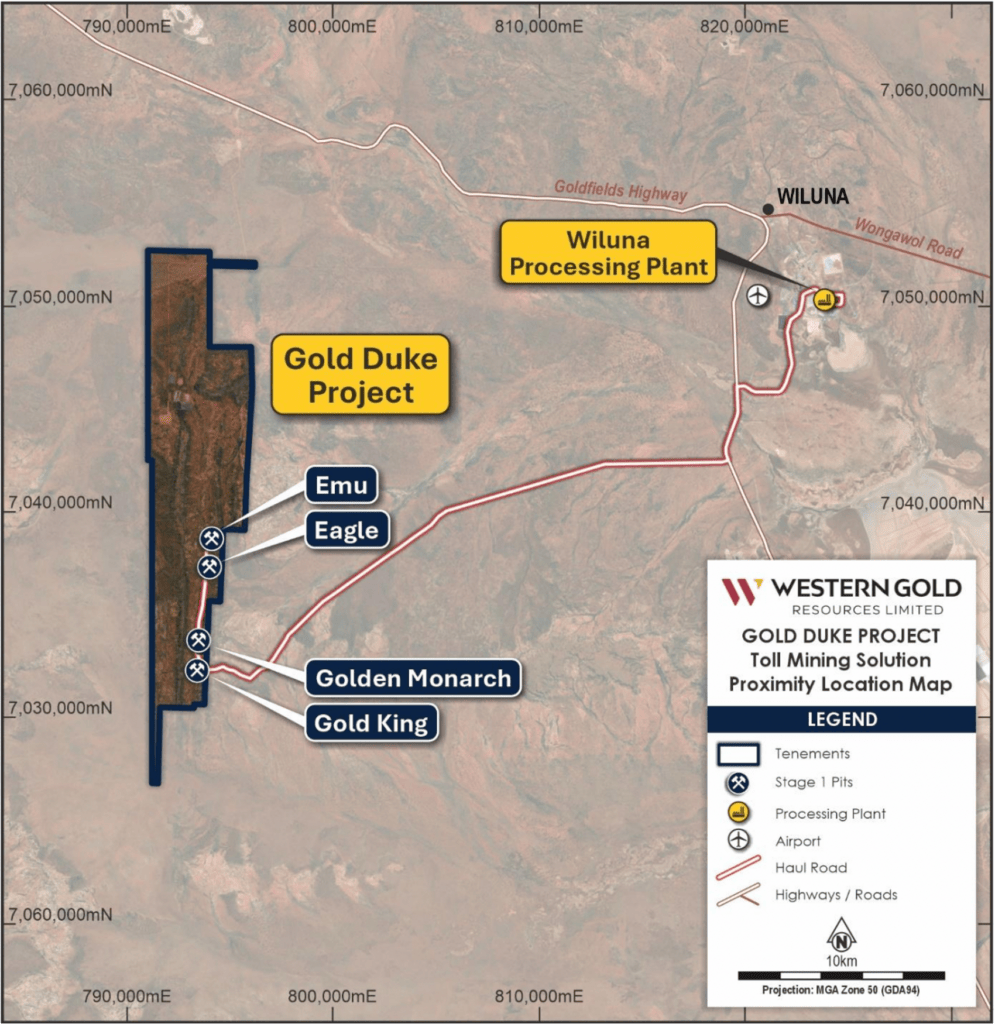

WGR owns the shovel-ready Gold Duke project in WA’s northern Goldfields and is nearing a decision to mine.

The plan is for stage 1 production to include 447,000t at 2.55g/t gold for 34,000oz of gold from the Eagle, Emu, Gold King and Golden Monarch deposits.

Under a recent scoping study, stage one of Gold Duke is expected to generate undiscounted, pre-tax cash surpluses of $56m at an Australian gold price of $4500/oz to $97m using a $5500/oz gold price.

This is somewhat conservative given the current gold price of $6070/oz.

All mining approvals have been secured for all four proposed mining pits within the project and managing director Cullum Winn said earlier this month that the company is in a strong position as it heads towards a final investment decision.

“With a fully funded development plan, low start-up capital, and rapid payback, we are exceptionally well positioned to move into production at a time of record Australian gold prices,” he said.

Everest Metals Corp (ASX:EMC)

Supported by mining partner MEGA Resources, Everest Metals has just initiated a 2500m drilling program designed to upgrade gold and silver resources at the Mt Dimer Taipan project, 150km northwest of Kalgoorlie in WA.

