The zinc mine coming back to life after 20 years as a rubbish dump

Zinc nugget ... Heron hopes to dig up 40,000 tonnes of the stuff annually from a mine mothballed 20 years ago. Picture: Getty

Tim Treadgold’s column, The Explorer, appears weekly in Stockhead

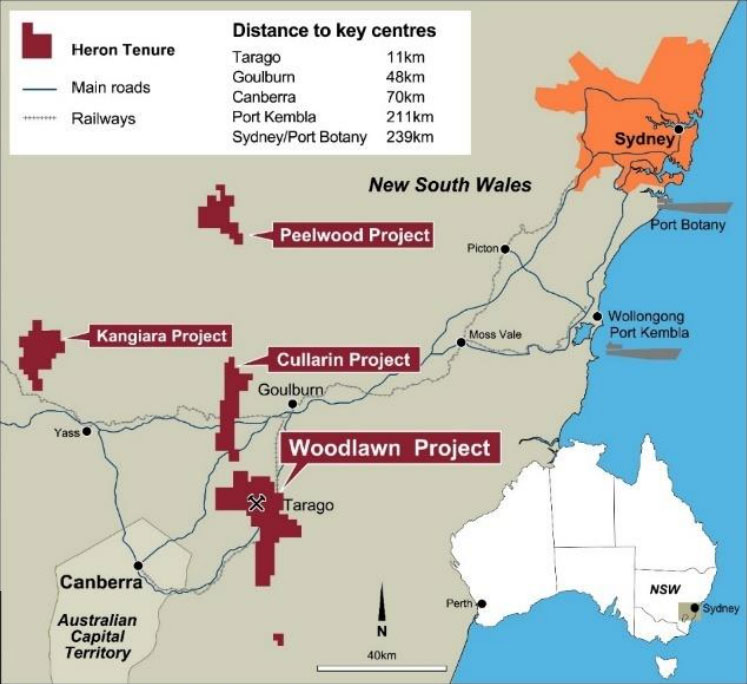

Old mines don’t die, they just wait for metal prices to rise before making a comeback — a fact Canberrans and Sydneysiders can see for themselves as the Woodlawn zinc mine near Lake George on the highway connecting those two major cities moves closer to a re-start.

Once an important source of a zinc, lead and copper, the gates at Woodlawn closed in 1998 after metal prices collapsed in the wake of what was dubbed the Asian Financial Crisis.

Zinc, which is mainly used to protect steel from rusting (galvanising), plunged below US40c a pound as demand for construction materials dried up.

A recent rise in the zinc price to a five-year high of $US1.32/lb has significantly improved the economics of Woodlawn — though not yet the share price of the company behind its re-birth, Heron Resources (ASX:HRR).

In theory, Woodlawn should be handsomely profitable for Heron. Though managing director Wayne Taylor avoided the issue of potential profits when presenting on Wednesday in the final session of the Diggers and Dealers forum in Kalgoorlie.

Perhaps it was Taylor’s background as a mining engineer which encouraged him to stick with the technical side of the project, complete with detail that other mining engineers would have found exciting.

A bit more of the hard sell, for which the conference is famous, might have done a better job in helping lift Heron’s share price out of the sub-10c range into which it has sunk, sitting close to a 12-month low of 7.5c.

An uplift might come as Heron starts to dig into the Woodlawn orebody and more investors become familiar with a project which disappeared from view almost 20 years ago to be left with just two notable attributes — a large wind-turbine “farm” and a rubbish dump in what was once its active open-pit mine.

The new Woodlawn will be an underground development, chasing rich lenses (seams) of mineralisation for their polymetallic ores which will yield around 40,000 tonnes of zinc a year, 10,000 tonnes of copper and 12,000 tonnes of lead – and all within 50km of Canberra.

Unresearched by investment banks and most stockbroking firms, Heron has the potential to become a significant producer of metals, a point recognised by one of the world’s big commodity traders, Louis Dreyfus, which has provided an offtake agreement for all production for the first three years.

Restoring Woodlawn is not a cheap undertaking with an all-up cost of around $240 million — $140 million of that coming in the form of equity (shares issued) and $100 million in debt.

But in return Heron, a small company with a stock market value of just $34.5 million (at 7.5c), gets a mine scheduled to start production towards the end of next year and run for an initial 9.3 years – but almost certainly longer as exploration probes deeper mineralised structures near the existing project site.

For investors in Sydney (or Canberra) with an interest in mining, the Woodlawn project is unique – a mine almost on their doorstep rather than on the other side of the country. They can drive by to see how hard their money is working.

Footnote: Heron was one of the last presenters at Diggers and Dealers and this is my final note from the conference which has surprised most delegates with its upbeat mood and near-record attendance. As a guide to the future trend in Australian mining a positive Kalgoorlie conference has often been an important pointer to the trend in equity markets, something to bear in mind when thinking about future investment choices.

Tim Treadgold’s The Explorer column appears weekly in Stockhead.

Tim is a Perth-based finance journalist who has been covering the resources sector for more than 40 years for national and international publications, long enough to know what’s gold and what’s fool’s gold — of which there’s quite a bit in the mining world.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.