There’s 944,000oz in the bag at Saturn’s Apollo Hill gold project, with more to come

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

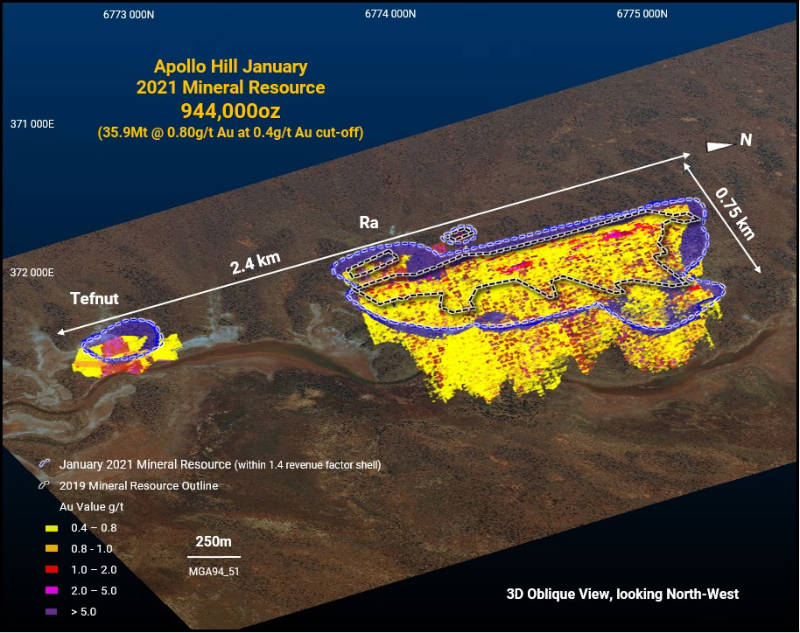

Special Report: Saturn has increased resources at its Apollo Hill project by 21 per cent to 944,000oz of gold with more than half of it in the higher confidence indicated category.

The addition of 163,000oz is based on an additional 265 holes totalling 55,000m completed by the company in 2020 and takes the total resources added since its listing three years ago to 439,000oz.

Saturn Metals (ASX:STN) adds that there is strong potential to continue growing the resource as mineralisation remains open along strike and both updip and downdip.

Managing director Ian Bamborough says the upgrade is the third significant step for the company and Apollo Hill in as many years with consistent improvements in size, quality and confidence of the resource boding well for its advancement.

“For the first time we have been able to publish the mineral resource within a ‘Whittle’ pit shell using preliminary cost assumptions,” he added.

“This has allowed the company to consider potential economies of scale, lower cost processing scenarios and the use of a lower cut-off grade to help obtain an improved stripping ratio.

“With the system open along strike and up and down plunge and metallurgical assumptions at an early stage of understanding, the gold deposit is positioned for continued growth.”

Drilling is currently underway to further test the extents of the Apollo Hill gold system with the company adding that it is well funded for the next phase of resource discovery and expansion with $12.5m in cash as of 31 December 2020.

The drilling on the 6km Apollo Hill trend represents just a small part of the company’s +1,000sqkm contiguous tenement package in Western Australia’s Goldfields region.

Why grade doesn’t always matter

Apollo Hill now has a resource of 35.9Mt grading 0.8 grams per tonne (g/t) for 944,00oz of contained gold with 59 per cent, or 21.2Mt at 0.8g/t for 556,000oz of contained gold, in the higher confidence indicated category from the surface, which has sufficient information on geology and grade continuity to help in the consideration of future mining options.

While the gold grades are not high, they are not necessarily an impediment to successful development as other factors such as orebody depth and shape, metallurgy, size, and mineralisation style all play a role in determining if a project is viable.

Capricorn Metals (ASX:CMM) is one example of this despite its Karlawinda project having grades that are very similar to those at Apollo Hill.

Construction is already underway at the project, which is expected to produce between 110,000oz and 125,000oz of gold per annum at an attractive All-in Sustaining Costs (AISC) of between $1,140 and $1,190 per ounce.

This is thanks to the single large, low strip ratio open pit and ore that can be processed using a well-understood conventional gravity and carbon in leach process.

Apollo Hill likewise has the potential to become a large tonnage, simple metallurgy, low-strip open pit mining operation.

This article was developed in collaboration with Saturn, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.