The critical minerals explorer with a nifty heritage agreement to Regener8 East Ponton

Regener8's heritage agreement deal gives local communities some skin in the game. Pic: Getty Images

- Heritage agreements can be long, arduous processes

- Explorers can especially have a difficult time affording parameters of agreements

- Yet Regener8 has penned a unique deal to offer traditional owners tranched share amounts based on hitting milestones

Greenfields exploration has many costly barriers and for junior explorers it can be a make-or-break situation. One of the costs involved is the responsibility to work with traditional landowners to make sure environmental and culturally appropriate mining practices are agreed and adhered to.

Under Australia’s Native Title Act, heritage agreements refer to deals between local communities and resources companies that require the land used for mining to be compensated for and kept in a reasonable condition to ensure cultural heritage significance is maintained.

After agreements are signed, heritage surveys get carried out to dot the i’s and cross the t’s with programs of works signed off by the Department of Mines to follow.

These deals are necessary to gain access to ground work on held tenements and often explorers, mainly because of capital restraints, have to wait months or even years to get out the drill bit.

Getting these agreements over the line requires fostering symbiotic relationships with local communities, where any issues and concerns are addressed for the development of the land. Many are confidential, meaning the details of the protections and compensation are not disclosed.

It can be up to two years in the making

South African miner Gold Fields – which has a 7.7Moz portfolio in WA’s Goldfields across its St Ives, Agnew, Granny Smith and Gruyere JV operations – recently signed a landmark heritage agreement across an expansive 102,000km2 area with the Ngadju People (NNTAC).

That delivered NNTAC “a substantial initial payment” in recognition of posthumous mining activities that have occurred across the St Ives landholding.

That deal was two years in the making and Gold Fields has committed to ensuring entry-level positions for Ngadju individuals at the St Ives gold mine.

Gold Industry Group said that to support this, additional financial aid will be available for training and education courses related to traineeships, apprenticeships, or graduate roles.

The gold producer will prioritise Ngadju employment and procurement, with NNTAC creating registers of interested candidates and businesses that’ll be given priority notification of opportunities before other potential applicants.

NNTAC chair Thelma Dimer said the agreement represents a significant achievement for the Ngadju community.

“Following two years of dedicated negotiations, it embodies our commitment to advancing a future that both respects our cultural heritage and delivers real benefits to our people.”

When you’re a big producer, community programs, compensation for land use and local hiring schemes can be nutted out in the negotiation process which is more often than not a win-win scenario for local landowners and the miners.

But what if you’re a junior exploration company that has a limited budget? Such initiatives are hard to quantify – especially for listed companies subject to shareholder scrutiny.

Capex is limited and so are employment opportunities, so what could ASX small caps with limited resources do to get such agreements over the line and get digging into their projects?