This is capitalising on a Right to Mine agreement in which MEGA has mobilised its mining fleet to prepare for open-pit mining operations and provided $18.6 million in non-dilutive funding.

EMC and MEGA expect to start extracting ore this month and begin toll treatment processing by March 2026 under a circa 200,000 tonnes per year agreement.

The project is fully permitted for mining, with a mining proposal and mine closure plan approved by the WA Department of Energy, Mines, Industry Regulation and Safety.

In the meantime, EMC intends to upgrade and possibly grow the project’s inferred gold and silver resource of 48,545oz of gold and 89,011oz of silver with the reverse circulation drilling.

Medallion Metals (ASX:MM8)

Medallion has one of the largest undeveloped gold and copper projects in WA at Ravensthorpe, which received significant underwriting after global trading giant Trafigura moved to provide a prepayment funding facility along with long-term offtake agreements for copper concentrate and gold doré.

Under the proposed structure – still subject to definitive documentation, approvals and due diligence – Trafigura would supply up to US$50m (A$77m) in prepayment with no hedging requirements, while locking in seven-year offtakes over copper and precious metal concentrates and a separate agreement for gold doré.

The package effectively pairs development funding and offtake under a single globally recognised counterparty, creating a clear commercial path to advance the Ravensthorpe mine.

The emerging developer is on track to become one of the major players in Australia’s 2025 gold boom after announcing the agreement to acquire IGO’s (ASX:IGO) Forrestania nickel operations, 400km east of Perth, had become binding in August.

It enables the Cosmic Boy mill to be reconfigured as the processing facility for the Ravensthorpe gold-copper ore, a key bit of infrastructure that could also open up previously stranded nearby deposits in the Forrestania region.

The company expects to release a feasibility study this month.

Carnavale Resources’ (ASX:CAV)

Carnavale’s recently updated scoping study has painted a strong picture for the Kookynie asset, confirming it as a high-margin, fast-payback development opportunity in WA’s Eastern Goldfields.

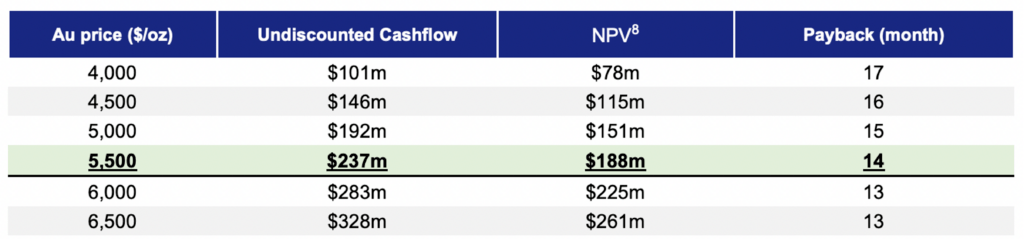

Using a conservative gold price of A$5500/oz, the study points to a pre-tax NPV of A$188m, 165% IRR and A$237m in free cash flow.

With low pre-production capex of just $3m, payback in a little over a year, and an initial five-year mine life, Kookynie is looking like a strong candidate for a contract mining and toll-treatment operation.

Impressively, the project’s open pits account for half of total production, including a bonanza zone grading 28.3g/t for 55,000oz.

Carnavale has outlined a clear development pathway for Kookynie, with the goal of reaching mine approval in 2026.

A $7.09m capital raise last month marked the start of the next chapter for Kookynie, with the company now focused on completing a BFS and taking the project to shovel-ready status.

Star Minerals (ASX:SMS)

Also benefitting from a MEGA Resources deal is SMS, which is aiming for production at the Tumblegum South project in WA’s Bryah Basin. It has a contained gold resource of 45,000oz on a granted mining lease, something which accelerates the pathway to production given the time it takes for WA’s mines department to approve the conversion of an exploration licence.

The current mine plan envisions production of between 167,000t at 2.43g/t (11,800oz of contained gold) to 255,000t at 2.16g/t (15,900oz).

Under the agreement, Bain Global Resources – the financial arm of MEGA – will provide working capital of up to $20 million, reducing the need for funding through share dilution and higher risk debt structures, to fund all grade control drilling and production to first revenue.

MEGA Resources will fund and provide mining, extraction and haulage services at Tumblegum South with mining expected to start in Q1 2026.

In return for the funding and services, commercial terms have been set out to split profits equally between SMS and MEGA/Bain.

This is subject to SMS signing an ore purchase agreement with a nearby processing plant.

At Stockhead, we tell it like it is. While Ballard Mining, Western Gold Resources, Everest Metals, Medallion Metals, Star Minerals and Carnavale Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.