The Father of Cadia: Majors have pledged $300 million to find the next gold giant in NSW’s Lachlan Fold Belt

'Oh, Gold Fields farming in to NSW gold and copper, you don't say.' Pic: Getty Images

- Gold Fields has inked an under-the-radar deal to hunt for copper and gold in the area around Newmont’s world class Cadia gold mine

- It’s thrust eyes on the Lachlan Fold Belt, where majors are quietly making deals to find the next giant Australian porphyry gold and copper deposits

- Legacy Minerals Holdings’ Chris Byrne estimates industry titans have pledged $300m to exploration in the LFB in the past 16 months

A virtual footnote in Gold Fields’ latest quarterly report has thrust envious eyes on the gold and copper rich Lachlan Fold Belt in New South Wales, with explorers quietly buzzing about the desperation of majors to gain a foothold in the famous mining district.

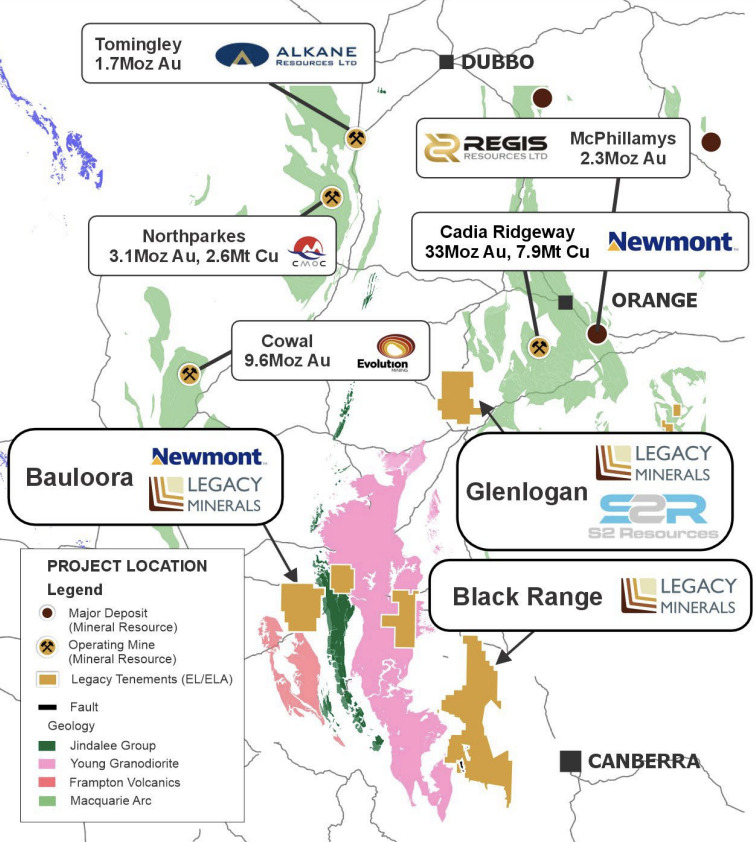

The company has revealed plans to spend a minimum of $9 million over the next three years on three tenements around Orange held by Gold and Copper Resources, a private explorer led by former coal baron Jeremy Barlow and his son James, with a catalogue of corporate bigwigs on its register.

Original founder Brian Locke had said he was looking for the ‘Father of Cadia’, an elusive gold and copper giant with the potential to dwarf Australia’s largest gold operation, now owned by the world’s largest gold producer Newmont Corporation (ASX:NEM) after its 2023 takeover of Australia’s top gold company Newcrest.

Gold Fields, which expects to produce 2.2-2.3Moz of gold across its African, South American and Australian operations in 2024, is rumoured to be prepared to spend up to $75 million over close to a decade to take a 75% stake in any or all of the projects. It can take its share to 80% by funding studies.

Gold Fields confirmed the investment in response to questions from Stockhead, but declined to reveal commitments beyond the $9m divulged in the quarterly.

“The earn-in has been structured in a way that will deliver Gold Fields the flexibility to prioritise future investment and commitments across our global greenfields portfolio,” a spokesperson for the South African mining giant said.

“Gold Fields has worked in NSW previously (including the Lachlan Fold Belt) and is pleased to be back in the region working with a partner like Gold and Copper Resources.”

A request for comment to GCR went unheeded. But it’s not the only small NSW gold play which has pricked up its ears at the news.

$300 million committed

Gold Fields was previously in the region having backed the IPO of Magmatic Resources (ASX:MAG).

That firm this year inked a $14 million deal for a earn-in by Andrew Forrest’s Fortescue (ASX:FMG), which is keen to diversify beyond iron ore and into copper like its bigger competitors BHP (ASX:BHP) and Rio Tinto (ASX:RIO).

