The IEA says we need hundreds of new mines ASAP to meet EV battery metals demand by 2030

Pic: Yellow Dog Productions / The Image Bank via Getty Images

- We need 50 more lithium mines, 60 more nickel mines and 17 more cobalt mines by 2030

- It can take up to 20 years for a mine to begin commercial production

- Novel extraction and processing tech could help bridge the supply-demand gap

The International Energy Agency (IEA) has just released a report and it looks like we’re going to need to expand battery and minerals supply chains 10-fold to meet government EV ambitions around the world.

Basically, we need 50 more lithium mines, 60 more nickel mines and 17 more cobalt mines by 2030 to meet net carbon emissions goals.

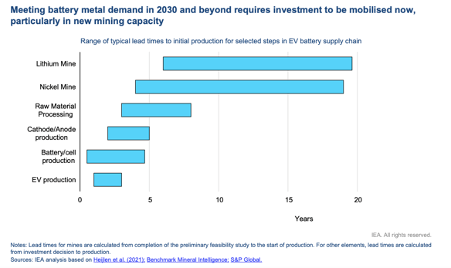

“Additional investments are needed in the short-term, particularly in mining, where lead times are much longer than for other parts of the supply chain – in some cases requiring more than a decade from initial feasibility studies to production, and then several more years to reach nominal production capacity,” the report said.

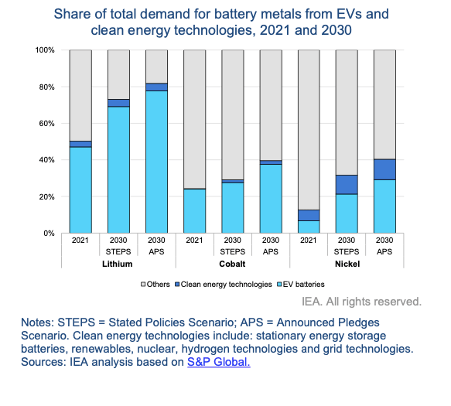

“Projected mineral supply until the end of the 2020s is in line with the demand for EV batteries in the Stated Policies Scenario (STEPS).

“But the supply of some minerals such as lithium would need to rise by up to one-third by 2030 to satisfy the pledges and announcements for EV batteries in the Announced Pledges Scenario (APS).

“For example, demand for lithium – the commodity with the largest projected demand-supply gap – is projected to increase sixfold to 500 kilotonnes by 2030 in the APS, requiring the equivalent of 50 new average-sized mines.”

Need 50 more lithium mines, 60 more nickel mines, and 17 more cobalt mines by 2030 to meet country announced emission pledges scenario.

July IEA report – Global Supply Chains of EV Batteries

https://t.co/2PaoVXDO9x pic.twitter.com/2xHVyDgUCp— Daniel Hill (@hilldanr) August 2, 2022

Don’t forget nickel and cobalt

By 2030, nickel is facing the largest absolute demand increase as high-nickel chemistries are the current dominant cathode for EVs, and are expected to remain so.

For cobalt, the opposite is true as battery makers continue to move to lower cobalt content chemistries (and even cobalt-free chemistries by 2030) to reduce costs and due to environmental, social and governance concerns.

But the report flags that the surge in global demand for EV batteries still increases total cobalt demand this decade.

“To meet the projected demand in 2030 in the Stated Policies Scenario, 41 nickel and 11 cobalt additional mines are needed – a significant scaling up requirement.”

“For the Announced Pledges Scenario, 60 nickel and 17 cobalt new mines are required in 2030, (assuming average annual mine production capacity of 38 kt for nickel and 7 kt for cobalt).”

Long lead time for mines to get off the ground

After an extractable resource is identified through exploration, the IEA says it can take from four to more than 20 years for a mine to begin commercial production.

That’s a hell of a long lead time.

It can also take between four to 16 years for the necessary feasibility studies, and engineering and construction work.

Then you’ve got to secure financing and permits and once the mine is up and running it can take up to 10 years to reach nameplate production capacity.

The IEA says that while upstream mineral extraction can cause major bottlenecks unless adequate investments are delivered well in advance, “it appears that EV battery metals demand in the Stated Policies Scenario will likely be met for all metals up to 2025 if announced new supply comes online as scheduled.”

That’s a big if, because dozens of mining projects will have to enter the market and reach capacity on schedule too.

Not to mention the new mineral processing and precursor plants that will have to be commissioned.

“Also, in order to translate this into EV deployment, tens of cathode and anode plants, gigafactories and EV production plants are required,” the report said.

Innovation could help bridge the gap

One way to bridge the supply-demand gap could be novel extraction and processing tech like Direct Lithium Extraction (DLE), High Pressure Acid Leaching (HPAL), and re-mining from mining waste.

“Direct lithium extraction can increase production from existing mines,” the IEA says.

“It bypasses the time-intensive need to evaporate the unconcentrated brine water and chemical removal of impurities.

“As well as offering cost and lead time advantages, DLE has sustainability advantages and widens the pool of economically extractable lithium supply.”

But it’s an untested process at scale.

For nickel, there’s HPAL, which uses acid separation under high temperature and pressure to produce nickel at Class 1 grade suitable for battery applications for laterite resources.

But that comes with its own issues.

“Capital costs for HPAL projects typically are double that of conventional smelters for oxide ore and take about four to five years to reach capacity,” the report said.

“There are also concerns with the environmental impact of HPAL as it often uses coal or oil-fired boilers for heat, thus emitting up to three times more GHG emissions than production from sulphide deposits.”

Then there’s mixed hydroxide precipitate (MHP), which is an intermediate product produced from laterite that can be refined into nickel and cobalt sulphates needed for batteries at low cost.

MHP can also be processed into nickel and cobalt products from selective acid leaching, a process with a lower environmental footprint.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.