The Explorers: Venturex Resources’ AJ on making the well-timed leap into production

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Venturex listed on the ASX just before the markets went completely pear-shaped in 2009-2010.

Junior explorers were hit particularly hard, and Venturex (ASX:VXR) was forced to rationalise its portfolio and preserve cash as the value of equities plummeted and capital vanished from the markets.

So it’s fitting that the company is currently developing a copper-zinc project, called Sulphur Springs, which is designed to be robust at any stage of the price cycle.

With $100m of cornerstone funding now locked in, Sulphur Springs is one of only a few Australian base metals projects nearing construction.

The low cost, high-grade project, 144km south-east of Port Hedland in WA, will produce about 15,000 tonnes of copper metal and 35,000 tonnes of zinc per annum over a plus-10-year life.

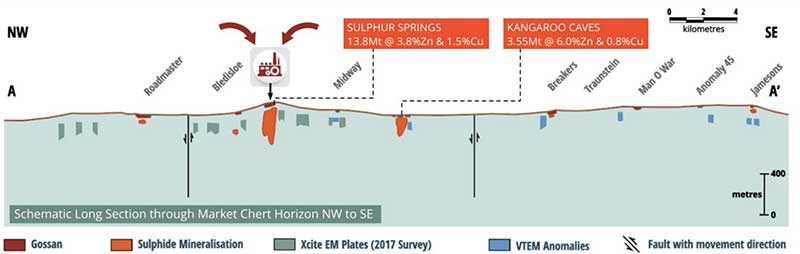

But this project could develop into something much bigger over the coming decades, because Venturex has also barely scratched the surface along its 27km-long volcanogenic massive sulphide (VMS) Panorama trend.

We ask experienced miner and managing director Ajanth (AJ) Saverimutto what sets Venturex apart from the crowd of aspiring mid-tier base metals miners.

You’ve brought projects into production before. What attracted you to the Sulphur Springs project and the role at Venturex?

The Sulphur Springs project orebody has exceptional grades of copper and zinc, which is something that attracted me personally. The grade is potentially two to three times higher than many other projects.

The other thing is the capacity to quickly expand the tonnage we can put through the mill.

Does that give you economies of scale?

It certainly does. You’re still running with one mine manager and the same technical team but you’re putting a lot more ore through the mill.

The robust project economics of Sulphur Springs already pays for the plant.

Our 2018 DFS forecast C1 operating costs of about $111/t plus $22/t capex costs and royalties equals total costs — everything except tax — of about $144/t.

At DFS prices, which are close to current prices, we make a margin of nearly $65/t.

1.2 million tonnes a year at a $65/t margins means we’re generating free cash-flow of ~$80m annually.

When we bring other deposits in the district into production our cash-flows will increase significantly, as the $22/t capex is a fixed cost and no additional capex will be required given the plant is already established.

In other words, additional discoveries will enable us to really leverage the value of the processing infrastructure that we establish.

What key lessons have you learnt over the years that will be important to Venturex’ success?

Firstly, we’ve brought in a team that have expertise to build this project.

Another thing I’ve learnt from many projects over the years is the importance of profit margins. A lot of people just go for project scale, but cashflow is more important.

And the other thing is grade. Grade is king.

With VMS deposits tending to ‘cluster’, are you confident this could be a large, multi-generational operation?

Right now, we have a cornerstone asset at Sulphur Springs that we can take into production quite quickly, as well as exploration upside.

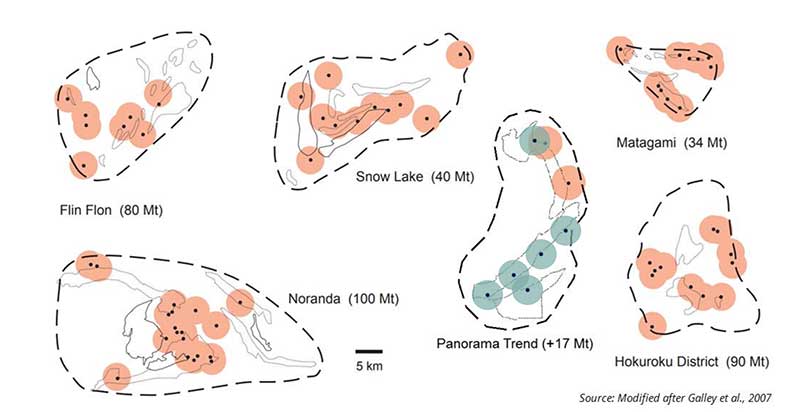

If you look at other notable VMS camps – such as Flin Flon, Snow Lake, Noranda – they have resources up to 100 million tonnes.

A lot of base metals projects can start out quite small and then grow into 30 to 40-year mining operations.

Overall, we want to have multiple [deposits] feeding the single mill at Sulphur Springs.

We have eight to 10 outcropping prospects, and we’ve only drilled out two of them, Sulphur Springs and Kangaroo Caves.

Recently we put a drill program into the Breakers prospect and hit high-grade zinc at decent widths.

We will follow up with a drill program to find the feeder zone, which is the high-grade copper zone underneath the zinc.

Does this $100m facility with Trafigura help fast track the rest of the project funding?

It does. It’s the cornerstone of our funding which we are now building around. We are looking at junior debt, NAIF, and then at equity – that could mean going to the markets or a JV arrangement.

Those are things we are working on now, and the company is progressing all avenues.

Is copper the place to be? Market fundamentals and moves by the major miners suggest it is, but current prices say otherwise.

It comes back to the quality of the deposit.

Certainly, the markets are a little bit tough right now, but the quality of the deposit and the cashflows are still robust.

It’s important to remember that the project makes good money even at current prices.

Looking forward, copper demand is going to come from electric vehicles and the renewable energy sectors.

The EV revolution will need a lot of copper; your normal [ICE] car needs 25kg of copper, while an EV uses 80kg.

But the other part of the equation is that production rates at some of the larger mines are dropping; even if demand remains [the same] we’re heading for a supply deficit.

I think a lot of the global miners know this, and that’s why they are trying to get copper into their portfolios.

So, Sulphur Springs is robust at lower prices, but then you have that potential upside if demand takes off over the medium term?

Correct, and that’s why you want projects set up at these prices. When the price does go up, we can make a lot of money because we have a project already in production.

Can good projects can ride out any cycle?

I would think so. I can’t comment on everyone else’s projects, but this is certainly a robust project.

We think we are undervalued compared to our peers. We have a high-grade, low-cost, high-margin operation with a major shareholder in Northern Star (ASX:NST) who have supported Venturex all the way through.

What are the next steps?

At the moment we are waiting for final approval from the EPA, and once we get that approval, we will be looking at finalising our funding and starting early works.

Post EPA approval, the construction of the plant through to ramp-up is about 18 months.

We want to get into that phase and start building.

The first job will be road access to site. We own a camp which we have to transport to site, so in the first three months we will be putting the road in — 7km to 8km — and then we can start construction.

Why should people invest in Venturex?

Venturex has an excellent cornerstone asset in Sulphur Springs.

We have a $100m debt funding solution already in place with a Tier-1 partner in Trafigura.

We have strong forward markets for copper and zinc and diminishing supply. We have a major shareholder in Northern Star, which has been a big supporter of the project.

There are also very few copper projects worldwide that have completed feasibility studies, are debt funded, and getting ready for production.

But we aren’t just a development story; we also have an exploration story that will develop as we uncover the potential of the Panorama VMS Trend.

And we have a very strong team that have built projects in the past and are looking forward to building this one.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.