That Brazil mining disaster has sent iron ore prices rocketing

View of the Córrego do Feijão Mine near the town of Brumadinho in southeastern Brazil a day after the collapse of a dam in a mine belonging to Vale. Pic: Pedro Vilela/Getty

Iron ore spot markets diverged sharply on Monday with lower grades tanking as mid and higher grades soared.

The catalyst was yet another deadly mining disaster in Brazil, raising concern about the potential for supply shortages in higher grade ore.

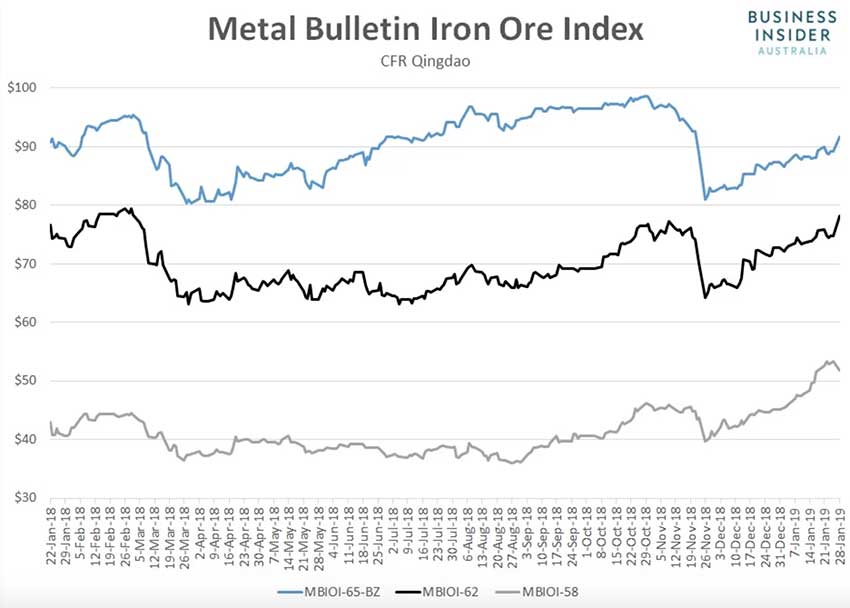

According to Metal Bulletin, the spot price for benchmark 62 per cent fines jumped 4.7 per cent to $78.18 a tonne, leaving it at the highest level since early March last year.

Not since late December 2016 has the benchmark logged a larger daily percentage gain.

Higher grades were also bid with the price for 65 per cent Brazilian iron ore fines lifting 2.8 per cent to $91.60 a tonne, a fresh multi-month high.

In contrast, lower grade ore was pulverised with the price for 58 per cent fines slumping 2.9 per cent to $51.83 a tonne. That was the largest percentage drop since November 26 last year.

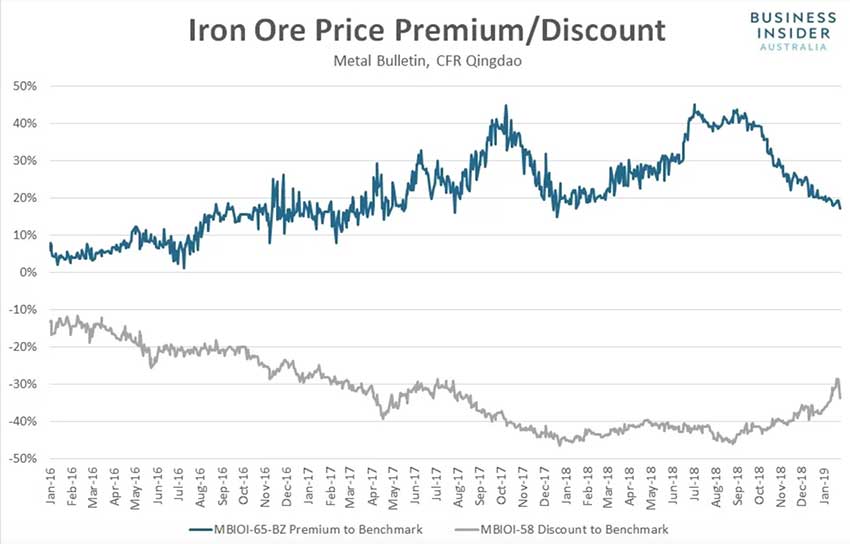

With the benchmark rising faster than 65 per cent fines, its price discount to high-grade ore narrowed to the smallest level since December 2016. The discount for 58 per cent fines to the benchmark widened sharply after hitting the narrowest level in a year last week.

The sharp divergence across the grades followed news of a deadly dam collapse at an iron ore mine operated by Vale on Friday, sparking concern it could lead to supply disruptions for high-grade, low-aluminium ore.

According to Reuters, a dam holding mine waste at Vale’s Corrego do Feijao mine in Brazil collapsed on Friday, burying mining facilities and nearby homes in the town of Brumadinho, killing dozens and leaving the community in shock as hundreds remain missing.

“We’re worried that the mine accident might lead to higher premiums on low-aluminium iron ore,” an iron ore trader with Zheshang Development Group told Reuters.

Vale is the world’s top supplier of low-aluminium iron ore, preferred by Chinese mills for its low impurity level. The Corrego de

Feijao facility accounts for 1.5 per cent of Vale’s annual iron ore output.

Another Chinese trader told Reuters that, like the Samarco mine disaster of 2015, the incident could lead to vast supply disruptions of higher-grade ore.

“(Samarco) led to a long halt in operations and we don’t know if this one will cause even longer and broader disruption for mining activities at Vale,” the iron ore trader based in Qingdao said.

Like spot markets, the news helped propel Chinese iron ore futures to 16-month highs on Monday with the May 2019 contract touching 567.5 yuan at one point before easing to close at 550.5 yuan.

Those earlier gains were maintained in overnight trade in China with iron ore futures edging higher despite declines in other steel and bulk commodity contracts.

SHFE Hot Rolled Coil ¥3,568 , -1.38 per cent

SHFE Rebar ¥3,656 , -1.48 per cent

DCE Iron Ore ¥553.50 , 0.00 per cent

DCE Coking Coal ¥1,207.50 , -1.35 per cent

DCE Coke ¥2,018.00 , -2.06 per cent

Trade in Chinese commodity futures will resume at midday AEDT.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.