The price surge across lower iron ore grades continues

Pic: Schroptschop / E+ via Getty Images

Lower grade iron ore prices continue to surge. According to Metal Bulletin, the spot price for 58 per cent fines jumped by 2.6 per cent to $49.59 a tonne, leaving it at the highest price since late August 2017.

It’s now surged 24.8 per cent from the recent cyclical low of $39.72 a tonne on November 26.

Unlike cheaper, less efficient ore, prices for mid and higher grades actually fell on Tuesday.

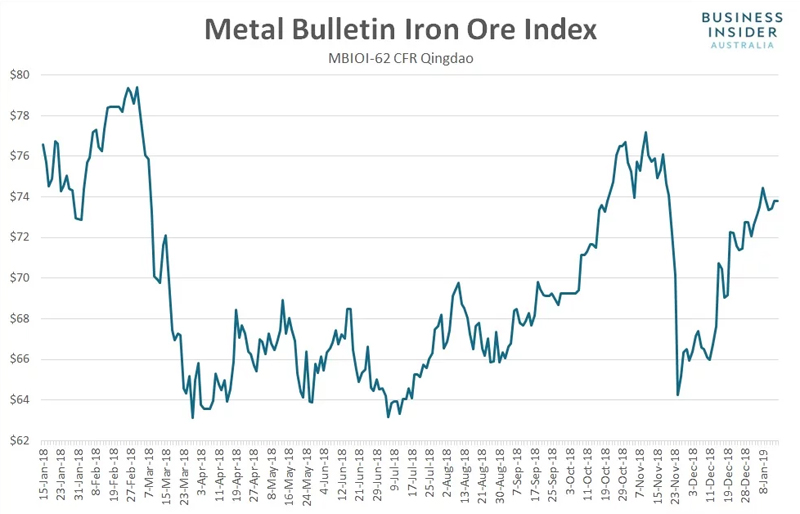

The benchmark price for 62 per cent fines fell by two cents to $73.78 a tonne. Fines with 65 per cent iron content fell by a larger 0.2 per cent to $88 a tonne.

With 58 per cent fines continuing to surge while the benchmark went backwards, the price discount for the former narrowed to the lowest level since August 4, 2017.

“China’s preference for higher grade iron ore has declined notably from peaks in recent months as mills look to cheaper lower grade alternatives following the fall in steel margins,” says Vivek Dhar, mining and energy commodities analyst at the Commonwealth Bank.

“Steel prices have fallen as demand concerns in China have escalated, particularly on the back of a slowdown in China’s manufacturing sector. Steel prices also fell as more relaxed environmental controls in northern China boosted steel supply.”

The strength in lower iron ore grades may have been assisted by weakness in Chinese steel markets on Tuesday.

Rebar and hot-rolled coil futures in Shanghai finished Tuesday’s day session at 3,519 and 3,416 yuan respectively, down from 3,553 and 3,437 yuan on Monday evening.

Despite the pullback in steel futures, bulk commodity contracts in Dalian ended mixed — iron ore and coke rose to 512 and 2,019 while coking coal eased to finish at 1,237.5 yuan.

The mixed price performance in futures markets came despite the prospect of additional stimulus measures being rolled out by Chinese policymakers.

“The People’s Bank of China (PBoC) indicated that the Chinese yuan exchange rate is no longer constraining the central bank’s reserve requirement ratio (RRR) cuts, implying that interest rate cuts could be in the policy toolkit if the economy deteriorates, and disclosed higher-than-market-expected loan growth in December,” said analysts at Credit Suisse.

“China Ministry of Finance (MoF) and National Development and Reform Commission (NDRC) confirmed the announcement of a value-added tax (VAT) cut at the March National People’s Congress and pledged to accelerate infrastructure investment.

“We think the weaker-than-expected December economic data has added a new sense of urgency in policymakers to rekindle growth. We expect a higher quota for local government special bond issuance, an 400-600 billion yuan VAT cut, more specific pro-consumption measures, and a further 300 basis point RRR cut.”

Chinese commodity futures were quiet in overnight trade, moving little from Tuesday’s day session close.

SHFE Hot Rolled Coil ¥3,419 , -0.12 per cent

SHFE Rebar ¥3,519 , -0.42 per cent

DCE Iron Ore ¥512.50 , 0.69 per cent

DCE Coking Coal ¥1,231.50 , -0.61 per cent

DCE Coke ¥2,017.00 , 0.30 per cent

The lack of movement provides no clear guide as to what direction physical markets will move on Wednesday, other than activity may well be quiet.

Trade in Chinese futures will resume at midday AEDT.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.