But they’re not the only big players with a horse in the race. AngloGold Ashanti announced two recent deals with CSE-listed Inflection Resources and ASX-listed Kincora Copper (ASX:KCC) to traverse ground in the region known for the massive Cadia, Cowal, Northparkes and Cobar mines via a commitment to spend up to a combined $135m across the two partnerships.

Chris Byrne, the MD of NSW explorer and 2021 ASX float Legacy Minerals Holdings (ASX:LGM) estimates $300m worth of commitments have been made in deals inked by majors to access exploration ground in the hot district in recent memory.

“It’s a global hot spot,” he told Stockhead.

“The number of deals getting done equates to what we anticipate is around $300 million over the last 16 months.

“I think that the premium has been demonstrated by both Newmont and Evolution’s acquisitions of Cadia and Northparkes, respectively.

“These are massive behemoths of operations that at various points produce roughly 700,000 ounces of gold per annum, which is often paid for entirely by the copper credits. So they’re world class assets.”

Minors with major potential

Where the Lachlan Fold Belt differs from most parts of Australia is the style and breadth of mineralisation it holds.

While WA’s big gold and base metal mines are typically higher grade, narrow vein quartz deposits or volcanogenic massive sulphides, the LFB bears large porphyries, a lower grade deposit style that hosts most of the world’s big copper mines.

Normally miners head to places such as Chile and Peru to find these orebodies, but operating in the South America is getting more complicated by the day.

Find something similar in a place like New South Wales – Alkane Resources’ (ASX:ALK) 8.3Moz gold, 1.5Mt copper Boda-Kaiser discovery is a recent example – and the premium could be significant.

“There’s been previous investments from some majors in New South Wales that have also gone unrecognised, like (US copper behemoth) Freeport-McMoRan had a very, very strong presence,” Byrne said.

“I don’t think the broader exploration and mining community in Australia appreciates just how prospective it is in New South Wales.

“A lot of the companies here trade at significant discounts to their WA peers (but) the majors don’t really care for those sorts of valuations.

“They’re looking at the prospectivity of the ground.

“Should you make a discovery like Cadia, if you look at Newmont’s global asset portfolio, that’s one of their best global assets that they got from that Newcrest deal. So it just demonstrates that Lachlan Fold is arguably one of the best, porphyry copper-gold terrains in the world.”

Playing the long game

Byrne said the share registers of companies like Legacy and its neighbour Waratah Minerals (ASX:WTM) included a number of successful Australian and international mining entrepreneurs known for playing the long game on resources.

Hedley Widdup, the CEO of listed mining fundie Lion Selection Group (ASX:LSX), said the Gold Fields/Gold & Copper agreement was a sign majors were looking beyond current market headwinds to a new stage of the cycle.

“There doesn’t seem to be any lack of interest from those big companies in having discussions around what might take place down the track,” he said.

“That’s a major company dealing in with an unlisted junior. That tells me that these guys are all prepping for the next cycle rather than worrying about what’s happened.”

Legacy has a deal with Newmont, a $15m farm-in at the Bauloora project signed ahead of the Newcrest merger that marked the Denver-based gold leader’s first new investment in the region since selling its McPhillamys JV with Alkane to Regis Resources (ASX:RRL) in 2012.

That is on top of deals with Helix Resources (ASX:HLX), Earth AI and Mark Bennett’s S2 Resources (ASX:S2R), the latter of which recently sunk two 1km deep holes into LGM’s Glenlogan project. It also holds the 100% owned Black Range and Drake projects in the LFB and New England Fold Belt, the latter of which contains 356,000oz of gold and 23.3Moz of silver.

McPhillamys

Tanya Plibersek’s decision to reject a tailings dam at the – admittedly pricey – $1bn McPhillamys project on Aboriginal heritage grounds after it had received key State and Federal planning and environmental approvals has been viewed as a negative for the New South Wales mining industry.

But Byrne said it was a concern for industrial developments more broadly across the country, given the call was made by a federal enviro minister. Byrne does not think the decision on the mine, which had the support of NSW regulators, will impact greenfields and brownfields exploration in the state.

“We don’t really see it affecting our boots on ground exploration in the greenfield space. It’s still worth chasing, and certainly it makes probably more valuable the New South Wales areas where we’ve got brownfields development,” he said.

“People will be more comfortable sinking money into projects that have a brownfields development, a recent mining history, or grants and mining licenses as opposed to looking at more riskier greenfield development projects like McPhillamys.”

At Stockhead, we tell it like it is. While Legacy Minerals Holdings was a Stockhead advertiser at the time of writing, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.