There’s a big Chinese gold producer on the hunt for WA projects

(Getty Images)

One of China’s largest gold producers is on the hunt for projects in Western Australia.

The $US5 billion ($7.4 billion) Hong Kong-listed Zhaojin International Mining plans to invest in WA’s gold mining sector through a joint venture with Perth-based PCF Capital.

Zhaojin is the fourth largest gold producer in China.

PCF Capital will seek out opportunities for the gold major and provide advice on potential transactions.

PCF Capital has executed over 130 transactions worth $3.5 billion in resources M&A, divestment and project financing in the two decades since it started.

The partnership has been two years in the making, according to PCF Capital managing director Liam Twigger.

The news comes less than two weeks after the Western Australian government revealed it was taking steps to revive China’s appetite for investment in the state’s mining and energy industries.

Chinese investment in Australia has been falling.

According to KPMG and the University of Sydney Business School, Chinese investment fell 36.3 per cent last year – around $8.2 billion.

China is Australia’s biggest trading partner and has been WA’s largest market for merchandise exports since 2006.

The Asian behemoth is also a significant investor in the state’s resources sector.

Chinese companies have direct interests in projects across several commodities including iron ore, liquefied natural gas, gold, lithium and manganese.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Twigger told Stockhead that Zhaojin wanted to match its Chinese production, which is currently 670,000 ounces a year, through investment in WA projects.

“So if you’re going to get that production you can either start and discover it or pick up advanced developers or pick up producers,” he said.

“Everything is on the table; Zhaojin has a $US5.5 billion market cap, so nothing is too big or small for them.”

Twigger said the deal with Zhaojin could also pave the way for other big Chinese players to inject cash into WA’s resources sector.

“PCF’s job is to generate opportunities in the first instance for Zhaojin and then to provide capital, and in the second instance to gain access to the broader Chinese investment community,” he said.

“So we’re not ruling out doing deals with the rest of China, just in the first instance we’ve got to try and help Zhaojin achieve its goal of getting 670,000 ounces of outside China production.”

WA Resources Minister Bill Johnston said there had never been a better time to invest, with the Australian gold price hitting record levels this month.

The gold price shot through $2200 an ounce in Aussie dollar terms last week.

The commodity’s rapid elevation is linked to intensifying trade concerns, Fed rate cut expectations, and compounded negative trends and worries across markets and economies.

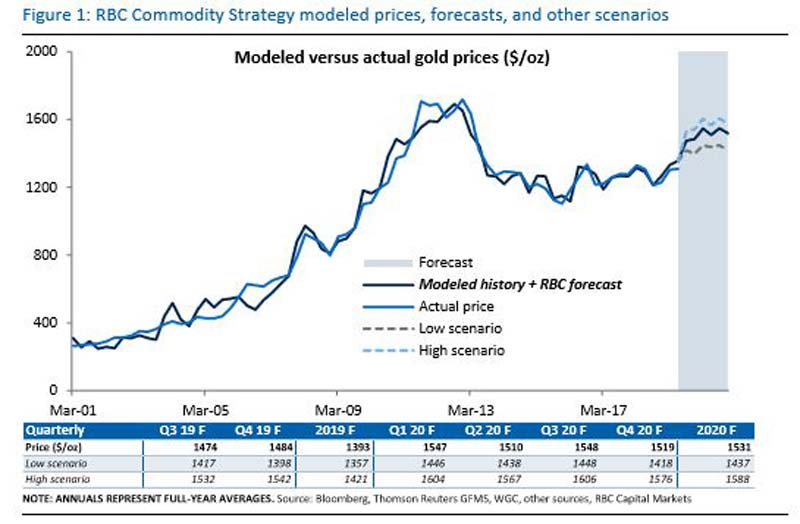

“It is quite clear that the intensified US-China trade war, Fed rate policy, and general market concern have breathed new life into gold, but the risks do not stop there,” RBC Capital Markets’ commodity strategist Christopher Louney said.

“The move seems stronger and stickier than we initially thought. In fact, we argue that the greater appreciation of risk underlying the move lends notable sustainability to elevated prices.

“A healthy amount of scepticism is still warranted in our view, but we find it difficult to argue against the efficacy of the current rally and expect current prices to persist this year.”

RBC tips that the gold price will trade between $US1,398 ($2,069) and $US1,542 per ounce for the rest of this year and could trade as high as $US1,606 ($2,377) in 2020.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.