The best performing commodities in the September quarter

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

With Q1 2020 now in the books, CBA has run the numbers and revealed the best performing commodities in the September quarter.

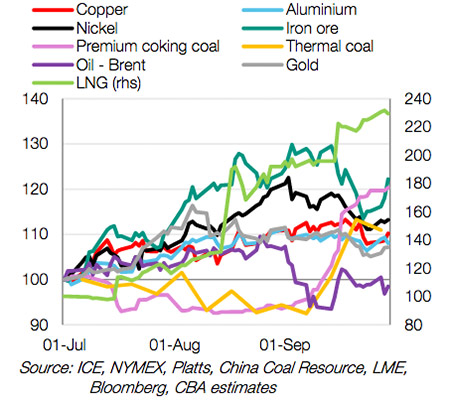

LNG was the standout performer after a second-half surge, while oil was the only one of nine commodities to lose ground.

This chart summarises the relative price performance:

Winter is coming, meaning strong demand for LNG

Looking ahead, analyst Vivek Dhar has upgraded his near-term forecasts for LNG and coking coal, but expects a structural decline in oil prices over the next years as post-COVID demand hopes fade.

Having risen by 130 per cent in the September quarter, CBA expects LNG prices to hold at around $5/mmbtu (metric million British thermal unit — a standard gas measurement) through the end of December.

At the heart of the recent rally is “the prospect of strong LNG demand during the winter months in North Asia”, Dhar said.

Coal-to-gas switching is taking place across China, South Korea and Japan, Dhar said, with LNG also making up the gap for a decline in Japanese nuclear energy production.

In addition, US supply is only just beginning to restart after bottoming out in July due to low prices and weak post-COVID demand.

“We thought it would take a little while for LNG demand to be strong enough to absorb the restart of US LNG exports. But winter demand in North Asia has proven stronger than expected,” Dhar said.

‘Easy gains’ are over

On the flip side, a lack of demand in global oil markets will keep prices subdued below $US50 a barrel through to the end of 2021, Dhar said.

Assessing the outlook, Dhar cited the latest forecast from the International Energy Agency (IEA), which now doesn’t expect oil demand to reach pre-COVID levels before the end of next year.

Oil demand is also expected to decline materially through to the end of this year, with most of the easy post-COVID gains already achieved, the IEA said.

In that context, global oil supply — both inside and outside of OPEC — will become the crucial swing factor.

Currently, OPEC requires member states to reduce daily production by a combined 7.7 million barrels per day (bpd) through the end of 2020.

However, the “real market worry” is what happens next year (when OPEC cuts are scheduled to fall back to 5.6 million bpd), particularly if demand forecasts prove accurate, Dhar said.

“In our view, any delay to (OPEC) production cuts will be contingent on demand faltering meaningfully more in coming months,” Dhar said.

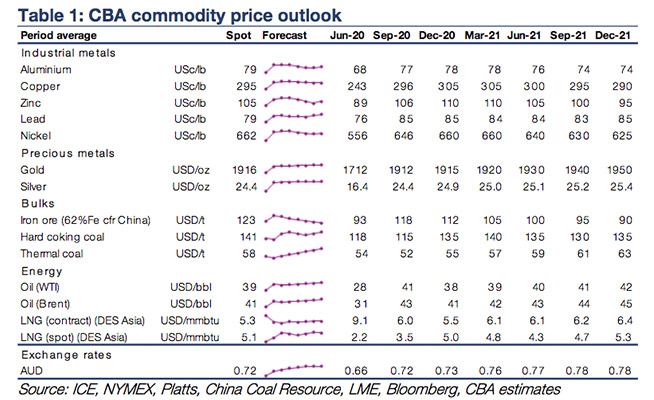

This table summarises CBA’s broader commodity price (and currency) outlook through to the end of next year:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.