There’s no end to the high-grade gold in Burkina Faso for West African Resources

Beyoncé adorned in gold at one of her performances. Pic: Getty

West African Resources (ASX:WAF) has found more extremely high-grade gold in Burkina Faso.

It may not be as high as the record 860 gram-per-tonne (g/t) hit it reported in February last year, but 132g/t is nothing to be sneezed at and would definitely be labelled “bonanza”.

There is no agreed-upon, official definition for “bonanza” grade – but anything over 5g/t gold is considered high-grade.

Reserve definition drilling at the M1 South prospect, part of the Sanbrado project, has delivered hits of 6.5m at 61.8g/t from 258.5m deep, including 3m at 132g/t.

This type of drilling is done to convert resources to reserves, which are discoveries that are commercially recoverable using existing technology.

Drilling at the M5 prospect, meanwhile, has returned intercepts of 14m at 12g/t from 510m, including 1m at 49.9g/t.

It’s more than a one-off for West African, which has previously reported multiple hits of high-grade gold from the highly fertile Burkina Faso.

The country is Africa’s third largest exploration jurisdiction for gold and the continent’s fourth largest producer.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Managing director Richard Hyde told Stockhead that typically most West African gold mines have a 1.5 to 2g/t head grade, but West African Resources’ M1 South deposit has an average resource grade of 12g/t.

“It’s funny that the actual high-grade has just been so consistent, which is unusual for a really high-grade system because usually they’re quite patchy,” he explained.

That’s good news for West African because the Sanbrado project is “just going to make lots of money” thanks to the extremely high-grade M1 South prospect, Mr Hyde said.

This is because the company can be more aggressive in its approach, allowing it to mine faster and not have to be so selective in the material it sends through the mill.

“We’ve sized the plant and operation based on the lower grade open pits and then it means we can approach the M1 South underground probably more aggressively and we can probably afford to take more dilution,” Mr Hyde said.

West African has found mineralisation in reserve down to 500m, but has drilled down to 700m and there is still more mineralisation.

If the company can successfully infill that additional mineralisation, Mr Hyde thinks the company can extend the life of the M1 South mine from around five years to eight years.

Several other gold explorers are having success in West Africa, including Mako Gold (ASX:MKG), which last month revealed it had made a new discovery in Burkina Faso that returned hits of up to 53.8g/t.

Meanwhile, newly listed African Gold (ASX:A1g) has now got boots on the ground at its “Agboville” project on the Ivory Coast.

Traditionally known for its cocoa and coffee, the Ivory Coast wants to see if it can lure more miners to its shores.

And apparently it’s just as prospective as its West African neighbours.

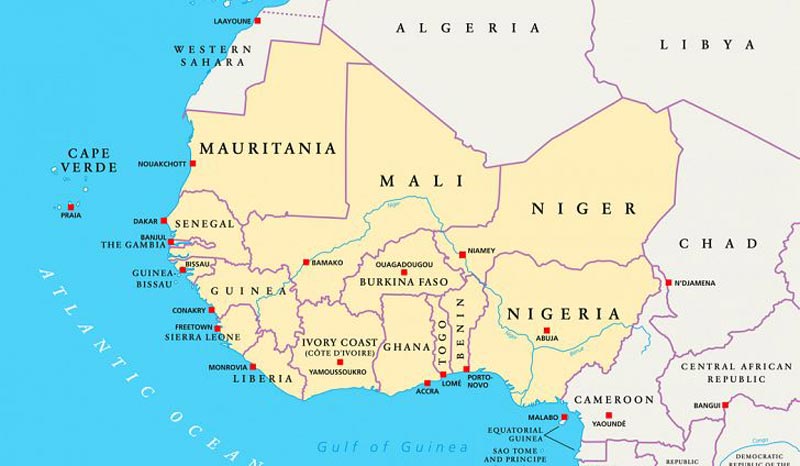

Bridge Street Capital analyst Dr Chris Baker told Stockhead late last year that the whole of West Africa from Ghana all the way through to Mali and Senegal is very prospective for gold orebodies and there have been some very, very large orebodies found.

“In the last 20 years we’ve seen two or three big gold rushes in West Africa,” he said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.