The next lithium boom? Pantera Minerals to capitalise on billions of dollars of investment in Arkansas’ Smackover Formation

Billions of dollars of investment is landing in Arkansas to develop lithium projects. Pic via Getty Images.

Last month, Pantera Minerals purchased a 35% stake in Daytona Lithium, which is rubbing shoulders with global majors like Exxon and Albemarle in the lithium-brine rich Smackover Formation.

US brine operators are expanding quickly to position themselves as top-tier, cost-effective global producers of lithium.

Instead of relying on traditional hard rock mining, many are turning to the production of this essential raw material from brine sources found in salt flats using oil and gas extraction methods.

Here, the advancement of Direct Lithium Extraction (DLE) technology is happening at a brisk pace.

Direct extraction technology is nothing new – it’s been used in water treatment for decades – but its use to extract lithium from brines is just now coming into its own.

DLE tech promises to produce cheaper, higher quality, and more environmentally friendly lithium than incumbent processes.

Rather than the traditional method of concentrating lithium by evaporating brine in vast pools, DLE brings the brine directly into a processing unit which then undergoes a series of chemical processes to isolate the lithium.

Arkansas’ fast-developing Smackover Formation is endowed with large quantities of easy-to-extract brine and is attracting major interest from global mining and energy producers such as ExxonMobil, Standard Lithium, Albemarle, Tetra Techologies, Lanxess and Koch Industries.

South Arkansas could host the next big lithium boom

The city of Magnolia experienced an oil boom around 100 years ago, thanks to the surrounding Smackover Formation.

The next boom could be lithium related, with the gigantic subterranean aquifer also reporting the highest lithium in brine values in North America.

You should buy real estate in Magnolia, Arkansas.

Why?

Magnolia sits on enough lithium for Tesla to build cars for 38 more years.

Exxon just bought $100m of land there.

The population will more than double over the next 5 years as a result.

Homes are $150k. pic.twitter.com/g3dVUPOOdw

— Chris Koerner (Mobile Home Park Guy) (@mhp_guy) July 21, 2023

The majors are moving fast. Global energy giant Exxon’s recent entrance into Smackover was marked by a >US$100m acquisition of 120,000 acres of private leases from lease-holder Galvanic Energy.

This, coupled with an agreement with Tetra Technologies to develop more than 6,100 lithium-rich acres in Arkansas, marks one of the first forays by an oil and gas major into the sector.

Exxon’s landholding is estimated to have 4Mt of LCE at an average of 325 parts per million (ppm) lithium – enough to power ~50 million EVs.

It also plans to build a 75,000-100,000mt production plant nearby, which at current levels equates to ~15% of the world’s lithium production.

Yet the latest movements in the region come from Vancouver-based Standard Lithium, which is charging full speed ahead with its plans to establish Arkansas’ very first commercial lithium production facility.

Just this week the lithium major unveiled exceptionally positive results from its definitive feasibility study (DFS) for a US$365m battery-grade lithium venture set to take shape just outside the town of El Dorado.

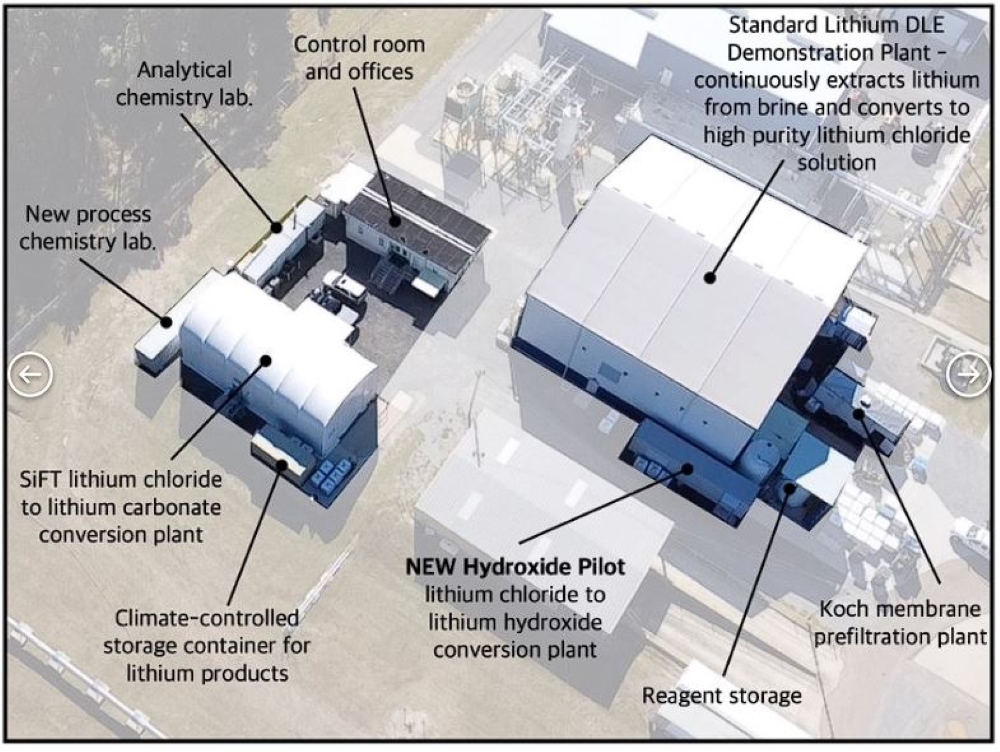

Standard Lithium has been producing battery-grade lithium carbonate (Li2CO3) at its demonstration facility located at the Lanxess South plant near El Dorado for three years already and has flagged full-scale production starting from 2026.

The company will employ state-of-the-art DLE methods to produce 5,700tpa Li2O3 at the project across a 25-year LOM.

On top of this, the producer is planning a $US1.27 billion commercial lithium plant JV called with 1A project with German-bromine producer Lanxess, west of the town of Magnolia, to churn out 30,000tpa of battery-grade lithium.

Standard Lithium has also partnered with Koch Industries and Tetra Technologies in the region to turn Arkansas into a global lithium powerhouse – investing in mineral leases and lithium exploration at pace.

With this flurry of exploration and development in one of the hottest lithium brine regions in the world, ASX-listed Pantera Minerals (ASX:PFE) sees an opportunity to create wealth for its investors.

Pantera in the Smackover

Pantera’s foray into the Smackover Formation is marked by its recent $2m investment into Daytona Lithium which gives it a 35% stake into 5,325 acres of brine-prospective ground called the Superbird project.

Superbird directly abuts Exxon’s Smackover lithium project, Standard Lithium’s Lanxess & South West Arkansas projects and Albemarle’s Lithium-Bromine brine project, which has been in production since the 70s.

Daytona employs a two-stage strategy to obtain mineral leases, leveraging its IP.

In Phase I, it targets a ‘First Target Area’ of around 6,400 acres, nearing completion, with negotiations for an additional 7,000 acres. Phase II focuses on the ‘Second Target Area,’ aiming to lease up to 50,000 acres.

“With Pantera’s 35% investment into Daytona Lithium, the Company enters one of the most significant and emerging brine plays in the USA,” Pantera CEO Matt Hansen says.

“The Smackover play is fast becoming recognised as a leading play globally for lithium brine production with a long-established bromine brine extraction industry and 100 years of oil and gas well data available.

“We look forward to working with the Daytona team with the aim of increasing the leased area and generating a lithium exploration target in the short term and creating value by providing shareholders with exploration exposure to this exciting battery metals project.”

This article was developed in collaboration with Pantera Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.