The junior shaking hands to Regener8 East Ponton

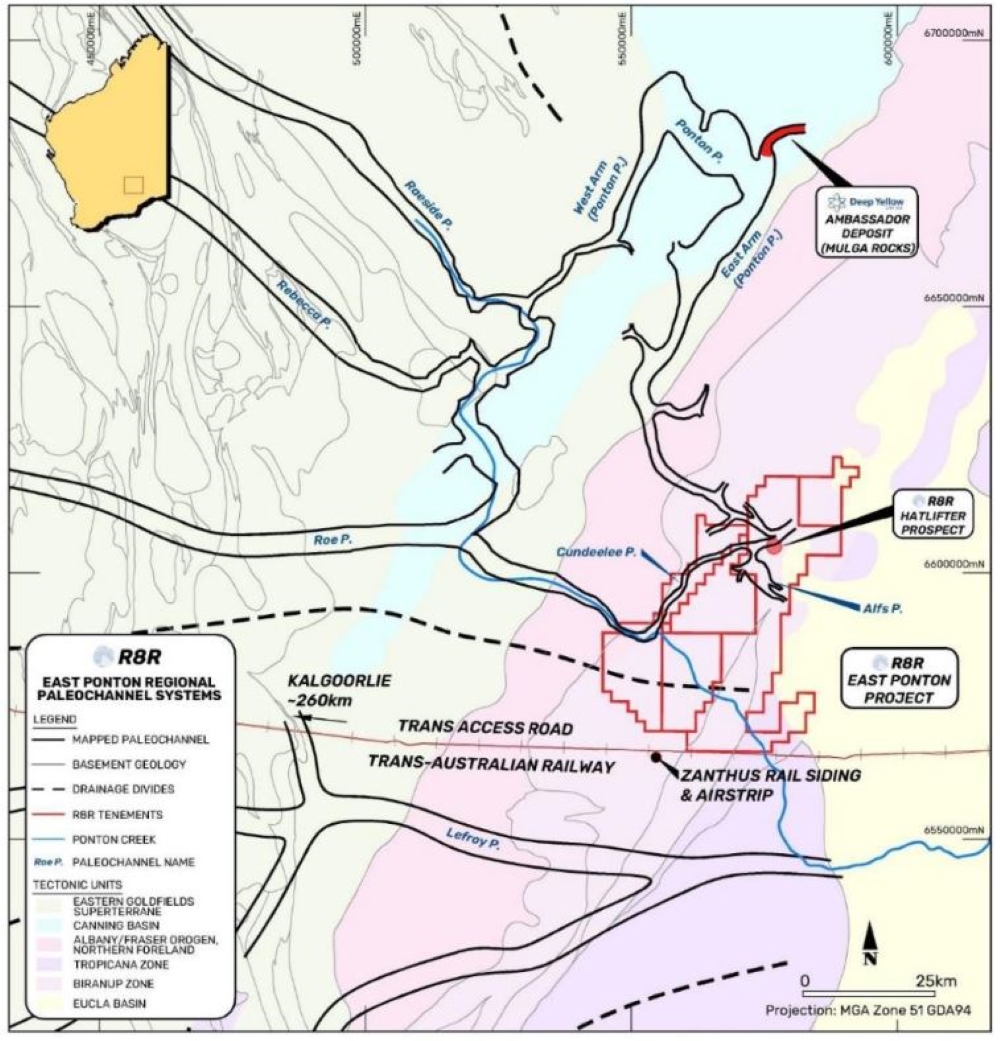

Navigating exploration in the Goldfields region, Regener8 (ASX:R8R) is looking to get to ground at its East Ponton critical minerals project in WA’s Goldfields region.

It recently inked a milestone-based compensation plan offering up to 1 million shares to the Upurli Upurli Nguratja Aboriginal Corporation (UUNAC), which lays out a clear pathway to get drilling across the highly prospective critical minerals project that has historical high grades of nickel, cobalt and rare earths.

The agreement lowers early doors capital expenditure and incentivises traditional owners to get on board with prospecting for orebodies on the tenure.

It’s reminiscent of other deals juniors make to kick start early doors exploration on a budget, such as drilling for equity models that explorers have implemented in WA’s mining sector that drilling companies such as Topdrill have executed, providing $500,000 or $1 million worth of drilling for shares in a small cap looking to hit paydirt.

Success stories such as Brightstar Resources (ASX:BTR), Wildcat Resources (ASX:WC8), Sayona Mining (ASX:SYA) and De Grey Mining (ASX:DEG) have all at some point tapped into this type of capital cost-sharing model.

READ MORE: Driller and dealers: The bold contractor you’ve barely heard of growing WA’s exploration scene

Back to to heritage agreement compensation, R8R’s deal with UUNAC positions it to hit the ground running with reduced expenditure and a shorter timeframe to get the shovel ready.

As part of the compensation associated with the Heritage Agreement, UUNAC is eligible to be issued up to 1 million shares in Regener8 upon milestone conditions being achieved:

- 100,000 shares upon signing of heritage agreement

- 100,000 shares upon completion of 5000m of drilling within the project area

- 150,000 shares upon exercising the company’s option agreement with Beau Resources to acquire the Grasshopper and Seven Sisters tenements

- 250,000 shares upon completion of 15,000m of drilling within the project area

- 400,000 shares upon declaring an inferred resource estimate in any commodity within the project area

All shares are subject to a 12 month escrow period from the date of issue and shipped off pursuant to R8R’s placement capacity.

Speaking with Stockhead, R8R MD Stephen Foley said that for a $5m market-capped junior, execution of the heritage agreement with UUNAC is a significant milestone for the company and the East Ponton project.

“It’s a culmination of joint efforts between the parties over the last 12 months, set against a backdrop of grant of native title, relationship building and moving targets of heritage acts,” Foley says.

“We have a great relationship with UUNAC and fostering good relationships with land owners early has been key to our success in getting our unique heritage agreement over the line so we can prove up East Ponton’s potential.”

Time to hit the ground spinning

With agreements in place R8R has executed a contract with Gyro Drilling for a maiden tunnelling of its East Ponton project in WA.

The program is initially testing the Hatlifter paleochannel-hosted nickel-cobalt target, where historical drilling returned a high-grade, end-of-hole intersection of 3m at 1.26% nickel and 0.6% cobalt from 57m.

Hatlifter shares many geological similarities to Deep Yellow’s (ASX:DYL) Mulga Rocks uranium-cum-multi commodity project within the same paleochannel system.

Spinning the drillbit will also test the Grasshopper rare earths and niobium carbonatite prospect where historical drilling by Anglo Gold Ashanti in 2013 highlighted numerous REE anomalies coincident with magnetic features interpreted as an intrusive complex.

The company sees some real potential in Grasshopper, too, as it’s just 40km from the Cundalee carbonatite which BHP once said played host to the largest untested carbonatite in the world.

R8R will be seeking to advance cultural heritage surveys in parallel with program of works permits and finalisation of targets and drill planning as soon as practicable.

Subject to that timeframe and the weather, the company says it anticipates Phase 1 drilling to kick off in the December quarter.

At Stockhead, we tell it like it is. While Regener8 is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.